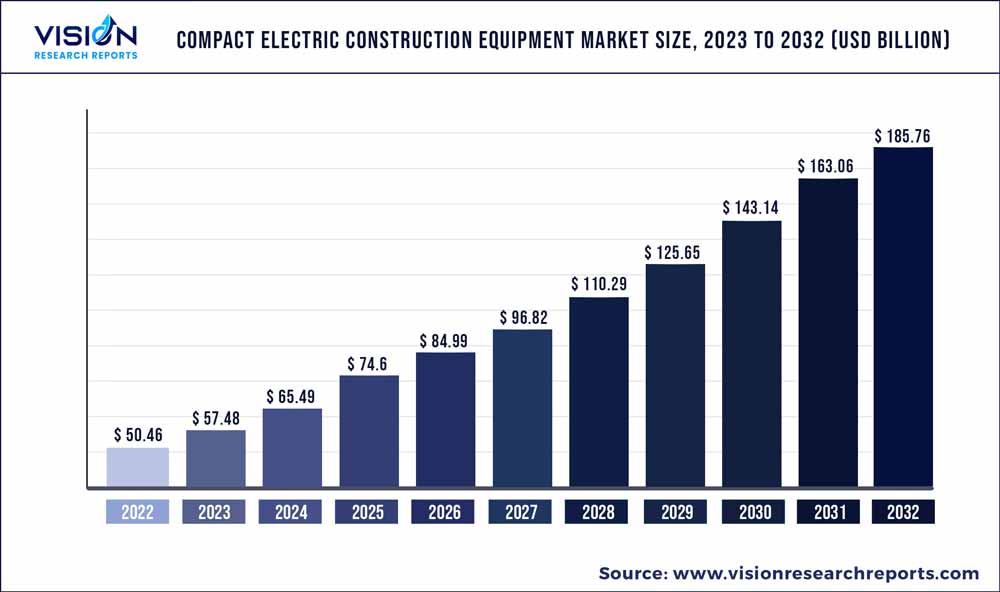

The global compact electric construction equipment market size was estimated at around USD 50.46 billion in 2022 and it is projected to hit around USD 185.76 billion by 2032, growing at a CAGR of 13.92% from 2023 to 2032.

Key Pointers

Report Scope of the Compact Electric Construction Equipment Market

| Report Coverage | Details |

| Revenue Share of Europe in 2022 | 40.06% |

| CAGR of Asia Pacific from 2023 to 2032 | 17.03% |

| Revenue Forecast by 2032 | USD 185.76 billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.92% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Caterpillar; JCB; HAULOTTE GROUP; Wacker Neuson SE; Toyota Motor Corporation; Hyster-Yale Group, Inc.; SANY Group; Volvo CE; Hyundai CE; Bobcat |

The need for more infrastructure, including homes, offices, schools, hospitals, and sports facilities is rising, as urbanization defines developing nations.

Thus, there is an exponential increase in demand for compact construction equipment that can work in small spaces, is portable, and has minimal maintenance and operating expenses, which is expected to hasten the growth of the market for compact electric construction equipment. For instance, in 2019, the government of India announced an investment of USD 1.4 trillion for infrastructure projects during the 2019-2023 period. This signifies the imminent demand for compact construction equipment in the country.

Increased environmental concerns and governmental laws, which are encouraging manufacturers to invest in creating new eco-friendly products like electric vehicles for construction applications, are a factor for this strong growth. Additionally, the increased urbanization in emerging economies is significantly pushing the demand for compact electric construction equipment, because it enables building projects to advance more quickly and with less effort.

Major players are moving towards online channels to push sales, which is anticipated to drive market growth. For example, in March 2022, Volvo CE made available a 2.5-ton battery-powered compact Volvo electric excavator in Asia. By releasing the product, the corporation anticipates increased sales and brand value in Western markets. Rapid urban infrastructural investments and a move towards adopting smart construction equipment to combat rising pollution are likely to lead countries like India and Japan to rapid economic growth. This is expected to enhance the demand for smart electric excavators.

Another factor anticipated to contribute to the compact electric construction equipment market's expansion is the exponential rise in demand from the warehouse sector for small, battery-powered forklifts that enable them to reduce operational costs and do away with the need for labor. To address escalating environmental issues, governments worldwide are outlawing the usage of ICE engines. The strategy that automakers are using to create and introduce electric vehicles is shifting as a result of the ban on fossil fuel vehicles.

