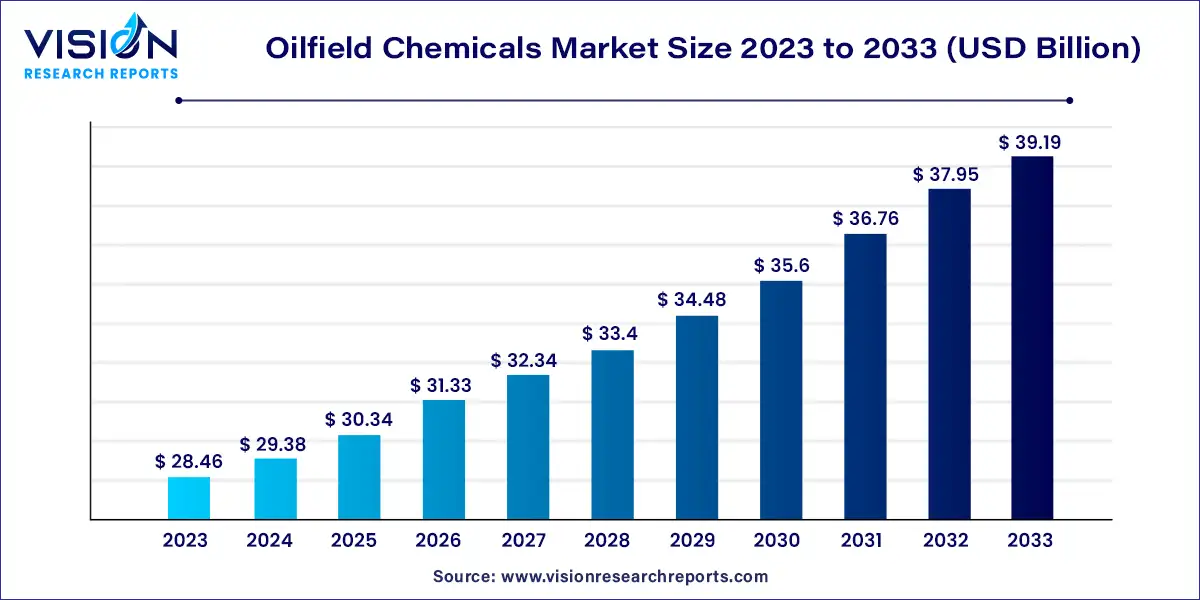

The global oilfield chemicals market size was estimated at around USD 28.46 billion in 2023 and it is projected to hit around USD 39.19 billion by 2033, growing at a CAGR of 3.25% from 2024 to 2033.

The oilfield chemicals market plays a crucial role in enhancing the efficiency and productivity of oil extraction and processing operations. These chemicals are essential for various functions, including drilling, production, refining, and enhanced oil recovery. The market is driven by the increasing demand for energy, advancements in drilling technologies, and the need to improve the lifespan of oil wells while minimizing environmental impact. Key products in this market include corrosion inhibitors, demulsifiers, surfactants, and biocides.

The growth of the oilfield chemicals market is fueled by the rising global demand for energy and fuel drives the need for enhanced oil recovery methods, necessitating advanced chemical solutions. Technological advancements in drilling and extraction techniques further propel the market, as these innovations often require specialized chemicals to optimize efficiency and reduce operational costs. Additionally, stringent environmental regulations and the increasing focus on sustainable practices push companies to adopt eco-friendly chemicals, spurring market growth. The expansion of unconventional oil and gas exploration activities, such as shale gas and deep-water drilling, also significantly contributes to the burgeoning demand for oilfield chemicals.

