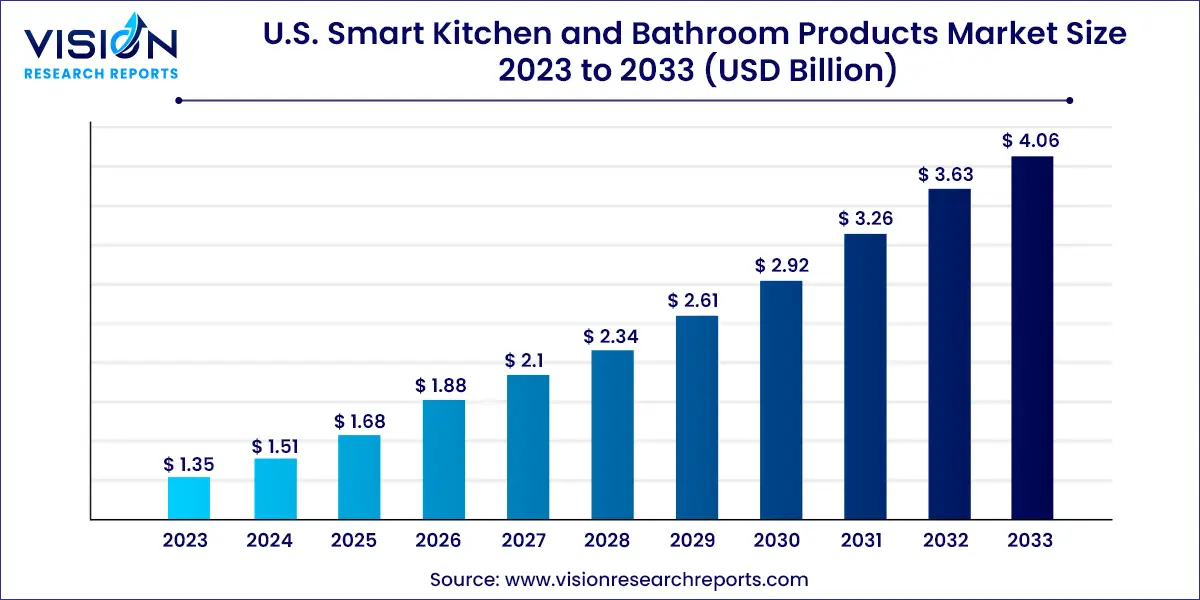

The U.S. smart kitchen and bathroom products market size was estimated at USD 1.35 billion in 2023 and it is expected to surpass around USD 4.06 billion by 2033, poised to grow at a CAGR of 11.63% from 2024 to 2033. The U.S. smart kitchen and bathroom products market is experiencing rapid growth, driven by increasing consumer demand for convenience, energy efficiency, and enhanced living experiences. As homes become more integrated with technology, the adoption of smart appliances and fixtures in kitchens and bathrooms is on the rise. This market encompasses a wide range of products, including smart refrigerators, ovens, dishwashers, faucets, showers, mirrors, and toilets, all equipped with advanced features like connectivity, voice control, automation, and energy monitoring.

The growth of the U.S. smart kitchen and bathroom products market is primarily driven by the rising demand for convenience and automation in modern households. Consumers are increasingly seeking smart appliances that not only simplify daily tasks but also contribute to energy efficiency and water conservation. The integration of IoT (Internet of Things) technology enables seamless connectivity and remote control of kitchen and bathroom devices, further enhancing their appeal. Additionally, the growing trend of home remodeling and renovation, coupled with the desire for modern, tech-enabled living spaces, is fueling the adoption of smart kitchen and bathroom products across the U.S.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.35 billion |

| Revenue Forecast by 2033 | USD 4.06 billion |

| Growth rate from 2024 to 2033 | CAGR of 11.63% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The commercial smart kitchen and bathroom product segment accounted for the largest share of 52% in 2023. The growing trend of automation and digitization, coupled with the increasing focus on sustainability and energy efficiency in commercial buildings, is expected to push the demand for smart kitchen and bathroom products in the commercial sector.

