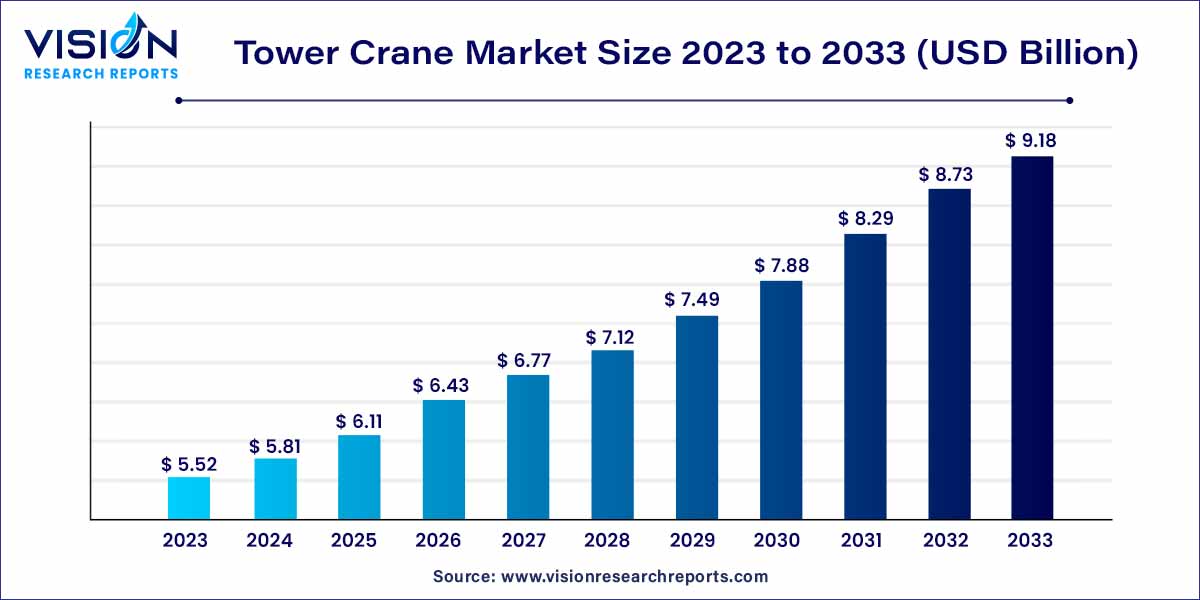

The global tower crane market size was estimated at around USD 5.52 billion in 2023 and it is projected to hit around USD 9.18 billion by 2033, growing at a CAGR of 5.22% from 2024 to 2033. The expansion might be ascribed to the continuous global upsurge in infrastructure development and construction projects.

The tower crane market is witnessing robust growth on a global scale, driven by the burgeoning construction activities and infrastructure development. Tower cranes, with their pivotal role in lifting and transporting heavy materials in construction sites, have become integral to the progress of large-scale projects. This overview provides a comprehensive insight into the key aspects shaping the current state and future prospects of the tower crane market.

The growth of the tower crane market is propelled by several key factors. Firstly, the escalating demand for high-rise buildings and infrastructure projects worldwide has significantly increased the need for efficient lifting solutions, positioning tower cranes as indispensable in the construction sector. Secondly, continuous technological advancements, including automation, real-time monitoring, and advanced control systems, contribute to enhanced safety, efficiency, and operational ease, further driving market expansion. Additionally, the global trend of urbanization, particularly in the Asia-Pacific region, is a major growth factor, with countries like China and India experiencing a surge in construction activities. The adoption of green and sustainable practices in construction, reflected in the development of eco-friendly tower cranes, aligns with the industry's commitment to environmental responsibility.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 9.18 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.22% |

| Revenue Share of North America in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 6.47% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on product, the hammerhead segment accounted for the largest market share of 42% in 2023. Hammerheads can reach extraordinary heights and carry heavy loads with precision, allowing construction companies to tackle complex projects with ease. Their ability to work in tight urban spaces further adds to their appeal, as they can maximize construction potential in densely populated areas. Hammerheads are designed to be energy-efficient and produce lower emissions compared to traditional construction machinery, contributing to a more environment-friendly construction industry.

In December 2021, LIEBHERR Australia installed hammerhead cranes within its lineup. The installation supported the construction of the WestConnex M4-M5 Link Tunnels. The incorporation of energy-efficient components in the crane underscores the company's focus on minimizing its environmental footprint and cutting down on operational expenses. Luffing jib is expected to register a considerable growth over the forecast period.

Based on design, the top-slewing crane segment held the largest revenue share of 60% in 2023. The growth is attributed to its exceptional lifting capacity and reach, making it an ideal choice for handling heavy loads and materials, allowing for efficient and rapid construction progress. This crane's adaptability to various construction environments, from skyscrapers to bridge building and beyond, contributes to its global prominence. Moreover, the top-slewing crane's innovation and technological advancements have played a crucial role in its widespread adoption. With features such as computerized controls, enhanced safety systems, and improved energy efficiency, these cranes continue to evolve, meeting the ever-growing demands of modern construction projects.