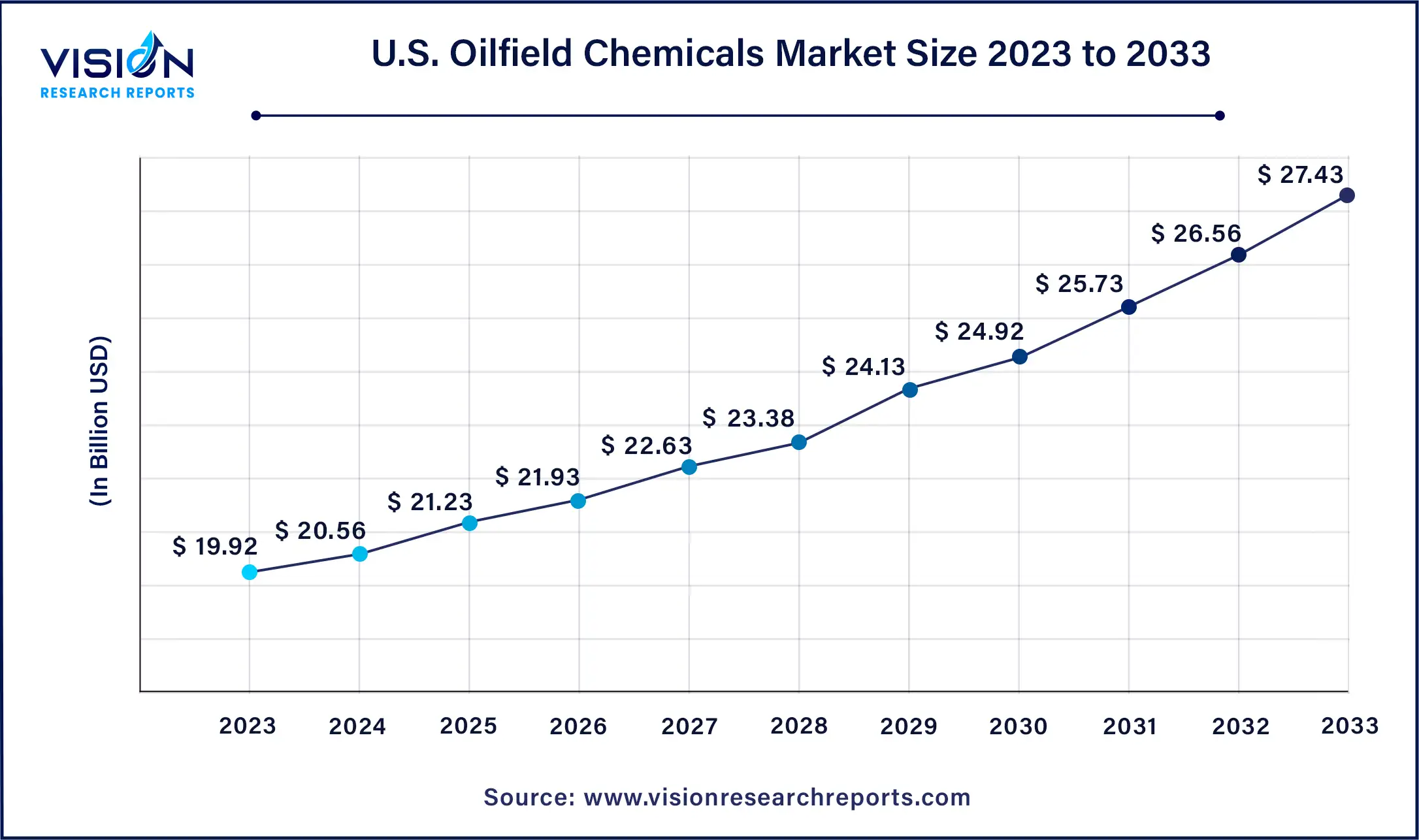

The U.S. oilfield chemicals market size was estimated at USD 19.92 billion in 2023 and is expected to surpass around USD 27.43 billion by 2033, poised to grow at a CAGR of 3.25% from 2024 to 2033.

