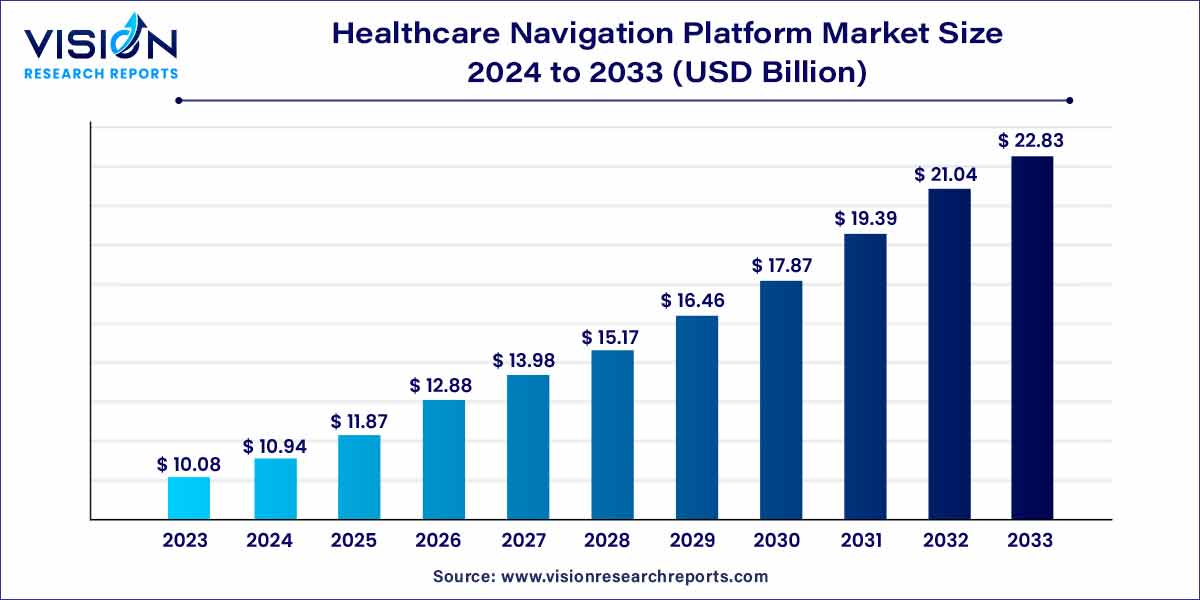

The global healthcare navigation platform market size was estimated at around USD 10.08 billion in 2023 and it is projected to hit around USD 22.83 billion by 2033, growing at a CAGR of 8.52% from 2024 to 2033. The healthcare navigation platform market is driven by the demand for enhanced healthcare accessibility, optimization of healthcare delivery and integration of telehealth solutions.

The healthcare navigation platform market is experiencing significant growth as the healthcare industry continues to embrace digital solutions for improving patient care and optimizing operational efficiency. These platforms play a crucial role in streamlining the healthcare journey, offering a comprehensive suite of tools to patients, providers, and payers. This overview delves into the key aspects of the healthcare navigation platform market, highlighting its current landscape and future prospects.

The growth of the healthcare navigation platform market is fueled by several key factors contributing to its expanding trajectory. Firstly, the increasing emphasis on patient-centric care and the demand for enhanced healthcare experiences propel the adoption of navigation platforms. These solutions streamline the healthcare journey, providing patients with tools for appointment scheduling, care coordination, and access to electronic health records. Additionally, the rising prevalence of chronic diseases necessitates more efficient healthcare delivery, further driving the need for comprehensive navigation platforms. Moreover, as the healthcare industry continues to grapple with escalating costs, organizations are turning to these platforms to optimize operational efficiency and improve overall accessibility. The integration of telehealth features and the facilitation of health information exchange also contribute to the attractiveness of these platforms. In essence, the growth of the healthcare navigation platform market is intricately linked to the industry's evolving priorities, technological advancements, and the ongoing pursuit of better patient outcomes.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.52% |

