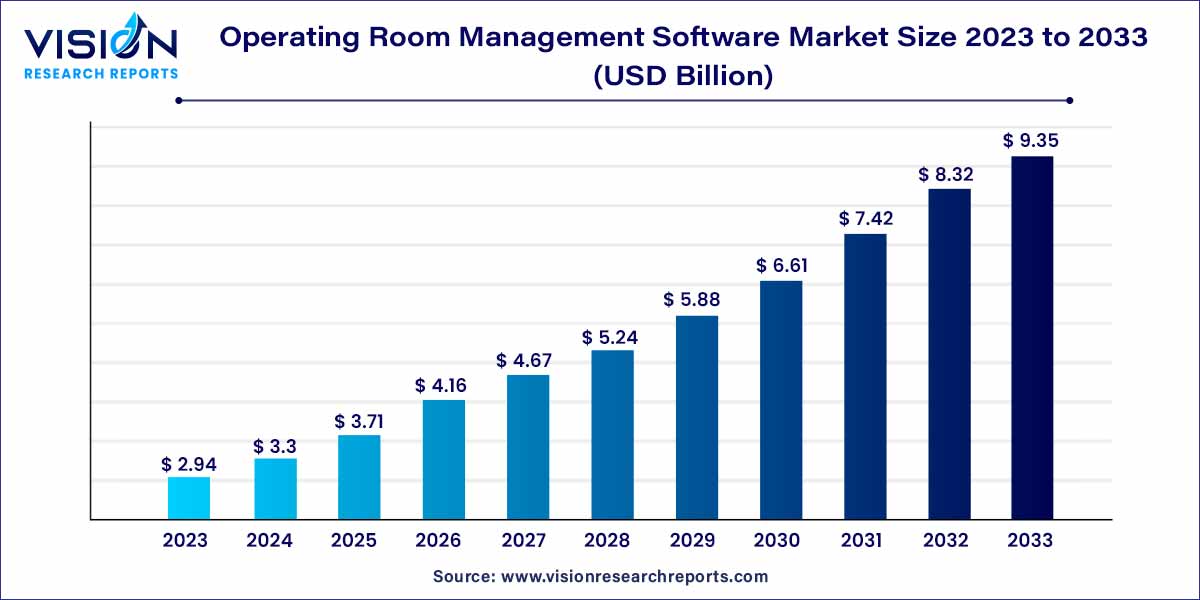

The global operating room management software market size was estimated at around USD 2.94 billion in 2023 and it is projected to hit around USD 9.35 billion by 2033, growing at a CAGR of 12.26% from 2024 to 2033.The market is experiencing growth due to several factors. These include the increasing use of electronic health records (EHRs), a surge in surgical procedures, a heightened emphasis on cost reduction and efficiency improvements in hospitals and ambulatory surgery centers (ASCs), and advancements in technology for managing operating rooms (ORs).

The operating room management software (ORMS) market is a dynamic and rapidly evolving sector within the healthcare technology landscape. This specialized software is designed to streamline and enhance the management of operating room (OR) processes, contributing to improved operational efficiency and patient care. Here, we provide an insightful overview of key aspects shaping the ORMS market.

The growth of the operating room management software (ORMS) market is propelled by several key factors. Firstly, the increasing complexity of surgical procedures necessitates advanced tools for efficient coordination and management. ORMS addresses this need by streamlining surgical workflows, minimizing delays, and optimizing resource utilization. Secondly, a growing emphasis on data-driven decision-making in healthcare contributes to the adoption of ORMS solutions, which offer comprehensive data management and analytics capabilities. Technological advancements, including the integration of artificial intelligence, further enhance the software's predictive and optimization capabilities. Additionally, the benefits offered by ORMS, such as improved operational efficiency, enhanced patient outcomes, and adherence to regulatory standards, drive its adoption across diverse healthcare settings. As healthcare facilities globally prioritize cost-effective, high-quality care, the Operating Room Management Software market is positioned for sustained growth, fueled by ongoing innovation and a commitment to optimizing the surgical care delivery process.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.26% |

