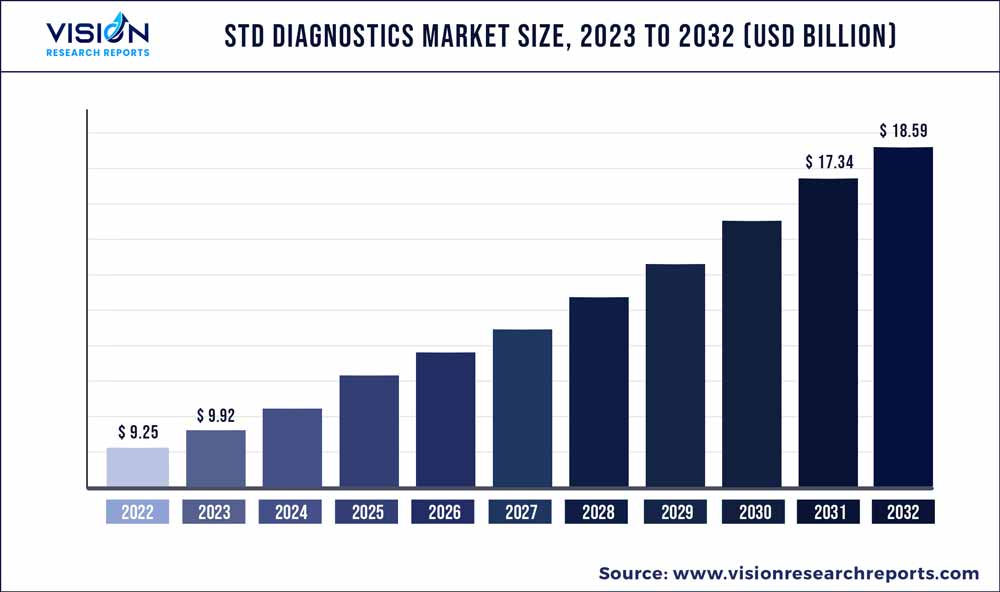

The global STD diagnostics market was valued at USD 9.25 billion in 2022 and it is predicted to surpass around USD 18.59 billion by 2032 with a CAGR of 7.23% from 2023 to 2032. The STD diagnostics market in the United States was accounted for USD 3 billion in 2022.

Key Pointers

Report Scope of the STD Diagnostics Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 38% |

| Revenue Forecast by 2032 | USD 18.59 billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.23% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | BD; F. Hoffmann-La Roche Ltd.; Hologic, Inc.; bioMérieux SA; Abbott; Danaher Corporation; Qiagen; Seegene Inc; Thermo Fisher Scientific Inc.; DiaSorin S.p.A; OraSure Technologies Inc.; Bio-Rad Laboratories, Inc |

The major factors driving the market are technological advancement in STD diagnostics and increasing government initiatives for early diagnostics and treatment. The rising disease burden is primarily driving the STD diagnostics industry. According to the Global Progress Report 2021, the total number of new cases of HIV was 1.7 million in 2020. In addition, 156 million new cases of Trichomonas vaginalis infection, 128 million new cases of Chlamydia trachomatis infection, 82 million new cases of Neisseria gonorrhea, and 7.1 million new cases of Treponema pallidum were recorded in 2020. The number of new cases of HBV and HCV was around 1.5 million in 2019.

Technological advancements related to accuracy, portability, and cost-effectiveness are expected to drive the Sexually Transmitted Disease (STD) diagnostics market over the forecast period. Key players are expanding their test portfolios, which include qPCR instruments, by investing in R&D to develop diagnostic kits that can identify emerging diseases or by entering into agreements with other kit manufacturing companies. In April 2021, at a deal price of USD 24.05 per share in cash, F. Hoffmann-La Roche Ltd. acquired GenMark Diagnostics, Inc. Now, it holds around 82.89% of the total shares of the company. GenMark Diagnostics, Inc., has proprietary technologies such as ePlex and eSensor XT-8 that can be utilized by F. Hoffmann-La Roche Ltd. to develop infectious disease tests including bloodstream infections.

Furthermore, the space has the presence of advanced technology such as multiplex PCR products and next-generation HIV testing kits. Development and commercialization of such products enable the diagnosis of a wide range of STIs with appropriate treatment. Seegene’s products Anyplex, Allplex, and Seeplex allow the detection of various causative agents. For example, one single test of Allplex STI/BV Panel Assay can differentiate 28 different causative agents. Thus, recent advance in technology is fueling the STD diagnostics industry.

