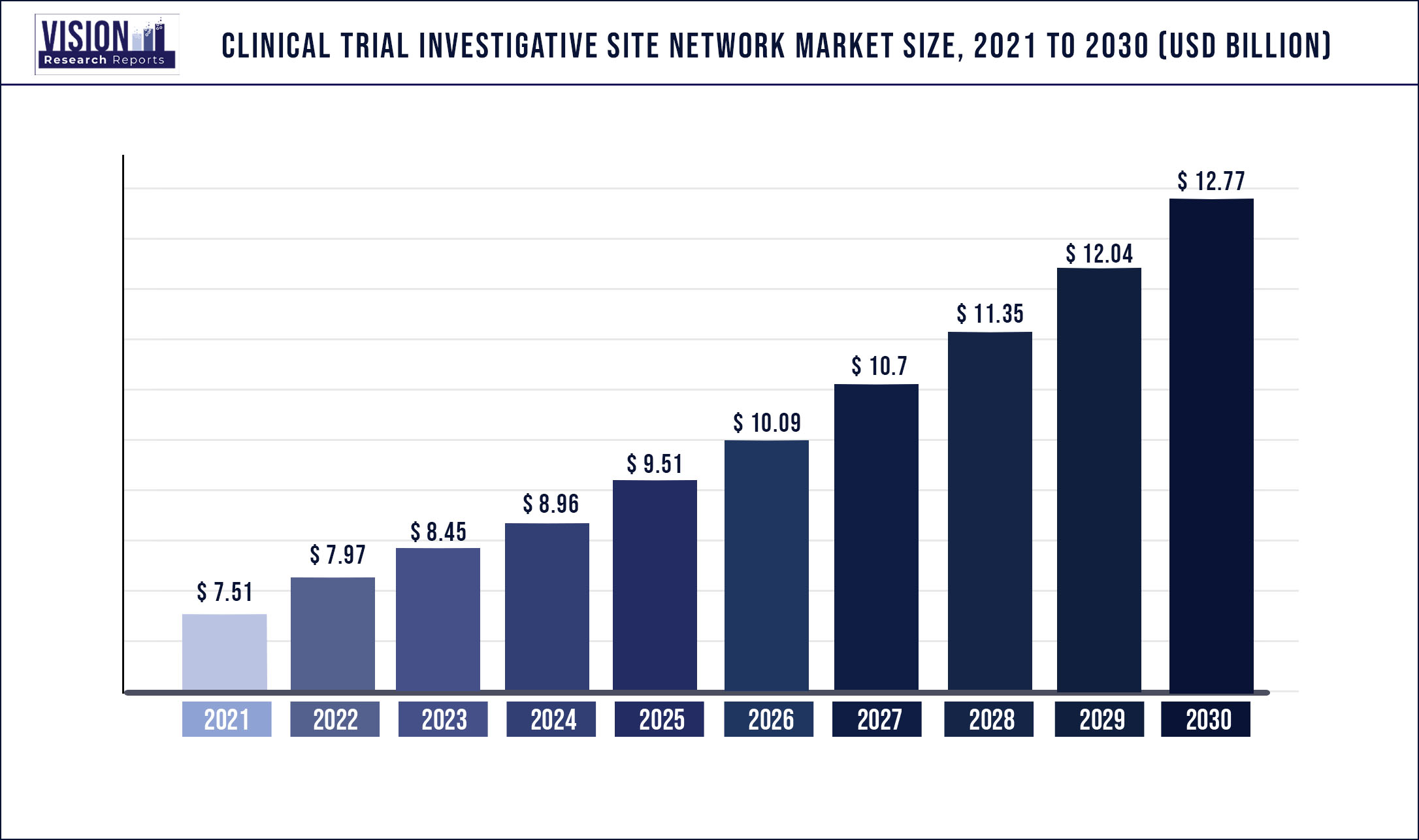

The global clinical trial investigative site network market was surpassed at USD 7.51 billion in 2021 and is expected to hit around USD 12.77 billion by 2030, growing at a CAGR of 6.08% from 2022 to 2030.

