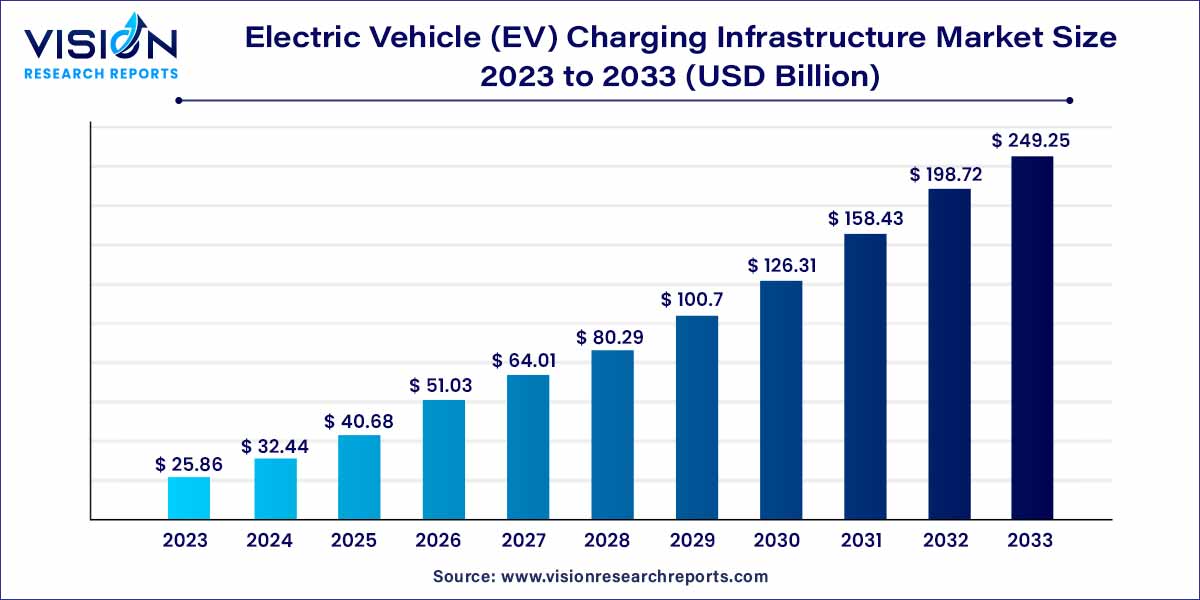

The global electric vehicle (EV) charging infrastructure market size was estimated at around USD 25.86 billion in 2023 and it is projected to hit around USD 249.25 billion by 2033, growing at a CAGR of 25.43% from 2024 to 2033.

The electric vehicle (EV) charging infrastructure market is experiencing rapid growth, driven by the increasing adoption of electric vehicles worldwide. As the automotive industry undergoes a transformative shift towards sustainable practices, the need for a robust and widespread charging infrastructure has become paramount. This overview delves into the key aspects of the EV charging infrastructure market, exploring market trends, drivers, challenges, and future prospects.

The growth of the electric vehicle (EV) charging infrastructure market is propelled by several key factors. Firstly, the global shift towards sustainable transportation solutions, driven by environmental concerns, is fostering increased adoption of electric vehicles (EVs). Governments worldwide are implementing stringent emission norms and offering incentives to promote EV usage, creating a conducive environment for market expansion. Additionally, advancements in charging technologies, such as fast-charging and wireless solutions, are enhancing the appeal of electric vehicles, contributing to heightened demand for charging infrastructure. Moreover, strategic collaborations between automotive manufacturers, energy companies, and technology providers are creating comprehensive charging networks, addressing concerns related to interoperability and standardization.

Government Incentives:

Environmental Awareness:

Infrastructure Gap:

Upfront Cost Concerns:

Expansion into Underserved Regions:

Government Support and Incentives:

