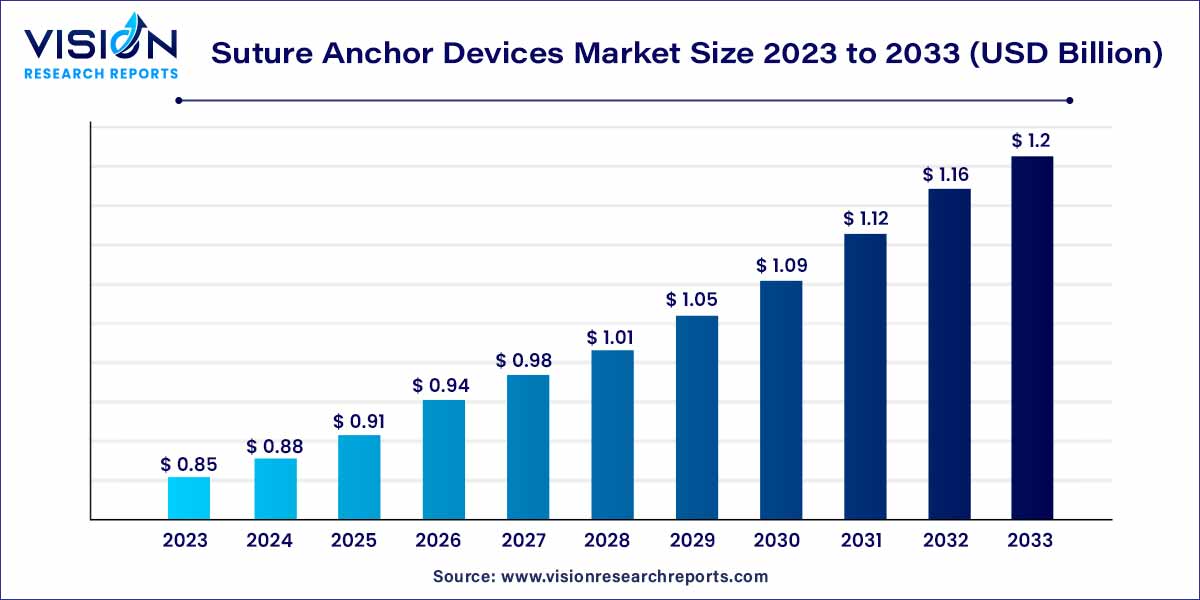

The global suture anchor devices market size was estimated at around USD 0.85 billion in 2023 and it is projected to hit around USD 1.2 billion by 2033, growing at a CAGR of 3.55% from 2024 to 2033.

The suture anchor devices market stands at the forefront of innovation and growth within the healthcare sector. These devices, integral to orthopedic and sports medicine practices, play a crucial role in advancing patient care and treatment outcomes.

The growth of the suture anchor devices market is propelled by several key factors. Firstly, the increasing prevalence of orthopedic injuries, coupled with a growing awareness of minimally invasive surgical techniques, contributes significantly to the rising demand for these devices. Moreover, the aging global population, susceptible to musculoskeletal issues, acts as a demographic driver, further augmenting market expansion. The market's dynamic segmentation based on product type, application, and end-user allows for a tailored understanding of evolving trends, catering to diverse stakeholder needs. Additionally, the competitive landscape, characterized by strategic initiatives of key players, mergers, acquisitions, and collaborations, plays a crucial role in shaping market dynamics.

| Report Coverage | Details |

| Market Size in 2023 | USD 0.85 billion |

| Revenue Forecast by 2033 | USD 1.2 billion |

| Growth rate from 2024 to 2033 | CAGR of 3.55% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Non-absorbable products accounted for a largest revenue share of 56% in 2023. The dominance is aided by their use in orthopedic procedures to secure sutures in bone and maintain their structural integrity. They are designed to provide long-term fixation for ligament and tendon repairs. Their widespread use across various orthopedic surgeries has contributed significantly to their market dominance, compared to absorbable suture anchors. Their durability offers strong and lasting support for tissue repair in orthopedic procedures, which has led to their higher adoption and market share.

