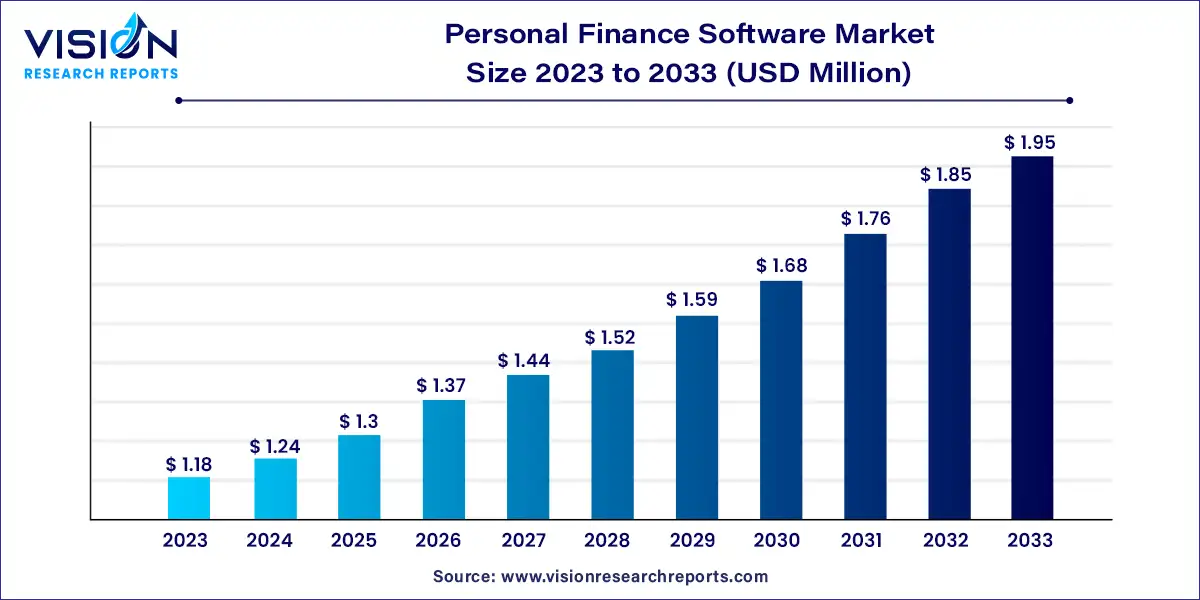

The global personal finance software market size was estimated at USD 1.18 billion in 2023 and it is expected to surpass around USD 1.95 billion by 2033, poised to grow at a CAGR of 5.15% from 2024 to 2033.

The personal finance software market is experiencing significant growth driven by the growing awareness among individuals regarding the importance of financial planning and management, leading to an increased demand for tools that facilitate budgeting, expense tracking, and investment management. Secondly, technological advancements, particularly in the areas of artificial intelligence and machine learning, are enhancing the capabilities of personal finance software, enabling users to access personalized insights and predictive analytics to make informed financial decisions. Additionally, the COVID-19 pandemic has accelerated the shift towards digital financial services, with more individuals seeking remote-friendly solutions for managing their finances. This increased adoption of digital platforms further fuels market expansion, providing opportunities for both established players and innovative startups to cater to evolving consumer needs and preferences in the personal finance space.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 30% |

| Revenue Forecast by 2033 | USD 1.95 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.15% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The budget planner segment accounted for the second-largest share of more than 30% of the overall revenue in 2023. The budget planner helps individuals and business owners to plan and budget their expenses. It enables them to achieve financial stability by paying bills on time and saving funds for other major expenses, such as a car or home. Furthermore, the increasing launches of such budget planner across the globe is anticipated to drive the segment’s growth. For instance, in November 2023, Santander UK, a financial services company, announced the launch of its financial support hub, a budget calculator, and financial health check.

The investment tracker segment is projected to register the fastest CAGR from 2024 to 2033. The growth of this segment can be attributed to the increasing awareness about investments among customers. Various organizations, such as The Securities and Exchange Commission's Office of Investor Education and Advocacy (OIEA), promote investment awareness among individuals. Furthermore, various personal finance software, such as Quicken Inc., Buxfer Inc., and Intuit, provide investment tracking tools that bode well with the segment’s growth.

The desktop-based software segment dominated the market in 2023 accounting for a share of more than 55% of the overall revenue. The dominance of the desktop-based software segment is primarily due to the accessibility of maximum features, including charts and graphs, over a desktop compared to mobile phones. Desktop-based software may be of more utility to institutions due to the complex nature of their cash flow. Several personal finance software, such as Moneydance, a desktop-based personal finance software, can be accessed using Windows, Mac, or Linux desktops.

