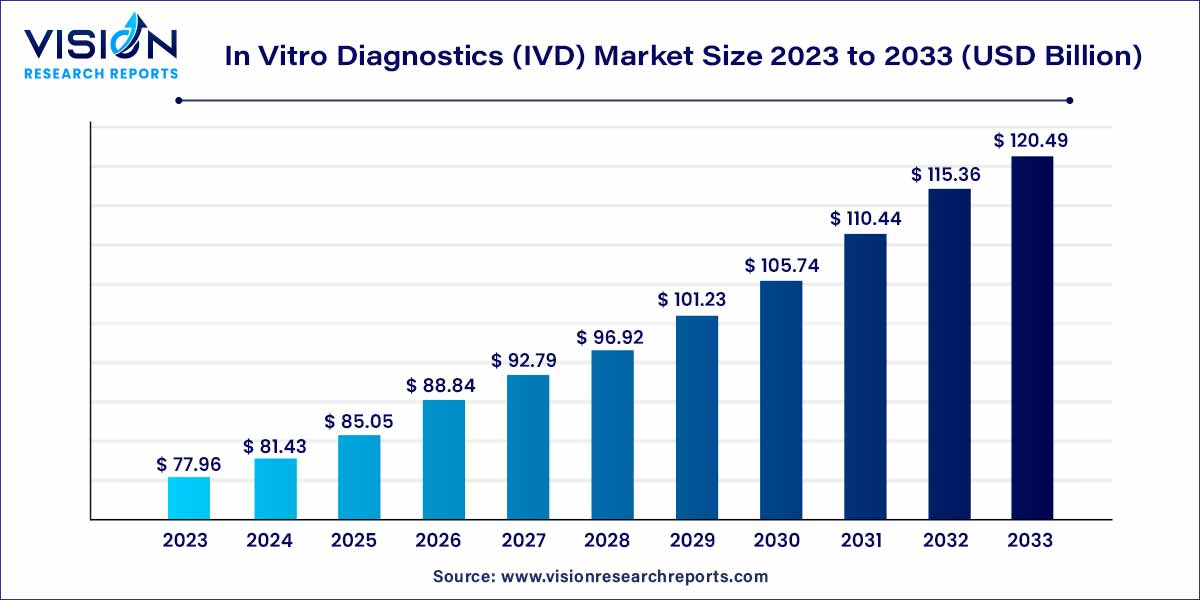

The global in vitro diagnostics (IVD) market size was estimated at around USD 77.96 billion in 2023 and it is projected to hit around USD 120.49 billion by 2033, growing at a CAGR of 4.45% from 2024 to 2033. The in vitro diagnostics (IVD) market is driven by the rising incidence of chronic diseases, rise of personalized medicine, point-of-care testing (POCT) growth, and global expansion and market opportunities.

The in vitro diagnostics (IVD) market plays a pivotal role in the healthcare sector, providing essential diagnostic information for disease detection, monitoring, and treatment decision-making. As a rapidly evolving segment of the healthcare industry, IVD encompasses a diverse range of tests and diagnostic tools conducted outside the human body.

The growth of the in vitro diagnostics (IVD) market is propelled by various factors that collectively contribute to its expanding significance in the healthcare sector. One primary driver is the increasing prevalence of chronic diseases globally, necessitating efficient diagnostic tools for early detection and monitoring. Additionally, the aging population contributes to the growing demand for diagnostic tests, as elderly individuals often require regular health assessments. Technological advancements, such as the integration of molecular diagnostics and next-generation sequencing, further enhance the precision and scope of diagnostic capabilities, fostering market growth. The rise of personalized medicine, tailoring treatments based on genetic profiles, has spurred demand for IVD tests that provide more nuanced insights into individual health conditions.

The reagents segment secured the majority share, accounting for 66% of the total revenue in 2023. It is expected to maintain its dominance, experiencing the fastest CAGR from 2024 to 2033. This sustained growth can be attributed to the extensive research and development initiatives undertaken by major industry players, aiming to create innovative reagents and test kits. An illustrative example is BD's achievement in February 2023, gaining market approval for the BD Onclarity HPV Assay to be used in conjunction with the ThinPrep Pap Test in the U.S. The heightened focus on Research and Development (R&D) endeavors, specifically geared towards faster cancer detection and precision medicine, is enabling companies to carve out profitable niches within the in vitro diagnostics (IVD) sector.

