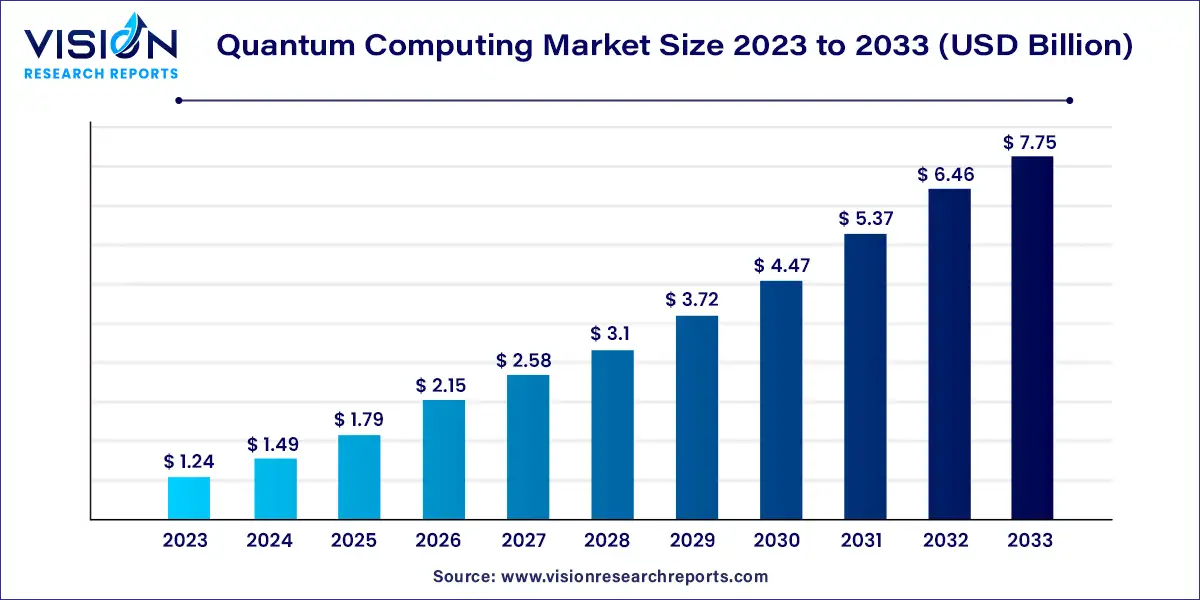

The global quantum computing market size was valued at USD 1.24 billion in 2023 and is anticipated to reach around USD 7.75 billion by 2033, growing at a CAGR of 20.12% from 2024 to 2033. Quantum computing represents a paradigm shift in computational technology, leveraging the principles of quantum mechanics to solve complex problems beyond the reach of classical computers. This emerging field promises transformative advancements across various sectors, including cryptography, materials science, and complex system modeling.

The growth of the quantum computing market is propelled by an increasing investment from both private enterprises and government bodies, which fuels research and accelerates technological advancements. Major technology companies are heavily investing in quantum research, aiming to harness its potential for solving complex problems that classical computers cannot efficiently address. Additionally, the rapid evolution of quantum hardware, including advancements in qubit stability and processor scalability, enhances computational power and opens new application possibilities. Governments worldwide are also recognizing the strategic importance of quantum technology, leading to the establishment of supportive initiatives and funding programs. Furthermore, the rising demand for advanced computing solutions in sectors such as pharmaceuticals, finance, and logistics, where quantum computing promises significant breakthroughs, is driving market expansion.

