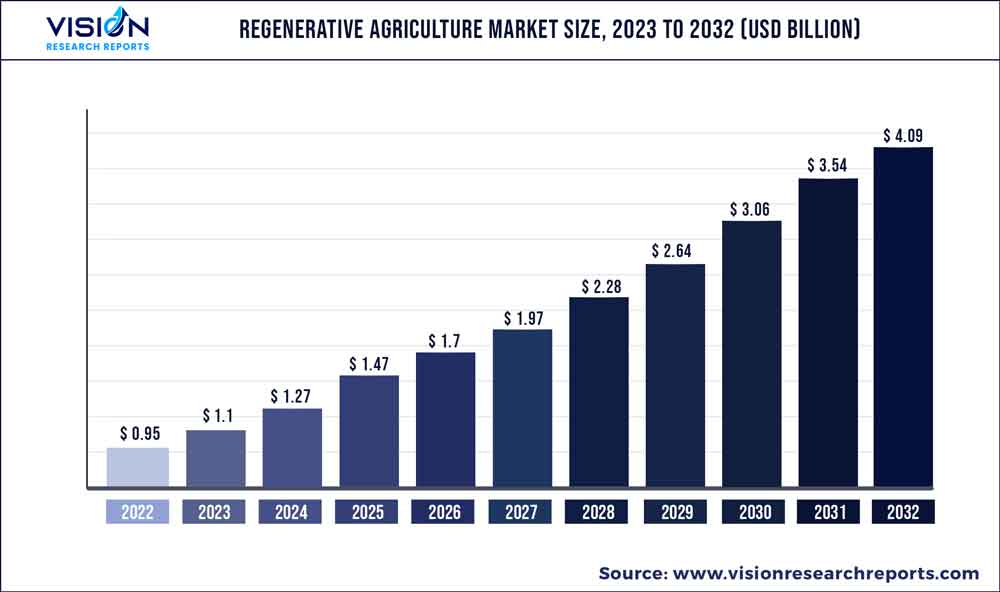

The global regenerative agriculture market size was estimated at around USD 0.95 billion in 2022 and it is projected to hit around USD 4.09 billion by 2032, growing at a CAGR of 15.73% from 2023 to 2032. The regenerative agriculture market in the United States was accounted for USD 201 million in 2022.

Key Pointers

Report Scope of the Regenerative Agriculture Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 36.33% |

| CAGR of Europe | 16.37% |

| Revenue Forecast by 2032 | USD 4.09 billion |

| Growth rate from 2023 to 2032 | CAGR of 15.73% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Vayda; Terramera Inc.; Agreed.Earth; Biotrex; Ecorobotix SA; Ruumi; Continuum Ag; Aker Technologies, Inc.; Indigo Ag, Inc.; Tortuga Agricultural Technologies, Inc.; Astanor Ventures; SATELLIGENCE |

Regenerative agriculture is a farming approach that prioritizes improving soil health, biodiversity, ecosystem services, and community well-being. This method is becoming increasingly popular worldwide as a sustainable alternative to conventional farming practices that often rely on synthetic inputs and heavy tillage. Governments worldwide recognize this industry’s significance in mitigating climate change, promoting soil health, and enhancing food security.

Incentives, subsidies, and support programs are provided to encourage farmers to adopt regenerative practices. For example, in the U.S., the Department of Agriculture has launched several initiatives to promote this market, such as the Environmental Quality Incentives Program, the Conservation Stewardship Program, and the Regional Conservation Partnership Program. Cover crops play a vital role in regenerative agriculture, as they can improve soil health by fixing nitrogen, increasing soil organic matter, reducing soil erosion, and suppressing weeds. Seed blending technology is a technological advancement in regenerative agriculture that allows farmers to create custom cover crop blends.

With seed blending technology, farmers can mix and match different cover crop species and varieties to create a blend tailored to their specific needs and goals. Seed blending technology uses specialized equipment to mix and distribute cover crop seeds evenly across a field. The equipment can handle a wide range of cover crop seed sizes and types, making it possible to create diverse and customized blends. The increasing awareness among consumers about sustainable practices has resulted in a shift in their preferences toward food items produced using these methods.

Nowadays, consumers seek healthy and nutritious food and those that are environmentally sustainable and support local communities. Consequently, several food companies are now promoting their products as being produced using regenerative practices, which has become a potent marketing tool. Consumers are willing to pay a premium price for food products that resonate with their values. As a result, more and more food companies are adopting these sustainable practices, contributing to the greater awareness and adoption of these practices across the food industry.

Component Insights

In terms of components, the market is classified into solutions and services. The solutions segment dominated the overall industry and accounted for a revenue share of 63.58% in 2022. The segment is estimated to witness a CAGR of 15.47% during the forecast period. The solutions component of the market refers to the various products and services available to support these practices. These solutions range from soil amendments and fertilizers to precision agriculture technologies and sustainable farming practices. Some examples of solutions that support the market include:

The services segment is anticipated to observe the fastest growth rate of 16.14% over the forecast period. The services component refers to the various support services required to implement and maintain sustainable agriculture practices. The components include various activities, such as soil testing, crop planning, pest & disease management, water management, and wildlife habitat restoration. These services are typically provided by agricultural consultants, soil scientists, ecologists, and other experts in the field. One of the key services in the market is soil testing. This involves analyzing the chemical and physical properties of the soil to determine its health and fertility. Soil testing helps farmers understand their crops’ specific nutrient requirements and allows them to apply fertilizers and other soil amendments more effectively.

