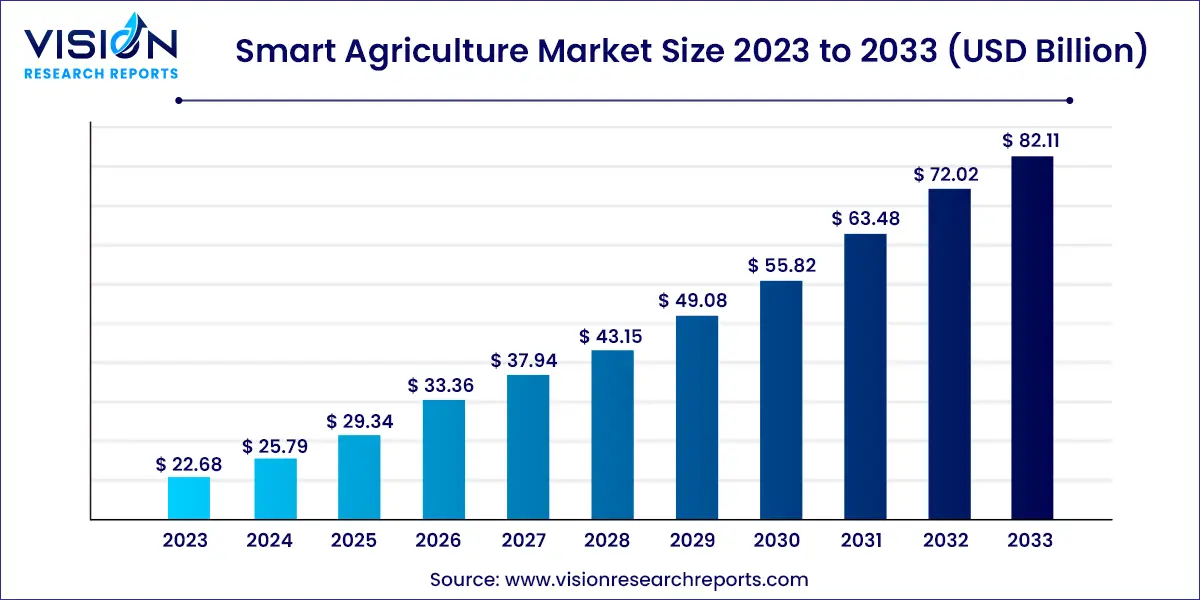

The global smart agriculture market size was estimated at USD 22.68 billion in 2023 and it is expected to surpass around USD 82.11 billion by 2033, poised to grow at a CAGR of 13.73% from 2024 to 2033. The smart agriculture market represents a transformative shift in farming practices through the integration of advanced technologies. This sector leverages innovations such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics to enhance agricultural productivity, efficiency, and sustainability.

The growth of the smart agriculture market is propelled by the escalating global population and the corresponding demand for increased food production are driving the need for advanced agricultural solutions. Farmers are increasingly turning to smart technologies to enhance crop yields and manage resources more efficiently. Additionally, advancements in technology, such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, are significantly contributing to market expansion. These technologies enable real-time monitoring, predictive analytics, and precision farming, leading to optimized agricultural practices. Furthermore, the rising emphasis on sustainability and environmental conservation is pushing the adoption of smart agriculture solutions that minimize resource wastage and reduce the environmental footprint.

