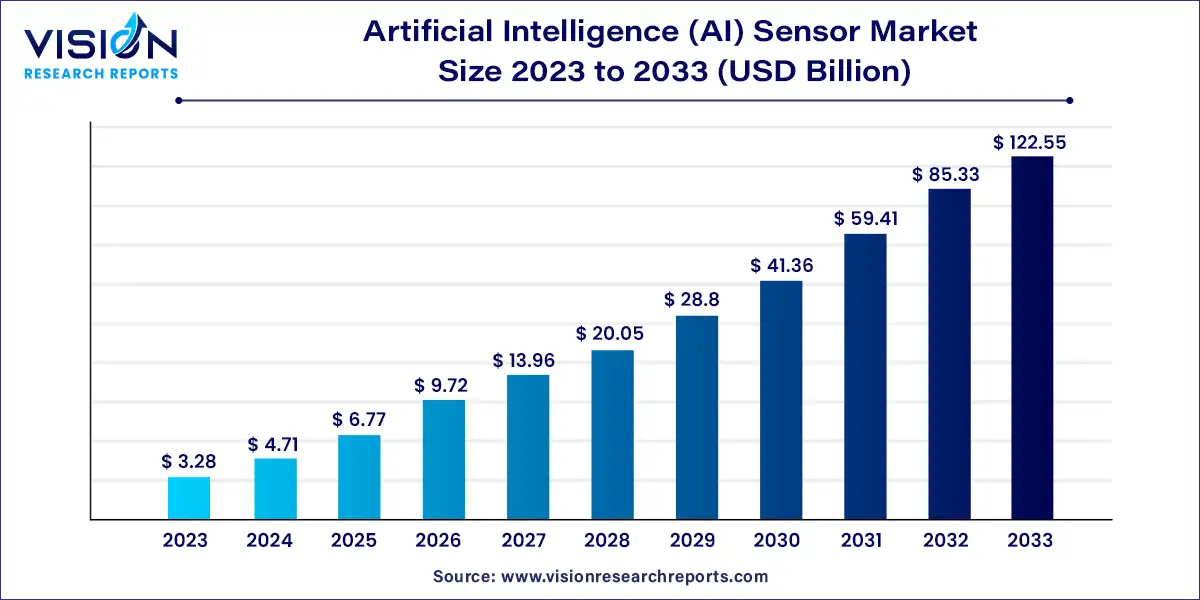

The global artificial intelligence (AI) sensor market size was estimated at around USD 3.28 billion in 2023 and it is projected to hit around USD 122.55 billion by 2033, growing at a CAGR of 43.63% from 2024 to 2033. The artificial intelligence (AI) sensor market is experiencing rapid growth driven by the integration of AI technologies into sensor systems to enhance data accuracy, decision-making, and automation across various industries. These advanced sensors are designed to collect, analyze, and interpret data with greater efficiency and intelligence compared to traditional sensors.

The expansion of the artificial intelligence (AI) sensor market is propelled by an advancement in AI and machine learning technologies have significantly enhanced sensor capabilities, enabling them to perform complex analyses and offer precise, real-time data interpretation. This progression supports increased automation and operational efficiency across various sectors. Additionally, the growing integration of AI sensors in the Internet of Things (IoT) frameworks amplifies their utility, as they provide critical insights from the vast streams of data generated by connected devices. Furthermore, industries such as automotive, healthcare, and manufacturing are increasingly adopting AI sensors to boost productivity, enhance safety measures, and streamline processes. These developments, combined with ongoing research and innovation in sensor technology, are driving robust market growth.

