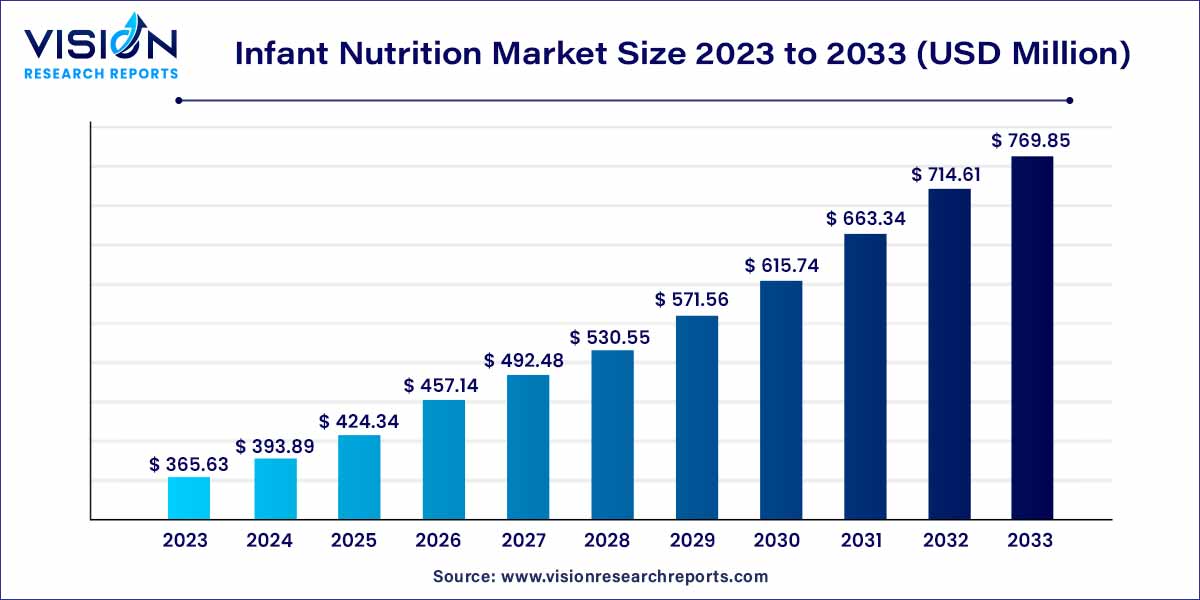

The global infant nutrition market was estimated at USD 365.63 million in 2023 and it is expected to surpass around USD 769.85 million by 2033, poised to grow at a CAGR of 7.73% from 2024 to 2033.

The infant nutrition market is a crucial sector within the broader food industry, dedicated to meeting the specific dietary needs of infants during their initial stages of development. This market encompasses a diverse range of products designed to provide essential nutrients required for the optimal growth and well-being of infants. From formula milk to complementary feeding options, the infant nutrition market plays a pivotal role in supporting the nutritional requirements of this vulnerable demographic.

The growth of the infant nutrition market is propelled by several key factors. Increasing awareness among parents about the critical role of early nutrition in infant development has significantly contributed to the market's expansion. Moreover, ongoing technological advancements in nutritional science have led to the formulation of innovative products that closely replicate the nutritional composition of breast milk, fostering better infant health outcomes. A stringent regulatory framework ensures product safety and quality, instilling consumer confidence. Global trends, such as changing demographics and urbanization, further drive the demand for convenient and nutritionally rich infant feeding solutions. The emphasis on health and wellness has spurred a growing preference for organic and premium infant nutrition products, creating new avenues for market growth. These factors collectively create a conducive environment for sustained expansion in the infant nutrition market, with ample opportunities for innovation and market differentiation.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 769.85 million |

| Growth Rate from 2024 to 2033 | CAGR of 7.73% |

| Revenue Share of North America in 2023 | 25% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Infant milk formula segment held the largest revenue share of 39% in 2023. The market dominance was fueled by heightened parental awareness of optimal infant nutrition and the convenience of formula feeding. Continuous innovation in baby formula with formulations closely resembling breast milk nutrition appeals to consumers seeking specialized and high-quality options. Shifting lifestyles, including more working mothers and the prevalence of nuclear families, drive the adoption of infant milk formula as a convenient feeding choice. Manufacturers respond by offering diverse newborn formula products to meet varying dietary needs. For instance, in September 2022, Nestlé launched Nutrilearn Connect, featuring myelin, a unique ingredient, in Hong Kong.

