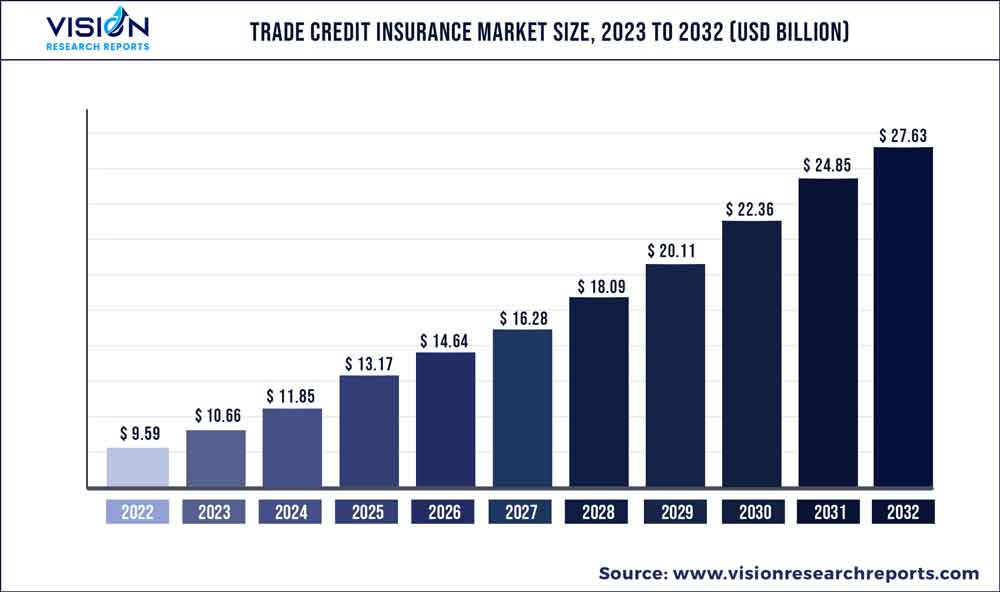

The global trade credit insurance market was estimated at USD 9.59 billion in 2022 and it is expected to surpass around USD 27.63 billion by 2032, poised to grow at a CAGR of 11.16% from 2023 to 2032. The trade credit insurance market in the United States was accounted for USD 1.6 billion in 2022.

Key Pointers

Report Scope of the Trade Credit Insurance Market

| Report Coverage | Details |

| Revenue Share of Europe in 2022 | 32.05% |

| Revenue Forecast by 2032 | USD 27.63 billion |

| Growth rate from 2023 to 2032 | CAGR of 11.16% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Allianz Trade; Atradius N.V; Coface; American International Group Inc, (AIG); Zurich; Chubb; QBE Insurance Group Limited; Great American Insurance Company; AON PLC; Credendo |

The growth of the market can be attributed to the increasing uncertainty and non-payment frauds. Furthermore, the rise in the import and export trades worldwide is also anticipated to drive the market’s growth.

Recently, venture capital firms have started focusing on insurance start-ups, assisting them in raising funds to expand their product portfolios and strengthen their market position. For instance, in June 2022, Hokodo Services Ltd, an insurance company based in London, announced that it raised USD 40 million through a series B funding round led by Notion Capital, a venture capital fund. The company aimed to utilize these funds for redefining the way that businesses transact.

The increasing partnerships between the market players to expand their offerings across various regions is anticipated to drive the market’s growth. For instance, in June 2022, Coface, a trade credit insurance provider, entered into a strategic partnership with Doha Insurance Group, an insurer in Qatar. This partnership was aimed at offering credit insurance products to companies based in Qatar and assisting them in boosting their growth in their export and domestic markets.

The COVID-19 pandemic significantly impacted the global industry. Lockdowns were implemented due to the pandemic, which led to a temporary prohibition on import and export, and manufacturing across multiple industries. Furthermore, it resulted in a sudden drop in the demand for trade credit insurance policies. However, the temporary shutdown of production units led to increased losses for businesses, due to which defaults in payment have risen tremendously, acting as one of the key drivers of the industry.

Enterprise Size Insights

The large enterprises segment accounted for the maximum revenue share of more than 60.03% in 2022 and is expected to retain its dominance over the forecast period. The growth can be attributed to the increasing demand for trade credit insurance policies by large enterprises to reduce the risks of non-payments. Furthermore, the market players such as Allianz Trade are involved in offering trade credit insurance specifically designed for large enterprises to protect their cash flow and receivables. Additionally, large enterprises trade in large volumes of sales over long payment terms, where the risk of non-payment can be significant. Hence, large enterprises are adopting trade credit insurance policies worldwide.

The small & medium enterprises segment is expected to grow at the fastest CAGR over the forecast period. This can be attributed to small & medium enterprises (SMEs) in the trade credit sector experiencing cash-flow difficulties as many of their sales are tied up in credit to buyers. Therefore, small & medium enterprises receive support from TCI as trade finance concentrates more on the trade itself rather than the underlying borrower. Moreover, governments worldwide are trying to support SMEs by introducing different schemes. For instance, in July 2022, the Export Credit Guarantee Corporation of India (ECGC), an export credit provider, unveiled a new scheme to insure up to 90% of the credit risk in export finance, assisting small & medium-sized exporters by empowering banks & financial institutions to provide more credit for export in the face of global economic volatility.

