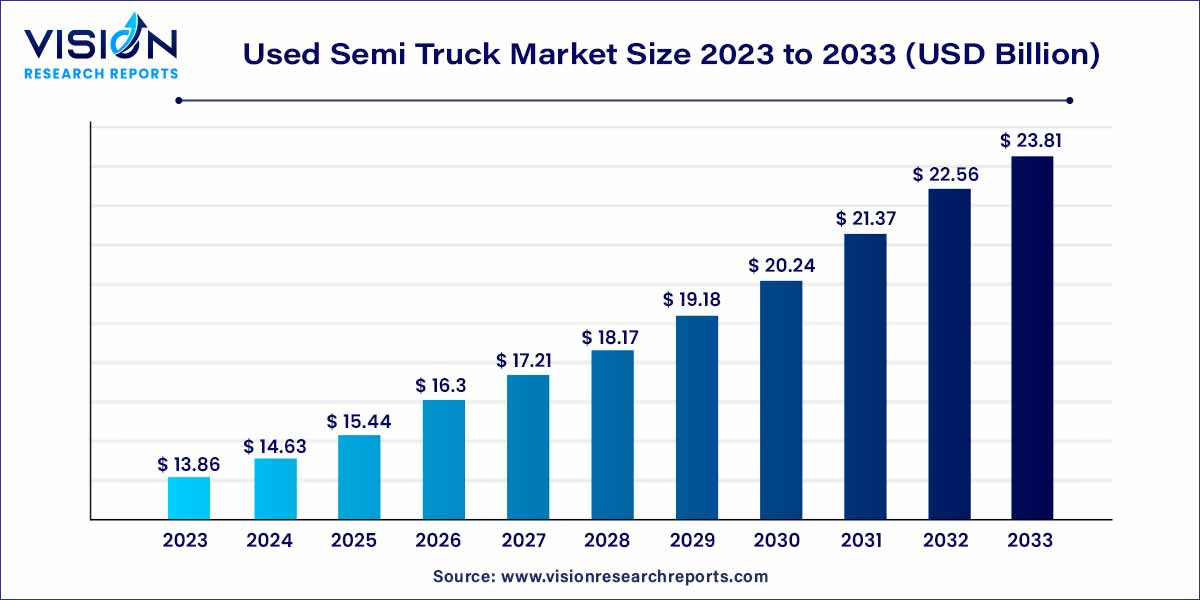

The global used semi truck market size was estimated at around USD 13.86 billion in 2023 and it is projected to hit around USD 23.81 billion by 2033, growing at a CAGR of 5.56% from 2024 to 2033.

The used semi truck market, a pivotal segment within the broader commercial vehicle industry, undergoes continuous evolution shaped by economic trends, technological advancements, and the dynamic demands of logistics. This overview provides a comprehensive insight into the key elements influencing the landscape of pre-owned commercial trucks.

In the realm of the used semi truck market, several key growth factors converge to propel the industry forward. Firstly, the burgeoning demand for cost-effective transportation solutions fuels the market's expansion, as businesses seek to optimize operational expenses. Additionally, the continuous technological advancements within the sector, such as improved fuel efficiency and enhanced connectivity features, contribute to the allure of used semi trucks. Furthermore, the market benefits from the cyclical nature of the transportation industry, where economic upswings typically correlate with increased demand for commercial vehicles. The growing emphasis on sustainability in logistics also acts as a catalyst, with environmentally conscious practices driving interest in fuel-efficient and eco-friendly pre-owned trucks. Moreover, as regulatory bodies adapt to evolving industry standards, compliance-related factors stimulate market growth by fostering a reliable and standardized marketplace. This confluence of economic, technological, and regulatory factors positions the used semi truck market on a trajectory of sustained growth, presenting opportunities for both buyers and sellers within the commercial vehicle ecosystem.

| Report Coverage | Details |

| Market Size in 2023 | USD 13.86 billion |

| Revenue Forecast by 2033 | USD 23.81 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.56% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The used semi-truck market is categorized by sales channels, including franchised dealers, independent dealers, and peer-to-peer transactions. The independent dealer segment held the largest revenue share in the market. This prominence can be linked to several factors, notably the widespread acceptance of independent dealerships due to their tendency to provide competitive pricing. This pricing strategy enables businesses to procure dependable vehicles at more economical rates compared to investing in brand-new trucks.

The market is categorized based on propulsion into ICE (Internal Combustion Engine) and electric segments. In the year 2023, the OEM (Original Equipment Manufacturer) segment secured the largest market share. The growth of the ICE segment can be credited to its enduring durability and proven performance over the years. In industries where long-haul and heavy-duty transportation is pivotal, many businesses opt for ICE trucks, valuing their reliability and established track record.

In 2023, North America emerged as the dominant force in the market. The influence of technological advancements and shifts in industry regulations played a substantial role in shaping the dynamics of the used semi-truck market in the region. The introduction of newer technologies, including more fuel-efficient engines and advanced safety features, has rendered older models less attractive, causing a decrease in their demand. Concurrently, alterations in emission standards and regulatory frameworks may drive businesses to upgrade their fleets, leading to a heightened supply of used semi-trucks.

By Sales Channel

By Propulsion Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Used Semi Truck Market

5.1. COVID-19 Landscape: Used Semi Truck Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Used Semi Truck Market, By Sales Channel

8.1. Used Semi Truck Market, by Sales Channel, 2024-2033

8.1.1. Franchised Dealer

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Independent Dealer

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Peer-to-Peer

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Used Semi Truck Market, By Propulsion Type

9.1. Used Semi Truck Market, by Propulsion Type, 2024-2033

9.1.1. ICE

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Electric

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Used Semi Truck Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.1.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Sales Channel (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

Chapter 11. Company Profiles

11.1. AB Volvo

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Arrow Truck Sales, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. INTERNATIONAL USED TRUCK CENTERS

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. IronPlanet, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. IVECO S.p.A

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. MAN

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. PACCAR Financial Used Truck Center

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Ryder System, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Sandhills Global (Truckpaper)

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Scania

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others