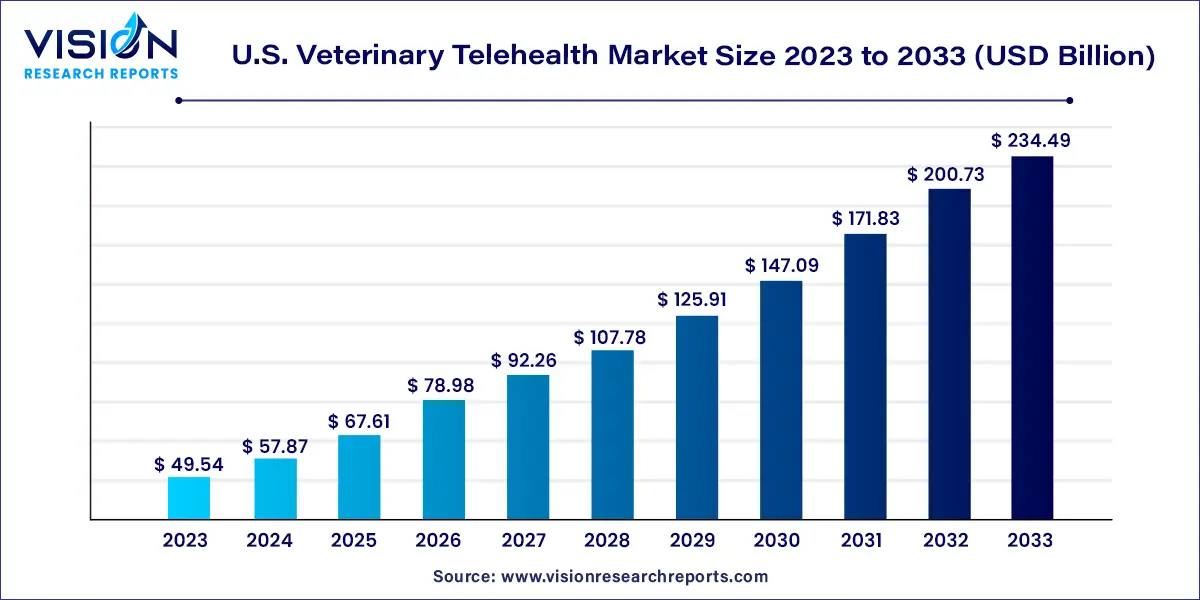

The U.S. veterinary telehealth market size was estimated at around USD 49.54 billion in 2023 and it is projected to hit around USD 234.49 billion by 2033, growing at a CAGR of 16.82% from 2024 to 2033. The U.S. veterinary telehealth market is driven by technological advancements and the increasing demand for remote healthcare services.

The growth of the U.S. veterinary telehealth market can be attributed to several key factors propelling its expansion. Primarily, the surge in pet ownership across the nation has created a heightened demand for convenient and accessible veterinary care. The increasing awareness and acceptance of telehealth services among pet owners further contribute to market growth. Technological advancements, particularly in telecommunication technologies such as video consultations and remote monitoring, have significantly enhanced the efficacy of veterinary telehealth solutions. The evolving regulatory landscape, adapting to the changing dynamics of healthcare delivery, provides a supportive framework for industry development. These collective factors create a fertile ground for the U.S. Veterinary Telehealth Market, positioning it as a vital component of contemporary pet healthcare services.

Teleconsulting claimed the dominant position in the market, securing the largest revenue share at 30% in 2023. Veterinarians are increasingly leveraging telehealth tools for teleconsulting, connecting with veterinary experts to gain valuable advice and insights on animal care. This facilitates the provision of timely and appropriate medical guidance for animals in need, ultimately enhancing their treatment outcomes. Additionally, teleconsultation plays a pivotal role in reducing transportation and associated costs. The immediate access to expert advice eliminates long waiting periods, enabling veterinarians to promptly address the healthcare needs of animals. These advantages contribute significantly to the expansion of the teleconsulting segment.

Telemedicine is poised to be the fastest-growing segment, projected to achieve a CAGR of 15.93% from 2024 to 2033, driven by the increasing penetration of the internet. The rise in internet users has led to a substantial uptick in the adoption of telehealth services for animals. The segment's growth is further fueled by industry players' initiatives, exemplified by Guardian Vets. In April 2021, the company, a prominent player in veterinary client communication technology and telemedicine, introduced three innovative services – Virtual CRS, Overflow Protection, and Callback Support. These services have effectively alleviated the workload on veterinary practices, contributing to the overall market expansion.

The "Others" category emerged as the market leader, accounting for the largest revenue market share at 29% in 2023. This diverse segment encompasses animals such as poultry, sheep, and goats. The substantial consumption of poultry and cattle products on a daily basis plays a pivotal role in propelling the growth of this segment. Notably, the global increase in pork production significantly contributes to this growth, as pork is widely consumed as a staple food. Sheep, in addition to their role in meat production, also contribute to the production of wool. The escalating incidence of chronic diseases in sheep and goats is a major factor driving the adoption of veterinary telehealth within this segment, fostering preventive measures and disease management strategies.

The Feline segment is poised to be the fastest-growing over the forecast period. This growth is attributed to the escalating expenditure on animal healthcare, particularly for felines. Common conditions like chronic kidney disease, hyperthyroidism, endocrine diseases, and diabetes are driving the clinical urgency to adopt veterinary telehealth, serving as impactful drivers for segment growth. Corporations are strategically expanding their product portfolios for felines due to their heightened sensitivity to diseases compared to other companion animals.

By Animal Type

By Service Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Veterinary Telehealth Market

5.1. COVID-19 Landscape: U.S. Veterinary Telehealth Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Veterinary Telehealth Market, By Animal Type

8.1. U.S. Veterinary Telehealth Market, by Animal Type, 2024-2033

8.1.1. Canine

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Feline

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Equine

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Bovine

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Swine

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Veterinary Telehealth Market, By Service Type

9.1. U.S. Veterinary Telehealth Market, by Service Type, 2024-2033

9.1.1. Telemedicine

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Teleconsulting

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Telemonitoring

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Veterinary Telehealth Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Animal Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Service Type (2021-2033)

Chapter 11. Company Profiles

11.1. Airvet

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Activ4Pets

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. PetHub, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. VitusVet

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Televet

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. GuardianVets

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Whiskers Worldwide, LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Animan Technologies Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Chewy, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Petzam

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others