The global RF interconnects market size was surpassed at USD 31.05 billion in 2023 and is expected to hit around USD 64.77 billion by 2033, growing at a CAGR of 7.63% from 2024 to 2033. The RF interconnect market is witnessing substantial growth fueled by advancements in wireless communication technologies, the proliferation of IoT devices, and the increasing adoption of 5G networks.

The growth of the RF interconnect market is driven by the global rollout of 5G networks is a significant catalyst, fueling demand for high-speed data transmission and reliable connectivity. Secondly, the rapid expansion of the Internet of Things (IoT) ecosystem across various sectors is creating a surge in demand for RF interconnect solutions to support diverse connectivity requirements. Additionally, the automotive industry's shift towards connected and autonomous vehicles is driving adoption of RF interconnect solutions for in-vehicle communication and telematics. Lastly, continuous investments in research and development are enhancing the performance and efficiency of RF interconnect solutions, further propelling market growth. These factors collectively contribute to the robust expansion of the RF interconnect market, offering lucrative opportunities for industry players.

| Report Coverage | Details |

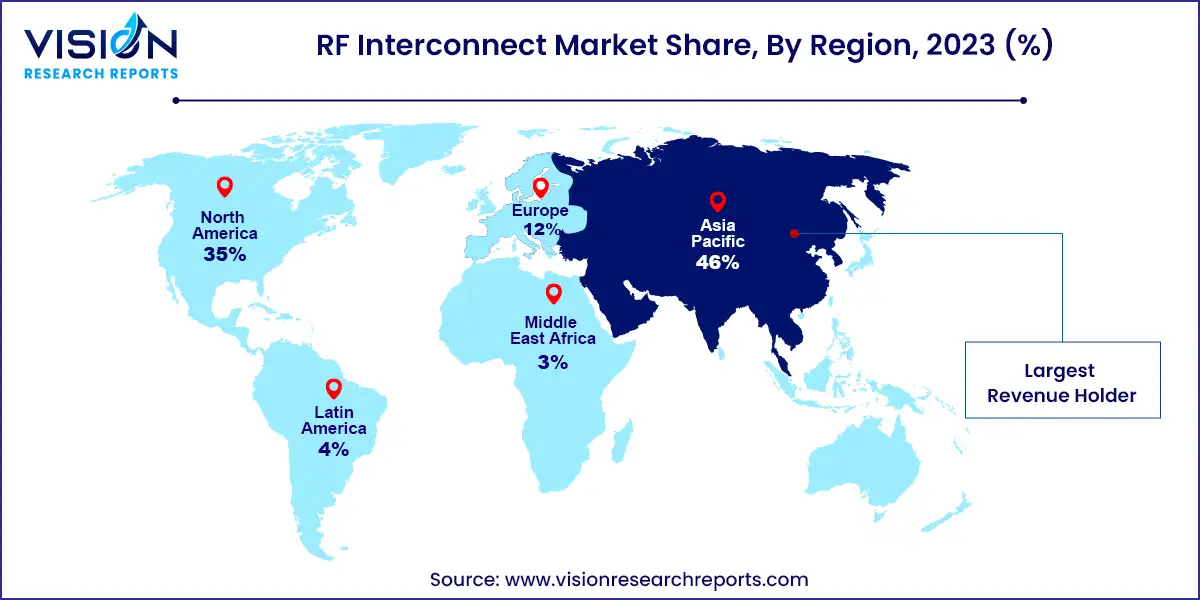

| Revenue Share of Asia Pacific in 2023 | 46% |

| CAGR of North America from 2024 to 2033 | 8.47% |

| Revenue Forecast by 2033 | USD 64.77 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.63% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on type, the market is classified into RF cable, RF cable assembly, RF coaxial adapter, and RF connector. The RF cable assembly segment held the largest revenue share of more than 35% in 2023 and is expected to witness a CAGR of 7.05% during the forecast period. Cable assembly refers to assembling one or more cables enclosed in a single tube. RF cable assemblies serve as communication lines for RF signals crossing from one point in a system to another (for example, equipment to equipment, equipment to the antenna, PC board to the antenna, PC board to a PC board, etc.).

This cable assembly normally consists of radio frequency coaxial connectors, which are mechanically attached to a coaxial cable. Several variables need to be considered when designing radio frequency coaxial cable assemblies, including mechanical considerations (length, weight, and size), environmental considerations, shielding effectiveness, electrical performance (return loss, insertion loss, and impedance), frequency, connector types, and materials and construction.

The RF coaxial adapter is anticipated to witness the fastest CAGR of 8.84% throughout the forecast period. These are passive coaxial components that transfer signals from one connector interface to another. They can be utilized to transition signals from a Sub-Miniature A (SMA) connector to an N-Type connector interface of Bayonet Neill-Concelman (BNC) connectors to Threaded Neill-Concelman (TNC) connectors, etc. Adapters and connectors are similar in terms of functionality.

These are also used for providing connections across a network from various devices. Like most adapters, plugs/sockets, and connectors, RF adapters can also be identified by gender. Female RF adapters are usually recognized by their pin, also called the plug, and male RF adapters have an opening designed for attaching the pin or plug on female connectors, which is used to join the two individual parts together. Male RF adapters are also referred to as jacks.

Based on frequency, the market is classified into up to 6GHz, above 50 GHz, and up to 50 GHz segments. The up to 50 GHz segment dominated with a revenue share of 43% in 2023 and is expected to grow at a CAGR of 7.15% during the forecast period. This range of frequency is known as the Super High Frequency (SHF). SHF is the International Telecommunication Union designation for RF within the range of 3 and 50 GHz. Since the wavelengths range from 1-10 cm, this frequency band is also called the centimeter band or centimeter wave.

