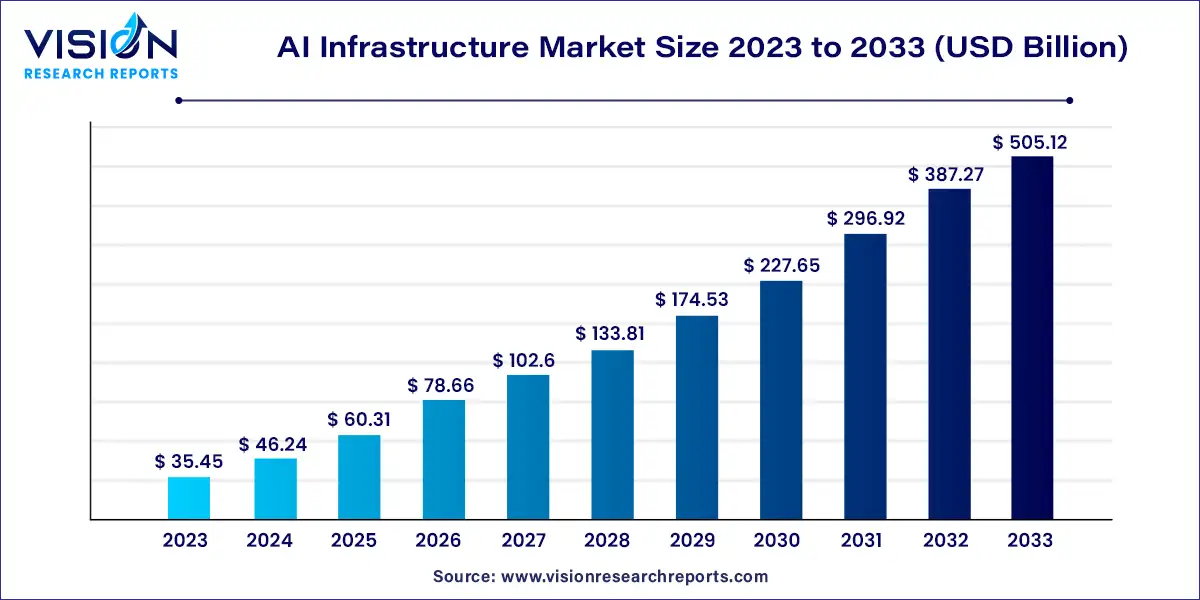

The global AI infrastructure market size was valued at USD 35.45 billion in 2023 and is anticipated to reach around USD 505.12 billion by 2033, growing at a CAGR of 30.43% from 2024 to 2033.

The AI infrastructure market has witnessed remarkable growth driven by the increasing adoption of artificial intelligence (AI) technologies across various industries. AI infrastructure refers to the hardware and software components necessary to support AI workloads, including processors, memory, storage, networking, and specialized AI accelerators.

The growth of the AI infrastructure market is propelled by an increasing adoption of artificial intelligence (AI) technologies across diverse industries drives the demand for robust infrastructure capable of supporting complex AI workloads. Secondly, advancements in AI hardware technologies, including specialized chips and accelerators, enhance the performance and efficiency of AI applications, fueling market growth. Thirdly, the emergence of cloud-based AI infrastructure solutions offers scalability, flexibility, and cost-effectiveness, driving adoption among businesses seeking to leverage AI capabilities. Moreover, the proliferation of edge computing and IoT devices drives the need for AI infrastructure at the network edge, further contributing to market expansion.

In 2023, the hardware segment claimed the largest market share, accounting for 64% of total revenue. This dominance stems from the escalating demand for specialized chips and processors capable of handling the intricate computations required by AI and machine learning algorithms. As AI systems evolve in complexity, so does their energy consumption, driving the need for energy-efficient hardware solutions that can sustain the computational demands of AI applications. Consequently, innovations in chip design and architecture aimed at reducing power consumption while upholding performance standards are on the rise, propelling market expansion.

Meanwhile, the services segment is poised to achieve a notable compound annual growth rate (CAGR) during the forecast period. This growth is propelled by the increasing requirement for tailored AI solutions that seamlessly integrate with organizations' existing systems and workflows. Service providers offering customization and integration services empower businesses to effectively harness the potential of AI technologies. With the rapid evolution of AI capabilities, maintaining an in-house team of AI experts becomes a costly endeavor for organizations. Therefore, the demand for services within the global market is anticipated to surge in the coming years.

In 2023, the machine learning segment emerged as the market leader, commanding a substantial revenue share of 59%. The proliferation of vast datasets fuels the growth of machine learning within AI infrastructure, coupled with advancements in computational hardware, such as GPUs and specialized AI processors. Continuous innovation in machine learning algorithms further propels the segment's expansion. Moreover, the demand for machine learning solutions is fueled by their capacity to tackle industry-specific challenges and capitalize on emerging opportunities.

