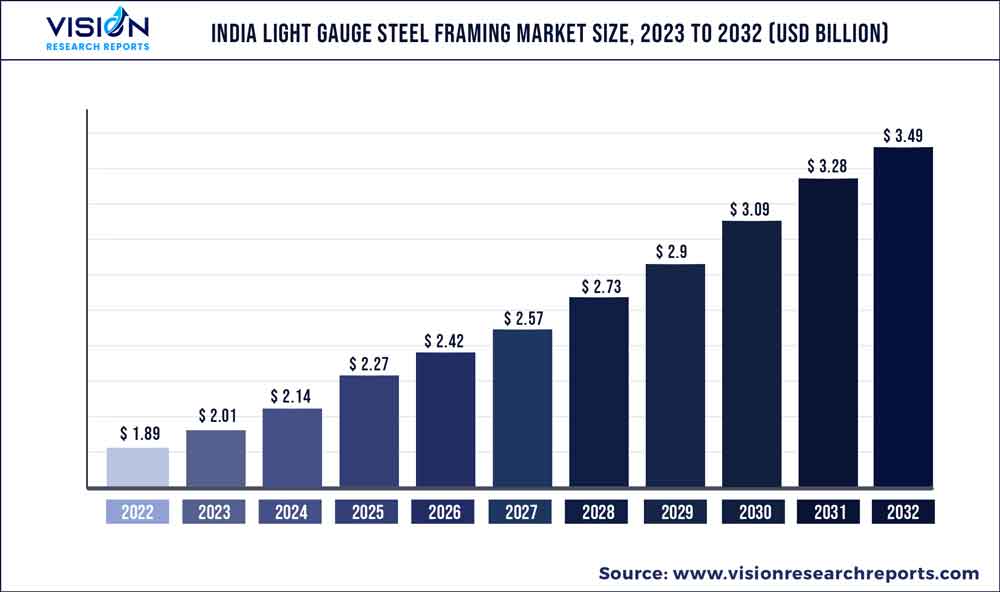

The India light gauge steel framing market size was estimated at around USD 1.89 billion in 2022 and it is projected to hit around USD 3.49 billion by 2032, growing at a CAGR of 6.33% from 2023 to 2032.

Key Pointers

Report Scope of the India Light Gauge Steel Framing Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.89 billion |

| Revenue Forecast by 2032 | USD 3.49 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.33% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Tata Group; EPACK Prefab; Steel Authority of India (SAIL); MGI Infra Pvt Ltd.; Mitsumi Housing Private Limited; Steelion; Nipani Infra & Industries Pvt. Ltd; Volta Green Structures; Jadro Steel LLP; Stratus Steel |

Several housing schemes implemented by the Indian government and state governments, such as Pradhan Mantri Awas Yojana (PMAY) (Urban), Pradhan Mantri Gramin Awas Yojana, Maharashtra Housing and Area Development Authority Lottery Scheme, and Delhi Development Authority Housing Scheme, are expected to support the market’s growth over the forecast years. In addition, various innovations in terms of technology have led to the development of products with improved strength, stability, and safety.

Light gauge steel framing is one of the pivotal structural materials and has been among the essential constructional materials. Advantages such as lightweight, better stability, and shorter completion time have been instrumental in increasing the demand for light gauge steel framing. Moreover, its applicability in various construction essentials has been a major driving factor for the growth in its demand over the last few years. The consistent growth in the number of commercial, residential, and industrial construction projects in India and ever-shrinking completion timelines are anticipated to boost the market growth over the forecast period.

Light gauge steel framing is widely used for numerous applications across residential, commercial, and industrial buildings owing to their inherent advantages, such as stability, flexibility, and sustainability. The product is progressively used in growing end-use industries, specifically in India, where rising industrialization and consumer income levels drive innovation in this sector. Light gauge steel frame structures cater precisely to the requirements of the growing construction sector owing to several advantages such as off-site fabrication, easy erection procedures, and reduced time for project completion.

Moreover, with advancements in technology, light gauge steel frames can be used for buildings with complex and irregular shapes without compromising the stability of the building. Several advantages over conventional construction materials such as wood and concrete are expected to drive the demand for the India light gauge steel frame market over the forecast period.

The COVID-19 pandemic has brought extensive disruption to the construction sector across the globe. The factors such as unavailability of labor, restrictions on transportation, and the temporary shutdown of construction activities and manufacturing facilities impacted the ongoing pipeline projects. However, light gauge steel framing was utilized to build emergency infrastructure for COVID-19 patients, such as temporary hospitals, vaccination centers, and supportive housing.

Type Insights

On the basis of type, the market is bifurcated into long-span steel framing, wall bearing steel framing, and skeleton steel framing. The wall bearing steel framing segment accounted for the largest market share of about 46.05% in 2022 and is expected to dominate the market during the forecast period. Wall bearing frame structures support the floor or roof loads of the building and are mostly suitable for low-rise structures, thereby extensively used for residential applications. These frames are required to be strong enough to resist any horizontal load. The wall-bearing frames are generally unsuitable for multi-story buildings, as the bearing size has to increase to withstand the loads exerted by multi-story buildings.

The skeleton steel framing is anticipated to expand with the highest CAGR of 6.77% during the forecast period, owing to its extensive adoption in multi-story residential buildings and commercial and industrial projects. Due to continuous technological advances, skeleton framing can be used as structural support, even for buildings with irregular surfaces and different shapes. The skeleton framing is made of a system of columns and beams to support the building’s exterior walls and interior floors, and it carries the load to the foundation.

End-use Insights

On the basis of end-use, the market has been segmented into residential, commercial, and industrial. The residential end-use segment dominated with a market share of about 44.04% in 2022. Light gauge framing is anticipated to be extensively adopted in the residential sector due to the growing inclination of people toward sustainable construction materials. Furthermore, India is implementing light gauge steel framing structures in residential buildings in government-funded housing schemes. The Pradhan Mantri Awas Yojana (PMAY) initiative has provided a significant boost to the adoption of light gauge steel framing in India.

The commercial end-use is expected to register the fastest CAGR of 6.86% during the forecast period. Commercial buildings extensively use long-span and skeleton frames due to their structural stability and aesthetic appeal. Light gauge framing is extensively utilized in the construction of commercial buildings such as hotels, shopping complexes, offices, hospitals, and educational institutes, owing to the cost-effectiveness, high safety standards, and fire resistance offered by the frames. The shorter installation time also contributes significantly to the increased adoption of light gauge steel framing in commercial building construction.

India Light Gauge Steel Framing Market Segmentations:

By Type

By End-Use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on India Light Gauge Steel Framing Market

5.1. COVID-19 Landscape: India Light Gauge Steel Framing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. India Light Gauge Steel Framing Market, By Type

8.1. India Light Gauge Steel Framing Market, by Type, 2023-2032

8.1.1. Skeleton Steel Framing

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Wall Bearing Steel Framing

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Long Span Steel Framing

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. India Light Gauge Steel Framing Market, By End-Use

9.1. India Light Gauge Steel Framing Market, by End-Use, 2023-2032

9.1.1. Commercial

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Residential

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. India Light Gauge Steel Framing Market, Regional Estimates and Trend Forecast

10.1. India

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by End-Use (2020-2032)

Chapter 11. Company Profiles

11.1. Tata Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. EPACK Prefab

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Steel Authority of India (SAIL)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. MGI Infra Pvt Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Mitsumi Housing Private Limited

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Steelion

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Nipani Infra & Industries Pvt. Ltd

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Volta Green Structures

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Jadro Steel LLP

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Stratus Steel

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others