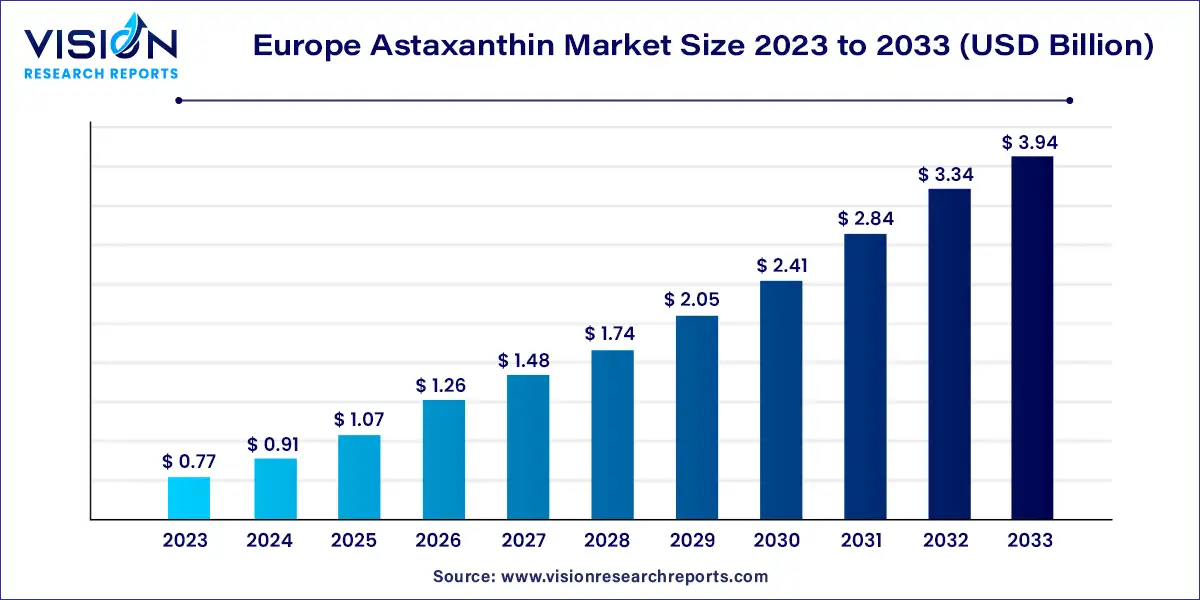

The Europe astaxanthin market was estimated at USD 0.77 billion in 2023 and it is expected to surpass around USD 3.94 billion by 2033, poised to grow at a CAGR of 17.72% from 2024 to 2033.

The Europe Astaxanthin market is experiencing notable growth, driven by several factors including increasing consumer awareness regarding the health benefits of astaxanthin, rising demand for natural antioxidants in various industries, and growing adoption of astaxanthin in the pharmaceutical and nutraceutical sectors.

Astaxanthin, a powerful antioxidant derived from microalgae, is gaining traction in the European market due to its proven benefits in promoting eye health, supporting cardiovascular health, and offering protection against oxidative stress. As consumers become more health-conscious, there is a rising preference for natural and sustainable sources of antioxidants, driving the demand for astaxanthin-based products.

The growth of the Europe astaxanthin market is propelled by anincreasing consumer awareness regarding the numerous health benefits associated with astaxanthin consumption is driving demand. Astaxanthin's proven efficacy in promoting eye health, cardiovascular health, and offering protection against oxidative stress has garnered significant attention among health-conscious consumers. Additionally, the rising preference for natural and sustainable antioxidants is fueling the adoption of astaxanthin in various industries, including pharmaceuticals, nutraceuticals, cosmetics, and aquaculture. Furthermore, the expanding applications of astaxanthin, such as its incorporation into skincare formulations and its use as a feed additive in aquaculture, are contributing to market growth. Moreover, strategic initiatives by key market players, such as product innovation and expansion of distribution networks, are further boosting the market.