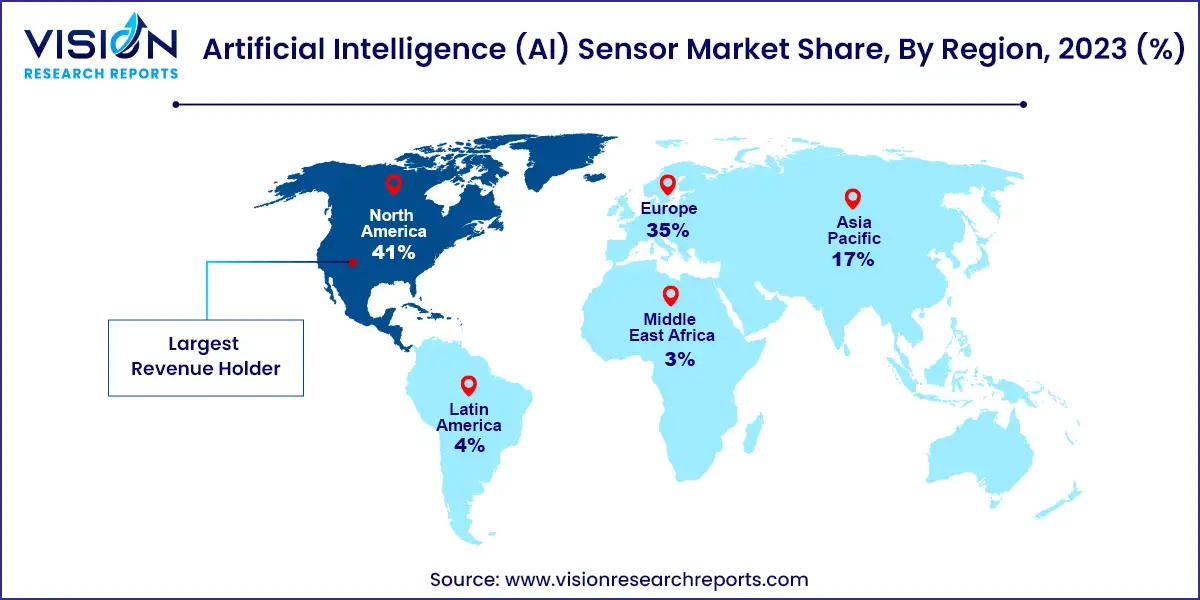

In 2023, North America led the market with a revenue share of 41%. The region's dominance is attributed to its strong technological infrastructure, key industry players, and substantial investments in research and development. The United States, in particular, has driven market growth through the presence of major tech companies and a dynamic startup ecosystem focusing on AI and sensor technologies. North America's regulatory focus on ethical AI and data privacy also impacts the adoption and development of AI sensor technologies.

| Attribute | North America |

| Market Value | USD 1.34 Billion |

| Growth Rate | 43.68% CAGR |

| Projected Value | USD 50.24 Billion |

Asia Pacific is expected to grow at the fastest CAGR of 52.83% from 2023 to 2033. Rapid market expansion in this region is driven by countries like China, Japan, South Korea, and India, which are leading in the adoption of AI technologies across various industries. The region's strong manufacturing base, increasing industrial automation, and rising demand for consumer electronics contribute to this growth. As the market evolves, new regional trends may emerge based on policy changes, market dynamics, and technological advancements.

In 2023, the machine learning segment led the market with a revenue share of 32%. This dominance is primarily due to the vast amount of data, often referred to as big data, available for analysis. Machine learning algorithms excel at identifying patterns, anomalies, and trends within large datasets generated by sensors, surpassing traditional programming methods in accuracy and intelligence. The integration of machine learning with sensors enhances AI systems' ability to learn and adapt, resulting in improved performance and more precise decision-making. This synergy between machine learning and sensors advances automation, intelligent monitoring, and predictive analysis.

The context-aware computing segment is anticipated to experience the fastest growth rate during the forecast period. This trend is driven by advancements in sensor technologies that have produced more sophisticated and precise sensors capable of capturing detailed environmental data, such as location, temperature, motion, light, and sound. Context-aware computing systems leverage this data, along with IoT connectivity and AI techniques, to deliver personalized and adaptive experiences, making it a highly sought-after technology in today's digital world.

In 2023, optical sensors held the largest market share at 21%, driven by the growing need for visual data processing and analysis. The rise in AI technology adoption and the proliferation of computer vision applications have made optical sensors crucial for capturing and interpreting visual information. These sensors are widely used across various industries, including autonomous vehicles, robotics, industrial automation, healthcare, and consumer electronics.

The ultrasonic sensor segment is projected to grow at the highest CAGR of 46.23% from 2023 to 2033. The increased use of automation, robotics, and autonomous systems in manufacturing, logistics, and automotive sectors is driving the demand for ultrasonic sensors. These sensors are essential for obstacle detection, collision avoidance, and proximity sensing, contributing to safer and more efficient operations. Additionally, ultrasonic sensors are finding new applications in healthcare, smart cities, and agricultural automation, such as non-invasive monitoring and gesture control in healthcare.

The smart home automation segment led the market with a 20% revenue share in 2023. This growth is fueled by rising demand for home automation solutions that enhance convenience, energy efficiency, security, and overall comfort. AI sensors are increasingly incorporated into smart home systems to improve automation, data processing, and decision-making.

The robotics segment is expected to grow at a CAGR of 47.13% from 2023 to 2033. Advances in AI sensors are making robots more capable, affordable, and adept at perceiving and interpreting their surroundings. This allows robots to navigate autonomously, avoid obstacles, and interact more effectively with their environment. As AI sensor technology progresses, robots are anticipated to become more intelligent and versatile, leading to broader adoption across various industries.

By Technology

By Sensor Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Artificial Intelligence (AI) Sensor Market

5.1. COVID-19 Landscape: Artificial Intelligence (AI) Sensor Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Artificial Intelligence (AI) Sensor Market, By Technology

8.1. Artificial Intelligence (AI) Sensor Market, by Technology, 2024-2033

8.1.1 NLP

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Machine Learning

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Computer Vision

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Context-aware Computing

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Artificial Intelligence (AI) Sensor Market, By Sensor Type

9.1. Artificial Intelligence (AI) Sensor Market, by Sensor Type, 2024-2033

9.1.1. Pressure

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Temperature

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Optical

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Position

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Ultrasonic

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Motion

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Navigation

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Artificial Intelligence (AI) Sensor Market, By Application

10.1. Artificial Intelligence (AI) Sensor Market, by Application, 2024-2033

10.1.1. Automotive

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Consumer Electronic

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Manufacturing

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Aerospace & Defense

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Robotics

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Smart Home Automation

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Healthcare

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Artificial Intelligence (AI) Sensor Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. ACI Worldwide

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Baidu, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BAE Systems.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. LexisNexis Risk Solutions.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Oracle Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Robert Bosch GmbH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Sensata Technologies, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Sensirion AG

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Silicon Sensing Systems Limited.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Sony Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others