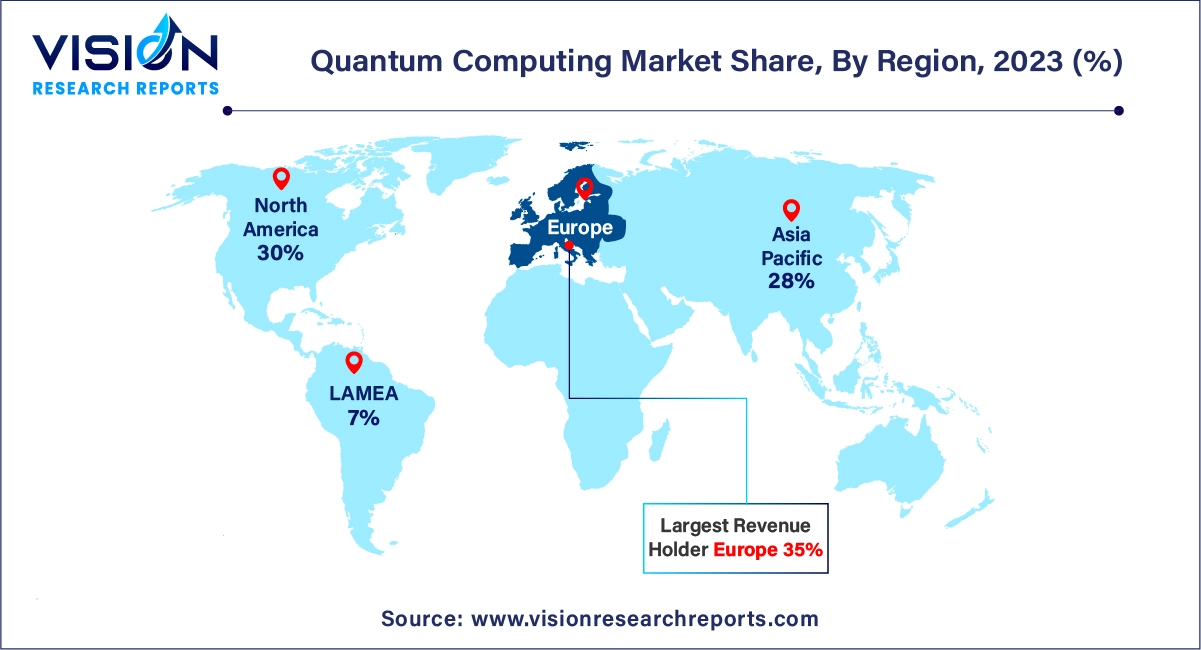

Europe held a substantial share of the quantum computing market in 2023, accounting for over 35% of revenue. The region's progress in quantum computing is driven by close collaboration between industrial and academic sectors. European quantum computing companies are partnering with universities and research institutions to develop new quantum algorithms and software solutions, accelerating the advancement of the technology.

The North American market, led by the U.S. and Canada, is a dominant force in quantum computing. The region benefits from a robust ecosystem of leading companies and research institutions supported by significant public and private investments. North America is at the forefront of quantum hardware, software, and cloud solutions, with a strong focus on applications in cryptography, optimization, and scientific research.

A key trend in Asia-Pacific is the development of open-source quantum software, which enhances accessibility and affordability for companies of all sizes. Additionally, there is a growing focus on creating quantum software tailored to specific sectors such as healthcare, finance, and materials science, which aids in the faster integration of quantum computing within these industries.

The MEA quantum computing market is in its nascent stage but is expected to grow significantly in the coming years. This growth is driven by increasing government investments and heightened awareness of the technology's benefits. The demand for faster and more efficient computing solutions in sectors like finance, healthcare, and materials science is fueling this expansion.

In 2023, the system segment led the market with a substantial revenue share of over 65%. This segment focuses on the development and implementation of quantum computing hardware and related systems. Rapid advancements were observed in quantum hardware, including quantum processors, qubit architectures, and quantum interconnects. Companies were actively working to increase qubit counts, enhance qubit quality, and improve error correction methods. These hardware advancements are crucial for achieving quantum supremacy and addressing practical challenges.

The service segment is projected to grow at the fastest compound annual growth rate (CAGR) from 2024 to 2033. This segment encompasses a range of quantum computing services, including consulting, quantum software development, quantum algorithm design, and quantum cloud services. Consulting firms specializing in quantum computing are in high demand for their expertise in helping businesses assess the impact of quantum technologies and develop strategies for integrating these technologies into their operations.

In 2023, the BFSI (Banking, Financial Services, and Insurance) sector dominated the market with the highest revenue share. The BFSI sector benefits greatly from quantum computing’s rapid data processing capabilities, which are essential for tasks such as fraud detection, customer behavior analysis, and decision-making. The sector leverages quantum computing to extract valuable insights from extensive datasets, thereby enhancing efficiency across various financial processes.