Product Insights

The forklift segment held the largest revenue share of nearly 80.04% in 2022 and is expected to continue its dominance over the forecast period. Electric forklifts are generally cheaper to operate than their traditional counterparts. They have fewer moving parts, require less maintenance, and are more energy-efficient, resulting in lower operating costs. This makes them attractive for companies looking to reduce their operating expenses. An electric forklift is ideal for indoor, smooth floor factory applications.

The loader segment is expected to witness rapid growth over the forecast period at a CAGR of 49.75% due to the high demand for compact loaders from the construction sector. Electric loaders have lower maintenance costs, with fewer moving parts and less frequent servicing requirements than diesel engines. Additionally, the cost of electricity is generally lower than the cost of diesel fuel, which can result in significant savings for construction companies over the lifetime of the equipment.

Also, the introduction of new products from notable players is expected to support the growth of the target segment. For instance, in January 2022, Doosan Bobcat announced the prototype of T7X, an electric Bobcat T7X compact track loader. The newly launched T7X is fully electric and offers benefits such as eliminating hydraulic systems, emissions, and vibrations. Such factors are expected to drive the segment’s growth over the forecast period.

Ton Insights

The ton segment is divided into below 5 tons, 6 to 8 tons, and above 8 tons. The below 5-ton segment held the largest revenue share of over 38.02% in 2022. This can be attributed to the increasing demand for compact construction machinery to increase operational efficiency and lower the environmental impact. Lightweight excavators and loaders are electrified faster than medium and large excavators. Thus, the manufacturers’ approach toward the electrification of compact excavators is expected to gain momentum gradually over the forecast period.

The above 8 ton segment is expected to witness significant growth in the global market due to high demand from industries for compact electric excavators and loaders that have a high load-carrying capacity. Another factor driving the demand for compact electric construction equipment is the increasing emphasis on safety in the construction industry. Electric equipment operates more quietly than diesel-powered machines, reducing noise pollution and enhancing safety on construction sites.

Regional Insights

Europe accounted for a revenue share of over 40.06% in 2022 and the regional market is expected to grow steadily over the forecast period. The European Union has set ambitious targets to reduce greenhouse gas emissions and combat climate change. To achieve these targets, the EU has implemented regulations to incentivize the use of electric vehicles and equipment. For instance, the EU has set a target for new cars to emit 37.5% less CO2 by 2030 compared to 2021 levels.

Additionally, regulations such as the Low Emission Zone in London have restricted the use of diesel-powered equipment in certain areas. The regional growth can be attributed to the surge in the adoption of zero-emission equipment, coupled with the increasing number of infrastructure projects in cities such as Oslo (Norway), Helsinki (Finland), London (UK), Copenhagen (Denmark), Amsterdam (Netherlands), and Stockholm, (Sweden).

Asia Pacific is expected to expand at a rapid CAGR of more than 17.03% over the forecast period, which has been attributed to rapid infrastructure development activities in the region. Governments in several Asia Pacific countries, including China, Japan, and South Korea, have introduced initiatives and policies to promote the adoption of electric vehicles and equipment. They are providing incentives and subsidies to encourage the use of eco-friendly products, including compact electric construction equipment.

For instance, the Chinese government signed the recent Regional Comprehensive Economic Partnership (RCEP) free trade agreement with Asia Pacific countries, including Japan, South Korea, Australia, and other smaller South-East Asian economies. The partnership is focused on developing the transportation infrastructure without comprising environmental regulations.

Compact Electric Construction Equipment Market Segmentations:

By Product

By Ton

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Compact Electric Construction Equipment Market

5.1. COVID-19 Landscape: Compact Electric Construction Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Compact Electric Construction Equipment Market, By Product

8.1. Compact Electric Construction Equipment Market, by Product, 2023-2032

8.1.1. Forklift

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Loader

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Excavator

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. AWP

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Compact Electric Construction Equipment Market, By Ton

9.1. Compact Electric Construction Equipment Market, by Ton, 2023-2032

9.1.1. Below 5 Ton

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. 6 to 8 Ton

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. 8 to 10 Ton

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Compact Electric Construction Equipment Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Ton (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Ton (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Ton (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Ton (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Ton (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Ton (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Ton (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Ton (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Ton (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Ton (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Ton (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Ton (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Ton (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Ton (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Ton (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Ton (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Ton (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Ton (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Ton (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Ton (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Ton (2020-2032)

Chapter 11. Company Profiles

11.1. Caterpillar

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. JCB

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. HAULOTTE GROUP

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Wacker Neuson SE

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Toyota Motor Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Hyster-Yale Group, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. SANY Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Volvo CE

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Hyundai CE

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Bobcat

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others