| Market Revenue by 2033 | USD 9.35 billion |

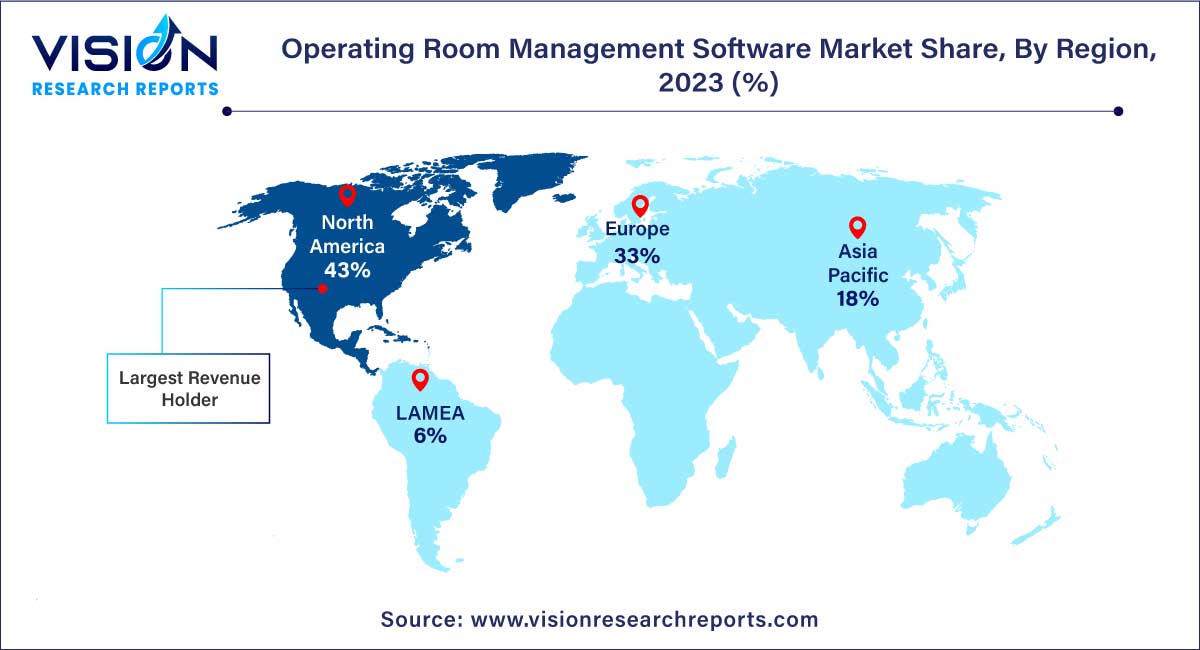

| Revenue Share of North America in 2023 | 43% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

Data management and communication solutions held the largest revenue share of 29% in 2023. Data Management & Communication, these solutions play a pivotal role in ensuring seamless coordination and communication within the operating room environment. By centralizing and managing patient data, surgical schedules, and resource allocation, the software enhances the efficiency of surgical workflows. Real-time communication features enable surgical teams to collaborate effectively, reducing delays and fostering a synchronized approach to patient care. This not only optimizes operational processes but also contributes to enhanced patient safety and outcomes.

The anesthesia information management segment is anticipated to grow at the fastest CAGR from 2024 to 2033. Anesthesia Information Management within the Operating Room Management Software further elevates the sophistication of surgical care. This component focuses on the comprehensive management of anesthesia-related data, ensuring accurate documentation of patient responses, drug administration, and vital signs during surgical procedures. By providing an integrated platform for anesthesia providers, the software enhances the precision and safety of administering anesthesia. Additionally, it facilitates post-operative analysis, contributing to continuous improvement in anesthesia protocols and patient care strategies.

The cloud- & web-based segment dominated the global market with a share of 86% in 2023. Cloud & Web-Based deployment models offer a dynamic and flexible approach to operating room management. By leveraging cloud infrastructure, these solutions provide accessibility from any location with internet connectivity, facilitating real-time collaboration among healthcare professionals. The scalability and ease of updates associated with Cloud & Web-Based deployments make them particularly attractive for healthcare facilities seeking agility and adaptability in their operational processes. Moreover, these solutions often result in cost efficiencies, as they eliminate the need for extensive on-site infrastructure.

On-Premises deployment remains a steadfast option for healthcare organizations with specific infrastructure requirements or stringent security protocols. By hosting the operating room management software on-site, institutions retain direct control over their data and can customize the software to align with internal IT policies. This deployment model is often preferred by healthcare facilities that prioritize maintaining sensitive patient information within their physical premises, addressing concerns related to data security and compliance. While On-Premises solutions may require a more substantial initial investment in infrastructure, they offer a level of autonomy and customization that aligns with the unique needs of certain healthcare environments.

