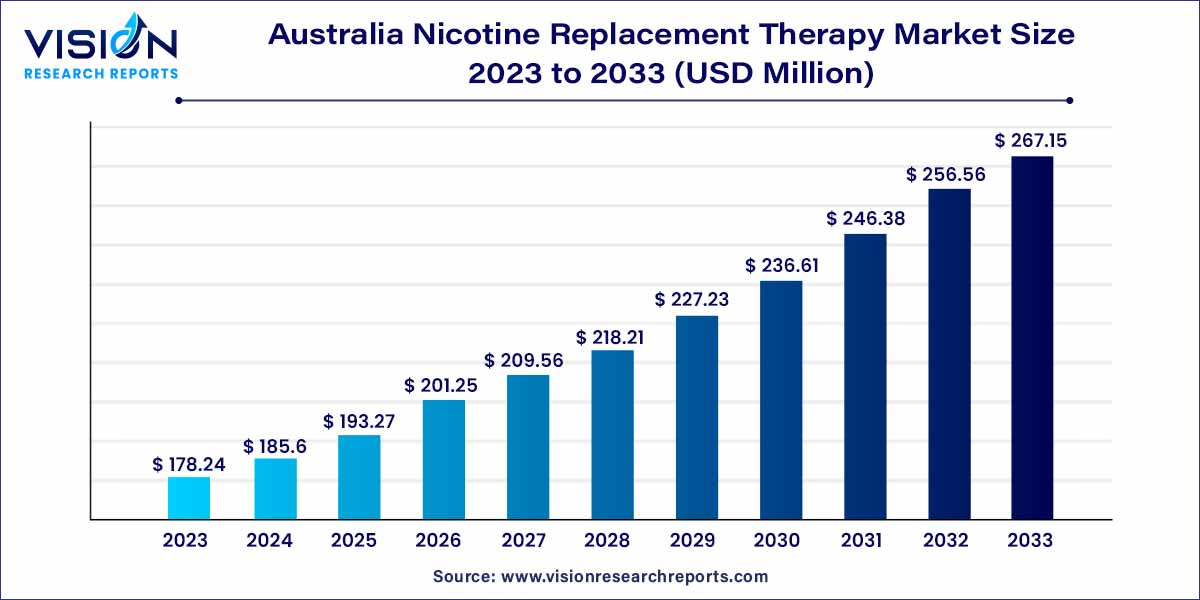

The Australia nicotine replacement therapy market size was estimated at around USD 178.24 million in 2023 and it is projected to hit around USD 267.15 million by 2033, growing at a CAGR of 4.13% from 2024 to 2033. The nicotine replacement therapy (NRT) market in Australia is a dynamic and evolving sector, playing a crucial role in the nation's efforts to reduce smoking prevalence and promote public health.

What are the Growth Factors of Australia Nicotine Replacement Therapy Market?

The growth of the nicotine replacement therapy (NRT) market in Australia is propelled by an escalating awareness of the detrimental health impacts associated with smoking has prompted an increasing number of individuals to actively seek effective smoking cessation solutions. The Australian government's unwavering commitment to public health is evident through supportive policies, including subsidized access to NRT products and comprehensive anti-smoking campaigns. This governmental backing not only fosters a conducive environment for market expansion but also underscores a collective effort to reduce tobacco consumption nationwide. Additionally, as consumers become more health-conscious, there is a notable shift towards embracing NRT as a viable and structured approach to nicotine dependency. The growing acceptance of NRT products as a mainstream option for smoking cessation aligns with a broader societal trend towards healthier lifestyles. Overall, these factors synergistically contribute to the positive trajectory and sustained growth of the nicotine replacement therapy market in Australia.

| Report Coverage | Details |

| Growth rate from 2024 to 2033 | CAGR of 4.13% |

| Market Size in 2023 | USD 178.24 million |

| Revenue Forecast by 2033 | USD 267.15 million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The nicotine replacement therapy (NRT) segment dominated the market with a significant revenue share of 80% in 2023. The increasing prevalence of health conditions linked to tobacco consumption is a key driver fostering the acceptance and awareness of NRTs in Australia. The government is actively implementing programs and strategies to encourage the adoption of nicotine replacement products, including gums, inhalers, and patches. Since the launch of the National Tobacco Campaign in 1997, initiated to reduce smoking rates in the country, there has been a notable increase in public awareness campaigns and improved accessibility of NRT products. These products are now available both over-the-counter and through prescription, making them more widely accessible for individuals seeking to quit smoking.

Furthermore, the Australian government is addressing economic factors that positively impact the acceptance of NRT. Notably, the government subsidizes the cost of pharmaceutical drugs essential for smoking cessation under the Pharmaceutical Benefits Scheme. Such initiatives are expected to contribute significantly to the accelerated growth of the NRT market in Australia throughout the forecast period.

In 2023, the offline segment claimed the largest share of revenue at 69%. Offline distribution channels play a crucial role in the nicotine replacement therapy (NRT) market in Australia, providing a vital avenue to reach a diverse range of consumers aiming to quit smoking. These channels facilitate direct interaction with trained professionals, instilling confidence in consumers who prefer purchasing NRT products from reputable sources staffed by licensed professionals. The personalized guidance and accurate information offered by these professionals contribute to the prominence of offline channels in the NRT market.

Concurrently, the online distribution channel segment is anticipated to experience substantial growth, with a projected CAGR of 5.88% during forecast period. This growth is attributed to factors such as consumer preferences, user-friendly online platforms, prompt shipping services, and competitive pricing. The online NRT market has notably enhanced accessibility for individuals on the quit-smoking journey. Online platforms provide extensive information about various NRT options, empowering consumers to make informed decisions aligned with their preferences and needs. This wealth of information positions the online segment as a driving force behind the anticipated growth in the NRT market, offering convenience and choice to those seeking effective smoking cessation solutions.

Who are the Top Manufactures in Australia Nicotine Replacement Therapy Market?

By Product

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Australia Nicotine Replacement Therapy Market

5.1. COVID-19 Landscape: Australia Nicotine Replacement Therapy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Australia Nicotine Replacement Therapy Market, By Product

8.1. Australia Nicotine Replacement Therapy Market, by Product, 2024-2033

8.1.1. Nicotine Replacement Therapy

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. E-Cigarettes

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Heat-not burn Tobacco Products

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Australia Nicotine Replacement Therapy Market, By Distribution Channel

9.1. Australia Nicotine Replacement Therapy Market, by Distribution Channel, 2024-2033

9.1.1. Online

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Offline

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Australia Nicotine Replacement Therapy Market, Regional Estimates and Trend Forecast

10.1. Australia

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 11. Company Profiles

11.1. Philip Morris Products S.A. (Altria Group)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. British American Tobacco p.l.c.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Haleon Group of Companies

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Johnson & Johnson

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Liber Pharmaceuticals Pty Ltd

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Alphapharm Pty Limited

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Perrigo Company plc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Amcal

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. GSK plc

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others