However, the number of government initiatives is increasing for containing the STD epidemic in various regions. These initiatives include regular vaccination coverage for hepatitis A, hepatitis B, human papillomavirus, and herpes zoster virus, among others. The vaccination coverage for adults and adolescents helps in reducing the overall disease burden in the region. This may adversely affect the sexually transmitted disease diagnostics industry's growth. According to the CDC, the HPV vaccine can aid in the prevention of 32,100 cases of cancer every year. In the U.S., vaccination coverage for herpes zoster among adults aged 50 & above and adults aged 60 & above was 24.1% and 34.5%, respectively.

Product Insights

The consumables segment dominated the global market in 2022 with a revenue share of 70% and is anticipated to grow at the fastest CAGR over the forecast period owing to increased demand for consumables coupled with the introduction of innovative solutions. Protein biomarker-specific antibodies, washing buffers, and fluorescent tags are some of the most used consumables in immunoassays. On the other hand, primers and fluorescent-labeled nucleotides are primarily and most frequently used reagents during molecular diagnostic techniques. This segment is projected to witness steady growth owing to extensive R&D initiatives undertaken by companies for the development of novel biomarker kits. In September 2021, a group of researchers discovered Tp0369, a novel promising biomarker candidate from the serum of syphilis patients using mass spectrometry. This discovery could promote the development of new syphilis diagnostics tests.

Furthermore, an increase in product approvals for addressing the high demand for diagnosis of STDs may contribute to the growth of respective consumables in the market. For instance, in May 2022, Abbott’s Alinity m STI Assay received FDA clearance. It is a multiplex test that can detect and differentiate four common STDs simultaneously—Neisseria gonorrhoeae (NG), Chlamydia trachomatis (CT), Mycoplasma genitalium (MG), and Trichomonas vaginalis (TV).

Application Insights

The HIV segment dominated the market with a share of 32% in 2022 and is anticipated to witness the fastest growth at a CAGR of 9.00% over the forecast period, owing to high testing rate, increased product approvals, such as fourth-generation HIV tests & self-testing kits, and significant R&D initiatives relevant to novel products. The CDC in March 2023 announced the launch of a project, Together TakeMeHome (TTMH), to distribute up to 1 million HIV self-tests over 5 years. These tests can be ordered by people aged 17 years and older in the U.S. including Puerto Rico via an online portal. The test is developed by CDC in partnership with Building Healthy Online Communities (BHOC), OraSure Technologies, Emory University, Signal Group, and NASTAD.

The HPV testing segment is expected to grow at a significant CAGR during the forecast period. Traditionally, the Pap smear has been the primary screening method for cervical cancer. However, there has been a shift towards HPV testing as a more sensitive and reliable method for detecting high-risk HPV strains that are associated with the development of cervical cancer. New product launches specifically by reputed organization such as UNICEF plays an important role in creating awareness for cervical cancer. In January 2023, UNICEF launched a new cervical cancer toolkit, a comprehensive tool including an HPV DNA-based diagnostic tool, a preventive HPV vaccine, and a treatment pool. The launch of this kit will benefit the most for women in lower-income countries.

Technology Insights

The immunoassay segment dominated the STD diagnostics market in 2022 with a revenue share of 45% owing to higher testing rates for Sexually Transmitted Disease (STD) diagnostics. Moreover, the approval of new immunoassay products for the diagnosis of sexually transmitted diseases may impel market growth. For instance, in August 2020, DiaSorin, Inc. received 510 (k) approval from the U.S. FDA for introducing LIAISON XL MUREX anti-HBe, which is used for the diagnosis of HBV infection.

The FDA clearance of the first extragenital diagnostic tests also supports the STD diagnostics market growth. In May 2019, Aptima Combo 2 Assay and Xpert CT/NG were introduced by Hologic, Inc. & Danaher Corporation, respectively, after obtaining the U.S. FDA approval for the detection of Chlamydia trachomatis and Neisseria gonorrhoeae via the throat & rectum. However, these tests were cleared for testing urine, vaginal, and endocervical samples.

The molecular diagnostics segment is expected to exhibit the fastest growth rate of over the forecast period. The increase in applications of molecular diagnostics in the fields of STD diagnostics directly influences the demand for PCR technologies. In June 2021, Bio-Rad Laboratories, Inc. entered into a partnership with Seegene, Inc. for the development and commercialization of multiplex PCR-based products for the diagnosis of infectious diseases. Such strategic initiatives may enable market players to introduce innovative products in the STD diagnostics industry.

