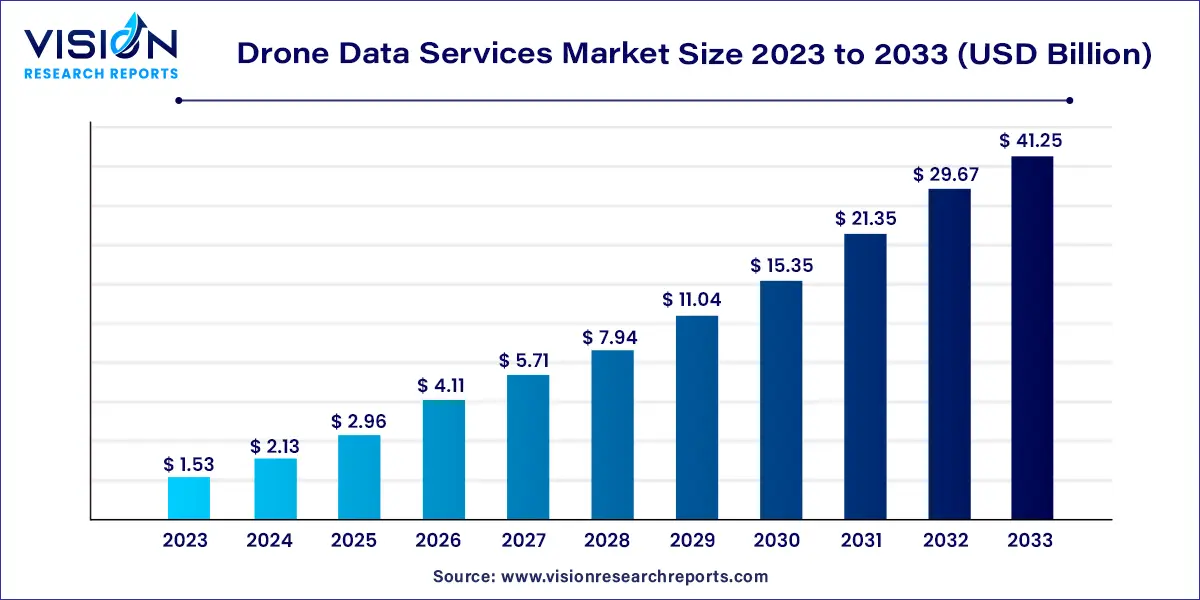

The global drone data services market size was estimated at around USD 1.53 billion in 2023 and it is projected to hit around USD 41.25 billion by 2033, growing at a CAGR of 39.02% from 2024 to 2033.

In the age of technological innovation, drones have emerged as powerful tools, reshaping the landscape of various industries. The drone data services market, a vital component of this technological revolution, encompasses a wide array of services that leverage drone technology to collect, process, and analyze data for diverse applications.

The rapid expansion of the drone data services market can be attributed to several key growth factors. First and foremost, the increasing adoption of drones across diverse industries, including agriculture, construction, and environmental monitoring, drives the demand for data services. Businesses are recognizing the efficiency and accuracy of aerial data collection, leading to a surge in service requirements. Moreover, advancements in sensor technologies and data processing techniques are enhancing the capabilities of drones, enabling them to capture and analyze intricate data with precision. Additionally, the growing awareness of the benefits of drone data services, such as improved decision-making, cost-effectiveness, and enhanced operational efficiency, fuels market growth.