The mobile-based software segment is projected to register the fastest growth rate over the forecast period. The growth of this segment can be attributed to the high penetration rate of mobile phones worldwide. For instance, in 2023, according to Newzoo International B.V., a video games and gamer data company, the smartphone penetration rate across China, the U.S., and Japan has climbed to 68.4%, 81.6%, and 78.6%, respectively. Furthermore, various desktop-based personal software companies have already started introducing applications based on Android and iOS operating systems.

The cloud segment dominated the market in 2023 and accounted for a share of more than 53% of the overall revenue. An increase in the adoption of the cloud by several enterprises across the globe is expected to drive the segment's growth. Furthermore, the cloud allows syncing of the data and offers multi-device access to the users. For instance, a person can easily switch between a mobile device and a desktop with cloud deployment; thereby, such benefits are expected to fuel the segment's growth over the forecast period.

The on-premise deployment segment is anticipated to register the second-fastest growth rate from 2024 to 2033. The growth of on-premise personal finance software can be attributed to its highly secured nature. The on-premise deployments provide control over software upgrades and their frequency. As a result, it can be a preferred choice for many small enterprises, as it offers the best way to secure and manage their financial data.

The individuals segment dominated the market in 2023 accounting for a share of more than 59% of the overall revenue. The growth of this segment can be attributed to the increasing adoption of personal finance software by individuals to track their financial data. A rise in the adoption of personal finance software can be attributed to the rising financial awareness among individuals. For instance, according to the FINRA survey, around 71% of adult Americans believe they have high financial literacy levels. The small businesses segment is expected to register the fastest CAGR from 2024 to 2033.

The growth can be attributed to the increasing adoption of personal finance software by small business owners. The adoption can be attributed to the benefits provided by the software, which include allowing small business owners to do expense tracking and budgeting, invoicing & payment management, and managing cash flow. Furthermore, the increasing number of small businesses across the globe is anticipated to fuel the segment's growth. For instance, according to advocacy.sba.gov and Oberlo, in 2023, the number of small businesses reached 33.2 million across the U.S.

North America dominated the global market in 2023 accounting for a share of more than 30% of the overall revenue. The presence of prominent personal finance software providers, such as Quicken Inc., Intuit, Inc. (Mint), and Buxfer Inc., is anticipated to fuel the regional market's growth. Furthermore, the rising campaigns and financial literacy programs are expected to fuel the regional market's growth over the forecast period. In addition, the rising investments in personal finance software companies also bode well for regional market growth.

Asia Pacific is expected to be the fastest-growing region over the forecast period. The region's growth can be attributed to the increasing adoption of personal finance software across countries, including China and India. Furthermore, a rise in the population of these countries creates growth opportunities for the regional market. In addition, the increasing financial awareness among individuals in this region is expected to drive regional market growth over the forecast period.

By Tools

By Type

By Deployment

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Personal Finance Software Market

5.1. COVID-19 Landscape: Personal Finance Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Personal Finance Software Market, By Tools

8.1. Personal Finance Software Market, by Tools, 2024-2033

8.1.1. Budget Planner

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Retirement Planner

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Investment Tracker

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Personal Finance Software Market, By Type

9.1. Personal Finance Software Market, by Type, 2024-2033

9.1.1. Desktop-based Software

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Mobile-based Software

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Personal Finance Software Market, By Deployment

10.1. Personal Finance Software Market, by Deployment, 2024-2033

10.1.1. Cloud

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. On-premise

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Personal Finance Software Market, By End-user

11.1. Personal Finance Software Market, by End-user, 2024-2033

11.1.1. Small Businesses

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Individuals

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Personal Finance Software Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Tools (2021-2033)

12.1.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Tools (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Tools (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Tools (2021-2033)

12.2.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Tools (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Tools (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Tools (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Tools (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Tools (2021-2033)

12.3.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Tools (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Tools (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Tools (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Tools (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Tools (2021-2033)

12.4.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Tools (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Tools (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Tools (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Tools (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Tools (2021-2033)

12.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Tools (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Tools (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 13. Company Profiles

13.1. Quicken Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. The Infinite Kind

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Intuit, Inc. (Mint)

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. You Need A Budget LLC

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Buxfer Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Doxo Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Money Dashboards

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Moneyspire Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Personal Capital Corp.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Pocket Smith Ltd

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others