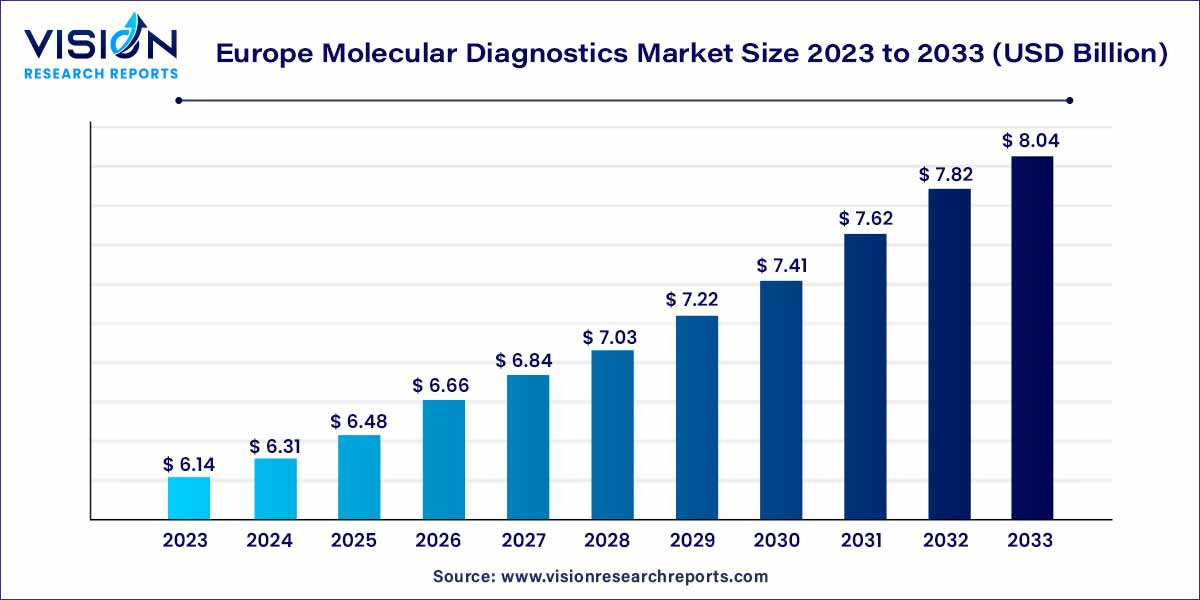

The Europe molecular diagnostics market size was estimated at around USD 6.14 billion in 2023 and it is projected to hit around USD 8.04 billion by 2033, growing at a CAGR of 2.73% from 2024 to 2033.

The Europe molecular diagnostics market stands at the forefront of transformative advancements in diagnostic technologies, playing a pivotal role in reshaping the healthcare landscape across the continent. This dynamic sector is defined by its emphasis on analyzing biological markers at the molecular level to glean insights into genetic variations associated with various diseases. As we delve into the overview of this market, key facets, trends, and market dynamics come to the forefront.

The growth of the Europe molecular diagnostics market is propelled by several key factors. Firstly, continual technological advancements in molecular diagnostic techniques, such as next-generation sequencing and real-time polymerase chain reaction (PCR), contribute to heightened precision and efficiency in disease detection. Secondly, the escalating prevalence of chronic diseases, ranging from cancer to cardiovascular disorders, underscores the crucial role of molecular diagnostics in early detection, precise prognosis, and tailored treatment strategies. The market's response to infectious disease management, particularly exemplified during the COVID-19 pandemic, further accentuates the indispensability of rapid and accurate pathogen identification. Additionally, the paradigm shift toward personalized medicine amplifies the significance of molecular diagnostics in tailoring treatment plans based on individual genetic profiles, thereby enhancing therapeutic outcomes. As these growth factors converge, the Europe molecular diagnostics market stands poised for sustained expansion, driving transformative advancements in healthcare across the continent.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.14 billion |

| Revenue Forecast by 2033 | USD 8.04 billion |

| Growth rate from 2024 to 2033 | CAGR of 2.73% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Prevalence of Chronic Diseases:

The rising incidence of chronic diseases, encompassing cancer, cardiovascular disorders, and genetic abnormalities, fuels the demand for molecular diagnostics. These tools offer early detection, precise prognosis, and tailored treatment strategies.

Infectious Disease Management:

The heightened focus on infectious disease control, particularly in response to events like the COVID-19 pandemic, emphasizes the critical role of molecular diagnostics in rapid and accurate pathogen identification, facilitating effective public health responses.

