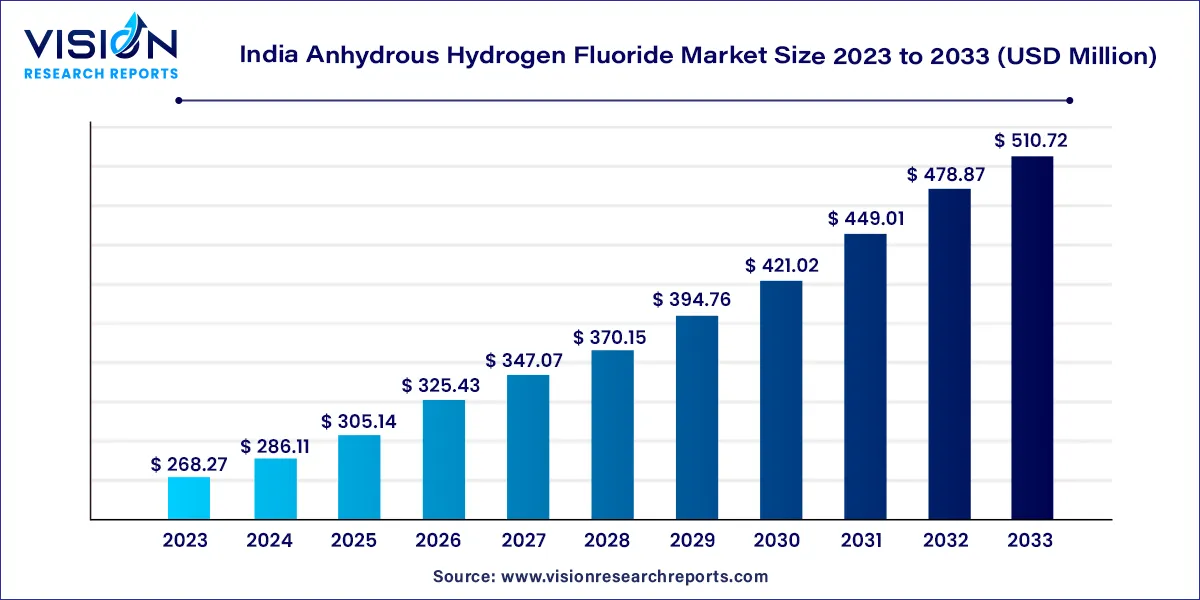

The India anhydrous hydrogen fluoride market size was valued at USD 268.27 million in 2023 and it is expected to hit around USD 510.72 million by 2033, poised to grow at a CAGR of 6.65% from 2024 to 2033.

The growth of the India anhydrous hydrogen fluoride (AHF) market is driven by an increasing demand from the chemical and pharmaceutical industries for high-purity AHF for manufacturing fluorine-based compounds and intermediates is a primary growth driver. The expanding electronics sector in India, where AHF is used in the production of semiconductors and etching processes, also contributes significantly. Additionally, the rise in industrial activities and infrastructure development necessitates the use of AHF in various applications, including refrigeration and air conditioning systems. Government initiatives to boost the manufacturing sector and advancements in technology further support the market's expansion

| Report Coverage | Details |

| Market Size in 2023 | USD 268.27 million |

| Revenue Forecast by 2033 | USD 510.72 million |

| Growth rate from 2024 to 2033 | CAGR of 6.65% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Honeywell International Inc.; Solvay; Linde pl; Arkema; Lanxess; Navin Fluorine International Limited; Gujarat Fluorochemicals Limited |

The Fluorogases segment dominated the India AHF market, with the highest revenue share of 68% in 2023. This is attributable to its use in increasing urbanization and infrastructure development, changing lifestyles, and rising income levels, which are further rising the demand for refrigerators and air conditioners in India.

According to the India Brand Equity Foundation report published in December 2023, the market size of refrigerators is anticipated to reach 27.5 million units and air conditioners are expected to reach 19.5 million units by 2025. In addition, hydrofluorocarbons are used to produce polyurethane foams. These foams are used in building insulation, furniture such as sofas & mattresses, packaging to protect delicate items during transportation, and automotive interiors. With an increase in demand for HFCs to manufacture polyurethane foams, the demand for anhydrous hydrogen fluoride is expected to increase over the forecast period.

Fluorogases are a group of synthetic gases that contain fluorine atoms. They are characterized by their high chemical inertness, low toxicity, and non-flammability. Hydrofluorocarbons are examples of fluoro gases used in refrigeration and air-conditioning. Moreover, anhydrous hydrogen fluoride is used to synthesize hydrofluorocarbons. When the hydrocarbon reacts with anhydrous hydrogen fluoride, the fluoride atom gets introduced into the hydrocarbon structure, forming the hydrofluorocarbons. HFCs are used to replace the ozone-depleting chlorofluorocarbons and hydrochlorofluorocarbons in refrigeration and air conditioning applications.

Fluorinated ethylene propylene, polytetrafluoroethylene, and polyvinylidene fluoride are examples of fluoropolymers that are used in the chemical processing industries, electronics, automotive and medical devices. Anhydrous hydrogen fluoride is used as a polymerization catalyst as well as a key raw material in the preparation of fluoropolymers. It is mainly used to introduce fluorine atoms into the polymer, which enhances the ability of fluoropolymers to sustain thermal stresses and resistance to acids and solvents.

Fluoropolymers are used in the automobile industry to manufacture fuel lines, O-rings, onboard diagnostic sensors (ODS), gaskets, and seals. Increasing production of vehicles and favorable government initiatives for the automotive sector is expected to drive the demand for fluoropolymers in India.

By End-use

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on India Anhydrous Hydrogen Fluoride Market

5.1. COVID-19 Landscape: India Anhydrous Hydrogen Fluoride Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. India Anhydrous Hydrogen Fluoride Market, By End-use

8.1.India Anhydrous Hydrogen Fluoride Market, by End-use Type, 2024-2033

8.1.1. Fluoropolymers

8.1.1.1.Market Revenue and Forecast (2021-2033)

8.1.2. Fluorogases

8.1.2.1.Market Revenue and Forecast (2021-2033)

8.1.3. Pesticides

8.1.3.1.Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1.Market Revenue and Forecast (2021-2033)

Chapter 9. India Anhydrous Hydrogen Fluoride Market, Regional Estimates and Trend Forecast

9.1. India

9.1.1. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 10.Company Profiles

10.1. Honeywell International Inc.

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Solvay

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Linde pl

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Arkema

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Lanxess

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Navin Fluorine International Limited

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Gujarat Fluorochemicals Limited

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others