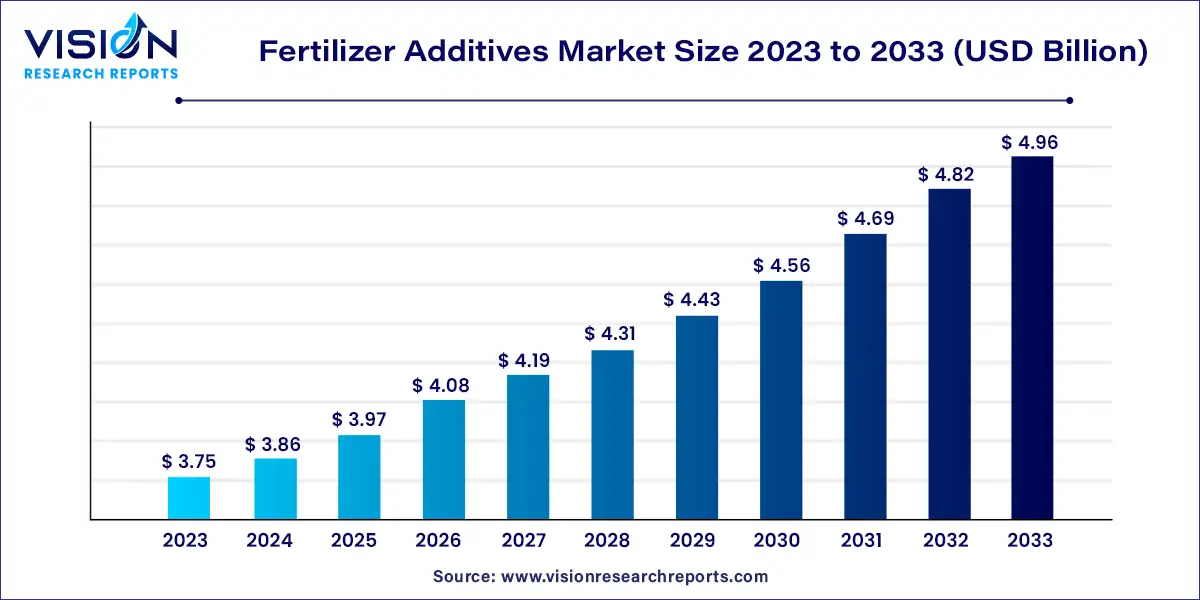

The global fertilizer additives market size was estimated at around USD 3.75 billion in 2023 and it is projected to hit around USD 4.96 billion by 2033, growing at a CAGR of 2.83% from 2024 to 2033.

The global fertilizer additives market is witnessing substantial growth, driven by the increasing demand for enhanced crop yield and quality. Fertilizer additives play a pivotal role in optimizing nutrient uptake, improving soil health, and mitigating environmental impacts.

The growth of the fertilizer additives market is propelled by several key factors. Firstly, increasing global population and subsequent food demand drive the need for enhanced crop yield and quality, spurring the demand for fertilizer additives. Additionally, the shift towards sustainable agriculture practices, spurred by environmental concerns, encourages the adoption of additives to optimize nutrient uptake and minimize environmental impact. Moreover, advancements in agricultural technology, including precision farming and smart fertilization, facilitate the adoption of fertilizer additives by enabling targeted nutrient application and maximizing resource utilization. These factors collectively contribute to the steady growth trajectory of the fertilizer additives market, promising further expansion in the foreseeable future.