SHF is also called microwave because the radio waves of these frequencies are within the microwave band. The small wavelength of microwaves permits SHF to be directed in thin beams by aperture antennas, which makes them suitable for data links, point-to-point communication, and radar. Most satellite phones (S-band), satellite communication, wireless LANs, microwave radio relay lines, radar transmitters, and multiple short-range terrestrial data links operate within this frequency range. They are also utilized for heating to cook food in microwave ovens, microwave hyperthermia to treat cancer, medical diathermy, and industrial microwave heating.

The up to 6 GHz segment is anticipated to witness the fastest growth, growing at a CAGR of 8.64% throughout the forecast period. This range of frequency is known as Ultra High Frequency (UHF). UHF connectors are radio frequency connectors that transmit frequencies up to 6 GHz. These connectors contain non-constant surge impedance and are typically used for radio applications such as ham radio, marine VHF radio, and amateur radio.

The increasing demand for higher data rates has been a driving force behind this growth. With the widespread adoption of wireless communication devices and the rapid expansion of the Internet of Things (IoT), there is a growing need for faster and more reliable data transmission. The up to 6GHz frequency range provides sufficient bandwidth to support these requirements, making it a popular choice for RF interconnect solutions.

Based on end-user, the RF interconnect market is classified into aerospace & defense, medical, industrial, and others. Among these, the others segment dominated in 2023, gaining a revenue share of 63% and is expected to witness a CAGR of 7.56% throughout the forecast period. Industries such as construction, IT & telecommunication, consumer electronics, manufacturing, and automobile are covered under the others category.

The consumer electronics sector is projected to provide promising growth opportunities to the global radio frequency cable industry owing to the ongoing development of high-tech products and the growing demand for HVAC equipment with advanced features. The growing demand for flexible, highly durable, high-performance RF systems for efficient signal processing in military applications, such as Electronic Warfare (EW), is expected to support the aerospace and defense segment outlook. Furthermore, increasing investments in digitization initiatives across industries are expected to drive the demand for power transmission and distribution networks.

The industrial segment is anticipated to witness the most rapid growth at a CAGR of 8.85% throughout the forecast period. High-frequency connectors connect cables, printed circuit boards, and devices to transmit extremely high frequencies. Connectors in the market range from miniature to large and heavy connectors. Connectors are not only necessary for enabling existing and forthcoming technologies, but they must also be able to withstand the ever-increasing transmission rates, adapt to economic and ecological conditions, and continually satisfy the demand for reliability and performance, even in tough conditions.

As transmission rates continue to increase, high-frequency connectors must be capable of handling higher frequencies without compromising signal integrity. The demand for faster data transmission and communication necessitates connectors that can support higher data rates and bandwidths. This significantly challenges connector manufacturers to develop innovative designs and materials that can meet these demanding requirements.

Asia Pacific led the overall market in 2023, with a revenue share of 46%. The Asia Pacific RF interconnect industry has experienced remarkable growth in recent years, fueled by various factors specific to the region. One key driver of this growth is the rapidly expanding telecommunications sector. Asia Pacific is home to some of the largest and fastest-growing telecommunications markets, such as China and India. The increasing demand for high-speed data transmission, mobile communication, and internet connectivity has led to a surge in the deployment of advanced RF interconnect solutions.

The emergence of 5G technology has also played a significant role in driving the growth of the RF interconnect industry in the Asia Pacific. The region has been at the forefront of 5G deployment, with several countries actively rolling out 5G networks. This transition to 5G requires a higher density of antennas and increased network capacity, which, in turn, drives the need for efficient RF interconnect technologies to support the increased data rates and frequencies associated with 5G.

North America is anticipated to witness the most rapid growth, growing at a CAGR of 8.47% throughout the forecast period. Different administrations' growing interest in providing high-speed internet service to citizens, new oil and gas development potential, and stringent laws for RF systems are some of the fundamental factors driving the growth of the RF interconnect in the North America region.

Moreover, the region's potential for new oil and gas development has also contributed to the growth of the RF interconnect industry. As the industry seeks to optimize production and improve operational efficiency, deploying RF interconnect solutions becomes essential for reliable communication and control systems in remote and harsh environments. For instance, the U.S. Federal Communications Commission has implemented several policies on RF devices' operation and their impacts on the human environment. The division has also implemented several rules and uses special software to detect radio frequency density near broadcasting towers to observe the installations.

By Type

By Frequency

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on RF Interconnect Market

5.1. COVID-19 Landscape: RF Interconnect Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global RF Interconnect Market, By Type

8.1. RF Interconnect Market, by Type, 2024-2033

8.1.1 RF Cable

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. RF Cable Assembly

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. RF Coaxial Adapter

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. RF Connector

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global RF Interconnect Market, By Frequency

9.1. RF Interconnect Market, by Frequency, 2024-2033

9.1.1. Up to 6GHz

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Up to 50 GHz

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Above 50 GHz

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global RF Interconnect Market, By End-user

10.1. RF Interconnect Market, by End-user, 2024-2033

10.1.1. Aerospace & Defense

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Medical

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global RF Interconnect Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.1.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.2.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.3.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Frequency (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 12. Company Profiles

12.1. Penn Engineering Components.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Jupiter Microwave Components Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Quantic Electronics.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Amphenol RF.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Delta Electronics, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Samtec

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Cobham Advanced Electronic Solutions.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Ducommun Incorporated

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. ETL Systems Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Smiths Interconnect

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others