Agriculture Type Insights

In terms of agriculture type, the market is classified into agroforestry, silvopasture, aquaculture/ocean farming, no-till & pasture cropping, holistically managed grazing, biochar, and others. The agroforestry segment dominated the market in 2022 with a revenue share of 19.58% and is projected to witness a CAGR of 16.02% during the forecast period. Agroforestry is an important practice in this market that integrates trees, crops, and livestock into a single farming system. This approach has gained popularity in recent years as a way to improve soil health, increase biodiversity, and enhance the overall sustainability of agricultural production.

In regenerative agriculture, agroforestry is seen as a key strategy for promoting sustainable and profitable farming practices. Farmers can provide additional benefits, such as shade, windbreaks, and erosion control by integrating trees into the farming system. In addition, tree roots help improve soil structure and increase water infiltration, leading to better soil health and increased productivity. The aquaculture/ocean farming segment is anticipated to grow at a considerable CAGR of 16.68% during the forecast period. Aquaculture, or ocean farming, can play a significant role in the market.

Aquaculture involves farming fish, shellfish, and other aquatic organisms in controlled environments, such as ponds, tanks, and cages. When done correctly, aquaculture can help reduce overfishing in wild fisheries, provide a reliable source of protein, and reduce the environmental impact of traditional fishing practices. In regenerative agriculture, aquaculture can help improve soil health and nutrient cycling by providing a source of organic fertilizer. Fish waste can be used as a natural fertilizer for crops, improving soil health and reducing the need for synthetic fertilizers.

End-User Insights

In terms of end-user, the market is classified into farmers, service organizations, financial institutions, advisory bodies, and consumer packaged goods manufacturers. The service organization segment dominated the overall market with a revenue share of 25.69% in 2022 and is estimated to witness a CAGR of 15.24% during the forecast period. In the service organization end-user segment of the regenerative agriculture market, there are various types of companies that provide services to farmers and landowners who want to transition to regenerative agriculture practices. These service organizations may include:

The farmer segment is anticipated to witness the fastest CAGR of 16.81% over the forecast period. Farmers are the primary end-users of regenerative agriculture practices, as they are the ones responsible for implementing the techniques and managing their farms. They play a critical role in the success of regenerative agriculture because they are the ones who must adapt their practices to ensure that they are regenerative. Adopting such practices requires a shift in mindset and a willingness to experiment with new techniques.

It involves changing traditional practices and embracing new methods that prioritize soil health, biodiversity, and ecosystem services. Farmers who adopt these practices may need to make changes to their crop rotations, cover cropping, grazing practices, and use of inputs like fertilizers and pesticides.

Regional Insights

North America led the overall market in 2022 with a revenue share of 36.33%. Regenerative agriculture is a growing movement in North America, aimed at improving soil health, biodiversity, and overall sustainability of agricultural practices. One indicator of the growth of regenerative agriculture in North America is the increase in certification programs and labels that indicate adherence to regenerative principles. Another sign of the growth of regenerative agriculture is the increasing number of companies and investors focusing on regenerative practices. Major food companies, such as General Mills and Danone, have made commitments to regenerative agriculture, and there are a growing number of investment funds dedicated to supporting regenerative agriculture practices.

In May 2022, the collaboration of Axa, Tikehau Capital, and Unilever resulted in the introduction of a new fund for regenerative agriculture. This move demonstrates a growing focus on a sector that has the potential to effectively address both land degradation and climate change issues. Europe is anticipated to witness the fastest growth CAGR of 16.37% over the forecast period. Regenerative agriculture is gaining momentum in Europe as a sustainable approach to farming that prioritizes soil health, biodiversity, and ecosystem services.

According to a report by the European Commission, the market in Europe is expected to grow significantly in the coming years, with a focus on reducing chemical inputs, increasing carbon sequestration, and promoting the use of cover crops, crop rotations, and agroforestry. Several European countries, including France, Germany, and Spain, have already launched initiatives to promote regenerative agriculture practices, such as offering financial incentives and technical support for farmers to transition to more sustainable practices. The European Union’s CAP has also recently undergone reform to prioritize environmental sustainability, including support for agroecology and organic farming.

Regenerative Agriculture Market Segmentations:

By Component

By Agriculture Type

By End-User

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Regenerative Agriculture Market

5.1. COVID-19 Landscape: Regenerative Agriculture Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Regenerative Agriculture Market, By Component

8.1. Regenerative Agriculture Market, by Component, 2023-2032

8.1.1 Solutions

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Regenerative Agriculture Market, By Agriculture Type

9.1. Regenerative Agriculture Market, by Agriculture Type, 2023-2032

9.1.1. Agroforestry

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Silvopasture

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Aquaculture/Ocean Farming

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. No-Till and Pasture Cropping

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Holistically Managed Grazing

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Biochar

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Regenerative Agriculture Market, By End-User

10.1. Regenerative Agriculture Market, by End-User, 2023-2032

10.1.1. Farmers

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Service Organization

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Financial Institutions

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Advisory Bodies

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Consumer Packaged Goods Manufacturers

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Regenerative Agriculture Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.1.3. Market Revenue and Forecast, by End-User (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-User (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-User (2020-2032)

Chapter 12. Company Profiles

12.1. Vayda

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Terramera Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Agreed.Earth

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Biotrex

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Ecorobotix SA

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Ruumi

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Continuum Ag

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Aker Technologies, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Indigo Ag, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Tortuga Agricultural Technologies, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others