Coverage Insights

The whole turnover coverage segment dominated the industry in 2022 and accounted for the largest share of more than 62.06% of the overall revenue. The whole turnover policy coverage provides cover against the risk of non-payment. Usually, businesses purchase the whole turnover policy to support their credit control management and get coverage against their total debtor book. Furthermore, the high share of this segment can be credited to the whole turnover coverage being less expensive and safeguarding insurers from the initial high-probability credit losses. Moreover, the insured can significantly reduce coverage costs by raising the deductible, depending on its risk retention capabilities.

The single buyer coverage segment, on the other hand, is anticipated to register a significant growth rate over the forecast period. The growth of this segment can be attributed to the credit limit offered that enables underwriters to cover all financial transactions with the customer. This policy provides highly tailored protection against a single buyer failing to pay for goods or services provided. The companies involved in dealing with new customers commonly opt for single-buyer insurance to avoid a customer’s payment issues.

Application Insights

The international application segment dominated the market in 2022 and accounted for the maximum share of over 66.02% of the overall revenue. This growth of the segment is attributed to the advantages, such as significantly reducing the payment risks associated with performing business at an international level by providing the exporter a conditional assurance of making the payment if the foreign buyer is not able to pay. Furthermore, the rising launch of trade credit insurance policies for the exporter is further anticipated to drive the segment’s growth. For instance, in July 2022, the Export Credit Guarantee Corporation of India (ECGC), introduced a scheme of insuring 90% of the credit risk in export finance for small exporters.

The domestic application segment is expected to grow at the fastest CAGR over the forecast period. The growth of this segment can be attributed to a rise in the adoption of trade credit insurance within domestic sales. The rise in the adoption of trade credit insurance in the domestic market can be attributed to businesses focusing on avoiding bad debts and improving their cash flow. Furthermore, trade credit insurance offers companies the protection they require as their customer base consolidates creating larger receivables from minimal customers and protecting them from great risk.

End-use Insights

The food & beverage was the single individual segment that dominated the market in 2022 accounting for the largest share of over 19.07% of the overall revenue. The segment growth can be attributed to the increasing demand for trade credit insurance across the food & beverage industry. The low margins, changing consumer expectations such as high-quality ingredients, and volatile agricultural commodity pricing have created a need for protection of cash flows driving trade credit insurances across the food & beverage industry. Furthermore, trade credit insurance allows food & beverage companies to mitigate credit risk and enhance competitiveness by offering extended payment terms, thereby driving the segment’s growth.

The automotive segment is anticipated to register the fastest CAGR over the forecast period. The growth of this segment can be attributed to the automotive sector being a major industry facing uncertainties due to rapid technological advancements, changing consumer tastes, government regulations, and relative pricing. Furthermore, trade credit insurance can be particularly important in the automotive industry, given the high value of transactions and the potential risks associated with supplying goods to a wide range of customers. The growing awareness regarding the benefits of trade credit insurance among businesses in the automotive industry is also driving the segment’s growth.

Regional Insights

Europe accounted for the largest revenue share of more than 32.05% in 2022 and is anticipated to retain its position over the forecast period. The presence of major market vendors and the high adoption of advanced technologies in the region are the key factors driving the region’s growth. Moreover, governments have launched different schemes to support companies by promoting TCI. For instance, in June 2020, The UK government formed a reinsurance scheme of USD 12.5 billion to assist businesses during the pandemic by assuring trade credit insurers insure financial transactions. The scheme will cover 90% of business-to-business TCI transactions for companies in the UK.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. The growth of the region can be attributed to the rising demand for TCI due to an increase in imports and exports in different sectors. With the potential growth in different sectors, there have been increasing investments from Asia Pacific countries, such as Japan, India, and China. For instance, in 2021, China implemented several policies to boost foreign trade growth, including boosting the development of new business forms and modes, deepening reform to promote cross-border trade, and improving the business environment at ports.

Trade Credit Insurance Market Segmentations:

By Enterprise Size

By Coverage

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Trade Credit Insurance Market

5.1. COVID-19 Landscape: Trade Credit Insurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Trade Credit Insurance Market, By Enterprise Size

8.1. Trade Credit Insurance Market, by Enterprise Size, 2023-2032

8.1.1. Large Enterprises

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Small & Medium Enterprises

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Trade Credit Insurance Market, By Coverage

9.1. Trade Credit Insurance Market, by Coverage, 2023-2032

9.1.1. Whole Turnover Coverage

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Single Buyer Coverage

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Trade Credit Insurance Market, By Application

10.1. Trade Credit Insurance Market, by Application, 2023-2032

10.1.1. Domestic

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. International

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Trade Credit Insurance Market, By End-use

11.1. Trade Credit Insurance Market, by End-use, 2023-2032

11.1.1. Food & Beverage

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. IT & Telecom

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Healthcare

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Energy

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Automotive

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Trade Credit Insurance Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.1.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.2.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.3.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.4.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Coverage (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Allianz Trade

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Atradius N.V

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Coface

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. American International Group Inc, (AIG)

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Zurich

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Chubb

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. QBE Insurance Group Limited

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Great American Insurance Company

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. AON PLC

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Credendo

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others