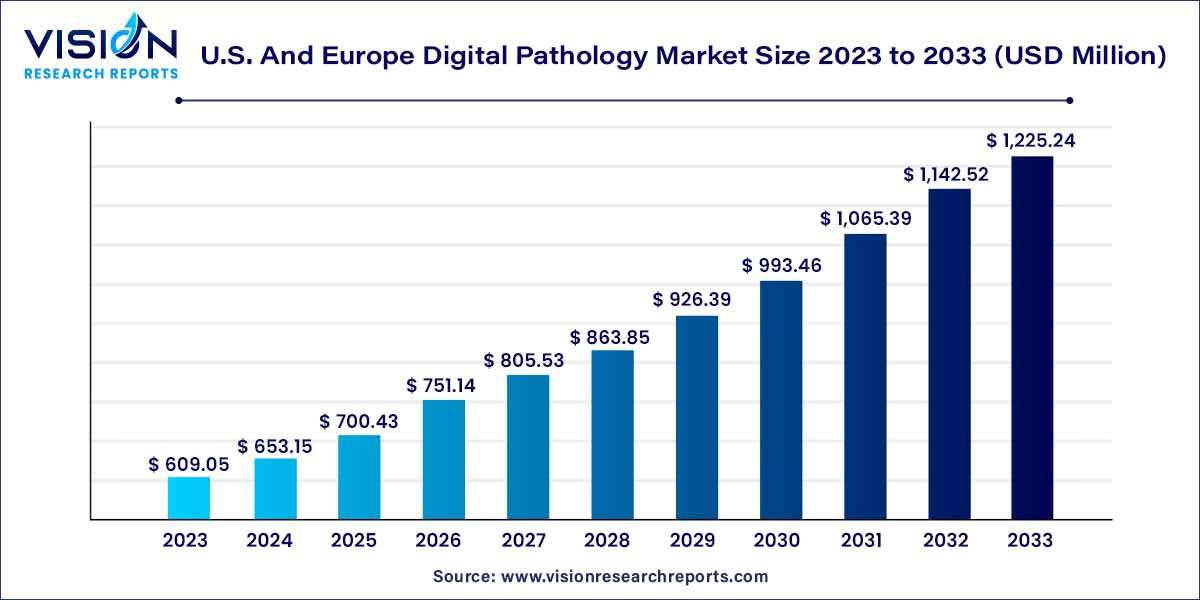

The U.S. and Europe digital pathology market size was estimated at around USD 609.05 million in 2023 and it is projected to hit around USD 1,225.24 million by 2033, growing at a CAGR of 7.24% from 2024 to 2033.

The growth of the digital pathology market in the United States and Europe is underpinned by several key factors. Technological advancements in imaging have played a pivotal role, allowing for the digitization of pathology practices and the creation of high-resolution images for analysis. In both regions, the rising prevalence of chronic diseases has heightened the demand for precise and efficient diagnostic tools, propelling the adoption of digital pathology solutions. Moreover, a proactive approach to healthcare innovation in the U.S. and Europe has fostered an environment conducive to embracing transformative technologies. The commitment to improving diagnostic capabilities, streamlining pathology workflows, and addressing the evolving healthcare needs of an aging population has led to significant investments in digital pathology infrastructure. As a result, the convergence of advanced technology and a growing emphasis on healthcare excellence positions the U.S. and Europe as dynamic hubs for the sustained expansion of the digital pathology market.

| Report Coverage | Details |

| Market Size in 2023 | USD 609.05 million |

| Revenue Forecast by 2033 | USD 1,225.24 million |

| Growth rate from 2024 to 2033 | CAGR of 7.24% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The device segment accounted for the largest market share of 52% in 2023. Devices such as high-resolution scanners and imaging systems contribute to improved diagnostic accuracy by providing detailed images of tissue samples for pathologists to analyze. Also, the automation provided by devices like slide scanners and loaders streamlines the workflow in pathology laboratories, reducing manual handling and expediting the digitization process. Furthermore, devices with integrated AI capabilities, like automated image analysis, are in demand for their potential to assist pathologists in detecting abnormalities and patterns, thereby impelling market growth. The software segment is anticipated to witness the fastest growth over the forecast period. The software solutions help manage and store vast amounts of digital images efficiently, ensuring easy retrieval and archiving.

Solutions like telepathology software are in demand for their role in facilitating remote consultations, second opinions, and collaborations among pathologists. Also, these solutions seamlessly integrate with electronic health records (EHRs) and enable comprehensive patient data exchange and informed decision-making, thereby driving the segment growth. Furthermore, government initiatives to constantly encourage the adoption of advanced pathology software and recommend them as a standardized approach are factors expected to boost demand. For instance, in November 2018, the UK Government and Philips consortium co-invested in digital pathology to accelerate the development of novel artificial intelligence software to support cancer diagnostics, which will be led by Philips and the NHS.

