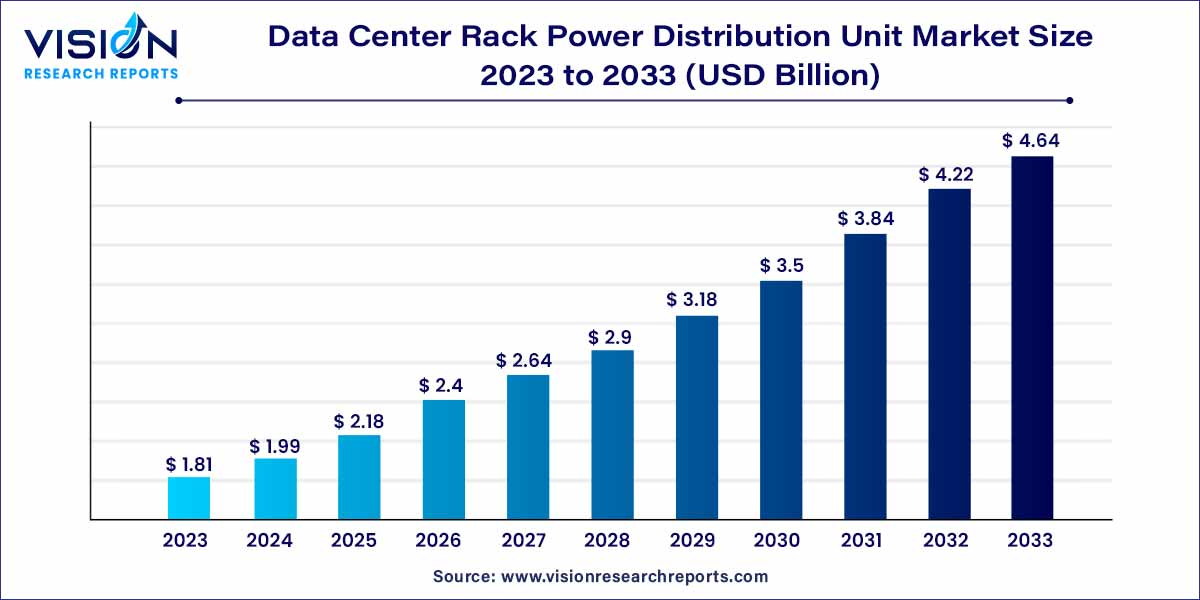

The global data center rack power distribution unit market size was estimated at around USD 1.81 billion in 2023 and it is projected to hit around USD 4.64 billion by 2033, growing at a CAGR of 9.86% from 2024 to 2033.

The data center rack power distribution unit (PDU) market serves as a cornerstone in the realm of data center infrastructure, offering indispensable solutions for the efficient distribution of electrical power within server racks. As the demand for robust and scalable data center architectures continues to surge, the PDU market has witnessed substantial growth, driven by a confluence of technological advancements, evolving energy efficiency imperatives, and the ever-increasing complexity of modern data center setups.

The data center rack power distribution unit (PDU) market is experiencing robust growth, fueled by several key factors. Firstly, the escalating demand for scalable power solutions, particularly in the context of data-intensive technologies such as cloud computing and artificial intelligence, has propelled the adoption of PDUs designed to meet the dynamic power requirements of high-density computing environments. Secondly, there is a pronounced industry-wide emphasis on energy efficiency and sustainability, driving the development of intelligent PDUs equipped with features like power monitoring and management. These solutions align with the growing global commitment to eco-friendly practices in data center operations. Additionally, ongoing technological innovations, including the integration of IoT capabilities in smart PDUs, facilitate real-time monitoring and predictive maintenance, addressing the need for intelligent, adaptive power distribution. The increasing complexity of data center architectures, such as hyper-converged and modular designs, further contributes to market growth, with a rising demand for customized PDUs capable of seamless integration. Lastly, stringent compliance with regulatory standards, such as TIA-942 and Uptime Institute's Tier Standards, underscores the importance of PDUs in ensuring data center adherence to industry guidelines. In navigating these dynamics, the Data Center Rack PDU market is poised for sustained expansion, playing a pivotal role in shaping the future of efficient and resilient data center infrastructure.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 4.64 billion |

| Growth Rate from 2024 to 2033 | CAGR of 9.86% |

| Revenue Share of North America in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 11.65% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The non-intelligent segment accounted for the largest revenue share of 54% in 2022. The non-intelligent rack power distribution units, which have only input load monitoring and power distribution functionalities, held the largest share of over 50.0% in 2019. Factors such as increased demand for power and load monitoring capabilities in data centers and cost-effectiveness are anticipated to boost the segment growth over the forecast period. Additionally, these power distribution units fulfill the requirements of various data centers as they accurately distribute current and voltage within the IT infrastructure.

The intelligent segment is expected to grow at the fastest CAGR of 10.75% during the forecast period. The intelligent rack PDU is further bifurcated into Metered PDU and Switched PDU. This is attributed to the shift of various organizations towards hyper-converged infrastructure. Additionally, features such as input metering, network connectivity, and output metering are expected to boost their demand.

North America dominated the market with the largest revenue share of 38% in 2022. This is attributed to the presence of key players such as APC Corp; Hewlett Packard Enterprise Development LP; and Cyber Power Systems (USA), Inc. U.S. is considered to be a major contributor in terms of revenue owing to the increasing adoption of online shopping, which has led to retailers having data centers in their own premises or lease storage space from third-party service providers. Furthermore, colocation providers in this region are significantly investing in constructing additional data centers to enhance their global footprint, which is subsequently fueling the regional market growth.

Asia Pacific is expected to grow at the fastest CAGR of 11.65% during the forecast period. Growing preference for digitalization is anticipated to encourage the adoption of cloud-based services and in turn, necessitate the utilization of data centers during the forecast period. Companies such as Amazon Web Services, Inc.; Google LLC; and IBM Corporation are expanding their cloud-based services in this region. Furthermore, rising expenditure on IT infrastructure in countries, such as Japan, China, and India, is fueling the demand for power distribution units in the region.

By Rack Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Center Rack Power Distribution Unit Market

5.1. COVID-19 Landscape: Data Center Rack Power Distribution Unit Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Center Rack Power Distribution Unit Market, By Rack Type

8.1. Data Center Rack Power Distribution Unit Market, by Rack Type Type, 2024-2033

8.1.1. Non-intelligent

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Intelligent

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Data Center Rack Power Distribution Unit Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Rack Type (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Rack Type (2021-2033)

Chapter 10. Company Profiles

10.1. Data Center Rack Power Distribution Unit

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Schneider Electric

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Cyber Power Systems (USA), Inc.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Eaton

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Enlogic

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Hewlett Packard Enterprise Development LP

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Leviton Manufacturing Co., Inc.

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Raritan, Inc.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. Server Technology, Inc.

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Tripp Lite

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others