| Market Revenue by 2033 | USD 22.83 billion |

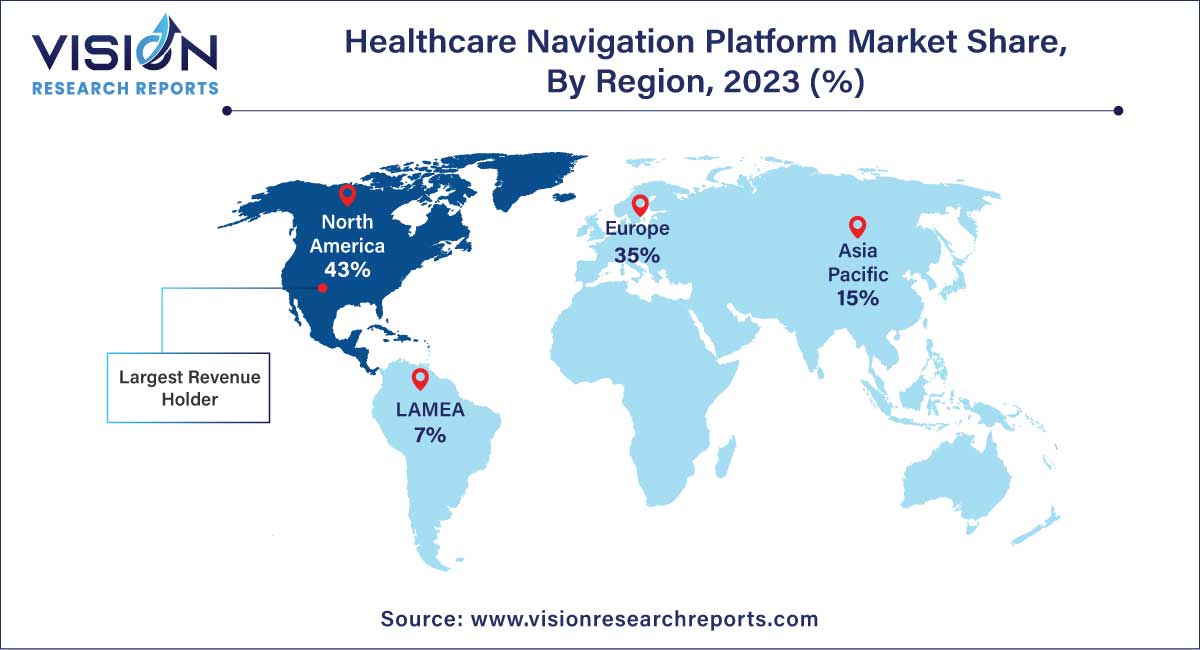

| Revenue Share of North America in 2023 | 43% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Rising Emphasis on Patient-Centric Care: The increasing focus on patient-centric care is a significant driver for the healthcare navigation platform market. These platforms offer tools and features that empower patients to actively participate in their healthcare journey, fostering a more personalized and engaging experience.

Demand for Enhanced Healthcare Accessibility: The growing need for improved accessibility to healthcare services is a driving force behind the adoption of navigation platforms. These solutions facilitate easier appointment scheduling, provide navigation assistance within healthcare facilities, and enhance overall access to medical resources.

Resistance to Technological Adoption: Resistance to adopting new technologies within the healthcare sector presents a notable restraint. Some healthcare providers and institutions may be hesitant to transition to navigation platforms due to concerns about disruption, the learning curve associated with new technologies, and the need for additional training.

Lack of Standardization: The absence of standardized practices and protocols in the healthcare industry hampers the effectiveness of navigation platforms. The lack of uniformity in data formats, communication standards, and interoperability frameworks can lead to compatibility issues, slowing down the integration of these platforms into existing healthcare ecosystems.

Expansion of Telehealth Services: The growing popularity of telehealth services presents a significant opportunity for Healthcare Navigation Platforms. Platforms that seamlessly integrate with telehealth technologies can enhance virtual care experiences, providing a comprehensive solution for remote patient monitoring, consultations, and follow-up care.

Customization for Specialized Care: Tailoring Healthcare Navigation Platforms to cater to specialized care needs, such as chronic disease management or specific medical specialties, represents a valuable opportunity. Customization can enhance the platforms' relevance and effectiveness in addressing the unique challenges of different healthcare domains.

The large enterprises segment held the largest revenue share in 2023. The dominance of this segment can be attributed to the considerable organizational size and resources that large enterprises possess. With ample resources and the capability for significant initial investments, these organizations implement comprehensive healthcare navigation platforms. This, in turn, equips their employees with tools and resources to navigate the intricate healthcare system effectively. Large enterprises, often prioritizing employee well-being, are willing to invest in technological solutions that not only improve access to care but also enhance employee satisfaction while effectively managing healthcare costs.

On the other hand, the SMEs segment is anticipated to experience the fastest CAGR throughout the forecast period. Healthcare navigation platforms present SMEs with a cost-effective solution, empowering their employees to navigate the healthcare system, access appropriate care, and manage their health efficiently. These platforms offer SMEs valuable tools and resources to optimize healthcare spending, elevate employee satisfaction levels, and ultimately boost overall productivity, thereby fueling the growth of this segment.

