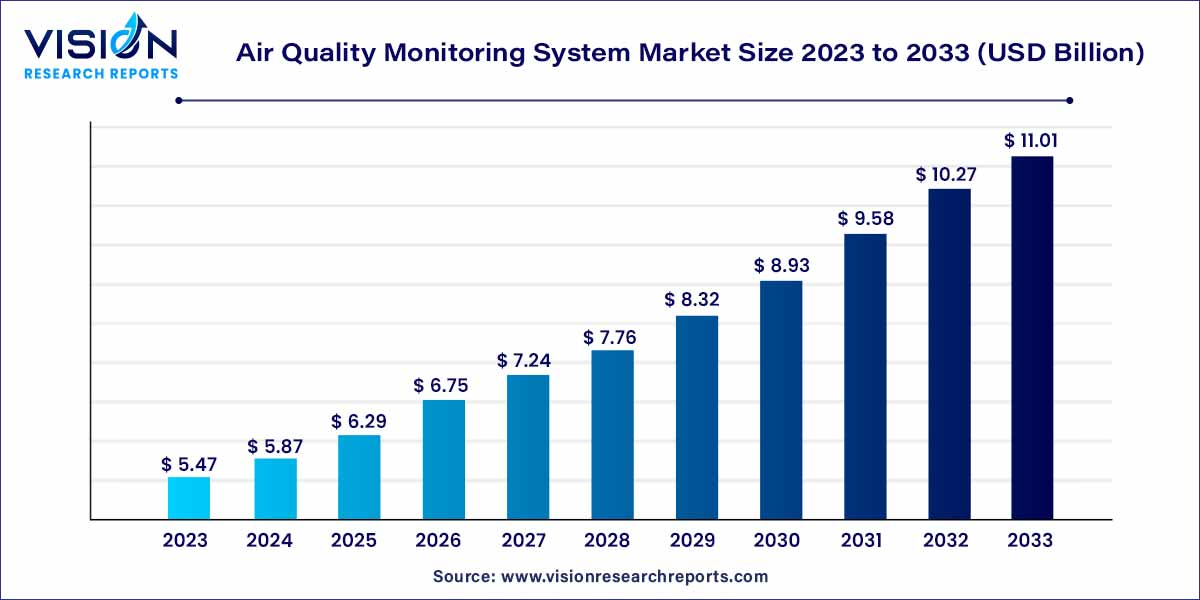

The global air quality monitoring system market size was estimated at around USD 5.47 billion in 2023 and it is projected to hit around USD 11.01 billion by 2033, growing at a CAGR of 7.25% from 2024 to 2033. The air quality monitoring system market in the United States was accounted for USD 1.4 billion in 2023.

The air quality monitoring (AQM) market is witnessing unprecedented growth and significance as societies worldwide grapple with escalating environmental concerns. This dynamic market revolves around technologies and solutions aimed at assessing and managing air quality parameters, fostering a crucial nexus between technology, environmental stewardship, and public health.

The robust growth of the air quality monitoring market is underpinned by several key factors. First and foremost, the escalating global awareness of environmental issues and the imperative to mitigate climate change have spurred governments and industries to invest significantly in air quality monitoring solutions. Stringent regulatory frameworks and standards mandating pollution control measures further drive the demand for advanced monitoring technologies. The rapid advancements in sensor technologies, facilitating real-time and accurate data collection, contribute to the market's expansion. Additionally, the rise of smart cities and the integration of air quality monitoring into urban planning strategies propel market growth. The increasing public awareness of the health impacts of air pollution fuels the demand for personal monitoring devices, fostering a more active consumer base.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 11.01 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.25% |

| Revenue Share of North America in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 8.78% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The outdoor segment dominated the market with the highest revenue share of 66% in 2023. As a result of increased integration activities of these systems with other smart city infrastructures such as smart poles, traffic systems, and streetlight solutions, government mandates for the use of air quality monitoring devices in industries such as oil and gas and pharmaceuticals are another factor driving the growth of the segment. The outdoor segment is bifurcated into fixed and portable segments. Fixed systems accounted for a larger share in 2022, fueled by a significant rise in air quality monitoring station installations in public places.

The indoor segment is expected to witness the fastest CAGR of 7.63% over the forecast period. Indoor monitoring systems are being increasingly adopted due to the growing popularity of smart homes and green buildings. Most people spend 75% to 85% of their daily time indoors. Several air impurities can cause respiratory disorders, allergies, and other ailments, which is a major factor attributed to the growth of the indoor segment. The indoor segment is further classified into portable and physical. The portable indoor air quality monitoring devices accounted for the largest CAGR of the indoor segment in 2023.