| Report Coverage | Details |

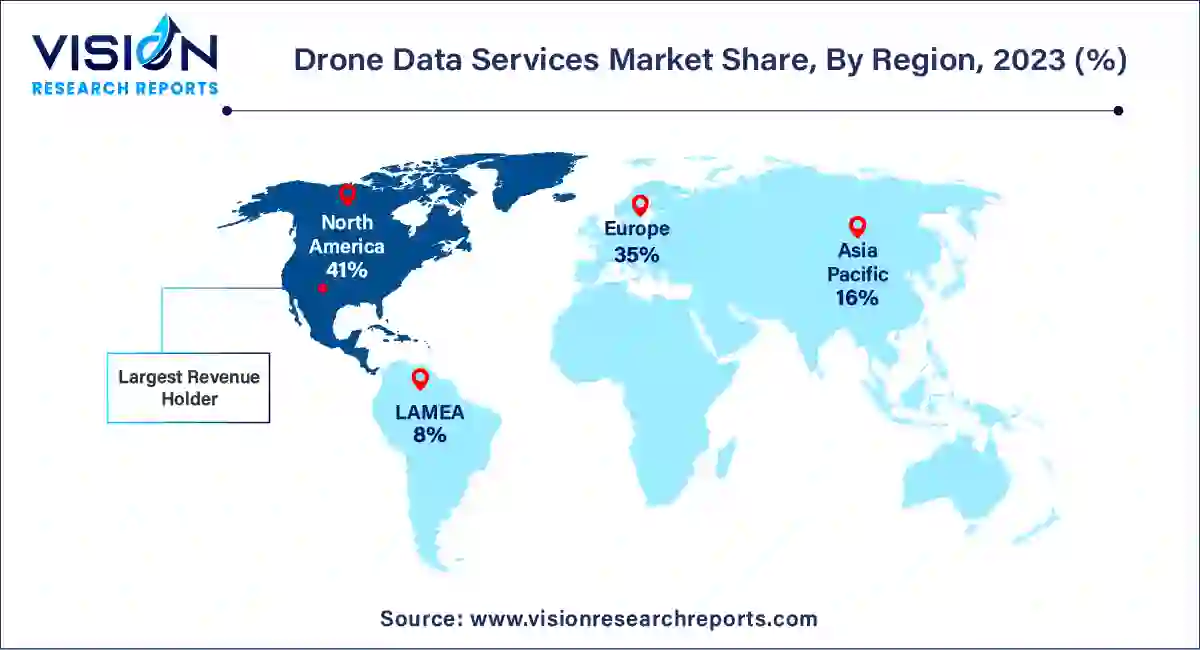

| Revenue Share of North America in 2023 | 41% |

| CAGR of Latin America from 2024 to 2033 | 46.48% |

| Revenue Forecast by 2033 | USD 41.25 billion |

| Growth Rate from 2024 to 2033 | CAGR of 39.02% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Mapping and surveying services within the drone data services market have redefined the way geographical information is collected and analyzed. Drones equipped with advanced sensors and high-resolution cameras offer a rapid and accurate means of mapping landscapes, capturing intricate details that traditional methods might miss. These services find extensive applications in urban planning, land surveying, and environmental mapping. With precise GPS systems and LiDAR technology, drones can create highly detailed maps, assisting industries and governments in making informed decisions about land use, infrastructure development, and resource management.

The 3D modeling & DEM segment is predicted to grow at the fastest CAGR of 40.56% during the forecast period. 3D modeling and Digital Elevation Model (DEM) services play a pivotal role in transforming raw aerial data into actionable insights. Drones equipped with specialized cameras and LiDAR sensors capture vast amounts of data, enabling the creation of detailed 3D models of terrains, buildings, and infrastructure. These models offer invaluable insights for various industries, including architecture, construction, and archaeology. By overlaying high-resolution imagery, drones create precise DEMs, aiding in flood modeling, slope analysis, and infrastructure planning.

The operator software segment held the biggest revenue share of 60% in 2023. Operator software stands at the forefront of the drone data services market, acting as the brain that guides drones in their missions. These sophisticated software solutions empower operators with intuitive interfaces and advanced controls, allowing them to plan, execute, and monitor drone operations seamlessly. Operator software not only simplifies the complexities of drone piloting but also enhances the overall efficiency and safety of missions. Through these platforms, operators can customize flight paths, adjust camera settings, and integrate real-time data feeds, ensuring precise data collection. Additionally, operator software often incorporates features like geofencing and collision avoidance, mitigating potential risks and ensuring compliance with regulations.

