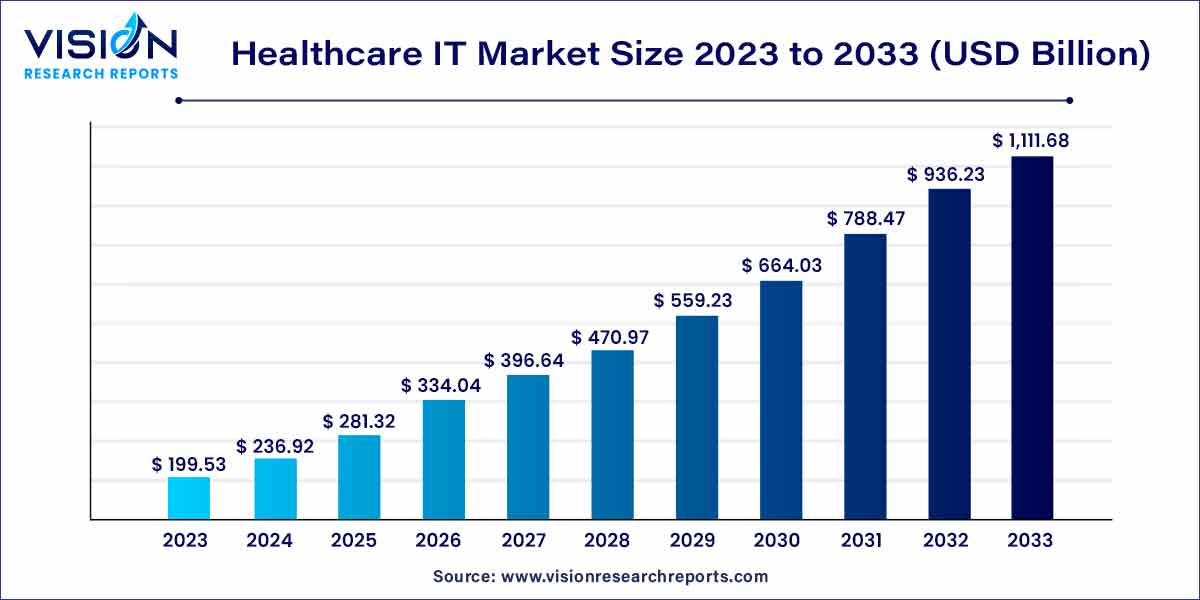

The global healthcare IT market size was estimated at around USD 199.53 billion in 2023 and it is projected to hit around USD 1111.68 billion by 2033, growing at a CAGR of 18.74% from 2024 to 2033.

The healthcare information technology (IT) market has witnessed significant growth in recent years, driven by the increasing integration of technology in the healthcare sector. As healthcare organizations strive to enhance patient care, optimize operational efficiency, and comply with regulatory requirements, the adoption of IT solutions has become crucial. This overview explores key facets of the healthcare IT market, shedding light on its current landscape and future prospects.

The growth of the Healthcare IT market is fueled by several key factors. Firstly, the increasing emphasis on digitization and the adoption of electronic health records (EHR) contribute significantly to the market expansion. As healthcare providers seek to enhance patient care, streamline workflows, and improve data accessibility, the demand for advanced IT solutions rises. Additionally, the growing prevalence of telehealth services, spurred by the need for remote patient monitoring and virtual consultations, propels market growth. The integration of cutting-edge technologies such as artificial intelligence and machine learning further augments the capabilities of healthcare IT systems, facilitating data-driven decision-making and personalized patient care. Moreover, regulatory initiatives promoting interoperability and data exchange among healthcare systems contribute to the sustained growth of the Healthcare IT market. Overall, the convergence of technological innovation, increased demand for efficient healthcare delivery, and supportive regulatory frameworks collectively drive the expansion of the healthcare IT market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 18.74% |