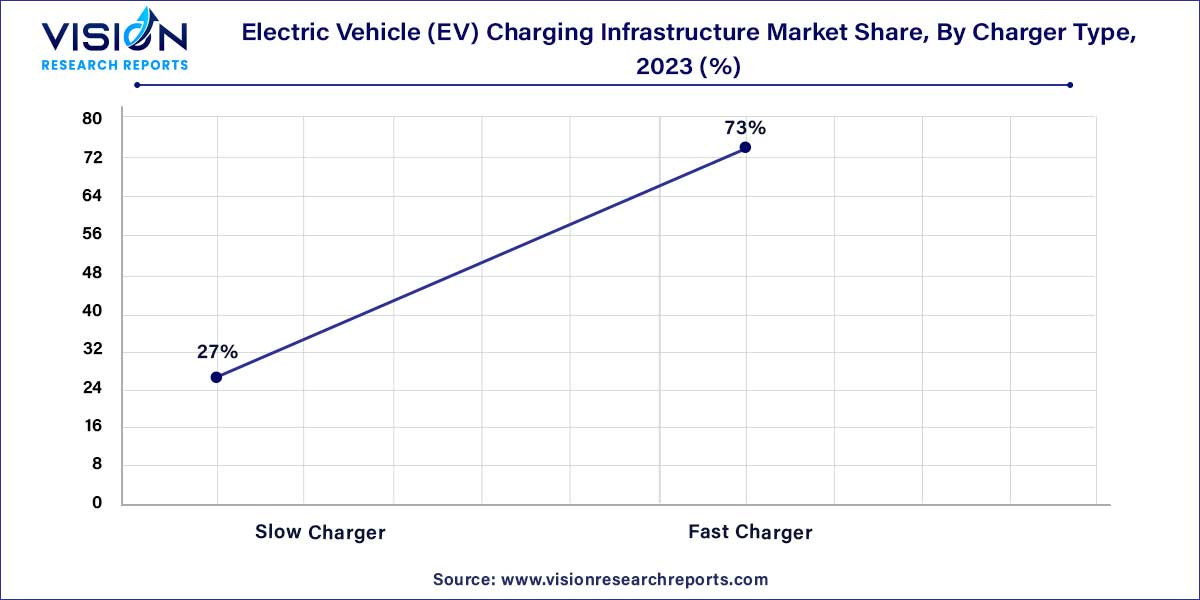

The fast charger segment took the lead in the market, contributing to 73% of the global revenue in 2023. This particular segment is projected to experience the highest Compound Annual Growth Rate (CAGR) during the forecast period. The growth is primarily driven by the concerted efforts of various governments to expedite the establishment of public fast-charging infrastructure. Many organizations have deployed Level 3 DC fast chargers or Level 2 AC charging stations, capable of fully charging an electric vehicle within a timeframe ranging from 30 minutes to 4 hours.

There is an anticipated growth in demand for slow chargers at a noteworthy CAGR over the forecast period. Slow chargers are predominantly embraced for residential applications, specifically for overnight charging. Furthermore, major electric vehicle manufacturers like BMW, General Motors, and Volkswagen Group include slow chargers with the purchase of their electric vehicles, contributing to the expansion of this segment. As an example, General Motors provides a slow charger as part of the package when customers purchase its electric car model.

In 2023, the "others" segment emerged as the leader in market revenue, claiming the largest share. This segment encompasses connectors such as GB/T, Mennekes, J1772, and others. The predominant position of this segment is chiefly attributed to the widespread adoption of GB/T connectors in China. The GB/T connector serves as the official EV plug standard in China, utilized by all EV chargers. The robust sales of electric vehicles, coupled with the extensive presence of EV charging infrastructure in China, is expected to propel the growth of this segment.

Simultaneously, the CCS connector is projected to record the highest Compound Annual Growth Rate (CAGR) during the forecast period. This surge is driven by the growing preference among major automobile manufacturers for incorporating CCS connectors in their electric vehicles.

In 2023, the non-connected charging stations segment claimed the largest share of market revenue. Also known as non-networked or standalone charging solutions, these non-connected options provide users with secure and convenient charging without the complexities and recurring fees associated with charging networks. Resembling the traditional fuel pump experience, non-connected charging solutions allow consumers to pay for charging facilities per use. Some non-connected solutions incorporate software platforms to monitor charger health and gather detailed diagnostic data. Furthermore, these chargers boast lower installation and ongoing costs, as they do not incur recurring networking and activation fees.

Conversely, the connected charging stations segment is projected to register the fastest CAGR in the forecast period. Connected charging solutions, also known as network chargers, are managed through network software systems. These solutions offer electric vehicles capabilities that benefit both drivers and hosts. Site hosts can access network facilities like advanced analytics, energy management, remote management features, and 24/7 customer support, while drivers can use applications to locate and reserve charging stations, among other use cases.

In 2023, the commercial application segment held the largest revenue share. This segment is intricately divided into fleet charging stations, destination charging stations, bus charging stations, highway charging stations, and other charging stations. The prominence of this segment is attributed to the proactive initiatives and funding allocations by both governments and automobile manufacturers aimed at expanding public Electric Vehicle Charging Infrastructure (EVCI).