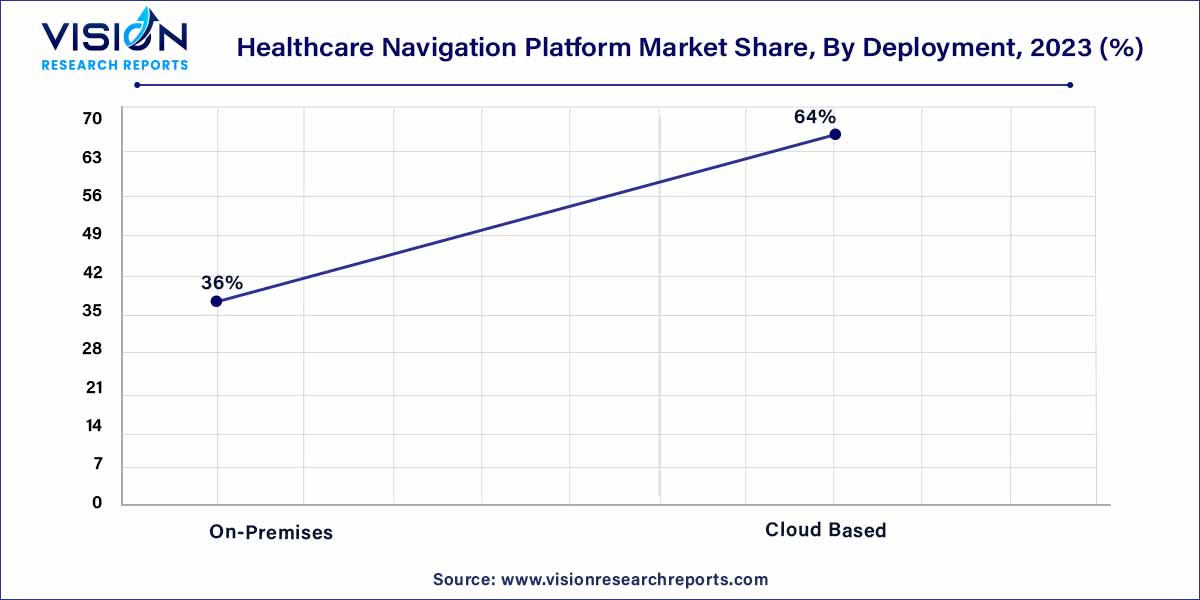

In 2023, the cloud-based segment contributed the largest market share of 64%, and is projected to exhibit the highest CAGR throughout the forecast period. The remarkable growth of this segment can be attributed to several advantages, including scalability, flexibility, cost-effectiveness, and ease of implementation. Healthcare navigation platforms hosted on the cloud offer seamless access to information and services from any location, facilitating convenient navigation of the healthcare system for both employees and users.

Furthermore, cloud-based platforms ensure secure storage and backup of sensitive healthcare data, thereby ensuring compliance with data protection regulations. Service providers are actively developing platforms that leverage data analytics and General Artificial Intelligence (Gen AI) to offer continuous user support around the clock. For example, in May 2022, Accolade introduced Medication Integrated Care, an innovative solution featuring advanced analytics powered by Rx Savings solutions. This offering aims to help employers address issues related to affordability, prescription medication complications, and care blockades. The pervasive adoption of cloud computing across various industries, particularly in healthcare, has significantly contributed to the dominant position of the cloud-based segment in the market.

In 2023, North America dominated the market with the largest market share of 43%. This leadership position is underpinned by several factors, including the widespread acceptance of digital health technologies such as telehealth and health apps. Additionally, the region boasts a notable concentration of large enterprises that are actively investing in solutions aimed at effectively managing employee benefits. A significant number of employers in North America, prioritizing employee well-being and committing to healthcare benefits, are instrumental in propelling the demand for healthcare navigation platforms.

Asia Pacific is poised for significant market growth. This anticipation is fueled by factors such as a growing population, an increase in healthcare expenditure, and the rising adoption of digital technologies contributing to the region's overall market expansion. The escalating demand for enhanced healthcare access, cost containment measures, and an improved patient experience are key drivers fostering the adoption of healthcare navigation platforms in the Asia Pacific. Moreover, the region benefits from the availability of cloud-based platforms and a pronounced focus on digital transformation within the healthcare sector, further accelerating the market's growth trajectory in Asia Pacific.

By Deployment

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Navigation Platform Market

5.1. COVID-19 Landscape: Healthcare Navigation Platform Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare Navigation Platform Market, By Deployment

8.1. Healthcare Navigation Platform Market, by Deployment, 2024-2033

8.1.1. On-Premises

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cloud Based

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Healthcare Navigation Platform Market, By End-use

9.1. Healthcare Navigation Platform Market, by End-use, 2024-2033

9.1.1. Large Enterprises

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Small and Medium Enterprises (SMEs)

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Healthcare Navigation Platform Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Quantum CorpHealth Pvt Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Accolade

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Transcarent

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Included Health, LLC

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Sharecare, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Apree Health

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Health Advocate

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Health Joy, LLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Wellframe

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others