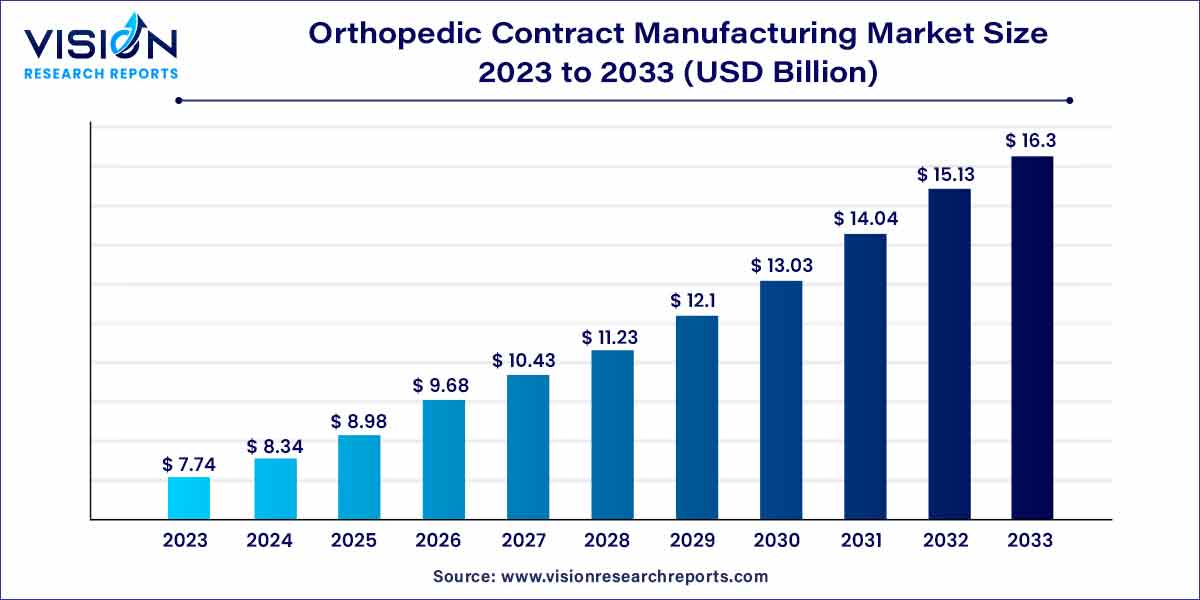

The global orthopedic contract manufacturing market size was estimated at around USD 7.74 billion in 2023 and it is projected to hit around USD 16.3 billion by 2033, growing at a CAGR of 7.73% from 2024 to 2033.

The orthopedic contract manufacturing market plays a pivotal role in the dynamic healthcare industry, providing essential services for the production of orthopedic devices and implants. This overview aims to shed light on the key aspects, trends, and factors shaping the landscape of this specialized market.

The growth of the orthopedic contract manufacturing market can be attributed to several key factors. Firstly, the increasing prevalence of musculoskeletal disorders, coupled with a rising aging population, has fueled the demand for orthopedic devices. As a result, manufacturers are turning to contract manufacturing services to efficiently meet this growing market demand. Technological advancements, particularly in 3D printing and robotic-assisted production, contribute significantly to the market's expansion by enhancing precision and customization in the manufacturing process. Moreover, the trend towards personalized orthopedic solutions is gaining traction, with manufacturers focusing on tailored implants to address individual patient needs. Compliance with stringent regulatory standards is another crucial growth factor, as adherence ensures the safety and efficacy of orthopedic devices. Overall, these factors collectively drive the upward trajectory of the orthopedic contract manufacturing market, presenting opportunities for innovation and market differentiation.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.73% |