| Market Revenue by 2033 | USD 1111.68 billion |

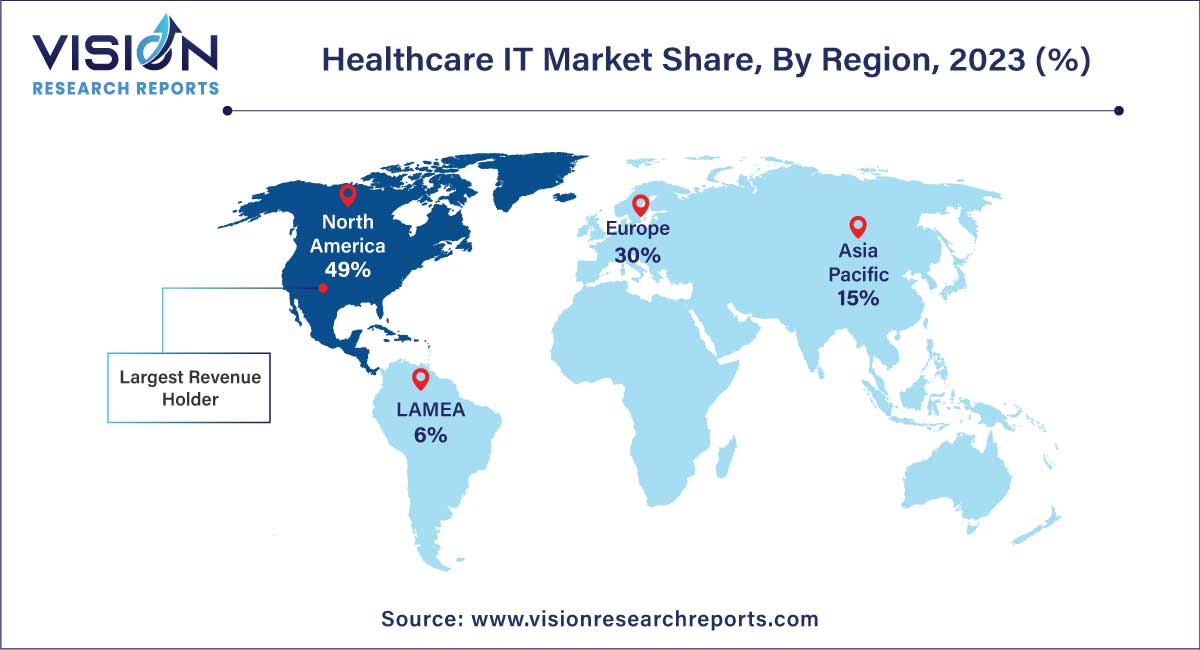

| Revenue Share of North America in 2023 | 49% |

| CAGR of Asia Pacific from 2024 to 2033 | 22.84% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The tele-healthcare segment dominated the market with a revenue share of 59% in 2023. This growth can be attributed to increasing demand for streamlined electronic healthcare systems, advancements in healthcare IT, and the need for technology-integrated tools. The segment is further divided into tele-care and telehealth. The increasing health consciousness, rising demand for cost-effective care, and growing geriatric population are other key factors contributing to this segment’s growth.

For instance, Independa, a TV-based platform specializing in remote engagement, care, and education, conducted a survey in November 2022 to examine smart TV users' behavior & attitude toward telehealth. Findings released in March 2023 revealed that over 90% of Americans had utilized telehealth services in the past year, with a satisfaction rate of 90%. These services included doctor's appointments, tele-dentistry, and vision appointments. The survey also highlighted the significance of increased smartphone penetration, as 71% of users accessed telehealth services using their smartphones. These findings indicate a growing awareness and positive reception of telehealth, which is expected to drive market growth, as telehealth adoption continues to rise during the forecast period.

The electronic prescribing system segment is anticipated to experience the fastest CAGR of 26.85% from 2024 to 2033. An increase in awareness of the advantages of e-prescribing is fueling the adoption of e-prescribing systems. In a study titled “Perception of physicians towards electronic prescription systems and associated factors at resource-limited settings" published in PLOS ONE in March 2021, survey participants expressed positive perceptions of electronic prescriptions, with 76.5% showing a favorable attitude. Approximately 70.8% of participants had over 5 years of computer usage experience. The study also revealed that nearly 90% of participants considered their electronic prescriptions to be legible.

The medical imaging information systems segment is sub-segmented into monitoring analysis software, radiology information systems, and picture archiving and communication systems (PACS). Factors such as an increasing need for streamlining healthcare operations, awareness of application of these systems in tracking billing information and orders of radiology imaging, and a growing prevalence of chronic diseases globally are significantly contributing to the overall growth of the medical imaging information systems segment.

North America held the largest revenue share of 49% in 2023. This growth is fueled by extensive adoption of healthcare IT solutions and services, especially in the U.S., as providers strive to enhance patient care while reducing costs. Adoption of healthcare IT solutions varies among providers due to various factors. A case in point is the high adoption of Electronic Health Records (EHR) in Oregon, where healthcare providers demonstrate varying adoption rates influenced by distinct digital divisions. The increase in adoption of electronic health records is increasing significantly in the U.S. As per Health IT reports, until 2021, nearly 9 out of 10 U.S.-based physicians had adopted EHR. Thus, high adoption rates also play a crucial role in boosting market growth.

Asia Pacific is anticipated to grow at the fastest CAGR of 22.84% from 2024 to 2033, attributed to the high demand for healthcare information technology services, owing to increased government spending on healthcare. Furthermore, the demand for healthcare IT systems has been increasing, as it enables efficient management of clinical, financial, and administrative aspects of hospitals.

Several government initiatives and supportive programs are also boosting the adoption of such technologies. For instance, in Australia, state as well as federal governments support healthcare IT. State-level programs, such as HealthSmart, and nationwide programs, such as HealthConnect, are examples of government programs undertaken to increase the integration of IT in healthcare. South Africa is also focusing on the development of fully integrated health record systems via its careconnect.sa program. Such initiatives and policies in various nations are supporting the regional market growth, and creating business opportunities for the new entrants.

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare IT Market

5.1. COVID-19 Landscape: Healthcare IT Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare IT Market, By Application

8.1. Healthcare IT Market, by Application Type, 2024-2033

8.1.1. Electronic Health Records

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Computerized Provider Order Entry Systems

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Electronic Prescribing Systems

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Laboratory Informatics

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Clinical Information Systems

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Medical Imaging Information Systems

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Tele-healthcare

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Healthcare IT Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. Philips Healthcare

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. McKesson Corporation

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. eMDs, Inc.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.)

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital)

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Carestream Health

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. GE HealthCare

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Agfa-Gevaert Group

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. Hewlett Packard Enterprise Development LP

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. eClinicalWorks

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others