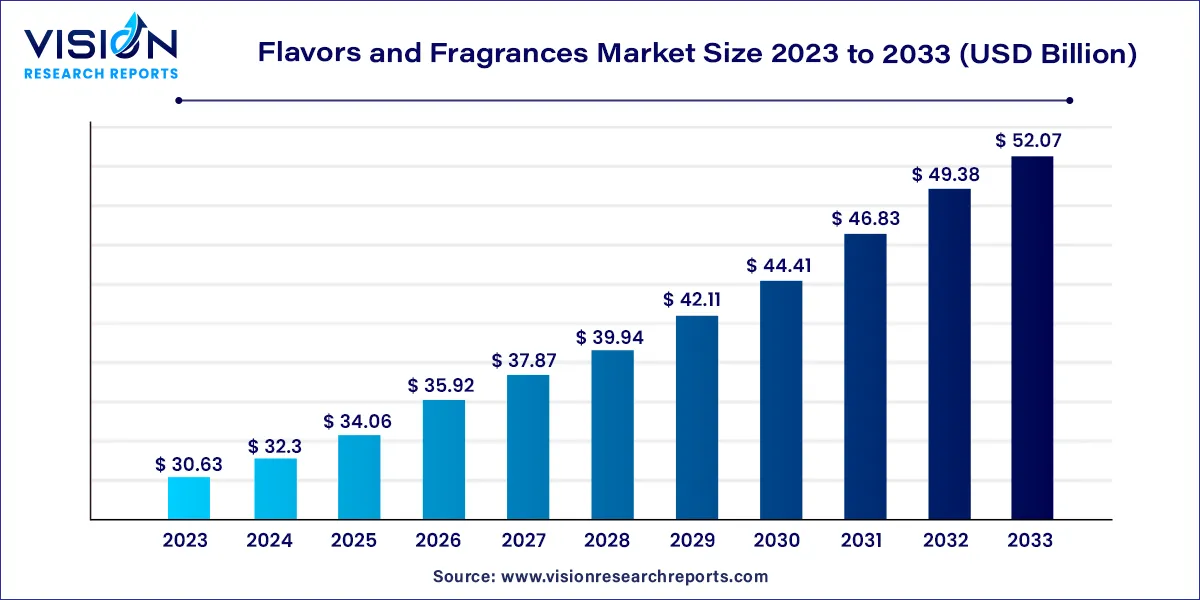

The global flavors and fragrances market size was valued at USD 30.63 billion in 2023 and it is predicted to surpass around USD 52.07 billion by 2033 with a CAGR of 5.45% from 2024 to 2033. The flavors and fragrances market is a dynamic and growing sector within the global economy, playing a crucial role in various industries including food and beverages, personal care, household products, and pharmaceuticals. This market encompasses a wide range of products designed to enhance taste, aroma, and overall sensory experiences for consumers.

The growth of the flavors and fragrances market is significantly driven by the rising consumer demand for innovative and diverse sensory experiences is a major catalyst, particularly within the food and beverage sector. As consumers increasingly seek unique and personalized taste and aroma profiles, companies are compelled to innovate and diversify their offerings. Second, the shift towards natural and organic ingredients reflects a broader trend towards health and environmental consciousness, pushing the market towards more sustainable and eco-friendly solutions. Additionally, advancements in technology, such as enhanced extraction methods and synthetic biology, enable the creation of novel flavors and fragrances, further stimulating market expansion. Regulatory compliance also plays a crucial role, as adherence to stringent safety and quality standards ensures consumer trust and market stability.