The absorbable segment, on the other hand, is expected to show lucrative growth, as these products are designed to degrade over time within the body, eliminating the need for surgical removal. They offer convenience by negating the requirement for a second surgery for anchor removal, thus helping reduce patient discomfort and healthcare costs.

Metallic suture anchors accounted for the largest revenue share in 2023. Their high demand can be attributed to their exceptional durability and strength, providing robust fixation in orthopedic surgeries. These anchors, commonly made from materials such as titanium or stainless steel, ensure long-term stability for tendon and ligament repairs. For example, in rotator cuff repairs, metallic anchors offer reliable stability for the reattachment of tendons to the bone, ensuring better healing outcomes due to their high tensile strength and resistance to degradation over time. The inherent strength and reliability of metallic suture anchors drive their preference for long-term fixation in orthopedic procedures, leading to their dominance.

The bio-absorbable suture anchor segment is estimated to register the fastest CAGR over the forecast period. This is due to their ability to support bone formation and the rising preference for biodegradable materials in orthopedic procedures

The knotless segment dominated the market in 2023 and is anticipated to further expand at the fastest CAGR during the forecast period. These anchors simplify the surgical process by eliminating the need for manual knot tying, reducing procedure time and potential complications associated with knot tying. They offer enhanced tissue preservation and distribute tension more evenly across the repaired tissue, improving outcomes and potentially resulting in faster patient rehabilitation.

The knotless segment held a significant market share in 2023 owing to the launch of innovative products by key players. A notable example is the introduction of Smith+Nephew's HEALICOIL KNOTLESS Suture Anchor, in September 2020 , which helped expand the company’s Advanced Healing Solutions line for rotator cuff repair.

The hospitals segment accounted for the largest market revenue share in 2023. Hospitals conduct more orthopedic procedures, including those involving suture anchors for ligament and tendon repairs. The specialized orthopedic departments and resources required for complex orthopedic surgeries contribute to a significant usage of suture anchor devices in these facilities.

The ambulatory surgical centers segment is estimated to register the fastest CAGR over the forecast period. Ambulatory surgical centers have gained substantial popularity due to their cost-effectiveness, efficiency in performing minor surgeries, and advancements in medical technologies, allowing more procedures to be performed outside traditional hospital settings. Additionally, the shift toward outpatient procedures for orthopedic surgeries has increased the demand for suture anchor devices in these centers.