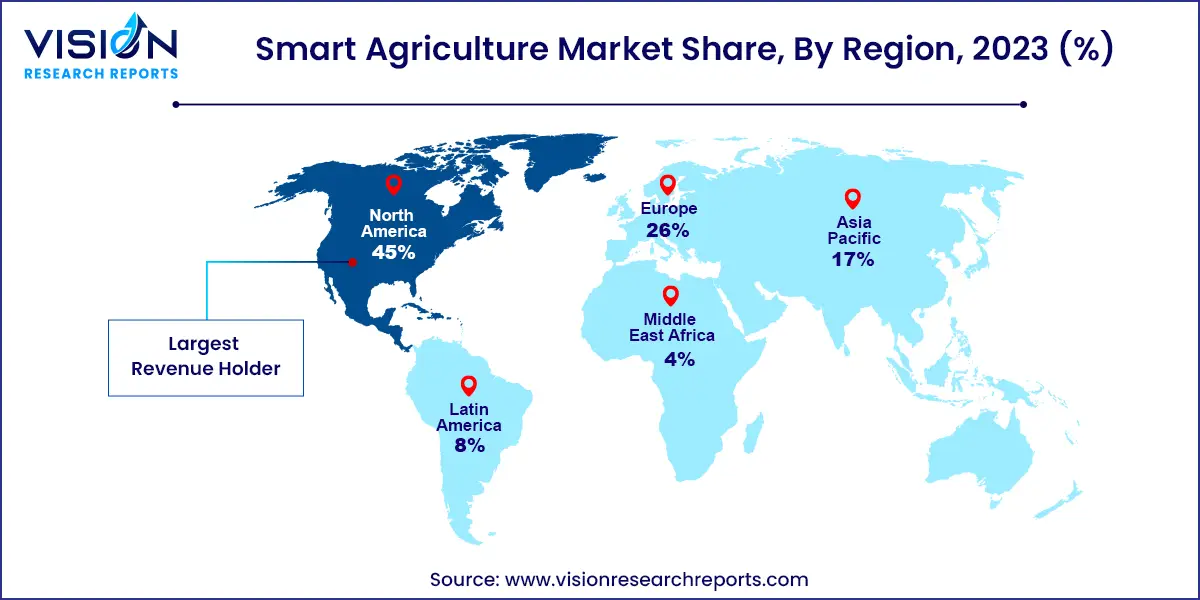

North America led the global smart agriculture market with a 45% share in 2023 and is expected to grow at a CAGR of 12.33% from 2024 to 2033. Government initiatives and regulations aimed at improving agriculture in the region are driving demand. The North America Climate Smart Agriculture Alliance (NACSAA) and subsidies for smart irrigation, such as rebates on smart controllers in California, highlight the region’s commitment to sustainable practices.

The Asia Pacific region is poised for the highest growth during the forecast period. Although smart farming is still in the early adoption phase here, increased government support and growing awareness among farmers are expected to boost regional demand. For instance, Japan's Ministry of Agriculture is funding precision agriculture development, and local farmers’ associations are promoting sustainable practices.

In 2023, the livestock monitoring segment held a significant 22% share of the global smart farming market. The market is segmented into precision farming, smart greenhouses, and other categories such as fish farming and horticulture. Precision livestock monitoring enhances real-time tracking of animal health, production, and welfare, aiming for optimal yields. Factors driving growth include the expansion of dairy farms and advancements in precision livestock monitoring technologies, which encourage market players to invest in new product developments and cost-effective livestock management solutions.

The smart greenhouse segment includes vertical farming and facilitates crop cultivation with minimal human intervention. It continuously monitors climatic conditions like soil moisture, temperature, and humidity, automatically adjusting these factors as needed.

Smart farming integrates IoT and information communication technologies to manage farming activities, conserve resources, and optimize yields. It provides real-time data on soil, air, and crop conditions to enhance farm profitability, sustainability, and environmental protection.

The software segment is projected to experience the highest growth rate from 2024 to 2033. The hardware segment is further divided into automation and control systems, HVAC systems, LED grow lights, RFID tags and readers, and sensing devices. Automation and control systems include application control devices, milking robots, guidance systems, driverless tractors, mobile devices, remote sensing, variable rate technology, drones, and wireless modules.

The automation of dairy and food production is expected to boost the milking robots segment, as these technologies improve milk quality and animal welfare while reducing labor costs. The rising demand for efficient herd management and cow health is anticipated to enhance the profitability of dairy and food processing sectors.

Drones within the automation and control systems are expected to see significant growth. Fixed-wing drones, with their rigid wings and forward airspeed, generate lift for stable flight, while rotary blade drones, including single and multi-rotor types, provide versatile flight capabilities. Hybrid drones, equipped with solar panels, offer prolonged flight durations by harnessing multiple energy sources.

In 2023, yield monitoring captured a 44% market share due to its role in tracking crop growth and reducing wastage through timely water and mineral supply. Applications within smart farming include irrigation management, yield monitoring, crop scouting, field mapping, weather forecasting, inventory management, and farm labor management. Weather monitoring and forecasting are expected to grow the fastest in the coming years.

Rising water scarcity and environmental awareness are driving changes in agricultural practices to conserve natural resources. Precision irrigation, which matches irrigation inputs with field yields, is expected to grow significantly. Smart greenhouses, which manage water, fertilizer, and HVAC systems, will also see expansion, particularly in HVAC management due to increasing greenhouse farms.

Livestock monitoring applications include milk harvesting, breeding management, feeding management, and animal comfort management. Technological advancements in livestock production are essential for addressing food shortages, with automated solutions enhancing animal well-being and productivity.

By Type

By Offering

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Agriculture Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Smart Agriculture Market

5.1. COVID-19 Landscape: Smart Agriculture Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Smart Agriculture Market, By Type

8.1. Smart Agriculture Market, by Type, 2023-2032

8.1.1 Precision farming

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Livestock monitoring

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Smart greenhouse

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Smart Agriculture Market, By Offering

9.1. Smart Agriculture Market, by Offering, 2023-2032

9.1.1. Hardware

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Software

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Services

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Smart Agriculture Market, By Application

10.1. Smart Agriculture Market, by Application, 2023-2032

10.1.1. Precision farming application

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Livestock monitoring application

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Smart greenhouse application

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Smart Agriculture Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Offering (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Offering (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Offering (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Offering (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Offering (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Offering (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Offering (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Offering (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Offering (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Offering (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Offering (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Offering (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Offering (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Offering (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Offering (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Offering (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Offering (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Offering (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Offering (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Offering (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Agriculture Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Offering (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Ag Leader Technology

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. AGCO Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. AgJunction

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. AgEagle Aerial Systems Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Autonomous Solutions, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Argus Control Systems Ltd

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. BouMatic Robotic B.V.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. CropMetrics

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. CLAAS KGaA mbH

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. CropZilla

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others