| Market Revenue by 2033 | USD 16.3 billion |

| Revenue Share of North America in 2023 | 37% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The implants segment took the lead in the market, capturing the largest revenue share at 64% in 2023. This significant share is a result of the escalating demand for orthopedic implants, driven by a rise in orthopedic conditions and advancements in implant materials and designs. Various companies are responding to this heightened demand by concentrating on the development and commercialization of innovative orthopedic implants, resulting in a noticeable uptick in product launches. Additionally, the growing preference for patient-centric products and personalized implants is contributing to the growth of this segment. Notably, in February 2023, CurvaFix, Inc. introduced the 7.5mm CurvaFix IM Implant to streamline surgical procedures for individuals with smaller bone structures. Companies are harnessing cutting-edge technologies like enhanced biomaterials and 3D printing to manufacture implants that offer superior biocompatibility, durability, and customization.

On the other hand, the cases segment is expected to experience a steady CAGR during the analysis period. The increasing prevalence of bone health conditions, such as osteoarthritis, plays a pivotal role in driving the demand for high-quality orthopedic implants, devices, cases, and related solutions. According to the World Health Organization, the global number of people affected by osteoarthritis has surged by 113% since 1990, reaching more than 550 million. Many orthopedic Original Equipment Manufacturers (OEMs) are turning to contract manufacturers to leverage their advanced technologies, specialized expertise, and cost-effective solutions to efficiently meet this growing demand. Consequently, these factors are expected to bolster the growth of the cases segment in the foreseeable future.

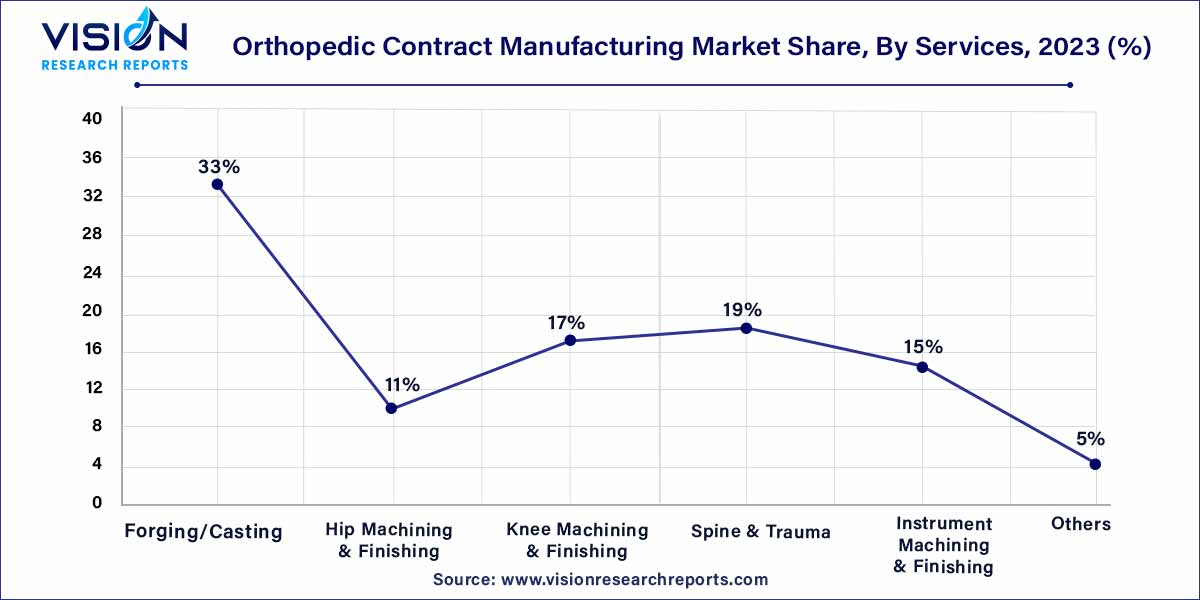

In 2023, the forging/casting segment dominated the market with the largest revenue share, accounting for 33%. A key factor contributing to the growth of this segment is the increasing presence of contract manufacturers in the orthopedic industry. The expanding focus of these manufacturers on diversifying their services has led to a heightened demand for orthopedic contract manufacturing, particularly in services such as forging and casting of orthopedic products. Furthermore, many contract manufacturers are investing in the development of advanced materials for innovative orthopedic products. For example, in June 2022, Tecomet, Inc., a prominent contract manufacturer in the orthopedic sector, announced a strategic investment of USD 4 million in its facility in Cork, Ireland, aimed at enhancing the facility's plastic and polyethylene machining capabilities. This move solidifies its position as a global center of excellence for polymeric materials used in orthopedic products.