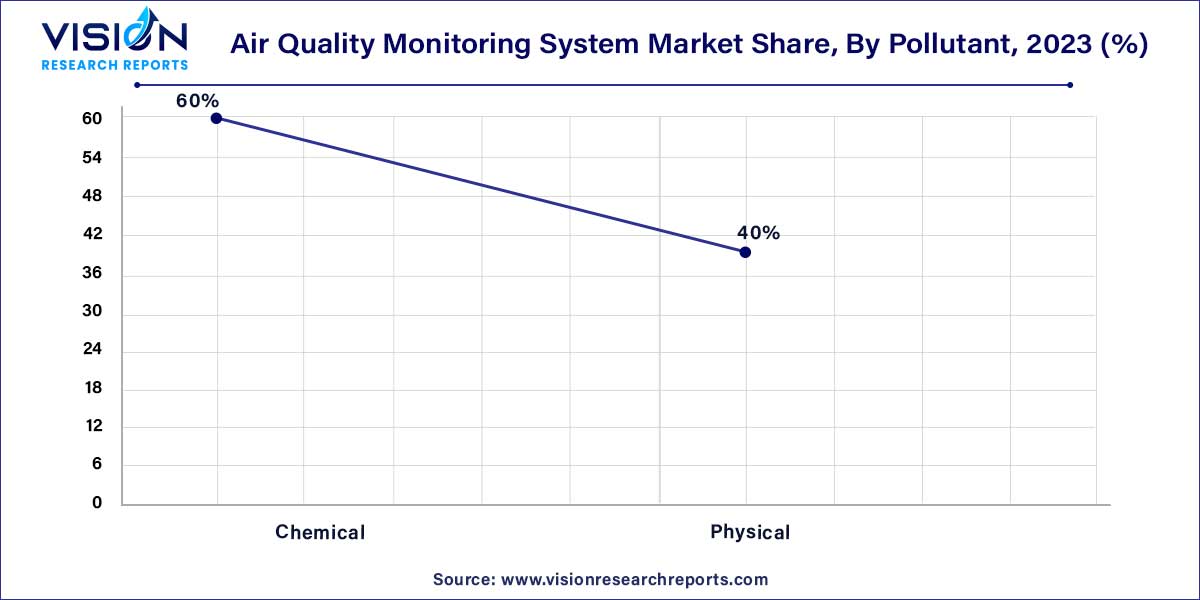

The chemical segment, which includes harmful pollutants such as carbon monoxide, dominated the market with the highest revenue share of 60% in 2023. Based on chemical pollutants, the market has been segmented into nitrogen oxides (NOX), sulfur oxides (SOX), carbon oxides (COX), volatile organic compounds (VOCs), and others. The carbon dioxide segment held the largest share, which can be attributed to a rise in the number of factories and vehicles, a major source of COx emissions.

On the other hand, the physical segment is expected to expand at the fastest CAGR of 7.53% over the forecast period, owing to rising awareness regarding particulate matter's health and environmental effects. Particulate matter of fewer than 10 micrometers can cause cardiovascular morbidity among older adults and children below ten. In response to the health risks associated with particulate matter, government agencies such as the Canadian Council of Ministers of the Environment have laid down regulations for manufacturing industries about the emission of particulate matter.

The hardware held the largest market share of 54% in 2023, owing to modernized designs with real-time applications. The large share of this segment can be attributed to the increasing number of system integrators in the market. Some multinational conglomerates perform the work of system integration and, therefore, purchase hardware such as sensors and displays from component manufacturers. With the Internet of Things (IoT), air quality monitoring devices have gained wide exposure. Newer units offer great connectivity and the potential to further relay real-time insights. The hardware is highly compatible with the software to capture data for air temperature, dust particles, VOCs, and carbon dioxide.

The software segment is projected to register the fastest CAGR of 8.35% over the forecast period. The growth of the software segment can be attributed to the increasing demand for these devices from smart city authorities. These authorities focus on integrating different systems, such as environmental monitoring systems, traffic monitoring solutions, and parking management devices in a city, into a single software solution. Moreover, industries such as chemicals, oil and gas, and pharmaceuticals widely adopt air quality monitoring software for remote monitoring.

The commercial segment led the market with the highest revenue share of 41% in 2023. Government agencies and defense product types handle highly sensitive and classified information, including national security data, intelligence reports, confidential government documents, and citizens' personally identifiable information (PII). Protecting this data from unauthorized access, breaches, and cyberattacks is paramount. Air quality monitoring system solutions protect government endpoints robustly, ensuring critical data's confidentiality, integrity, and availability.

The industrial segment is expected to witness the fastest CAGR of 7.53% over the forecast period. The growth of the industrial segment is attributable to the increasing adoption of air quality monitoring systems by various industries in response to stringent government mandates. The industrial segment is fragmented into oil and gas, manufacturing, food and beverages, pharmaceutical, healthcare, and other industries.