Location of Testing Insights

The laboratory testing segment dominated the market with a share of 79% in 2022. Many healthcare institutions are working with laboratories to integrate different tests. For instance, in October 2019, Becton, Dickinson, and Company (BD) and Check-Points Health B.V. received FDA clearance for BD MAX Check-Points CPO assay, which is used with BD MAX System to support clinical microbiology laboratories. This assay helps detect carbapenemase genes and is used as a molecular screening test for antibiotic-resistant, carbapenemase-producing organisms. Syndromic panels for STIs are available on the BD MAX product menu, assisting laboratory professionals in their efforts in providing clinical diagnosis, which helps physicians improve patient outcomes while increasing laboratory efficiency.

The point-of-care testing segment is estimated to witness the fastest growth over the forecast period, owing to the increased preference of patients and increased focus of manufacturers on the development of PoC diagnostics. Key companies are donating devices to hospitals for support and to enable them in providing quality care in diagnosing STDs discreetly amidst the Covid pandemic. In May 2021, OraSure Technologies, Inc. along with its partners, including Insignia Federal Group, LLC, Building Healthy Online Communities (BHOC), and Emory University, was selected by the CDC for the distribution of 100,000 HIV self-test kits in the U.S.

Regional Insights

North America held a market share of 38% in 2022 and is expected to maintain its dominance over the forecast period. This dominance can be attributed to the high testing rates, technological advancements, proactive government measures, improvements in healthcare infrastructure, and the presence of major players. Reimbursement policies and favorable government initiatives are likely to drive market growth. The New Technology Add-on Payment (NTAP) program has been introduced by the CMS to reduce financial losses for hospitals. An increase in the number of partnerships between in-vitro diagnostic companies and non-profit organizations for spreading awareness about STDs is creating lucrative growth opportunities in the STD diagnostics industry. In June 2021, OraSure Technologies, Inc. collaborated with Will Rodgers Liver Health Foundation for increasing awareness about Hepatitis C in the U.S.

Asia Pacific is estimated to witness the fastest growth rate over the forecast period. The high growth rate can be attributed to the rising disease burden of STIs and increasing testing rates. According to The Institute for New Era Strategy, around 641,000 people were infected with HCV in 2020, out of which, more than 530,000 people were aged under 80, and 157,000 were aged under 60 in Japan. Positive changes, such as healthcare benefits by the government, increased awareness among the population, and increased willingness to avail high-end medical facilities are also expected to drive the market growth in the region.

STD Diagnostics Market Segmentations:

By Product

By Application

By Technology

By Location of Testing

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on STD Diagnostics Market

5.1. COVID-19 Landscape: STD Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global STD Diagnostics Market, By Product

8.1. STD Diagnostics Market, by Product, 2023-2032

8.1.1. Instruments and Services

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Software

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global STD Diagnostics Market, By Application

9.1. STD Diagnostics Market, by Application, 2023-2032

9.1.1. CT/NG testing

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Syphilis testing

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Gonorrhea testing

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. HSV testing

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. HPV testing

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. HIV testing

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Ureaplasma & Mycoplasma testing

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Trichomonas

9.1.8.1. Market Revenue and Forecast (2020-2032)

9.1.9. VZV testing

9.1.9.1. Market Revenue and Forecast (2020-2032)

9.1.10. Others

9.1.10.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global STD Diagnostics Market, By Technology

10.1. STD Diagnostics Market, by Technology, 2023-2032

10.1.1. Immunoassay

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Molecular Diagnostics

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Other

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global STD Diagnostics Market, By Location of Testing

11.1. STD Diagnostics Market, by Location of Testing, 2023-2032

11.1.1. Laboratory Testing

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Point of Care Testing

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global STD Diagnostics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.2. Market Revenue and Forecast, by Application (2020-2032)

12.1.3. Market Revenue and Forecast, by Technology (2020-2032)

12.1.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Technology (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Technology (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.3. Market Revenue and Forecast, by Technology (2020-2032)

12.2.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Technology (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Technology (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Technology (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Technology (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.3. Market Revenue and Forecast, by Technology (2020-2032)

12.3.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Technology (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Technology (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Technology (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Technology (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.3. Market Revenue and Forecast, by Technology (2020-2032)

12.4.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Technology (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Technology (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Technology (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Technology (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.5.3. Market Revenue and Forecast, by Technology (2020-2032)

12.5.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Technology (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Technology (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Location of Testing (2020-2032)

Chapter 13. Company Profiles

13.1. BD

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. F. Hoffmann-La Roche Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Hologic, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. bioMérieux SA

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Abbott

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Danaher Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Qiagen

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Seegene Inc

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Thermo Fisher Scientific Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. DiaSorin S.p.A

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others