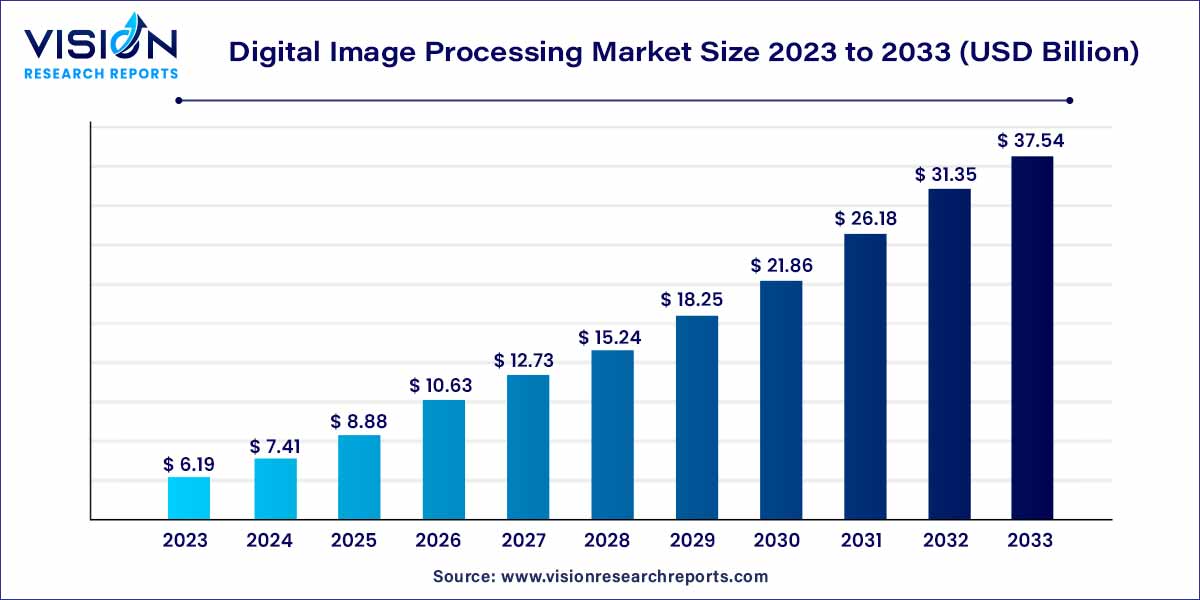

The global digital image processing market size was estimated at around USD 6.19 billion in 2023 and it is projected to hit around USD 37.54 billion by 2033, growing at a CAGR of 19.75% from 2024 to 2033.

The digital image processing (DIP) market, a dynamic and integral component of the contemporary technological ecosystem, stands at the forefront of innovation in visual information manipulation. This overview provides a comprehensive exploration of the market's landscape, offering insights into its foundational elements, current state, and future trajectories.

The exponential growth of the digital image processing (DIP) market can be attributed to a confluence of compelling factors propelling its expansion. Foremost among these is the relentless advancement in computational capabilities, where the integration of cutting-edge technologies such as artificial intelligence, machine learning, and computer vision continues to redefine the scope of image processing applications. The increasing demand for high-quality visual data in sectors like healthcare, automotive, and entertainment further fuels market growth, driving the development of sophisticated algorithms for image enhancement, recognition, and analysis. Additionally, the rise of edge computing, facilitating real-time processing at the data source, contributes to heightened efficiency and reduced latency in image processing applications. As industries increasingly recognize the transformative potential of DIP in enhancing decision-making processes and operational efficiency, a surge in investments and research and development activities further underscores the market's robust growth. Amidst this landscape, the digital image processing market stands as a testament to innovation's power in reshaping how we perceive and interact with visual information.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 19.75% |