The rise of precision medicine is anticipated to fuel the demand for these innovative reagents and consumables. Meanwhile, the instruments segment secured the second-largest share in 2023. Anticipated growth in this segment is driven by increasing approvals for novel IVD instruments. For example, in April 2023, bioMérieux SA submitted a 510(k) application to the U.S. Food and Drug Administration (FDA) for VITEK REVEAL, a rapid Antimicrobial Susceptibility Testing (AST) system. Companies are aligning their instrument launches with the global surge in demand for genetic testing.

In 2023, the immunoassay segment emerged as the leader in revenue generation. The heightened occurrence of chronic and communicable diseases, coupled with a growing emphasis on early diagnosis, contributed to an escalated demand for immunological methods. This includes various forms of Enzyme-Linked Immunosorbent Assays (ELISAs). Notably, major industry players are directing their efforts towards Research and Development (R&D) initiatives focused on the creation of new immunological diagnostic instruments and tests for in vitro diagnostics (IVD) applications. As an illustration, in October 2023, Sysmex Corporation and Fujirebio Holdings, Inc. joined forces to bolster their R&D, production, clinical development, and marketing activities in the field of immunoassay.

Concurrently, the coagulation segment is projected to exhibit the most rapid CAGR from 2024 to 2033. This growth is attributed to the increasing prevalence of cardiovascular diseases, blood-related disorders, and autoimmune diseases. Advancements in instruments, including the introduction of updated handheld coagulation analyzers like the Xprecia Stride Coagulation Analyzer, are anticipated to augment the overall workflow of detection. Key players in the provision of instruments and coagulation tests include Abbott, Siemens Healthcare GmbH, and Beckman Coulter, Inc.

The hospitals segment dominated the revenue share in 2023, primarily driven by an increase in hospitalizations requiring swift diagnostic support. The continual development of healthcare infrastructure, coupled with favorable initiatives from government bodies, is expected to augment existing hospital facilities, leading to a surge in demand for hospital-based in vitro diagnostics (IVD) tests. Given that a substantial volume of IVD devices is procured by hospitals and utilized in significant quantities, the demand is particularly noteworthy.

In December 2023, the American Hospital Association communicated to the FDA, urging against the application of device regulations on hospital's Laboratory Developed Tests (LDTs). On the other hand, the homecare segment is poised for a high CAGR from 2024 to 2033, fueled by the growing geriatric population and an increased demand for in vitro diagnostics (IVD) devices in home care settings. This is accompanied by a rising need for innovative molecular diagnostic and immunoassay platforms, facilitating patients in conducting self-tests.

In 2023, the infectious diseases segment emerged as the dominant force in the market, with a significant boost attributed to the outbreak of the COVID-19 pandemic in recent years. This surge in segment share was further propelled by key players introducing novel testing products aimed at enhancing access to high-quality and innovative laboratory services for both patients and healthcare providers. An illustrative example is BD's achievement in February 2023, obtaining Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA) for a new molecular diagnostic combination test designed to detect SARS-CoV-2, Influenza A+B, and Respiratory Syncytial Virus (RSV). Initiatives of this nature by key industry players are poised to play a pivotal role in driving market growth.

Conversely, the oncology segment is anticipated to exhibit the fastest CAGR from 2024 to 2033. The increasing incidence of cancer, coupled with a high mortality rate, is driving the demand for cancer biomarker tests at an early stage. Furthermore, the industry is expected to witness growth due to the rising approvals of novel tests, ongoing Research and Development (R&D) activities, and favorable initiatives undertaken by regulatory bodies. For instance, in June 2023, the U.S. FDA announced a pilot program providing manufacturers with the opportunity to submit validation and performance data for Laboratory Developed Tests (LDTs) for cancer. Additionally, in April 2023, Biocartis Group NV and APIS Assay Technologies Ltd. collaborated to manufacture and commercialize a breast cancer subtyping test on Idylla, a molecular diagnostics platform