Cost Implications:

The adoption of advanced molecular diagnostic technologies often comes with a substantial financial burden. High costs associated with these technologies may limit accessibility for healthcare institutions and patients, impacting the widespread adoption of molecular diagnostics.

Data Security and Privacy Concerns:

As molecular diagnostics involve the handling of sensitive genetic information, ensuring robust data security and privacy measures is paramount. Concerns related to the protection of patient data may influence the acceptance and trust in molecular diagnostic technologies.

Point-of-Care Diagnostics:

The development of rapid and portable molecular diagnostic devices presents a significant opportunity for the market. Point-of-care testing allows for timely and decentralized healthcare interventions, meeting the increasing demand for quick and on-the-spot diagnostic solutions.

Advancements in Data Analytics:

The integration of advanced data analytics and artificial intelligence in molecular diagnostics opens new avenues for interpreting complex genetic information. Harnessing these technologies can enhance diagnostic accuracy, provide deeper insights, and contribute to the development of more targeted and effective treatment strategies.

On the basis of products, the molecular diagnostics market is segmented into reagents, instruments, and other products, which include services and software programs that are helpful in running the instrumentation process. The reagents segment dominated the market in 2023 with a revenue share of more than 61% and is expected to grow at a significant CAGR over the forecast period. The growth of this segment has resulted from technological refinements in the diagnostic procedures employed to investigate multiple diseases. Reagents, including formamide, salts, dextran sulfate or heparin, and SDS, are commonly used in situ hybridization assays. The growing usage of techniques comprising fluorescence in situ hybridization is contributing to the further growth of this sector.

The PCR segment accounted for the largest revenue share of 76% in 2023, attributable largely to the increasing application of molecular diagnostics in the field of pharmacogenomics and the growing usage of multiplex PCR technologies. Roche offers PCR tests for the diagnosis of the two most commonly reported sexually transmitted infectious diseases, such as Chlamydia trachomatis and Neisseria gonorrhea testing kits. The development of these rapid testing tools is further expected to propel the growth of this sector in Europe.

The in situ hybridization (ISH) and sequencing segments are expected to grow at the fastest CAGR of 11.35% over the forecast period. ISH is a highly sensitive and specific technique that can be used to detect cancer at an early stage when it is most treatable. This is driving demand for ISH in the cancer diagnostics market. In addition, recent advances in ISH technology are making ISH more attractive to users and are driving market growth. Sequencing determines the order of nucleotides in a DNA or RNA molecule. This information can be used to identify genetic mutations that are associated with diseases. Sequencing is also used to track the evolution of viruses and bacteria.

Next-generation sequencing (NGS) technologies are increasingly used in the diagnosis of a wide range of diseases, including cancer, infectious diseases, and genetic disorders owing to a more comprehensive and accurate picture of the genetic makeup of a patient than traditional molecular diagnostic methods. The threat of infectious diseases is also a major driver of the sequencing segment. NGS can be used to identify and track the spread of infectious diseases, and it is also used to develop new vaccines and treatments. For instance, in August 2022, Predicine launched its first CE-IVD marked product PredicineCARE in Europe for genomic profiling in blood & urine. In patients with cancer, the cell-free DNA (cfDNA) assay is a targeted NGS technique for identifying single nucleotide variants, insertions and deletions, DNA rearrangements, and copy number changes. PredicineCARE, according to the company, targets 152 genes, including gene targets suggested by guidelines and associated with treatments or clinical studies currently being tested. The assay has been utilized in patient testing, clinical studies, and the creation of companion diagnostics.

By Product

By Technology

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Molecular Diagnostics Market

5.1. COVID-19 Landscape: Europe Molecular Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Molecular Diagnostics Market, By Product

8.1. Europe Molecular Diagnostics Market, by Product, 2024-2033

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reagents

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Software

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Europe Molecular Diagnostics Market, By Technology

9.1. Europe Molecular Diagnostics Market, by Technology, 2024-2033

9.1.1. Polymerase Chain Reaction (PCR)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. In Situ Hybridization

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Isothermal Nucleic Acid Amplification Technology (INAAT)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Chips & Microarrays

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Mass Spectrometry

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Sequencing

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Transcription-mediated Amplification (TMA)

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Europe Molecular Diagnostics Market, Regional Estimates and Trend Forecast

10.1. Europe

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Technology (2021-2033)

Chapter 11. Company Profiles

11.1. Bio-Rad Laboratories, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Abbott Laboratories

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Siemens Healthcare GmbH

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Alere, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Dako

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Bayer AG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Hologic, Inc. (Gen probe)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Danaher Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Sysmex Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Novartis AG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others