| Market Revenue by 2033 | USD 37.54 billion |

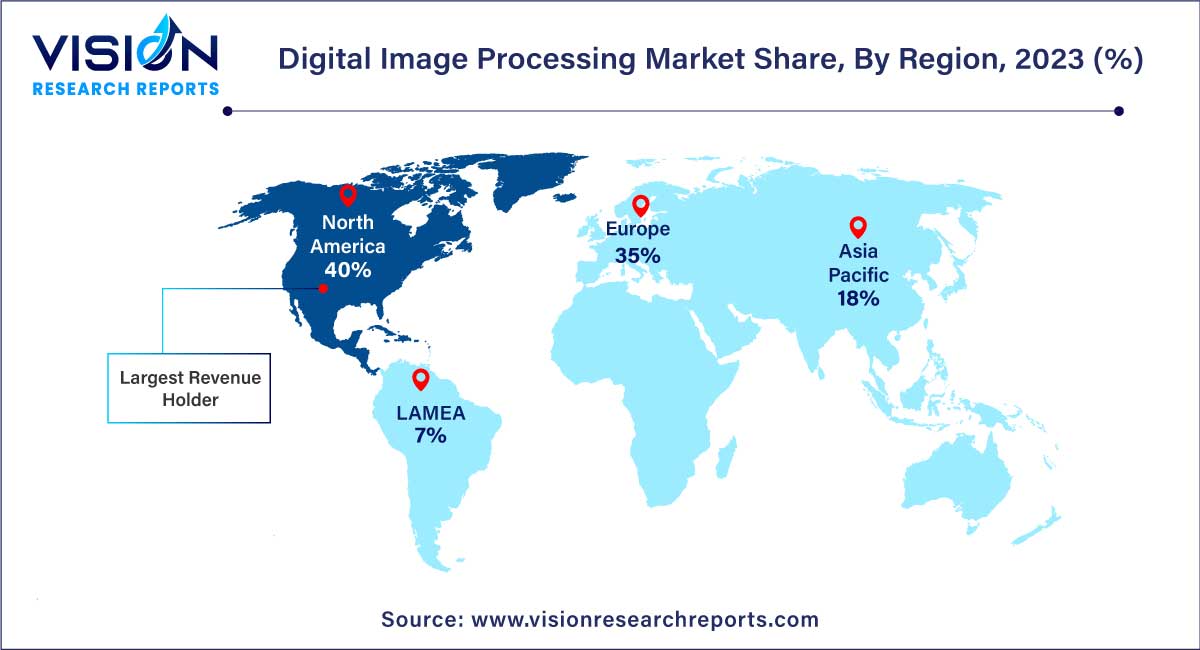

| Revenue Share of North America in 2023 | 40% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

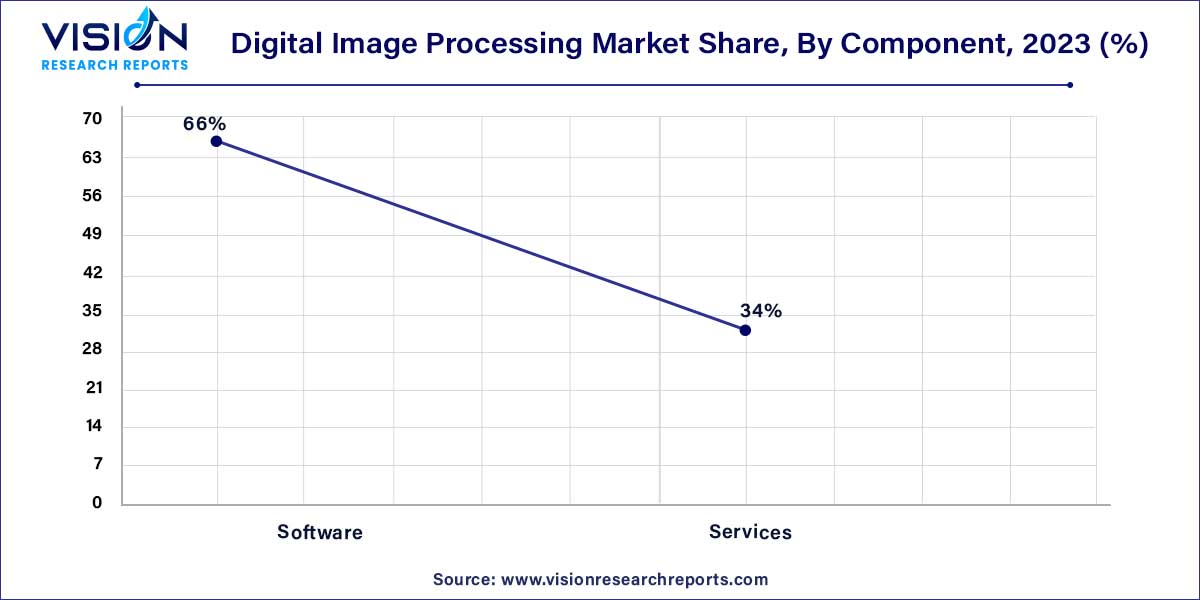

The software segment led the market in 2023, accounting for 66% of the global revenue share. This can be attributed to the increasing demand for image-processing software solutions across various industries, advancements in software technology, and the flexibility and adaptability of software-based solutions to address a wide range of image-processing needs.