Baby food segment is anticipated to witness significant market growth over the forecast period. Companies are strategically offering a diverse range of convenient and nutritious options for parents, capitalizing on the rising popularity of ready-to-eat and easy-to-prepare baby food to meet the demand for time-saving solutions. These factors contribute to the sustained growth of the segment throughout the forecast period.

Solid form segment held the largest revenue share in 2023. Powdered infant formulas offer greater convenience and portability than liquid alternatives, making them a preferred choice for on-the-go parents or those who prefer flexibility in preparation. In addition, powdered formulas are generally more cost-effective than ready-to-feed or liquid concentrates, attracting price-sensitive consumers.

The liquid form segment is anticipated to witness a significant CAGR, driven by pre-packaged and sealed options, addressing contamination concerns, and appealing to parents prioritizing hygiene and safety.

The hypermarket/supermarket segment holds the market dominance with the largest share in 2023. Hypermarkets and supermarkets, such as SM Market, Walmart, Amazon, Morrisons, and others, provide a convenient one-stop shopping experience for parents seeking infant nutrition products alongside groceries and household items. The appeal of this convenience factor drives consumer preference for these retail channels. Companies are increasingly launching their products in hypermarkets/supermarkets to enhance sales. For instance, in July 2023, Else Nutrition expanded its distribution in the Midwest market through a partnership with Schnucks, a major regional supermarket chain. The Else Toddler Organic 22oz product is now available at approximately 110 Schnucks locations across Missouri, Wisconsin, Illinois, and Indiana.

Online channels segment is anticipated to grow at the fastest CAGR during the forecast period. Online platforms offer a broad range of infant nutrition products, including various formulas, baby food, and supplements. This extensive product selection allows consumers to explore different options and choose products that meet their preferences and requirements. The increasing internet penetration and global shift towards online shopping would likely drive the segment growth over the forecast period.