The academic research segment accounted for the largest market share of 46% in 2023. due to the high adoption of digital pathology in various research studies, such as tumor morphological research. Numerous academic research institutions are joining forces with digital pathology providers to integrate this technology into their research endeavors. For instance, in November 2022, the University Medical Center Utrecht entered into a collaboration with Paige to integrate their application into clinical environments. This partnership also encompasses the undertaking of a clinical health economics study, designed to expedite the reimbursement process and promote the broad adoption of AI applications within the realm of pathology. The disease diagnosis segment is anticipated to grow at the fastest CAGR of 7.65% from 2023 to 2032.

A rise in the prevalence of chronic illnesses and the growing emphasis placed by manufacturers on the advancement of rapid & innovative diagnostic techniques, aimed at facilitating seamless exchange of information within and between departments, are propelling the segment growth. Embracing digital technologies in the medical field contributes to the enhancement and optimization of disease diagnosis procedures, consequently bolstering treatment effectiveness. For instance, in April 2022, PreciseDx partnered with The Michael J. Fox Foundation to introduce AI-integrated digital pathology technology, designed for the early diagnosis of Parkinson's disease even before pronounced symptoms manifest in patients. Furthermore, a rising number of initiatives led by both public and private entities, including the American Society for Clinical Pathology (ASCP) and the College of American Pathologists (CAP), aimed at augmenting the quality of cancer diagnosis, is expected to drive the segment growth.

The hospital segment contributed the largest market share of 37% in 2023. Hospitals are increasingly adopting digital pathology solutions to enhance their pathology departments and provide more accurate and efficient disease diagnoses. Also, hospitals benefit from streamlined workflows as digital pathology eliminates the need for physical slide handling and automates processes like slide scanning. This reduces turnaround times and enhances efficiency. Furthermore, digital pathology promotes collaboration among hospital staff, enabling pathologists, clinicians, and other specialists to collectively review cases and make well-informed treatment decisions. Moreover, many hospitals are implementing digital scanning techniques to improve patient compliance and speed diagnosis.

For instance, in March 2023, Ibex Medical Analytics, known as Ibex, secured a PathLAKE contract that encompasses the provision of AI-enhanced solutions across 25 NHS facilities to bolster cancer diagnosis efforts. This development is anticipated to significantly influence the market's trajectory in the foreseeable future. The diagnostics lab segment is expected to grow at the fastest growth rate over the forecast period. This trajectory is attributed to the amplified emphasis on facets like drug development, preclinical GLP pathology, and oncology clinical trials. In addition, the rising incidence of cancer and the integration of digital pathology within diagnostics labs are key drivers propelling market expansion.

For instance, in January 2022, Inform Diagnostics introduced FullFocus, an AI-enabled digital pathology viewer devised by Paige, within its laboratory. This strategic integration of AI tools is expected to enhance operational efficiency, streamline logistics, and expedite the attainment of prompt outcomes. Moreover, digital pathology offers opportunities for error eradication as there is a reduction in error identification due to synchronization between images and LIS. In addition, the advantage of these diagnostic laboratories is the availability of funds for innovation. The process encourages further innovation by encouraging pathologists to become specialized, giving scientists access to better resources & knowledge, and exchanging practices with wider geographies.

By Product

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. And Europe Digital Pathology Market

5.1. COVID-19 Landscape: U.S. And Europe Digital Pathology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. And Europe Digital Pathology Market, By Product

8.1. U.S. And Europe Digital Pathology Market, by Product, 2024-2033

8.1.1 Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Device

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Storage System

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. And Europe Digital Pathology Market, By Application

9.1. U.S. And Europe Digital Pathology Market, by Application, 2024-2033

9.1.1. Drug Discovery & Development

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Academic Research

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Disease Diagnosis

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. And Europe Digital Pathology Market, By End-use

10.1. U.S. And Europe Digital Pathology Market, by End-use, 2024-2033

10.1.1. Software

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Biotech & Pharma Companies

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Diagnostic Labs

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Academic & Research Institutes

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. And Europe Digital Pathology Market, Regional Estimates and Trend Forecast

11.1. U.S. And Europe

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Leica Biosystems Nussloch GmbH (Danaher).

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Hamamatsu Photonics, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Koninklijke Philips N.V.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Olympus Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. F. Hoffmann-La Roche Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Mikroscan Technologies, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Inspirata, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Epredia (3DHISTECH Ltd.)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Visiopharm A/S.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Huron Technologies International Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others