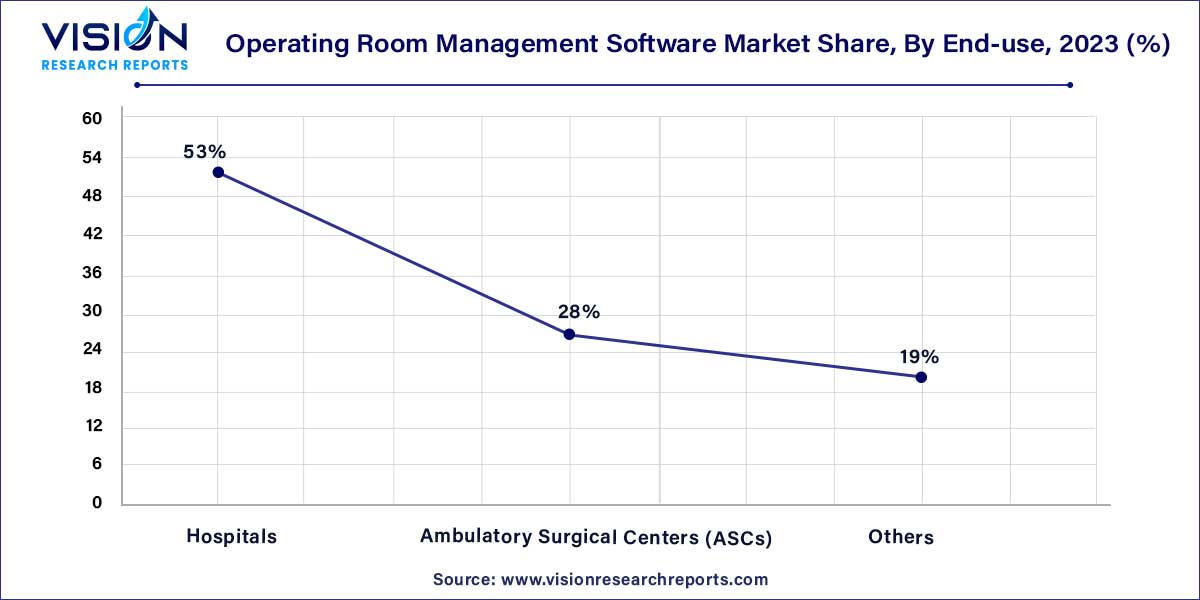

The hospitals segment accounted for the largest revenue share of 53% in 2023. In hospital settings, the operating room management software plays a pivotal role in optimizing complex surgical workflows. It facilitates efficient scheduling of surgical procedures, streamlining resource allocation, and enhancing communication among multidisciplinary teams. The software's ability to centralize patient data and ensure real-time collaboration contributes to heightened operational efficiency within the hospital environment. Additionally, it aids in compliance with regulatory standards and reporting requirements, reinforcing the commitment to patient safety and quality of care.

The ambulatory surgical centers segment accounted for a significant revenue share in 2023. Ambulatory Surgical Centers (ASCs) represent another crucial segment of the end-user landscape for operating room management software. These centers, characterized by their focus on outpatient procedures, benefit from the software's capacity to enhance the coordination and management of surgical processes in a more streamlined manner. Given the often faster-paced nature of ASCs, the efficiency gains provided by the software are particularly valuable. From patient data management to optimized resource utilization, the software supports ASCs in delivering high-quality care while adhering to the unique operational requirements of outpatient surgical settings.

North America led the market with a revenue share of 43% in 2023. In North America, the market is characterized by a robust presence, driven by a high level of technological awareness and a proactive approach to healthcare innovation. The region's advanced healthcare infrastructure, coupled with a focus on improving patient outcomes, has contributed to the widespread adoption of operating room management software.

Asia Pacific is anticipated to experience significant growth from 2024 to 2033. Asia-Pacific represents a rapidly growing market for operating room management software, fueled by the increasing healthcare expenditure, growing awareness of technological solutions, and the expansion of healthcare infrastructure. Countries like China and India are witnessing a surge in demand for these solutions as they strive to enhance the efficiency of surgical care delivery and cope with the rising volume of surgical procedures. The region's diverse healthcare settings, including urban hospitals and remote healthcare facilities, present unique challenges and opportunities for software developers.

By Solution

By Deployment

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Solution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Operating Room Management Software Market

5.1. COVID-19 Landscape: Operating Room Management Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Operating Room Management Software Market, By Solution

8.1. Operating Room Management Software Market, by Solution, 2024-2033

8.1.1 Anesthesia Information Management

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Data Management & Communication

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Operating Room Scheduling Management

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Operating Room Supply Management

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Performance Management

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Operating Room Management Software Market, By Deployment

9.1. Operating Room Management Software Market, by Deployment, 2024-2033

9.1.1. Cloud & Web Based

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. On-premises

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Operating Room Management Software Market, By End-use

10.1. Operating Room Management Software Market, by End-use, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Ambulatory Surgical Centers (ASCs)

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Operating Room Management Software Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Surgical Information Systems.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Veradigm LLC (Allscripts Healthcare Solutions, Inc.).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Picis Clinical Solutions, Inc., a division of N. Harris Computer Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. GE Healthcare.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Koninklijke Philips N.V.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. BD

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Oracle Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. PerfectServe, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Getinge.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Max Systems Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others