Additionally, the software segment has witnessed significant growth due to the integration of artificial intelligence and machine learning algorithms, which have further enhanced the capabilities of image-processing software, making it a preferred choice for businesses and organizations seeking efficient and customizable solutions for their image-processing requirements. In March 2023, WiMi Hologram Cloud Inc. a China-based augmented reality solution provider announced the launch of holographic-enabled digital image processing software comprising channel attention mechanism and visual saliency.

The service segment is predicted to foresee significant growth in the forecast years owing to the complexity and diversity of image-processing tasks. Consulting services are in demand due to increased requirements for expert guidance and strategic advice. Many organizations prefer to outsource these tasks to expert service providers who can deliver constant results and adapt to evolving requirements. Furthermore, services often offer a cost-effective approach, as they eliminate the necessity for in-house development and maintenance of image processing solutions.

The object recognition segment held the largest revenue share of 29% in 2023. This high share is attributed to the increasing demand for object recognition technology across various industries and applications. Object recognition, powered by artificial intelligence (AI) and deep learning, has become an essential component in fields such as autonomous vehicles, security and surveillance, retail, and industrial automation, among others.

For instance, in retail, it can be used to manage inventory, monitor shelves, and analyze customer behavior. In manufacturing, object recognition can be used to improve quality control, detect defects, and automate assembly operations. In automotive, object recognition is important for advanced driver-assistance systems (ADAS) and self-driving vehicles. In healthcare, object recognition assists with medical image analysis to detect and diagnose diseases. In security, object recognition is used to identify and track individuals and objects in surveillance systems.

The other application segment is predicted to foresee significant growth during the forecast years. This segment includes pattern recognition, remote sensing, video processing, and machine or robotic vision. Pattern recognition application has wide applications in computer vision, speech recognition, and natural language processing (NLP) technology. It has end-use applications in numerous industries, including healthcare for medical image analysis, financial services for fraud detection, quality control in manufacturing, and others.

The retail & e-commerce segment led the market with the highest revenue share 28% in 2023. The rapid growth of the retail and e-commerce industry, fueled by the increasing trend of online shopping, has significantly propelled the need for digital image processing. Image processing technologies are critical for applications such as recommendation systems, product image enhancement, virtual try-ons, and visual search, which enhance the online shopping experience and propel consumer engagement. Moreover, the retail and e-commerce sector depends heavily on image processing to automate product tagging, optimize inventory management, and facilitate visual merchandising.

The automobile & transportation segment is predicted to foresee significant growth in the forecast years owing to the growing integration of digital image processing technologies in advanced driver assistance systems (ADAS) and autonomous vehicles, which have become vital for improving road safety and vehicle automation. Additionally, the transportation sector heavily depends on image processing for applications like vehicle monitoring, traffic management, and logistics optimization, which further strengthened the segment's growth

North America dominated the market with the largest market share of 40% in 2023 owing to the presence of numerous prominent technology companies and research institutions specializing in image processing and related technologies in the region. Furthermore, the regional market benefits from a strong economy, substantial investments in R&D, and innovations, which contribute to its strong foothold in the market. Additionally, the region's diverse range of industries, from healthcare and automotive to entertainment and aerospace, rely extensively on digital image processing solutions, further fueling the market's growth in the region.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Asia Pacific is one of the fastest-growing markets for digital image processing owing to the growing adoption of digital technologies, the growth of the healthcare and automotive industries, and the increasing need for surveillance and security services in the region. Moreover, government initiatives and investments in smart cities, healthcare modernization, and infrastructure development are creating opportunities for image-processing technologies, further propelling the region's growth in the market.

By Component

By Application

By End-use Industry

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Image Processing Market

5.1. COVID-19 Landscape: Digital Image Processing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Image Processing Market, By Component

8.1. Digital Image Processing Market, by Component, 2024-2033

8.1.1 Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Digital Image Processing Market, By Application

9.1. Digital Image Processing Market, by Application, 2024-2033

9.1.1. Visual Product Search

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Object Recognition

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Vision Analytics

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Digital Image Processing Market, By End-use

10.1. Digital Image Processing Market, by End-use, 2024-2033

10.1.1. Healthcare

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Automobile & Transportation

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. BFSI

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Retail & E-commerce

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Digital Image Processing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Nvidia Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Canon Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Samsung Electronics Co. Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Panasonic Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cognex Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Teledyne Technologies

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Vegavid Technology.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Visionary.ai.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. IBM.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Microsoft

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others