The natural astaxanthin segment led the market, holding a 57% revenue share in 2023. Renowned for its exceptional antioxidant properties, natural astaxanthin boasts the highest Oxygen Radical Absorbance Capacity (ORAC) compared to its synthetic counterpart. Its rich, deep red pigment is widely employed to enhance the color of various seafood offerings, including shrimp, krill, and salmon.

The natural astaxanthin is anticipated to witness the swiftest CAGR of 21.33% from 2024 to 2033, owes its popularity to its efficacy in promoting skin health. It is prominently featured as a key ingredient in numerous cosmetic formulations. Moreover, the projected growth is fueled by the increasing integration of natural astaxanthin in treatments for complex ailments such as Alzheimer’s, Parkinson’s, hypercholesterolemia, cancer, and stroke.

Among products, the dried algae meal or biomass segment commanded the market, holding a 26% revenue share from 2024 to 2033. This dominance is attributed to its versatility in biomass production for various preparations like capsules and tablets. Its utility in bulk production, minimal downstream processing, and extensive use as animal feed are key drivers of its growth.

Industry leaders are introducing innovative products within this segment, poised to drive further growth in the coming years. The softgel segment is expected to witness a noteworthy CAGR of 18.23% from 2024 to 2033. This growth is primarily propelled by the increasing demand for astaxanthin-based softgels. The superior stability offered by softgels has made them a preferred choice, coupled with their ease of use, further augmenting demand.

The aquaculture and animal feed segment dominated with a 47% revenue share in 2023. Astaxanthin plays a crucial role as an ingredient in animal feed production, contributing to the well-being of livestock. The segment has seen robust growth in recent years, propelled by rising meat and seafood consumption. Many animal feed manufacturers prefer incorporating astaxanthin into their formulations to support livestock health.

The nutraceuticals segment is projected to undergo a remarkable CAGR of 18.64% from 2024 to 2033. This growth trajectory is primarily fueled by the increasing recognition of astaxanthin-based nutritional products. Additionally, the burgeoning awareness of astaxanthin's exceptional antioxidant properties is driving a surge in demand. Sedentary lifestyles, prolonged work hours, and various nutritional deficiencies are further stimulating the demand for nutraceuticals in the region.

The Germany astaxanthin market dominated the European regional market, capturing the largest revenue share of 21% in 2023. This dominance can be attributed to several factors, including the growing integration of astaxanthin in anti-aging cosmetic formulations and the rising demand for nutraceuticals and other immunity-boosting products. Furthermore, the presence of key market players such as Sea & Sun Organic GmbH, Fraunhofer IGB, and BGG WORLD has significantly contributed to the market's growth in Germany.

The astaxanthin market in the UK is poised to witness a CAGR of 19.02% from 2024 to 2033, driven by increasing awareness about the benefits of nutritional supplements and immunity boosters. The rising geriatric population is also a key driver of the demand for astaxanthin-based products in the UK.

By Source

By Product

By Application

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Source Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Astaxanthin Market

5.1. COVID-19 Landscape: Europe Astaxanthin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Astaxanthin Market, By Source

8.1. Europe Astaxanthin Market, by Source, 2024-2033

8.1.1 Natural

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Europe Astaxanthin Market, By Product

9.1. Europe Astaxanthin Market, by Product, 2024-2033

9.1.1. Dried Algae Meal or Biomass

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Oil

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Softgel

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Liquid

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Europe Astaxanthin Market, By Application

10.1. Europe Astaxanthin Market, by Application, 2024-2033

10.1.1. Nutraceuticals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Cosmetics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Aquaculture and Animal Feed

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Food

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Europe Astaxanthin Market, Regional Estimates and Trend Forecast

11.1. Europe

11.1.1. Market Revenue and Forecast, by Source (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Algalíf Iceland hf.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. ALGAMO.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BASF SE.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. DSM (dsm-firmenich).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Nutri-Link.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. The Synergy Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Sea & Sun Organic GmbH.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Fraunhofer CBP

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. VALENSA INTERNATIONAL.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. AstaReal

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others