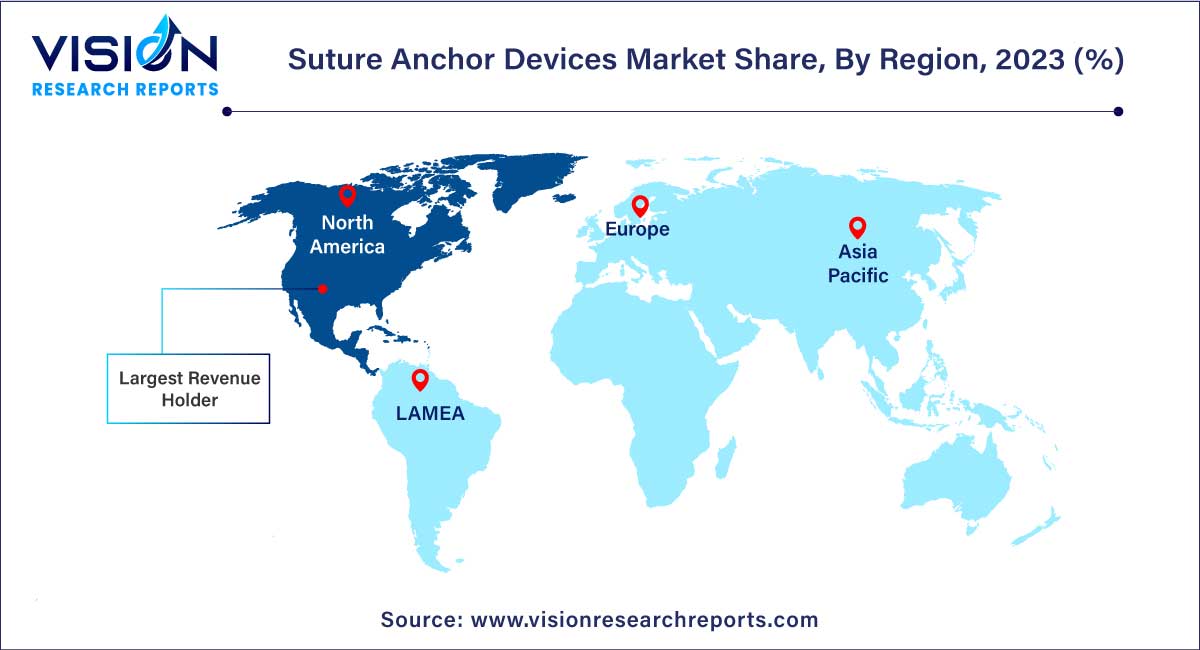

North America dominated the market with the largest market share in 2023. This is because the region has a well-established healthcare infrastructure and a high adoption rate of suture anchor products. It also has a large patient population, favorable reimbursement policies in the healthcare system, and witnesses a higher number of research and development activities, which have driven market growth.

Furthermore, the increasing number of surgeries being performed in hospitals, the establishment of multi-specialty hospitals, and the rapid adoption of more advanced biosurgery treatment procedures have all contributed to North America's dominance in the market for suture anchor devices. Key players such as Smith & Nephew, Stryker Corporation, and Johnson & Johnson are headquartered in North America, contributing to the region's market dominance.

The U.S. accounted for North America's largest share in suture anchor devices in 2023. The high purchasing power and a rise in the adoption rate of suture anchor products have driven market growth in the country. Additionally, the high prevalence of sports-related injuries has prompted a substantial demand for orthopedic interventions, stimulating the usage of suture anchors in repairing ligament and tendon injuries.

For instance, an article published by Ohio State University in 2021, titled "Arm Injury Statistics," reported that 6 million people in the U.S. break a bone each year. In adults aged above 75 years, hip fractures become the most common injury area. Fractures account for 16% of all musculoskeletal injuries in the U.S. annually. Over 40% of fractures take place at home. These factors collectively set the U.S. as the leading country in the suture anchor device market, with the highest revenue share and a strong outlook for continued dominance.

Asia Pacific is expected to advance with the fastest growth rate during the forecast period. The rising geriatric population increases the incidence of orthopedic conditions, necessitating more interventions involving suture anchors. Moreover, continuous technological advancements, increased awareness about advanced medical treatments, and expanding investments in healthcare contribute to the anticipated rapid growth rate of the market for suture anchor devices in the Asia Pacific region.

By Product

By Material Type

By Tying Type

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Suture Anchor Devices Market

5.1. COVID-19 Landscape: Suture Anchor Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Suture Anchor Devices Market, By Product

8.1. Suture Anchor Devices Market, by Product, 2024-2033

8.1.1. Absorbable

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non-absorbable

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Suture Anchor Devices Market, By Material Type

9.1. Suture Anchor Devices Market, by Material Type, 2024-2033

9.1.1. Metallic Suture Anchor

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Bio-absorbable Suture Anchor

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Suture Anchor Devices Market, By Tying Type

10.1. Suture Anchor Devices Market, by Tying Type, 2024-2033

10.1.1. Knotted Suture Anchors

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Knotless

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Suture Anchor Devices Market, By Tying Type

11.1. Suture Anchor Devices Market, by Tying Type, 2024-2033

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Ambulatory Surgical Centers

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Clinics

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Suture Anchor Devices Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.1.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.5.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Tying Type (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Material Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Tying Type (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Tying Type (2021-2033)

Chapter 13. Company Profiles

13.1. Smith & Nephew plc

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Zimmer Biomet Holdings

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. CONMED Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Arthrex, Inc

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Johnson and Johnson (DePuy Synthes, Inc.)

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Stryker Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Parcus Medical

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Wright Medical

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Orthomed

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Enovis

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others