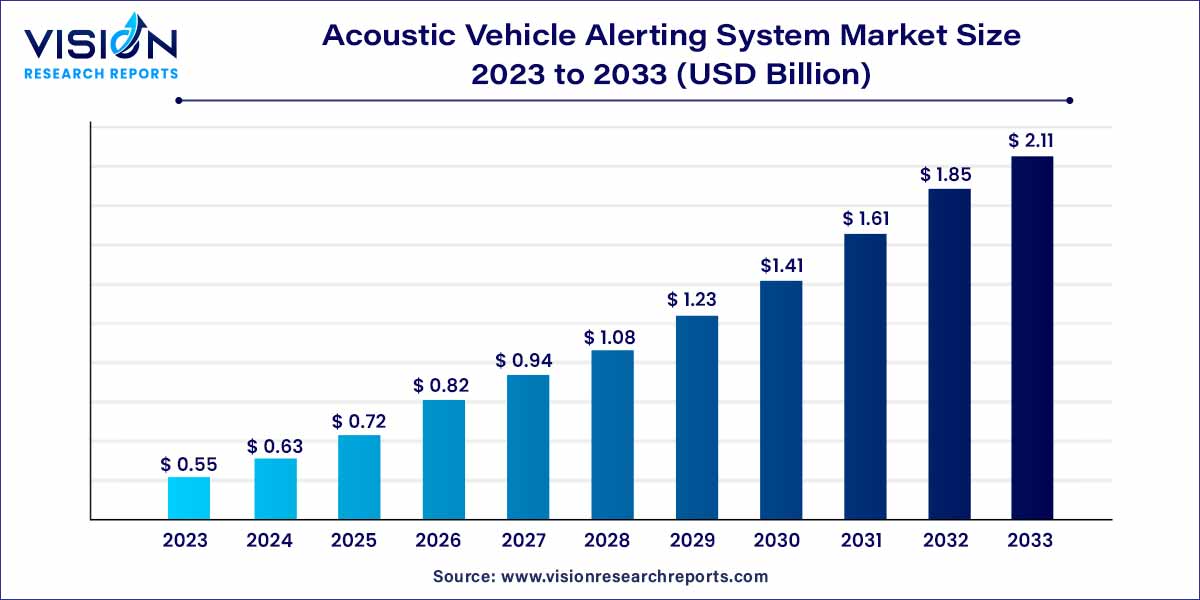

The global acoustic vehicle alerting system market size was estimated at around USD 0.55 billion in 2023 and it is projected to hit around USD 2.11 billion by 2033, growing at a CAGR of 14.42% from 2024 to 2033.

The acoustic vehicle alerting system (AVAS) market has witnessed significant growth in recent years, driven by the increasing emphasis on pedestrian safety and the rising adoption of electric vehicles (EVs). This overview delves into the key factors influencing the AVAS market, including market dynamics, technological advancements, and regulatory landscape.

The growth of the acoustic vehicle alerting system (AVAS) market is propelled by several key factors. Firstly, an escalating emphasis on pedestrian safety, particularly in urban environments, has driven the demand for AVAS solutions. As governments worldwide intensify efforts to reduce road accidents, the integration of AVAS in vehicles becomes a crucial component of safety measures. Additionally, the surge in adoption of electric vehicles (EVs) has significantly contributed to the market's expansion. Electric vehicles, known for their silent operation at low speeds, necessitate the implementation of AVAS to mitigate potential hazards for pedestrians. Moreover, technological advancements in AVAS, including customizable alert sounds and intelligent algorithms adapting to diverse driving scenarios, further fuel market growth. The dynamic regulatory landscape mandating the inclusion of AVAS in electric vehicles adds to the market's momentum. As safety regulations evolve and electric vehicle adoption continues, the AVAS market is poised for sustained growth in the foreseeable future.

| Report Coverage | Details |

| Growth rate from 2024 to 2033 | CAGR of 14.42% |

| Market Size in 2023 | USD 0.55 billion |

| Revenue Forecast by 2033 | USD 2.11 billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on the vehicle type, the acoustic vehicle alerting system market is segmented into two-wheelers, passenger, and commercial. The passenger vehicles segment led the market in 2023. The market is driven by initiatives taken by governments of various countries to promote the manufacturing and adoption of electric passenger vehicles. Additionally, increasing awareness of the environmental hazards of combustion engine vehicle emissions is promoting customers to adopt electric passenger vehicles.

On the basis of propulsion, the market is segmented into Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), and Hybrid Electric Vehicle (HEV). The HEV segment dominated the market in 2023. The continued urbanization and growing infrastructure spending in developing economies, such as China, India, and Turkey, are expected to drive the growth of the electric commercial vehicle market. Furthermore, the growth of the e-commerce sector, which has completely transformed logistics, is contributing to the high demand for electric commercial vehicles.

On the basis of a sales channel, the market is segmented into OEM and aftermarket. An OEM segment held the largest market share in 2023. The government mandates for the implementation of AVAS for safety concerns are propelling demand in the market. For instance, as per the EU regulation 540/2014, all new vehicles sold or imported from July 2021 in Europe must be equipped with an Acoustic Vehicle Alerting System.

Asia Pacific dominated the market in 2023. The automotive sector, which includes the manufacture of motor vehicles and aftermarket parts, has a high production level and contributes significantly to the region's sales of two-wheelers, passenger cars, and commercial vehicles. The sector has a promising future since original equipment manufacturers are becoming more involved in aftermarket activities, and component wholesalers are merging.

By Vehicle Type

By Propulsion

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Vehicle Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Acoustic Vehicle Alerting System Market

5.1. COVID-19 Landscape: Acoustic Vehicle Alerting System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Acoustic Vehicle Alerting System Market, By Vehicle Type

8.1. Acoustic Vehicle Alerting System Market, by Vehicle Type, 2024-2033

8.1.1 Two-Wheelers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Passenger

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Commercial

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Acoustic Vehicle Alerting System Market, By Propulsion

9.1. Acoustic Vehicle Alerting System Market, by Propulsion, 2024-2033

9.1.1. Battery Electric Vehicles (BEV)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Plug-In Hybrid Electric Vehicles (PHEV)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Hybrid Electric Vehicle (HEV)

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Acoustic Vehicle Alerting System Market, By Sales Channel

10.1. Acoustic Vehicle Alerting System Market, by Sales Channel, 2024-2033

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Acoustic Vehicle Alerting System Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Propulsion (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Hella Gmbh & Co. KGaA.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Brigade Electronics.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Mercedes-Benz AG.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Continental Engineering Services GmbH.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Harman International.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Soundracer AB

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Kendrion NV.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Kufatec GmbH & Co. Kg

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Texas Instruments.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Honda Motor Company

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others