In the commercial sector, smart toilets accounted for the largest share of 55% in 2023. There has been an increase in the installation of smart toilets in many commercial settings, such as offices, hotels, restaurants, and resorts. Smart toilets offer advanced features such as automated flushing, touchless operation, bidet functions, adjustable water temperature, air drying, and self-cleaning capabilities. These features promote hygiene, convenience, and efficiency in high-traffic environments.

Smart toilets also contribute to water conservation by incorporating water-saving technologies and allowing for precise control of water usage. This has led to an increase in their installation in commercial settings. For instance, the Orlando-based Lake Nona Wave Hotel, which opened its doors in December 2021, has Toto Neorest smart toilets in every guest room. Similarly, High-end hotels such as Hyatt Hotels; Global Hotel Group; Extended Stay America; and Marriott have installed smart bathroom products such as smart toilets and smart shower systems in their rooms to reduce water waste.

The household smart bathroom products segment is anticipated to grow at a CAGR of 11.75% over the forecast period from 2024 to 2033. The increasing trend of home renovations and remodeling projects supports the demand for smart bathroom products. Homeowners in the United States are investing in upgrading their bathrooms with modern, technologically advanced fixtures and appliances to enhance comfort, convenience, and efficiency.

For instance, according to the 2023 Kitchen and Bath Market Outlook published by The National Kitchen & Bath Association, the spending on kitchen and bathroom remodeling in the U.S. increased by 16% in 2023 compared to 2021. In 2023, USD 37.6 billion was spent by homeowners on bathroom remodeling in the United States.

Sales of smart kitchen and bathroom products through wholesale channel accounted for the largest share of 60% in 2023 in the U.S. Through wholesale channels, 73.1% of smart kitchen and bathroom products are purchased by commercial institutions. Over the last decade, the expansion of the hospitality sector, including hotels, resorts, and hospitals, has led to an increased demand for smart kitchen and bathroom products in these segments.

With the rise in tourism and travel, there is an increased demand for modern, durable, and aesthetically appealing products in hotels, restaurants, and cafes across the country. As restaurants and hotels seek to modernize and renovate their facilities, they are actively opting for smart products with advanced technology to meet their customers' changing needs and preferences. This trend is fueling the demand for smart kitchen and bathroom products, especially for those providing premium and environmentally friendly solutions to their guests. For instance, in 2021, the Sheraton Waikiki Hotel in Hawaii celebrated its 50th anniversary and replaced all 1,635 traditional room toilets with smart toilets.

Sales through online distribution channel is expected to grow with a CAGR of 14.16% over the forecast period. Online sales channels offer convenience and flexibility for consumers, who can browse and purchase products from the comfort of their own homes at any time of day. Online sales channels often offer competitive pricing and deals that may not be available in physical retail stores. This can be particularly attractive for price-sensitive consumers who want value for money.

Players operating in the market are adopting innovative strategies to enhance consumers' online shopping experience. For instance, in 2023, TOTO LTD. presented a proposal that included virtual showroom experiences, allowing customers to view products through their devices, and virtual showroom consultations, enabling customers to participate in consultations from the comfort of their homes.

By Product

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Smart Kitchen and Bathroom Products Market

5.1. COVID-19 Landscape: U.S. Smart Kitchen and Bathroom Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Smart Kitchen and Bathroom Products Market, By Product

8.1. U.S. Smart Kitchen and Bathroom Products Market, by Product, 2024-2033

8.1.1. Household Smart Kitchen

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Household Smart Bathroom

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Smart Total Home

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Commercial

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Smart Toilets

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Smart Kitchen and Bathroom Products Market, By Distribution Channel

9.1. U.S. Smart Kitchen and Bathroom Products Market, by Distribution Channel, 2024-2033

9.1.1. Wholesale

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Retail

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Online

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Smart Kitchen and Bathroom Products Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 11. Company Profiles

11.1. Kohler Co.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Moen Incorporated

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. TOTO LTD.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Delta Faucet Company

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. American Standard (LIXIL Corporation)

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. GROHE AMERICA, INC. (LIXIL Corporation)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Duravit AG

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Signature Hardware (Ferguson plc)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Villeroy & Boch AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Roca Sanitario, S.A

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others