Moreover, the growth of this segment is propelled by collaborations between public transport agencies and automotive manufacturers for the installation of charging stations specifically designed for electric buses. As an illustrative example, in September 2022, bp pulse partnered with The Hertz Corporation, a leading American car rental company, to deploy a network of EV charging solutions powered by bp pulse across North America.

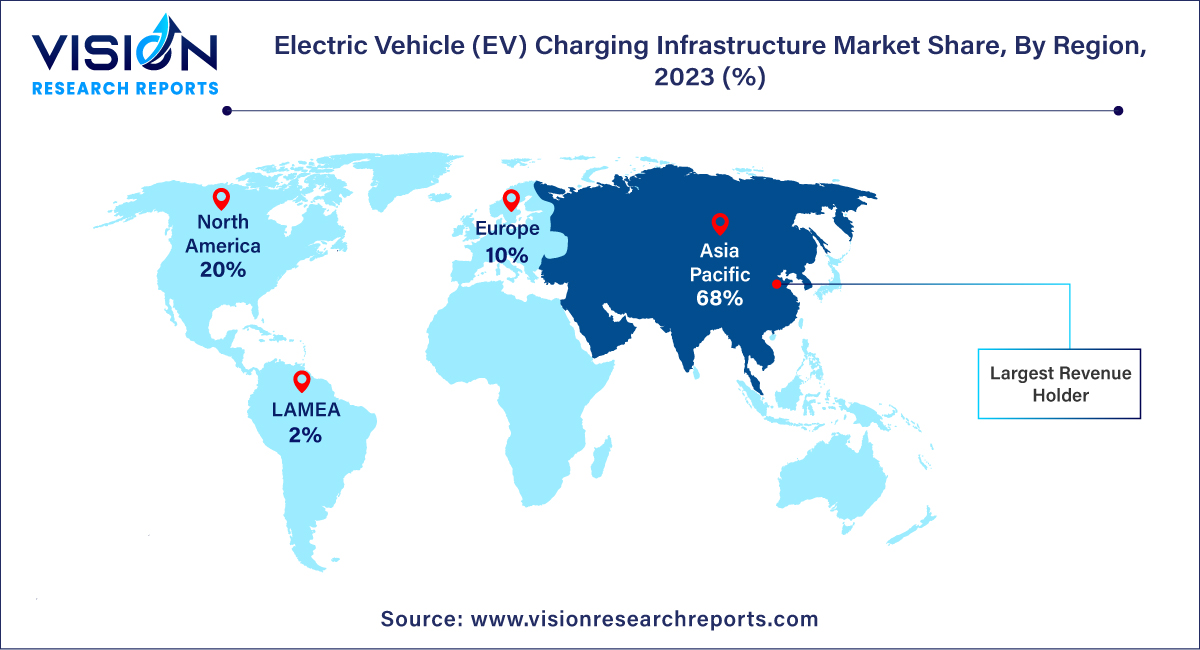

In 2023, Asia Pacific dominated the market with the largest market share of 68%. Key countries in the region, notably China, Japan, and South Korea, renowned as hubs for electric vehicles, are making significant investments in the advancement of charging infrastructure. Notably, in January 2022, the Chinese Government announced its commitment to substantial investments in EV infrastructure, with the aim of supporting 20 million EVs on the road by 2025.

Europe is poised to experience noteworthy growth in the electric vehicle (EV) charging infrastructure market. Several European nations have set ambitious targets for reducing carbon emissions and increasing electric car adoption by 2020. A case in point is the U.K., which, in July 2018, enacted the Automated and Electric Vehicles (AEV) Act, granting the government new powers to facilitate the rapid development of EV Charging Infrastructure on motorways and fuel stations. Similarly, other European countries such as France, Germany, Belgium, and the U.K. are directing their efforts towards the development of electric vehicle charging and support infrastructure, aiming to establish interoperability across different EVs throughout the region. These initiatives contribute significantly to the growth of the Europe EV Charging Infrastructure market.