The bottom slewing segment is anticipated to grow at a considerable rate over the forecast period. The growth can be attributed to their versatility and adaptability, making them indispensable in a wide range of construction and industrial applications. Their relatively compact design and high load-bearing capacity make them a preferred choice in urban areas with limited space. Additionally, advancements in crane technology have led to increased efficiency and safety features, further driving their popularity. Modern bottom slewing cranes come equipped with sophisticated control systems, remote operation capabilities, and advanced safety measures, reducing the risk of accidents and enhancing overall productivity.

Based on the application, the construction segment contributed the largest market share of 50% in 2023. The construction industry's increasing demand, owing to the growing urbanization and population growth, and technological advancements in the construction sector have contributed to the rising demand for tower cranes. These cranes are equipped with advanced features such as remote-control systems, precision engineering, and increased automation, which enhance safety and improve efficiency on construction sites. In July 2023, Radius Group, a provider of lifting solutions, collaborated with Skyline Cockpit, an Israeli technology provider for cranes to introduce a remote-control technology for tower cranes.

The mining segment is anticipated to grow at a fastest CAGR of 5.12% over the forecast period. The mining sector plays a pivotal role in the global economy, as it provides essential raw materials for various industries, including construction, manufacturing, and energy production. As mining operations expand to meet the rising global demand for minerals, the need for efficient and versatile equipment such as tower cranes becomes imperative. These cranes are instrumental in the construction and maintenance of mining infrastructure, such as conveyor systems, processing plants, and storage facilities, making them indispensable for the industry's growth.

Based on lifting capacity, the 6 to 80 metric tons segment accounted for the largest market share of over 47% in 2023. The global demand for taller and more complex structures, such as skyscrapers, bridges, and industrial facilities, fuels the continuous development of these towering giants. Architects and engineers constantly push the limits of design and construction, necessitating crane technology that can keep up with their ambitions.

The above-80 metric tons segment is expected to register the second-highest growth rate over the forecast period. This growth can be attributed to the increasing demand for mega-infrastructure projects, such as skyscrapers, bridges, and industrial facilities, which necessitates the use of these heavy-duty cranes to handle massive loads and reach great heights. Urbanization and population growth have fueled the construction industry's expansion, leading to a surge in the need for larger and more powerful tower cranes.

North America dominated the market with a revenue share of 38% in 2023. The growth of the region is primarily driven by electricity or diesel engines, depending on the specific job site requirements and environmental considerations. In the region, electric tower cranes are becoming increasingly popular due to their eco-friendliness and cost-efficiency. They are connected to the local power grid, drawing electricity to operate their motors, which drive the crane's various movements such as lifting, lowering, and slewing.

Asia Pacific is expected to register the highest CAGR of 6.47% over the forecast period. The soaring demand for skyscrapers, infrastructure projects, and urban development has fuelled the proliferation of tower cranes across the region. These cranes are essential for lifting heavy materials and equipment to great heights, making them indispensable in the construction of high-rise buildings and large-scale infrastructure. Apart from the region’s continuous urbanization and population growth, government investments in infrastructure, such as transportation networks and energy facilities, have contributed to the high demand for these cranes.

By Product

By Design

By Application

By Lifting Capacity

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Tower Crane Market

5.1. COVID-19 Landscape: Tower Crane Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Tower Crane Market, By Product

8.1. Tower Crane Market, by Product, 2024-2033

8.1.1. Flat Top

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hammerhead

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Luffing Jib

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Self-erecting

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Tower Crane Market, By Design

9.1. Tower Crane Market, by Design, 2024-2033

9.1.1. Top Slewing Crane

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Bottom Slewing Crane

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Tower Crane Market, By Application

10.1. Tower Crane Market, by Application, 2024-2033

10.1.1. Construction

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Mining

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Tower Crane Market, By Lifting Capacity

11.1. Tower Crane Market, by Lifting Capacity, 2024-2033

11.1.1. Below 5 Metric Tons

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. 6 to 80 Metric Tons

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Above 80 Metric Tons

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Tower Crane Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Design (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Design (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Design (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Design (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Design (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Design (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Design (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Design (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Design (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Design (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Design (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Design (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Design (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Design (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Design (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Design (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Design (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Design (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Design (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Design (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Design (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Lifting Capacity (2021-2033)

Chapter 13. Company Profiles

13.1. COMANSA

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. FAVELLE FAVCO BERHAD

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Grúas Sáez, S.L.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. JASO Tower Cranes

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. LIEBHERR

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Raimondi

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Sichuan Construction Machinery (Group)Co., Ltd

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Terex Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. The Manitowoc Company, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. WOLFFKRAN International AG.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others