In the field of drug discovery, quantum computing is a revolutionary advancement. It enables highly accurate simulations of complex molecular interactions, speeding up the identification of potential drug candidates. Quantum algorithms provide deep insights into molecular structures, aiding researchers in developing medications more efficiently and cost-effectively. This technology holds the potential to expedite the delivery of life-saving drugs globally.

The on-premises segment was the market leader in 2023, holding the largest revenue share. Some enterprises and research institutions opted for on-premises quantum computing solutions to maintain control and security over sensitive applications. This approach also included the development and integration of quantum software into existing systems for specific tasks.

Quantum cloud services are gaining traction, allowing users to access quantum computing resources remotely, thus bypassing the need for on-premises hardware. Providers of quantum cloud services are expanding their offerings to serve a broader range of industries and applications. Additionally, many organizations are adopting hybrid quantum-classical computing solutions, combining classical and quantum computing resources to tackle complex problems effectively.

The optimization segment led the market in 2023 with the highest revenue share. Quantum computing is particularly promising in solving complex optimization problems more efficiently than classical computers. This technology is applied to enhance supply chain and logistics operations, helping businesses find more efficient transportation routes, reduce shipping and inventory costs, and improve overall supply chain performance.

A notable trend is the integration of quantum computing with machine learning, known as Quantum Machine Learning (QML). QML leverages quantum algorithms to accelerate complex computations, offering significant benefits for optimization, data analytics, and artificial intelligence model training. As quantum technology matures, increased exploration and adoption of QML are expected to drive advancements in AI and data science, with collaborative research fueling innovation in both fields.

By Offering

By Deployment

By Application

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Application Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Quantum Computing Market

5.1. COVID-19 Landscape: Quantum Computing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Quantum Computing Market, By Application

8.1. Quantum Computing Market, by Application, 2024-2033

8.1.1 Machine Learning

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Optimization

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Biomedical Simulations

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Financial Services

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Electronic Material Discovery

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Other (Traffic Optimization, Weather Forecasting, and others.)

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Quantum Computing Market, By End Use

9.1. Quantum Computing Market, by End Use, 2024-2033

9.1.1. Healthcare and Pharmaceuticals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Chemicals

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Defence

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. BFSI

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Energy and Power

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Quantum Computing Market, By Offering Type

10.1. Quantum Computing Market, by Offering Type, 2024-2033

10.1.1. Consulting Solutions

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Systems

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Quantum Computing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.2. Market Revenue and Forecast, by End Use (2021-2033)

11.1.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.2. Market Revenue and Forecast, by End Use (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.2. Market Revenue and Forecast, by End Use (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.2. Market Revenue and Forecast, by End Use (2021-2033)

11.2.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.2. Market Revenue and Forecast, by End Use (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.2. Market Revenue and Forecast, by End Use (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.2. Market Revenue and Forecast, by End Use (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.2. Market Revenue and Forecast, by End Use (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.2. Market Revenue and Forecast, by End Use (2021-2033)

11.3.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.2. Market Revenue and Forecast, by End Use (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.2. Market Revenue and Forecast, by End Use (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.2. Market Revenue and Forecast, by End Use (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.2. Market Revenue and Forecast, by End Use (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.2. Market Revenue and Forecast, by End Use (2021-2033)

11.4.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.2. Market Revenue and Forecast, by End Use (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.2. Market Revenue and Forecast, by End Use (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.2. Market Revenue and Forecast, by End Use (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.2. Market Revenue and Forecast, by End Use (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.2. Market Revenue and Forecast, by End Use (2021-2033)

11.5.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.2. Market Revenue and Forecast, by End Use (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Offering Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.2. Market Revenue and Forecast, by End Use (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Offering Type (2021-2033)

Chapter 12. Company Profiles

12.1. IBM Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. D-Wave Systems Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cambridge Quantum Computing Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Intel Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Rigetti & Co, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Google LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Quantica Computacao

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Zapata Computing

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. XANADU

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Accenture Plc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others