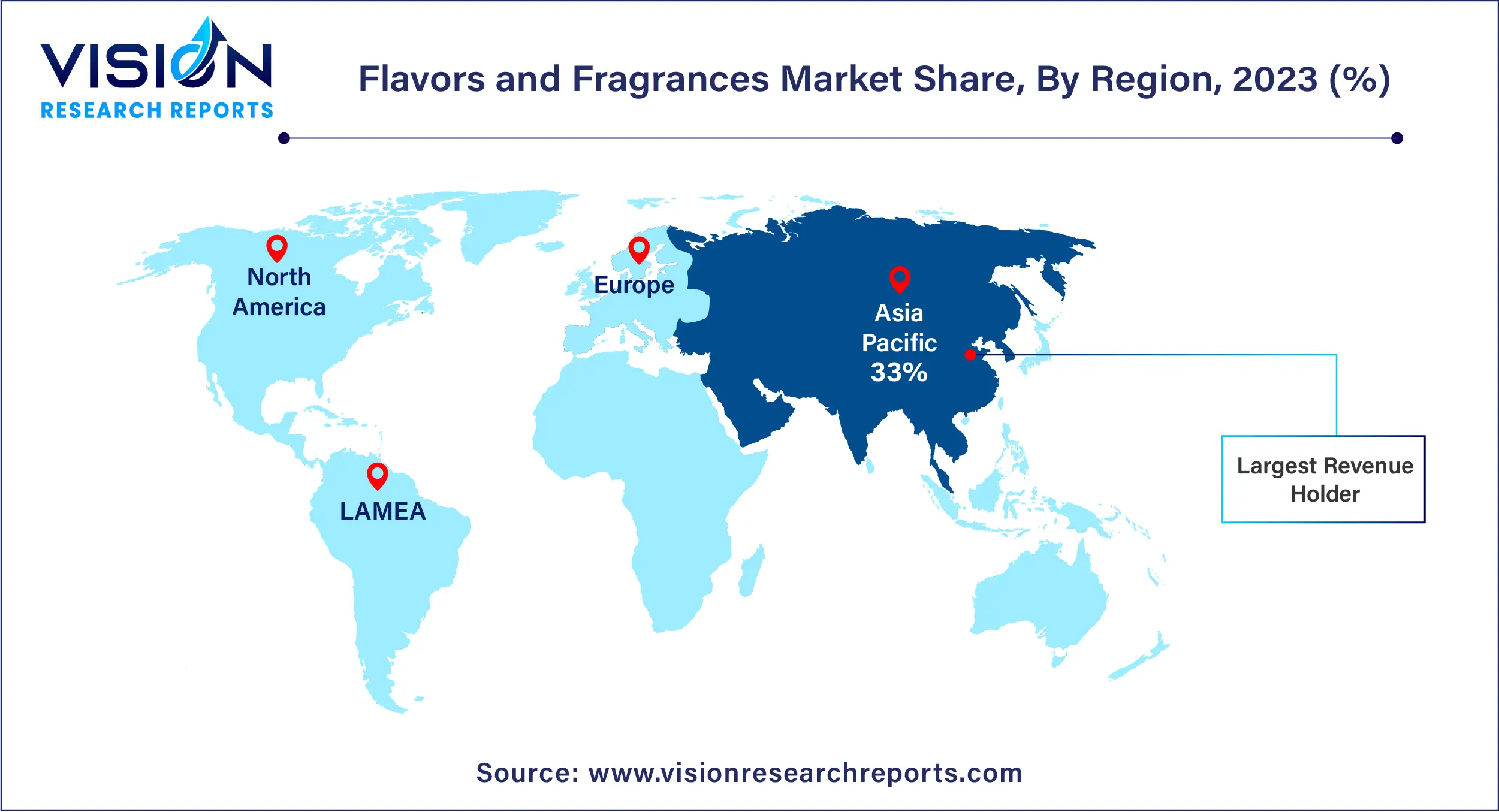

In 2023, Asia Pacific led the global market with a revenue share exceeding 33%. This prominence is attributed to the growing consumer preference for nutritious and healthy foods and beverages in densely populated countries like India and China. Asian flavors and fragrances are also gaining popularity in Europe, the Middle East, and North America. Key markets in Asia Pacific include Indonesia, India, China, and Vietnam, where numerous companies are investing in business expansion and R&D facilities.

| Attribute | Asia Pacific |

| Market Value | USD 10.10 Billion |

| Growth Rate | 5.47% CAGR |

| Projected Value | USD 17.18 Billion |

Government incentives, such as subsidies and tax benefits, along with high per capita income, are attracting global companies to the region. The Comprehensive Economic & Trade Agreement (CETA) is expected to eliminate customs duties on food, agricultural, and industrial products, facilitating trade between Europe and North America. This agreement is anticipated to boost the trade of essential oils and floral extracts, providing significant growth opportunities for industry players in North America.

In 2023, the natural chemicals segment led the industry, capturing over 75% of the revenue. This dominance is driven by the growing use of natural chemicals across various sectors, including pharmaceuticals, aromatherapy, and natural cosmetics. Additionally, increased investment in research for natural fragrance compounds is expected to positively influence the industry. Aroma chemicals, which are synthetic scents, are widely used in essential oils, food and beverages, and perfumes.

Aroma chemicals are vital for creating fragrances and flavors that enhance the appeal and taste of food products. These chemicals include phenols, aldehydes, alcohols, esters, and others. The rising demand for exotic essential oils, such as sandalwood, junipers, rosemary, lavender, and geranium, reflects the growing trend towards natural products in pharmaceuticals, aromatherapy, and cosmetics. Developed countries, in particular, are seeing a high demand for fragrances where synthetic odors are replaced by natural oils, leading to the development of new blends.

In 2023, the fragrances segment was the largest, accounting for over 52% of global revenue. This substantial share is due to the increased demand for fragrances in toiletries, including hand washes, detergents, soaps, personal care items, and cosmetics. Fragrance also plays a key role in aromatherapy, driving demand for essential oils, aromatic compounds, and oils.

Moreover, the growing popularity of aromatherapy diffusers is expected to further boost industry growth. Flavors, used primarily in food and beverages, are seeing increased application in both commercial and domestic settings. Additionally, feed and feed additive producers are focusing on enhancing feed palatability, which is likely to drive the demand for flavors in animal feed applications, contributing to overall market growth.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Flavors And Fragrances Market

5.1. COVID-19 Landscape: Flavors And Fragrances Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Flavors And Fragrances Market, By Product

8.1. Flavors And Fragrances Market, by Product, 2024-2033

8.1.1. Natural

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Aroma Chemical

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Flavors And Fragrances Market, By February

9.1. Flavors And Fragrances Market, by February, 2024-2033

9.1.1. Flavors

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Fragrances

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Flavors And Fragrances Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by February (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by February (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by February (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by February (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by February (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by February (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by February (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by February (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by February (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by February (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by February (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by February (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by February (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by February (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by February (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by February (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by February (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by February (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by February (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by February (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by February (2021-2033)

Chapter 11. Company Profiles

11.1. Sensient Technologies Corp.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Mane SA

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Takasago International Corp.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Manohar Botanical Extracts Pvt. Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Alpha Aromatics

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ozone Naturals

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Elevance Renewable Sciences, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Firmenich SA

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Symrise AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Vigon International, Inc

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others