Report Highlights

Growing investments in pharmaceutical R&D, increasing demand for new therapies and complications associated with site management of clinical trials are some of the major factors driving the growth of the industry. There has been a consistent rise the clinical trials in the last 5 years. For instance, according to ClinicalTrials.gov, over 262,298 trials were registered in 2018, whereas as of September 2022, over 399,518 trials were registered. The clinical trials are expected to grow even further as the funding for research improves.

This is expected to propel the growth of the industry post-pandemic. There is a growing focus on reducing the cost associated with clinical research. Hiring a clinical trial investigative site network supports the regulatory function, improves the enrollment of participants, assists in data management, and quality assurance. It increases process compliance, reduces process issues with each trial, and helps with faster trial initiations, and shorter trial timelines. These factors are supporting the demand for clinical investigative site networks. The governments are actively trying to improve R&D by providing tax deductions. For instance, in January 2022, the Indian government stated that it is providing a weighted average tax deduction of up to 200% in R&D.

Such initiatives are expected to improve the R&D activities on drugs and thus support industry growth. According to the IQVIA, report on oncology trends, clinical trials for cancer have been increasing for the last 10 years. For instance, in 2011, 1,242 trials were registered for cancer, and as of 2021, 2,335 trials were registered for cancer. The number of clinical trials for cancer is expected to rise even further owing to the growing prevalence of the disease. This is expected to improve the demand for clinical investigative site networks for cancer clinical trials post-pandemic.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 7.51 billion |

| Revenue Forecast by 2030 | USD 12.77 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.08% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Therapeutic areas, phase, end-use, region |

| Companies Covered |

ICON Plc: MERIDIAN CLINICAL RESEARCH; IQVIA Inc.; Clinedge; WCG; ClinChoice; Access Clinical Research; FOMAT Medical Research Inc.; SGS; KV Clinical; SMO-Pharmina; Xylem Clinical Research; Aurum Clinical Research |

Therapeutic Area Insights

The oncology segment accounted for the highest share of more than 32.51% of the overall revenue in 2021. Based on therapeutic areas, the industry has been further segmented into oncology, cardiology, Central Nervous System (CNS), pain management, endocrine, and others. The increasing clinical research on novel anti-cancer drugs and therapies, the high prevalence of different types of cancer, and the rise in the funding of oncology-associated research are supporting the growth of the segment. Cancer cases are expected to rise in the coming years, as a significant number of people follow a sedentary lifestyle.

According to an article published by Cancer Tomorrow, the number of cancer cases is expected to rise to 30.2 million by 2040. The high burden of cancer cases will strongly boost the demand for novel anti-cancer therapeutics, thereby propelling the number of oncology-based clinical trials and simultaneously supporting industry growth. The pain management segment is expected to grow at a significant CAGR during the forecast period. The rising incidence of chronic pain is one of the major factors anticipated to fuel the segment’s revenue expansion over the forecast period.

Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) were the type of drug most regularly prescribed to both males and females for chronic pain relief. An article published by the BMJ Publishing Group in 2020, stated that non-steroidal anti-inflammatory drugs were extensively prescribed for the relief of inflammation and pain, and as of December 2020, nearly 11 million NSAID prescriptions were dispensed in primary care in England. Such statistics support the lucrative CAGR of the segment, thereby boosting the growth of the industry.

Phase Insights

The phase III segment dominated the global industry in 2021 and accounted for the maximum share of more than 53.7% of the overall revenue. The segment is likely to remain dominant even during the forecast years. Clinical studies in phase III are more complicated than those in earlier stages; additionally, this phase includes a greater number of patients than other phases, thus increasing the demand for clinical trial investigative site networks in this phase of clinical trials. This phase also has the highest failure rate due to the sample size and research design necessitating precise dosing at an optimal level.