Concurrently, the deep learning segment exhibits the highest growth rate and is anticipated to maintain a significant compound annual growth rate (CAGR) throughout the forecast period. The development of more robust and energy-efficient GPUs, TPUs, and specialized hardware is poised to accelerate advancements in deep learning. These hardware enhancements facilitate the training of increasingly intricate models, thereby reducing the time and energy expenditure required to achieve significant breakthroughs.

In 2023, the training segment emerged as the market leader, capturing the largest revenue share at 72%. This segment is propelled by a surge in data generation across diverse sectors, providing the essential raw material for training advanced AI models. The abundance of large and varied datasets empowers models to discern nuanced patterns and deliver more precise predictions. Furthermore, ongoing innovations in deep learning architectures and training algorithms, such as transformer models and reinforcement learning techniques, continually expand the horizons of AI capabilities.

Concurrently, the inference segment is poised for substantial growth with a notable compound annual growth rate (CAGR) forecasted over the coming years. This growth is fueled by the transition towards edge computing, where data processing occurs in close proximity to the data source. Edge computing facilitates efficient AI inference, enabling real-time decision-making and analysis without the need for extensive data transfer to centralized servers.

In 2023, the on-premise segment emerged as the dominant force in the market, commanding a substantial revenue share of 51%. This segment's growth is propelled by several key factors including the escalating demand for data security and compliance, stringent latency requirements, customization options, and cost efficiency. Industries such as finance and healthcare, which prioritize stringent control over data privacy, often opt for on-premise AI infrastructure to maintain sovereignty over sensitive data.

Meanwhile, the hybrid segment is poised for significant growth, expected to achieve a notable compound annual growth rate (CAGR) over the forecast period. Hybrid infrastructure offers organizations a strategic balance by allowing them to retain core operations on-premise while leveraging cloud services for supplementary tasks. This approach enables cost reduction by mitigating maintenance expenses associated with a fully on-premise setup. Moreover, organizations can optimize on-premise resources for regular workloads while utilizing cloud resources for demanding tasks such as AI model training, thereby striking a balance between performance and cost-effectiveness.

In 2023, the cloud service providers (CSPs) segment emerged as the market leader, commanding the largest revenue share at 48%. This dominance is attributed to the exponential growth in data stemming from sources like social media, IoT devices, and online transactions, which serves as a fertile ground for AI and machine learning models. Enterprises make substantial investments in AI infrastructure to leverage this data for actionable insights. AI technologies such as process automation and predictive maintenance play a pivotal role in cost reduction, operational streamlining, and efficiency enhancement, thereby driving the adoption of AI solutions among enterprises.

Concurrently, the enterprise segment is poised for rapid growth, expected to register the fastest compound annual growth rate (CAGR) over the forecast period. Similar to CSPs, enterprises benefit from the abundant data streams generated by social media, IoT devices, and online transactions, fueling the development and deployment of AI and machine learning models. The adoption of AI technologies enables enterprises to unlock valuable insights, streamline operations, and optimize efficiency, thereby fostering the integration of AI solutions across diverse business sectors.