On the other hand, the spine & trauma segment is expected to experience a lucrative CAGR during the forecast period. The substantial growth of this segment is primarily driven by the increasing global demand for spine and trauma products. Additionally, the rising incidence of sports injuries is another significant factor contributing to the demand for trauma devices. For instance, in September 2023, Orthofix Medical Inc., a leading global company specializing in trauma and spine solutions, announced the U.S. launch of the Galaxy Fixation Gemini system, designed for external fixation in trauma settings. The continuous introduction of spine and trauma devices concurrently fuels the demand for contract manufacturing services, thereby supporting the growth of this segment.

In 2023, North America dominated the market with the largest market share of 37%. The region stands as a key contributor to overall market growth, hosting numerous medical device companies that opt to outsource specific manufacturing functions to contract service providers. This practice significantly fuels market expansion. The high cost of manufacturing poses a notable challenge, prompting many medical device companies in North America to enlist the expertise of third-party vendors. The United States, within North America, clinched the largest market share. Notably, major medical device companies in the U.S. are increasingly outsourcing manufacturing services to Contract Manufacturing Organizations (CMOs). This shift is attributed to the utilization of advanced technologies and specialized capabilities, contributing significantly to market growth. These companies are also drawn towards medical device outsourcing due to the need for high-maintenance and efficient systems for managing raw materials, resulting in minimized overall setup costs. Furthermore, manufacturing service outsourcing enables companies to focus on core capabilities, share associated risks, and enhance service delivery, essential elements in gaining a competitive edge.

Looking ahead, the Asia Pacific region is poised to witness a notable CAGR over the forecast period. Factors such as pricing pressures, budget scrutiny in developed economies, and fluctuations in reimbursement schemes are anticipated to drive the adoption of cost-containment measures by Original Equipment Manufacturers (OEMs). This trend is expected to boost the outsourcing of orthopedic device manufacturing to emerging countries like India and China. Contract manufacturers in these regions offer benefits such as robust export infrastructure, artificially low currency values, cost-effective labor, and government incentives for local manufacturers, particularly in China. Consequently, these factors are expected to underpin the growth of the orthopedic contract manufacturing market in the Asia Pacific region.

By Type

By Services

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Orthopedic Contract Manufacturing Market

5.1. COVID-19 Landscape: Orthopedic Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Orthopedic Contract Manufacturing Market, By Type

8.1. Orthopedic Contract Manufacturing Market, by Type, 2024-2033

8.1.1. Implants

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Cases

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Trays

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Orthopedic Contract Manufacturing Market, By Services

9.1. Orthopedic Contract Manufacturing Market, by Services, 2024-2033

9.1.1. Forging/Casting

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hip Machining & Finishing

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Knee Machining & Finishing

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Spine & Trauma

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Instrument Machining & Finishing

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Orthopedic Contract Manufacturing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Services (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Services (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Services (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Services (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Services (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Services (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Services (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Services (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Services (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Services (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Services (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Services (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Services (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Services (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Services (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Services (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Services (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Services (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Services (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Services (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Services (2021-2033)

Chapter 11. Company Profiles

11.1. Tecomet, Inc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Orchid Orthopedic Solutions

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Cretex companies

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Viant

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. ARCH Medical Solutions Corp.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Avalign Technologies

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. LISI Medical

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Paragon Medical

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Norman Noble, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Autocam Medical

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others