Cloud-based UAV data services are expected to grow at the fastest CAGR of 43.56% during the forecast period. Cloud-based platforms have revolutionized the way businesses access, store, and analyze drone-generated data. In the Drone Data Services Market, cloud-based platforms serve as centralized hubs where vast amounts of aerial data are securely stored and processed. These platforms offer scalability, enabling businesses to handle extensive datasets without the need for substantial on-site infrastructure. Cloud-based solutions facilitate seamless collaboration among stakeholders, allowing geographically dispersed teams to access and analyze drone data in real time. Moreover, these platforms often integrate powerful data analytics tools, leveraging Artificial Intelligence and Machine Learning algorithms to derive actionable insights from raw data. Cloud-based platforms not only enhance data processing speed but also ensure data integrity, enabling businesses to make informed decisions with confidence.

The renewable segment is anticipated to grow at the noteworthy CAGR of 45.94% during the forecast period. Drone data services market has emerged as a transformative force, revolutionizing how the renewables sector operates and maintains its assets. Drones equipped with advanced sensors and imaging technologies offer renewable energy companies a cost-effective and efficient solution for infrastructure inspection, maintenance, and site optimization. Wind and solar farms, often spanning vast areas, benefit immensely from drones' aerial perspective. Drones conduct detailed inspections of wind turbine blades, solar panels, and other critical components, identifying defects, wear, and damage with precision. This proactive approach allows renewable energy companies to schedule timely maintenance, minimizing downtime and optimizing energy production. Moreover, drones aid in site selection and optimization by capturing high-resolution aerial imagery and terrain data, facilitating accurate planning and enhancing the overall efficiency of renewable energy projects.

Beyond renewables, a myriad of industries benefits from the versatility of drone data services. Sectors such as insurance, telecommunications, and disaster management leverage drones to streamline operations and enhance decision-making processes. In the insurance industry, drones conduct rapid and accurate assessments of property damage caused by natural disasters or accidents. This swift data collection aids insurance companies in processing claims efficiently, leading to improved customer satisfaction. Telecommunications companies deploy drones for infrastructure inspection, ensuring the integrity of cell towers and communication networks. By capturing high-resolution images and analyzing equipment conditions, drones help in preventive maintenance, minimizing service outages and ensuring seamless connectivity for consumers. In disaster management, drones play a vital role in emergency response. They assess the extent of damage in disaster-stricken areas, identify hazards, and aid in search and rescue operations.

North America accounted for the largest market share of 41% in 2023. North America, with its robust technological infrastructure and early adoption of drone technology, remains a prominent player. The region sees extensive applications of drones in agriculture, construction, and environmental monitoring, driven by supportive regulations and significant investments in research and development. Additionally, Europe stands as a key market, characterized by stringent regulatory frameworks that prioritize safety and privacy. European countries utilize drones for diverse applications, including urban planning, heritage preservation, and disaster management.

Latin America is predicted to grow at the remarkable CAGR of 46.48% over the forecast period. Latin America showcases a growing interest in drone technology, particularly in agriculture and forestry. Brazil, with its vast agricultural landscapes, employs drones for crop monitoring and yield optimization. Central and South American countries utilize drones in environmental conservation, mapping, and disaster response.

By Service Type

By Platform

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Service Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Drone Data Services Market

5.1. COVID-19 Landscape: Drone Data Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Drone Data Services Market, By Service Type

8.1. Drone Data Services Market, by Service Type, 2024-2033

8.1.1 Mapping & Surveying

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Photogrammetry

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. 3D Modeling & Digital Elevation Model (DEM)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Drone Data Services Market, By Platform

9.1. Drone Data Services Market, by Platform, 2024-2033

9.1.1. Cloud-Based

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Operator Software

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Drone Data Services Market, By End-use

10.1. Drone Data Services Market, by End-use, 2024-2033

10.1.1. Real Estate & Construction

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Agriculture

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Mining

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Oil & Gas

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Renewables

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Drone Data Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Platform (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Platform (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Platform (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Platform (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Platform (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Platform (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. 4DMapper.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Agribotix.com.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Airware Limited DronecloudTM.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. DroneDeploy.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. DRONIFI.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Pix4D SA

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. PrecisionHawk Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Sentera

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Skycatch, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others