By Charger Type

By Charging Type

By Installation Type

By Level of Charging

By Connectivity

By Operation

By Deployment

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Electric vehicle (EV) charging infrastructure Market, By Charger Type

7.1. Electric vehicle (EV) charging infrastructure Market, by Charger Type, 2024-2033

7.1.1. Slow Charger

7.1.1.1. Market Revenue and Forecast (2021-2033)

7.1.2. Fast Charger

7.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 8. Global Electric vehicle (EV) charging infrastructure Market, By Charging Type

8.1. Electric vehicle (EV) charging infrastructure Market, by Charging Type, 2024-2033

8.1.1. AC

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. DC

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Electric vehicle (EV) charging infrastructure Market, By Installation Type

9.1. Electric vehicle (EV) charging infrastructure Market, by Installation Type, 2024-2033

9.1.1. Fixed

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Portable

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Connector

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. CHAdeMO

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. CCS

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Electric vehicle (EV) charging infrastructure Market, By Level of Charging

10.1. Electric vehicle (EV) charging infrastructure Market, by Level of Charging, 2024-2033

10.1.1. Level 1

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Level 2

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Level 3

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Electric vehicle (EV) charging infrastructure Market, By Connectivity

11.1. Electric vehicle (EV) charging infrastructure Market, by Connectivity, 2024-2033

11.1.1. Non-connected Charging Stations

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Connected Charging Stations

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Electric vehicle (EV) charging infrastructure Market, By Operation

12.1. Electric vehicle (EV) charging infrastructure Market, by Operation, 2024-2033

12.1.1. Mode 1

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Mode 2

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Mode 3

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Mode 4

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Electric vehicle (EV) charging infrastructure Market, By Deployment

13.1. Electric vehicle (EV) charging infrastructure Market, by Deployment, 2024-2033

13.1.1. Private

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Semi-Public

13.1.2.1. Market Revenue and Forecast (2021-2033)

13.1.3. Public

13.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 14. Global Electric vehicle (EV) charging infrastructure Market, By Application

14.1. Electric vehicle (EV) charging infrastructure Market, by Application, 2024-2033

14.1.1. Commercial

14.1.1.1. Market Revenue and Forecast (2021-2033)

14.1.2. Residential

14.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 15. Global Electric vehicle (EV) charging infrastructure Market, Regional Estimates and Trend Forecast

15.1. North America

15.1.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.1.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.1.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.1.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.1.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.1.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.1.7. Market Revenue and Forecast, by Operation (2021-2033)

15.1.8. Market Revenue and Forecast, by Application (2021-2033)

15.1.8. U.S.

15.1.8.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.1.8.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.1.8.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.1.8.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.1.8.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.1.8.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.1.8.7. Market Revenue and Forecast, by Operation (2021-2033)

15.1.8.8. Market Revenue and Forecast, by Application (2021-2033)

15.1.9. Rest of North America

15.1.9.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.1.9.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.1.9.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.1.9.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.1.9.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.1.9.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.1.9.7. Market Revenue and Forecast, by Operation (2021-2033)

15.1.9.8 Market Revenue and Forecast, by Application (2021-2033)

15.2. Europe

15.2.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.2.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.2.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.2.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.2.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.2.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.2.7. Market Revenue and Forecast, by Operation (2021-2033)

15.2.8. Market Revenue and Forecast, by Application (2021-2033)

15.2.8. UK

15.2.8.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.2.8.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.2.8.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.2.8.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.2.8.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.2.8.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.2.8.7. Market Revenue and Forecast, by Operation (2021-2033)

15.2.8.8. Market Revenue and Forecast, by Application (2021-2033)

15.2.9. Germany

15.2.9.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.2.9.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.2.9.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.2.9.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.2.9.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.2.9.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.2.9.7. Market Revenue and Forecast, by Operation (2021-2033)

15.2.9.8. Market Revenue and Forecast, by Application (2021-2033)

15.2.10. France

15.2.10.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.2.10.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.2.10.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.2.10.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.2.10.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.2.10.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.2.10.7. Market Revenue and Forecast, by Operation (2021-2033)

15.2.10.8. Market Revenue and Forecast, by Application (2021-2033)

15.2.11. Rest of Europe

15.2.11.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.2.11.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.2.11.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.2.11.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.2.11.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.2.11.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.2.11.7. Market Revenue and Forecast, by Operation (2021-2033)

15.2.11.8. Market Revenue and Forecast, by Application (2021-2033)

15.3. APAC

15.3.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.3.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.3.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.3.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.3.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.3.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.3.7. Market Revenue and Forecast, by Operation (2021-2033)

15.3.8. Market Revenue and Forecast, by Application (2021-2033)

15.3.8. India

15.3.8.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.3.8.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.3.8.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.3.8.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.3.8.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.3.8.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.3.8.7. Market Revenue and Forecast, by Operation (2021-2033)

15.3.8.8. Market Revenue and Forecast, by Application (2021-2033)

15.3.9. China

15.3.9.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.3.9.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.3.9.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.3.9.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.3.9.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.3.9.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.3.9.7. Market Revenue and Forecast, by Operation (2021-2033)