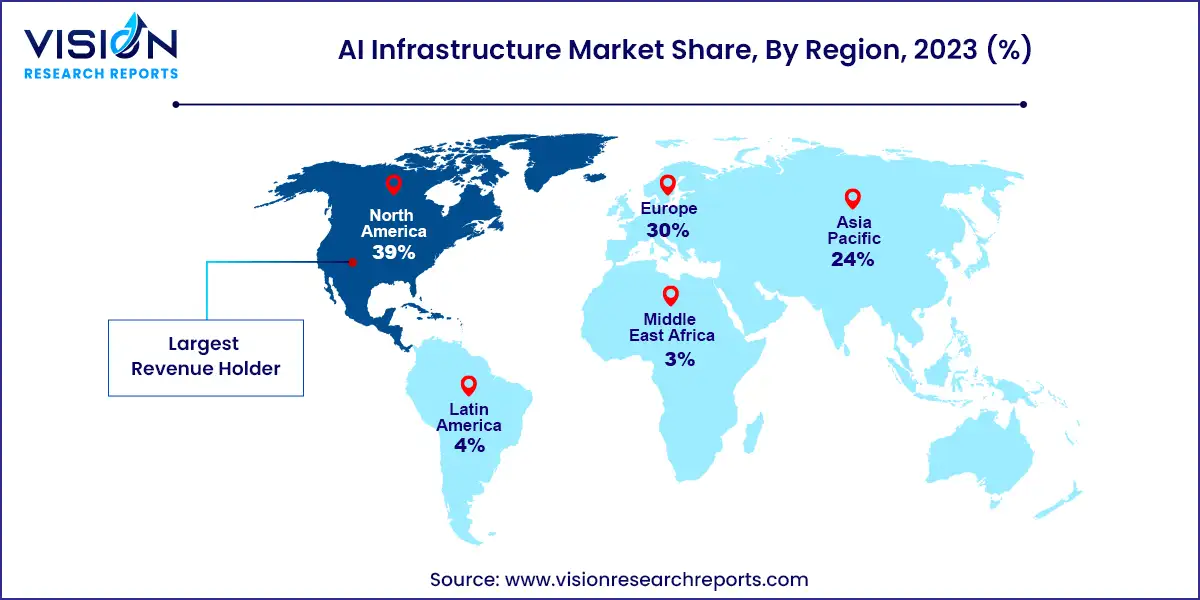

In 2023, North America asserted its dominance in the AI infrastructure market, capturing a significant revenue share of 39%. This leadership position can be attributed to North America's prominence in cloud computing services, with key players such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform headquartered in the region. The widespread availability and adoption of cloud services in North America facilitate the implementation of scalable AI infrastructure solutions.

Meanwhile, the AI infrastructure market in Asia Pacific is poised for rapid expansion, projected to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. This growth is propelled by several factors, including the flourishing startup ecosystems, increasing internet and smartphone penetration, and the burgeoning digital consumer base in the region. These trends create a burgeoning demand for AI infrastructure to support a wide array of AI-driven services and applications, thereby presenting lucrative opportunities for market growth in Asia Pacific.

By Component

By Technology

By Application

By Deployment

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on AI Infrastructure Market

5.1. COVID-19 Landscape: AI Infrastructure Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global AI Infrastructure Market, By Component

8.1. AI Infrastructure Market, by Component, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global AI Infrastructure Market, By Technology

9.1. AI Infrastructure Market, by Technology, 2024-2033

9.1.1. Machine Learning

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Deep Learning

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global AI Infrastructure Market, By Application

10.1. AI Infrastructure Market, by Application, 2024-2033

10.1.1. Training

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Inference

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global AI Infrastructure Market, By Deployment

11.1. AI Infrastructure Market, by April, 2024-2033

11.1.1. On-premise

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Cloud

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Hybrid

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global AI Infrastructure Market, By End-user

12.1. AI Infrastructure Market, by End-user, 2024-2033

12.1.1. Enterprises

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Government Organizations

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Cloud Service Providers (CSPs)

12.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global AI Infrastructure Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.4. Market Revenue and Forecast, by April (2021-2033)

13.1.5. Market Revenue and Forecast, by End-user (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.6.4. Market Revenue and Forecast, by April (2021-2033)

13.1.7. Market Revenue and Forecast, by End-user (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.4. Market Revenue and Forecast, by April (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-user (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.4. Market Revenue and Forecast, by April (2021-2033)

13.2.5. Market Revenue and Forecast, by End-user (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.7. Market Revenue and Forecast, by April (2021-2033)

13.2.8. Market Revenue and Forecast, by End-user (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.10. Market Revenue and Forecast, by April (2021-2033)

13.2.11. Market Revenue and Forecast, by End-user (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.12.4. Market Revenue and Forecast, by April (2021-2033)

13.2.13. Market Revenue and Forecast, by End-user (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.14.4. Market Revenue and Forecast, by April (2021-2033)

13.2.15. Market Revenue and Forecast, by End-user (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.4. Market Revenue and Forecast, by April (2021-2033)

13.3.5. Market Revenue and Forecast, by End-user (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.6.4. Market Revenue and Forecast, by April (2021-2033)

13.3.7. Market Revenue and Forecast, by End-user (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.8.4. Market Revenue and Forecast, by April (2021-2033)

13.3.9. Market Revenue and Forecast, by End-user (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.4. Market Revenue and Forecast, by April (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-user (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.4. Market Revenue and Forecast, by April (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-user (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.4. Market Revenue and Forecast, by April (2021-2033)

13.4.5. Market Revenue and Forecast, by End-user (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.6.4. Market Revenue and Forecast, by April (2021-2033)

13.4.7. Market Revenue and Forecast, by End-user (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.8.4. Market Revenue and Forecast, by April (2021-2033)

13.4.9. Market Revenue and Forecast, by End-user (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.4. Market Revenue and Forecast, by April (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-user (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.4. Market Revenue and Forecast, by April (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-user (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.2. Market Revenue and Forecast, by Technology (2021-2033)

13.5.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.4. Market Revenue and Forecast, by April (2021-2033)

13.5.5. Market Revenue and Forecast, by End-user (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.6.4. Market Revenue and Forecast, by April (2021-2033)

13.5.7. Market Revenue and Forecast, by End-user (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.4. Market Revenue and Forecast, by April (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 14. Company Profiles

14.1. North America

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Europe

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Asia Pacific

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Latin America

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Middle East & Africa (MEA)

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others