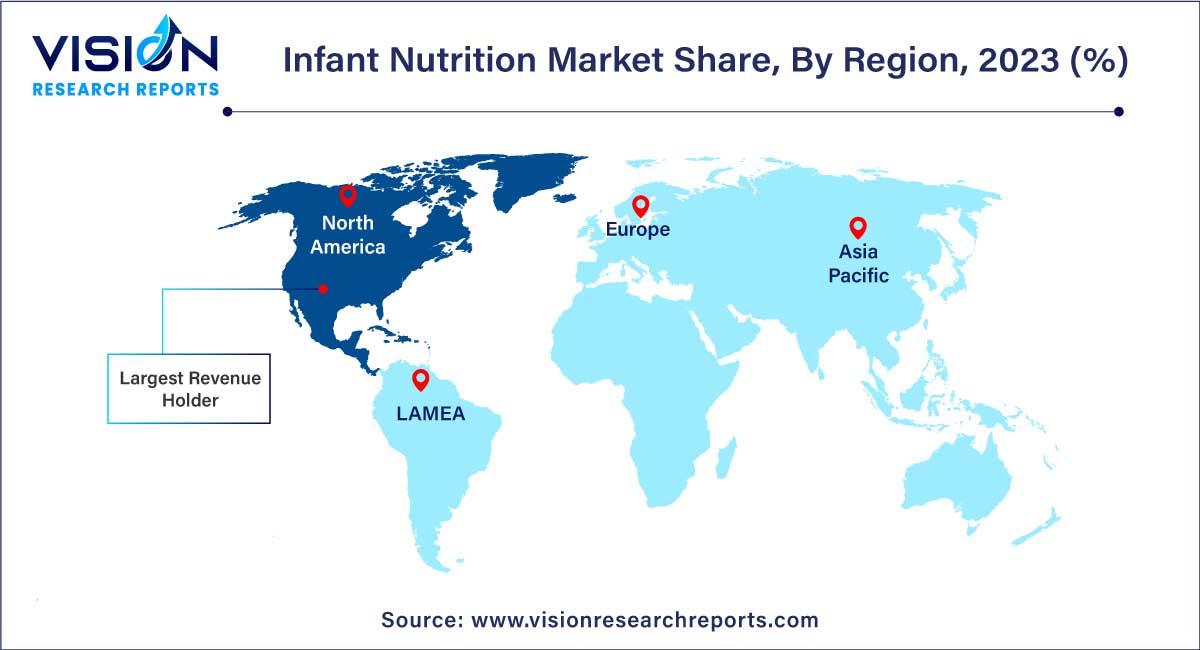

North America dominated the market with a revenue share of 25% in 2023, driven by factors such as the increasing number of working women, government support for quality healthcare, high purchasing power parity, and the presence of key market players. In the U.S., the proportion of working women is increasing. For instance, according to a Catalyst Organization analysis published in August 2022, there were 75,699,000 women aged 16 and up in the labor force in 2021, representing 56.1% of all women in the U.S. population and nearly half (47.0%) of the entire labor force. This trend highlights the growing reliance of working mothers on infant/baby nutrition, enabling them to feed their newborns conveniently, even in their absence.

Simultaneously, the region is witnessing strategies such as new product launches by startups and established baby-feeding companies. For instance, Sugarlogix, a startup, leverages advanced gene-editing technologies to replicate the most common breast milk sugars in a lab known for enhancing the baby's immune system. In addition, Bobbie Labs, its research, and development unit focused on enhancing newborn nutrition, was inaugurated in October 2022. Bobbie Labs is a crucial element of Bobbie's USD 100 million commitment to improve infant formula accessibility, quality, and choices for all US families.

The Asia Pacific region is anticipated to witness the fastest CAGR during the forecast period due to a rising number of childbirths and an increasing population of working women. The combination of high birth rates in some APAC countries and growing urbanization contributes to a large and expanding consumer base for infant nutrition products.

Danone stated in September 2023 that a new newborn formula with milk droplets that closely resemble mothers' milk would be available in China.

The clinically proven, readily digested, and certified-clean ingredient baby formula from ByHeart, which will be sold at Target stores nationwide, will make its retail debut in August 2023. The business further said that it will reintroduce its product to customers directly at ByHeart.com later this year.

Danone stated in April 2023 that it would be expanding its line of nutrition products in Poland by purchasing ProMedica.

By Product Type

By Form

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Infant Nutrition Market

5.1. COVID-19 Landscape: Infant Nutrition Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Infant Nutrition Market, By Product Type

8.1. Infant Nutrition Market, by Product Type, 2024-2033

8.1.1 Infant Milk Formula

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Baby Food

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Follow-on Milk

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Infant Nutrition Market, By Form

9.1. Infant Nutrition Market, by Form, 2024-2033

9.1.1. Solid

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Liquid

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Infant Nutrition Market, By Sales Channel

10.1. Infant Nutrition Market, by Sales Channel, 2024-2033

10.1.1. Hypermarkets/Supermarkets

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Pharmacy/Medical Stores

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Online Channels

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Specialty Stores

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Infant Nutrition Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Form (2021-2033)

11.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Nestlé.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Walgreen Co.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Nutricia.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Abbott.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. The Hain Celestial Group.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Holle baby food AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. China Mengniu Dairy Company Limited.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Perrigo Company plc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. The Kraft Heinz Company.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. DANA DAIRY GROUP

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others