15.3.9.8. Market Revenue and Forecast, by Application (2021-2033)

15.3.10. Japan

15.3.10.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.3.10.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.3.10.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.3.10.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.3.10.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.3.10.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.3.10.7. Market Revenue and Forecast, by Operation (2021-2033)

15.3.10.8. Market Revenue and Forecast, by Application (2021-2033)

15.3.11. Rest of APAC

15.3.11.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.3.11.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.3.11.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.3.11.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.3.11.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.3.11.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.3.11.7. Market Revenue and Forecast, by Operation (2021-2033)

15.3.11.8. Market Revenue and Forecast, by Application (2021-2033)

15.4. MEA

15.4.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.4.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.4.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.4.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.4.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.4.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.4.7. Market Revenue and Forecast, by Operation (2021-2033)

15.4.8. Market Revenue and Forecast, by Application (2021-2033)

15.4.9. GCC

15.4.9.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.4.9.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.4.9.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.4.9.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.4.9.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.4.9.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.4.9.7. Market Revenue and Forecast, by Operation (2021-2033)

15.4.9. 8. Market Revenue and Forecast, by Application (2021-2033)

15.4.9. North Africa

15.4.10.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.4.10.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.4.10.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.4.10.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.4.10.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.4.10.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.4.10.7. Market Revenue and Forecast, by Operation (2021-2033)

15.4.10. 8. Market Revenue and Forecast, by Application (2021-2033)

15.4.11. South Africa

15.4.11.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.4.11.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.4.11.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.4.11.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.4.11.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.4.11.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.4.11.7. Market Revenue and Forecast, by Operation (2021-2033)

15.4.11.8. Market Revenue and Forecast, by Application (2021-2033)

15.4.12. Rest of MEA

15.4.12.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.4.12.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.4.12.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.4.12.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.4.12.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.4.12.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.4.12.7. Market Revenue and Forecast, by Operation (2021-2033)

15.4.12.8. Market Revenue and Forecast, by Application (2021-2033)

15.5. Latin America

15.5.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.5.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.5.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.5.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.5.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.5.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.5.7. Market Revenue and Forecast, by Operation (2021-2033)

15.5.8. Market Revenue and Forecast, by Application (2021-2033)

15.5.8. Brazil

15.5.8.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.5.8.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.5.8.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.5.8.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.5.8.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.5.8.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.5.8.7. Market Revenue and Forecast, by Operation (2021-2033)

15.5.8.8. Market Revenue and Forecast, by Application (2021-2033)

15.5.9. Rest of LATAM

15.5.9.1. Market Revenue and Forecast, by Charger Type (2021-2033)

15.5.9.2. Market Revenue and Forecast, by Charging Type (2021-2033)

15.5.9.3. Market Revenue and Forecast, by Installation Type (2021-2033)

15.5.9.4. Market Revenue and Forecast, by Level of Charging (2021-2033)

15.5.9.5. Market Revenue and Forecast, by Connectivity (2021-2033)

15.5.9.6. Market Revenue and Forecast, by Deployment (2021-2033)

15.5.9.7. Market Revenue and Forecast, by Operation (2021-2033)

15.5.9.8. Market Revenue and Forecast, by Application (2021-2033)

Chapter 16. Company Profiles

16.1. ABB Ltd.

16.1.1. Company Overview

16.1.2. Product Offerings

16.1.3. Financial Performance

16.1.4. Recent Initiatives

16.2. ChargePoint, Inc.

16.2.1. Company Overview

16.2.2. Product Offerings

16.2.3. Financial Performance

16.2.4. Recent Initiatives

16.3. Leviton Manufacturing Co., Inc.

16.3.1. Company Overview

16.3.2. Product Offerings

16.3.3. Financial Performance

16.3.4. Recent Initiatives

16.4. Blink Charging Co.

16.4.1. Company Overview

16.4.2. Product Offerings

16.4.3. Financial Performance

16.4.4. Recent Initiatives

16.5. Tesla Inc.

16.5.1. Company Overview

16.5.2. Product Offerings

16.5.3. Financial Performance

16.5.4. Recent Initiatives

16.6. Webasto Group

16.6.1. Company Overview

16.6.2. Product Offerings

16.6.3. Financial Performance

16.6.4. Recent Initiatives

16.7. bp pulse

16.7.1. Company Overview

16.7.2. Product Offerings

16.7.3. Financial Performance

16.7.4. Recent Initiatives

Chapter 17. Research Methodology

17.1. Primary Research

17.2. Secondary Research

17.3. Assumptions

Chapter 18. Appendix

18.1. About Us

18.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others