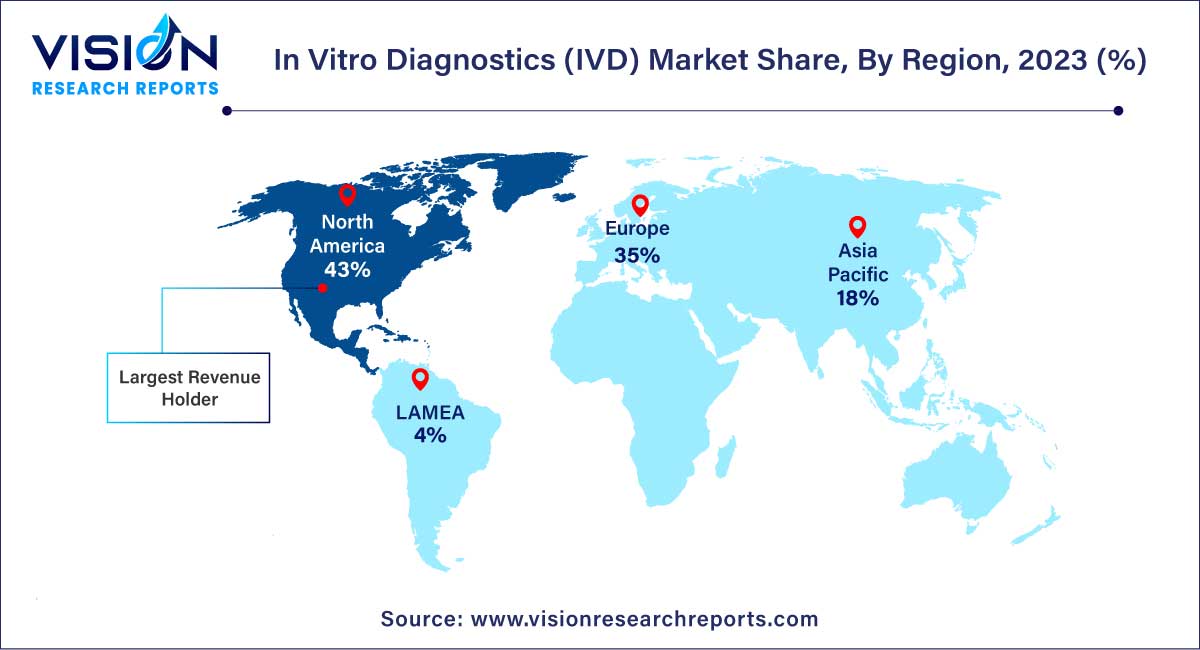

In 2023, North America asserted its dominance in the market, capturing a substantial share of 43%. Projections indicate that the region will maintain its leading position throughout the forecast period. Several factors contribute to the collective drive of the market in North America, including the increasing prevalence of chronic diseases, the presence of robust industry players, a growing number of novel test launches, and supportive government funding. An illustrative example is the January 2023 collaboration between BD and CerTest Biotec, securing Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA) for a Polymerase Chain Reaction (PCR) test designed for Mpox virus detection in the U.S.

In contrast, Asia Pacific is poised for substantial growth from 2024 to 2033. This anticipated growth in the regional market can be attributed to several factors, including the presence of stabilizing economies, a rapidly expanding middle-class population, supportive government policies, and swift urbanization across the region. A notable collaboration in October 2023 involved Fapon and Halodoc partnering to boost in vitro diagnostic product sales and services in Indonesia.

By Product

By Technology

By Application

By Test Location

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on In Vitro Diagnostics (IVD) Market

5.1. COVID-19 Landscape: In Vitro Diagnostics (IVD) Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global In Vitro Diagnostics (IVD) Market, By Product

8.1. In Vitro Diagnostics (IVD) Market, by Product, 2024-2033

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reagents

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global In Vitro Diagnostics (IVD) Market, By Technology

9.1. In Vitro Diagnostics (IVD) Market, by Technology, 2024-2033

9.1.1. Immunoassay

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hematology

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Clinical Chemistry

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Molecular Diagnostics

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Coagulation

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Microbiology

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global In Vitro Diagnostics (IVD) Market, By Application

10.1. In Vitro Diagnostics (IVD) Market, by Application, 2024-2033

10.1.1. Infectious Diseases

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Diabetes

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Oncology

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Cardiology

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Nephrology

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Autoimmune Diseases

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Drug Testing

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global In Vitro Diagnostics (IVD) Market, By Test Location

11.1. In Vitro Diagnostics (IVD) Market, by Test Location, 2024-2033

11.1.1. Point of Care

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Home-care

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global In Vitro Diagnostics (IVD) Market, By End-use

12.1. In Vitro Diagnostics (IVD) Market, by End-use, 2024-2033

12.1.1. Hospitals

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Laboratory

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Home-care

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global In Vitro Diagnostics (IVD) Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.7. Market Revenue and Forecast, by Test Location (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.10. Market Revenue and Forecast, by Test Location (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product (2021-2033)

13.5.2. Market Revenue and Forecast, by Technology (2021-2033)

13.5.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Test Location (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. Abbott

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. bioMérieux SA

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. QuidelOrtho Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Siemens Healthineers AG

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Bio-Rad Laboratories, Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Qiagen

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Sysmex Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Charles River Laboratories

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Quest Diagnostics Incorporated

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Agilent Technologies, Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others