Such complications increase the need for experienced Principal Investigators (PI) who can be reached via clinical trial investigative site networks. Hence, the aforementioned factors are responsible for the segment’s high share. The phase I segment is expected to register the fastest CAGR during the forecast years. An increase in R&D spending and demand for novel treatments for rare diseases is driving up the number of phase I trials, which, in turn, is boosting the demand for clinical trial investigative site network services. The increasing global disease burden, which drives the demand for new therapeutics and complicated research, is also expected to boost the segment’s growth.

End-use Insights

On the basis of end-uses, the global industry has been further categorized into sponsors and CROs. The sponsor segment dominated the global industry in 2021 and accounted for the maximum share of more than 65.02% of the overall revenue. The segment will expand further at a steady growth rate maintaining its dominant position throughout the forecast period. The key sponsors include biopharmaceutical companies, pharmaceutical companies, and medical device companies. The high amount of funding for clinical research by the sponsors is one of the major factors supporting the segment's growth.

The growing focus of these sponsors on the development of effective treatments for rare diseases and a rise in the demand for new therapeutic options are also expected to support the segment's growth. The CROs segment is expected to register the fastest growth rate during the forecast. CROs collaborate with the clinical trial investigative site network to reduce participant enrolment time and increase the rate of patient recruitment in clinical research. Thus, the increasing number of collaborations between CROs and the clinical trial investigative site network is expected to fuel the segment growth over the forecast period.

Regional Insights

In terms of region, North America dominated the global industry in 2021 and accounted for the maximum share of 50.11% of the overall revenue. This high share can be attributed to the increasing pharmaceutical industries in the U.S. and Canada investing in clinical research. Moreover, favorable government support in the U.S. for clinical trials is anticipated to boost the demand for the clinical trial investigative site network in the region. For instance, in March 2020, the FDA launched a Coronavirus Treatment Acceleration Program (CTAP) for possible therapies to accelerate the development of treatment for global diseases caused by the coronavirus.

Moreover, the percentage of Principal Investigators (PI), which is a crucial element of the site networks is comparatively high in the U.S. than in other parts of the world. For instance, as per WIRB-Copernicus Group, as of 2020, 63% of all PI were based in the U.S. and Canada. On the other hand, the Asia Pacific region is anticipated to witness the fastest growth rate during the forecast period. The region has become a hotspot for conducting clinical trials on account of the ease of regulatory compliance, cheap study costs, a growing patient population, and the existence of a few elite clinical institutions functioning as sites.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Clinical Trial Investigative Site Network Market

5.1. COVID-19 Landscape: Clinical Trial Investigative Site Network Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Clinical Trial Investigative Site Network Market, By Therapeutic Areas

8.1. Clinical Trial Investigative Site Network Market, by Therapeutic Areas, 2022-2030

8.1.1 Oncology

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Cardiology

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. CNS

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Pain Management

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Endocrine

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Clinical Trial Investigative Site Network Market, By Phase

9.1. Clinical Trial Investigative Site Network Market, by Phase, 2022-2030

9.1.1. Phase I

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Phase II

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Phase III

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Phase IV

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Clinical Trial Investigative Site Network Market, By End-use

10.1. Clinical Trial Investigative Site Network Market, by End-use, 2022-2030

10.1.1. Sponsor

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. CRO

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Clinical Trial Investigative Site Network Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.1.2. Market Revenue and Forecast, by Phase (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Phase (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Phase (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.2.2. Market Revenue and Forecast, by Phase (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Phase (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Phase (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Phase (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Phase (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.3.2. Market Revenue and Forecast, by Phase (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Phase (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Phase (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Phase (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Phase (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.4.2. Market Revenue and Forecast, by Phase (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Phase (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Phase (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Phase (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Phase (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.5.2. Market Revenue and Forecast, by Phase (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Phase (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Therapeutic Areas (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Phase (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. ICON Plc

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Meridian Clinical Research

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. IQVIA Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Clinedge

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. WCG

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ClinChoice

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Access Clinical Research

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. FOMAT Medical Research, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. SGS

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. KV Clinical

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others