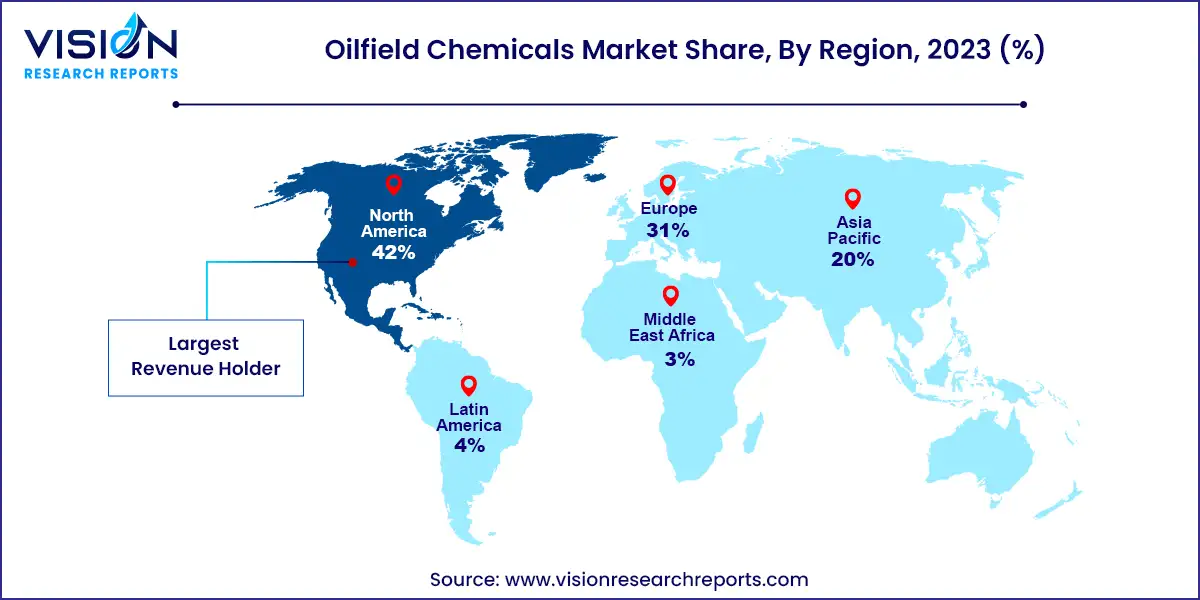

North America led the market with a 42% revenue share in 2023. This dominance is due to the region’s status as a major oil producer, with significant contributions from the U.S., Canada, and Mexico. The presence of large oil companies like Chevron Corporation, Exxon Mobil Corporation, Suncor Energy Inc., and Petroleos Mexicanos boosts market activity. These companies frequently engage in mergers and acquisitions to expand market share. For instance, in June 2023, NexTier Oilfield Solutions and Patterson-UTI announced a merger, creating the second-largest oilfield services company in North America with a market value of USD 5.40 billion.

Canada boasts a robust offshore oil and gas industry, ranking as the fourth-largest producer of crude oil globally. The country features significant oil-producing facilities, particularly in Alberta, with oil reserves estimated at 161.7 billion barrels, and in British Columbia, which produced 12,000 barrels of crude oil per day in 2021. Six major offshore oil exploration sites are located in the regions of Labrador and Newfoundland. About 30% of Canada's crude oil production is processed domestically, with the remainder refined in the U.S. The presence of key oil and gas players in North America is expected to drive the demand for oilfield chemicals in the region in the near future.

In 2023, the rheology modifiers segment led the market with a revenue share of 25%. This dominance is due to the ability of rheology modifiers to alter the rheological properties of oil wells, serving as additives in synthetic-based drilling fluids, as well as in water and oil emulsions. Rheology involves the study of the deformation and flow of materials when subjected to sufficient stress or force. Key characteristics influenced by rheological properties in oil wells include yield stress, viscosity, compliance toward change, and relaxation time.