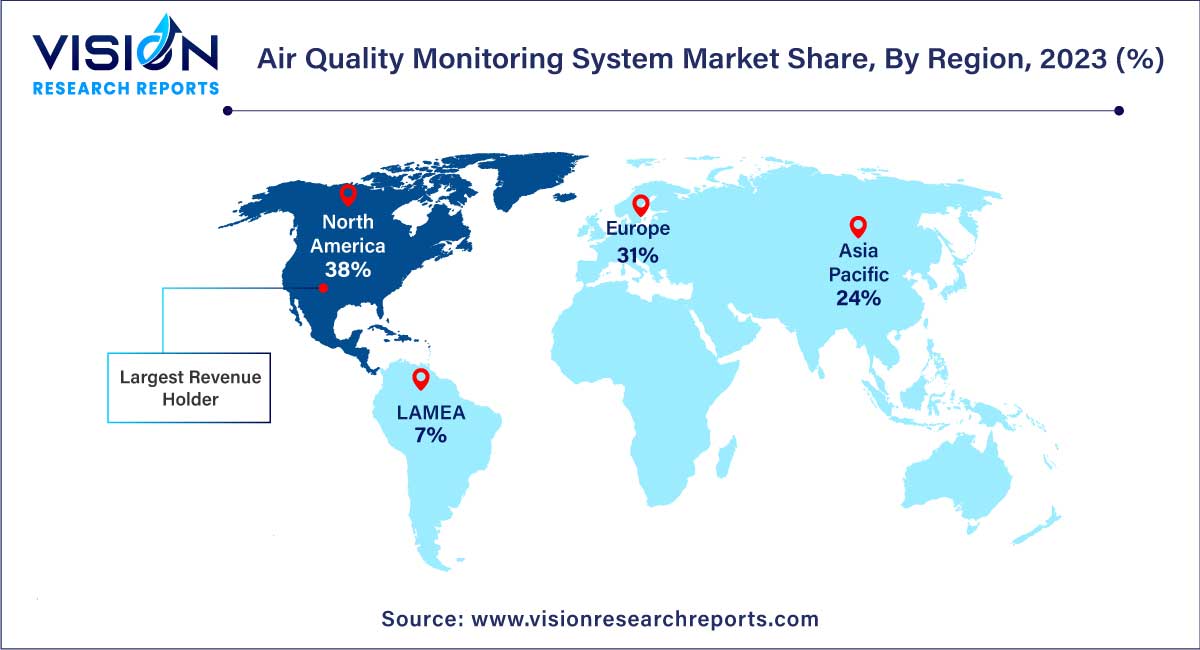

North America dominated the air quality monitoring system market with the largest revenue share of 38% in 2023. It can be attributed to rising levels of acid rain in the region, which has caused 90% of lakes in North America to be acidic. The governments, in response, have mandated strict implications for monitoring the air quality, which will propel market growth. Also, the well-established distribution channels of leading manufacturers bode well for market growth.

Asia Pacific is expected to expand at the fastest CAGR of 8.78% during the forecast period, owing to the increasing prevalence of respiratory and cardiovascular diseases owing to air pollution in various cities across the region. Of the 30 global cities with the worst air quality index (AQI) in 2022, Asia Pacific is home to 24 cities. Besides, favorable government initiatives bode well for market growth in the region.

By Product Type

By Pollutant

By Component

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Air Quality Monitoring System Market

5.1. COVID-19 Landscape: Air Quality Monitoring System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Air Quality Monitoring System Market, By Product Type

8.1. Air Quality Monitoring System Market, by Product Type, 2024-2033

8.1.1. Indoor Air Quality Monitoring Systems

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Outdoor Air Quality Monitoring Systems

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Air Quality Monitoring System Market, By Pollutant

9.1. Air Quality Monitoring System Market, by Pollutant, 2024-2033

9.1.1. Chemical

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Physical

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Air Quality Monitoring System Market, By Component

10.1. Air Quality Monitoring System Market, by Component, 2024-2033

10.1.1. Hardware

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Software

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Services

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Air Quality Monitoring System Market, By End-use

11.1. Air Quality Monitoring System Market, by End-use, 2024-2033

11.1.1. Residential

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Commercial

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Industrial

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Air Quality Monitoring System Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.1.3. Market Revenue and Forecast, by Component (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Component (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Component (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.2.3. Market Revenue and Forecast, by Component (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Component (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Component (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Component (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Component (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.3.3. Market Revenue and Forecast, by Component (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Component (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Component (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Component (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Component (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.4.3. Market Revenue and Forecast, by Component (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Component (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Component (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Component (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Component (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.5.3. Market Revenue and Forecast, by Component (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Component (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Pollutant (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Component (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. 3M

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. General Electric

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. HORIBA Scientific

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Aeroqual

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Emerson Electric Co.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Seimens

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Merck KGaA

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Teledyne Technologies Incorporated.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Testo SE & Co. KGaA

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Thermo Fisher Scientific Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others