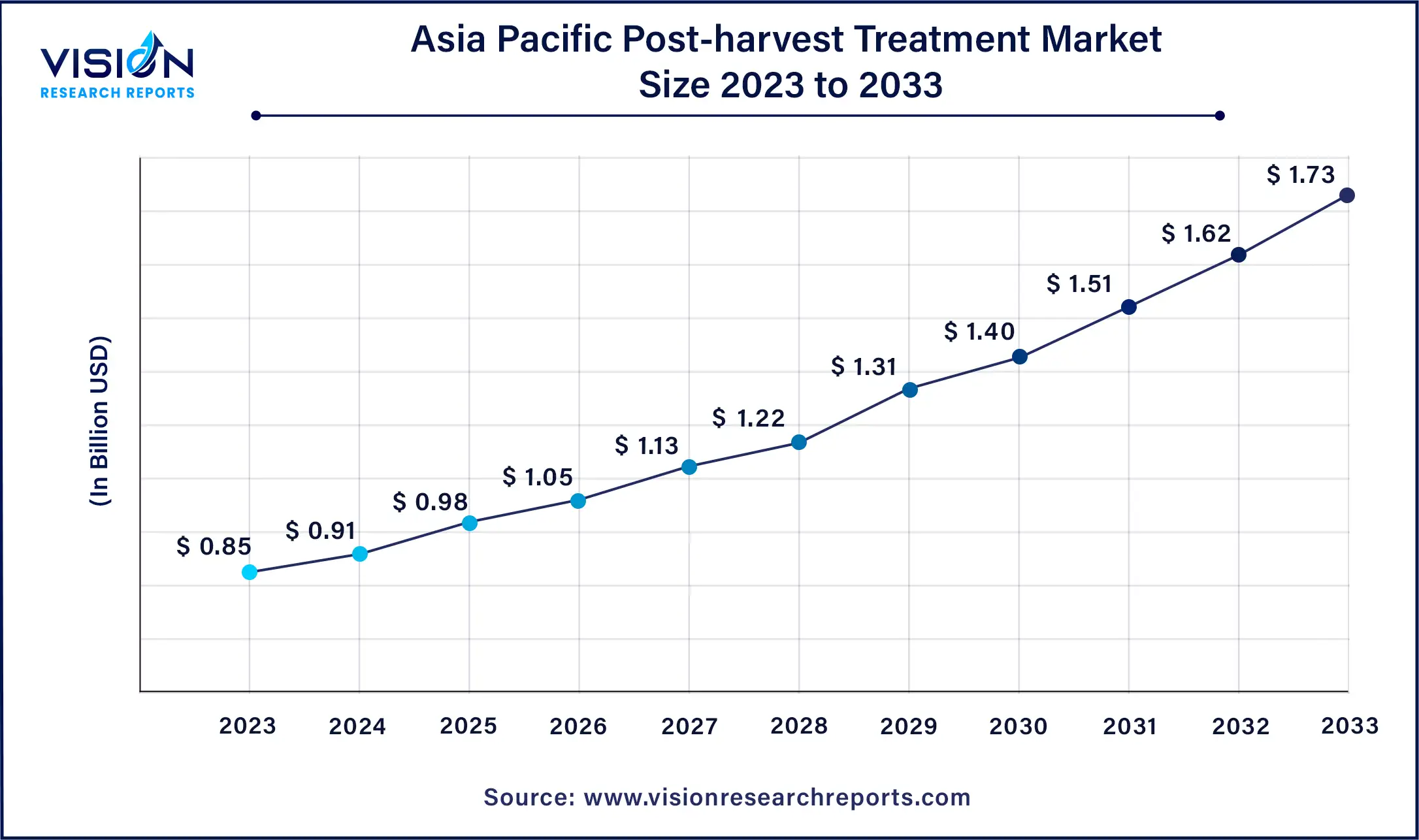

The Asia Pacific fertilizer additives market size was estimated at around USD 2.28 billion in 2023 and it is projected to hit around USD 3.02 billion by 2033, growing at a CAGR of 2.85% from 2024 to 2033.

In 2023, Asia Pacific emerged as the dominant force in the fertilizer additives market, capturing a substantial revenue share of 61%. The demand for additives is anticipated to surge, particularly in emerging economies such as China and India, driven by the growth of their agriculture sectors. Agriculture holds significant importance as a sector contributing to the GDP of these economies, including Bangladesh, India, China, and Sri Lanka.

The fertilizer additives market in North America is forecasted to experience significant growth with a notable compound annual growth rate (CAGR) during the projected period. Within North America, the United States stands as the dominant market player. In 2023, urea and ammonium nitrate emerged as the most preferred fertilizers in this region. Moreover, crop management planning has garnered increasing attention from governments across North American countries, which is poised to positively influence market expansion throughout the forecast period.

In 2023, the anti-caking segment dominated the market in terms of revenue share, attributed to its primary functions: anti-caking, anti-dusting, corrosion inhibition, and anti-coating. Among these, anti-caking stands out as the most significant function. This importance arises particularly during the monsoon season when fertilizer storage can lead to the formation of flakes. Thus, additives play a critical role in safeguarding the safe storage and transportation of fertilizers. Similarly, anti-dusting is crucial for maintaining fertilizer quality during transportation and storage, especially in environments prone to dust exposure.

The hydrophobic agents segment, also known as water repellents, serves to protect fertilizers from moisture in the atmosphere. Moisture poses a risk of diminishing essential nutrient content, such as nitrogen, phosphorus, and potassium, in fertilizers.

In 2023, the urea segment held the largest revenue share based on end-product classification. Urea, a nitrogenous fertilizer, is widely favored due to its availability and ease of synthesis, making it a preferred choice among farmers. The urea market is anticipated to witness substantial growth, particularly in emerging economies like India and Brazil, owing to its high nitrogen content and widespread use, notably in the Asia Pacific region. Its accessibility and cost-effectiveness further contribute to its popularity, ensuring its continued rise in demand.

Ammonium nitrate, another significant nitrogen source, contains both nitrate and ammonia, offering high nutritional value at a competitive price point compared to other nitrogenous products. It ranks second in usage after urea and has experienced a surge in demand in price-sensitive regions like Asia Pacific and Latin America. The increased popularity of ammonium nitrate can be attributed to its affordability and rich nitrogen and ammonium content.

Ammonium phosphate, renowned for its high phosphorus content, is susceptible to moisture absorption in the field and during storage. To mitigate this, fertilizers with hydrophobic properties are employed. Market offerings include two primary grades: ammonium polyphosphates (APP) and diammonium phosphate (DAP), utilized based on specific application needs.

By Function

By End-Product

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Fertilizer Additives Market

5.1. COVID-19 Landscape: Fertilizer Additives Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Fertilizer Additives Market, By Function

8.1. Fertilizer Additives Market, by Function, 2024-2033

8.1.1. Corrosion Inhibitors

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hydrophobic Agents

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Anti-dusting Agents

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Anti-caking Agent

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Slow-Release Coatings

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Fertilizer Additives Market, By End-Product

9.1. Fertilizer Additives Market, by End-Product, 2024-2033

9.1.1. Urea

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Ammonium Nitrate

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Ammonium Phosphate

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Ammonium Sulphate

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Fertilizer Additives Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Function (2021-2033)

10.1.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Function (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Function (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Function (2021-2033)

10.2.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Function (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Function (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Function (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Function (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Function (2021-2033)

10.3.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Function (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Function (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Function (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Function (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Function (2021-2033)

10.4.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Function (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Function (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Function (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Function (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Function (2021-2033)

10.5.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Function (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-Product (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Function (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-Product (2021-2033)

Chapter 11. Company Profiles

11.1. Clariant AG

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. KAO Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Dorf Ketal Chemicals (I) Pvt. Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Solvay S.A.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. ArrMaz

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Chemipol S.A.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Cameron Chemicals

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Michelman Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Tolsa SA

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. ChemSol, LLC

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others