Another product expected to see growth in the coming years is inhibitors. Corrosion poses a major challenge in oilfield exploration, causing significant damage to equipment and infrastructure. In 2022, the cost of corrosion worldwide was over USD 1.3 billion, according to the Saudi Association of Corrosion Engineers (SACE). Extracted oil contains impurities like carbon dioxide and hydrogen sulfide, which react with the metal surfaces of pipelines, leading to corrosion. To control this, water-soluble inhibitors, such as amides, long-chain amines, or imidazoline, are used to form a protective thin layer on the metal surfaces.

In 2023, the workover and completion segment led the market with a revenue share of 41%. This is because workover and completion chemicals are essential for oil companies after oil extraction. These chemicals, often solid-free fluids, are used in various drilling tasks such as fracture stimulation, water shut-off, gravel packing, acid stimulation, wax cleanout, and perforations. Completion involves making a well ready for production after drilling, with chemicals used at various stages to enhance reservoir connectivity and ensure well integrity. Perforating fluids, for instance, are used to create holes in the casing and cement, connecting the wellbore with the reservoir. Fracturing fluids are used in hydraulic fracturing to inject fluids and create fractures in the reservoir, improving production rates.

The drilling segment is also expected to grow significantly. Oilfield chemicals enhance the efficiency of drilling operations by separating water and oil, and preventing corrosion in pipes and equipment. Heavy equipment and pipes are prone to damage from exposure to corrosive agents like carbon dioxide, oxygen, or hydrogen sulfide, leading to losses and high maintenance costs. Corrosion inhibitors are used as coatings on equipment to neutralize these agents.

Onshore locations dominated the market with a 62% revenue share in 2023. This is due to technological advancements, enhanced oil recovery techniques, and increasing demand for oil products, driving onshore exploration activities, particularly in developing economies. For example, Brazil’s Oil and Gas Producers Association (ABPIP) reports that small and medium-sized oil companies in Brazil are projected to invest USD 7.74 billion in onshore fields by 2029, increasing oil output from 150,000 barrels in 2016 to 500,000 barrels by 2029. Onshore oil fields, located beneath land surfaces, involve drilling exploratory wells to assess oil presence and reservoir characteristics, with chemicals used throughout drilling, extraction, production, and completion processes to enhance efficiency, safety, and equipment protection.

Offshore oil fields are expected to grow as well. Located beneath the seabed, these fields expose exploration equipment to marine environments, increasing susceptibility to corrosion. Oilfield chemicals are essential in these environments for anti-corrosion, water separation, hydrate prevention, and infrastructure integrity maintenance.

By Product

By Application

By Location

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Oilfield Chemicals Market

5.1. COVID-19 Landscape: Oilfield Chemicals Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Oilfield Chemicals Market, By Product

8.1. Oilfield Chemicals Market, by Product, 2024-2033

8.1.1 Inhibitors

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Demulsifiers

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Rheology Modifiers

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Friction Reducers

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Biocides

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Surfactants

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Foamers

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Other Products

8.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Oilfield Chemicals Market, By Application

9.1. Oilfield Chemicals Market, by Application, 2024-2033

9.1.1. Drilling

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Production

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cementing

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Workover & Completion

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Oilfield Chemicals Market, By Location

10.1. Oilfield Chemicals Market, by Location, 2024-2033

10.1.1. Onshore

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Offshore

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Oilfield Chemicals Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by Location (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Location (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Location (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by Location (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Location (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Location (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Location (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Location (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by Location (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Location (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Location (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Location (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Location (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by Location (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Location (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Location (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Location (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Location (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by Location (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Location (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Location (2021-2033)

Chapter 12. Company Profiles

12.1. Nouryon.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. BASF SE.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. SMC Global.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Baker Hughes.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Halliburton.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. The Lubrizol Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Aquapharm Chemical Pvt. Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Clariant

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Solvay S.A.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Thermax Chemical Division

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others