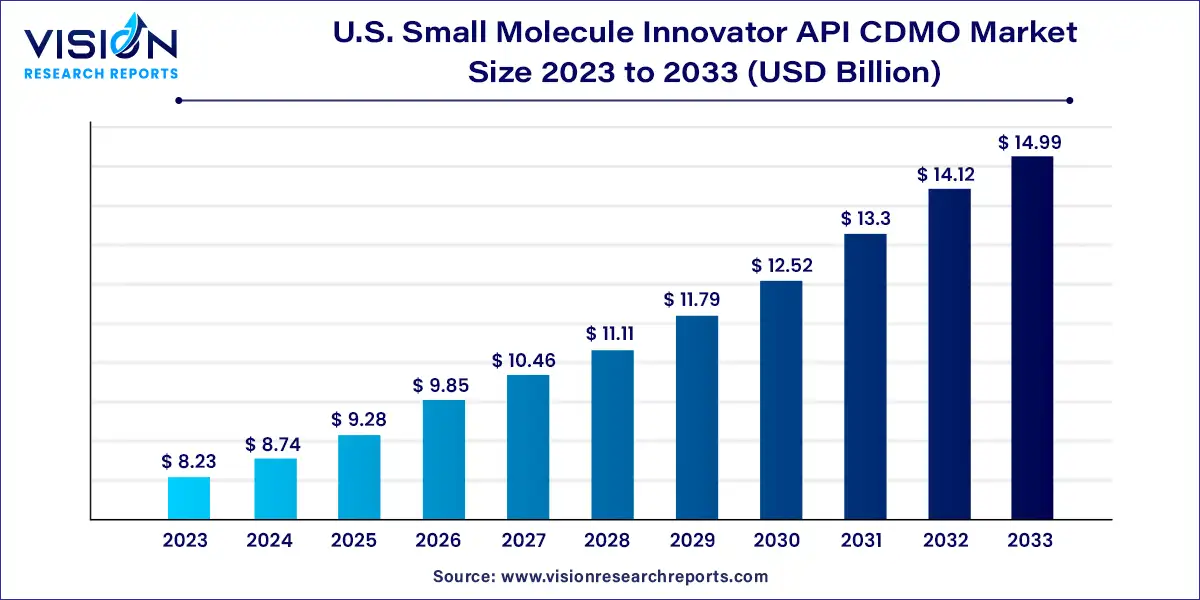

The U.S. small molecule innovator API CDMO market size was estimated at around USD 8.23 billion in 2023 and it is projected to hit around USD 14.99 billion by 2033, growing at a CAGR of 6.18% from 2024 to 2033.

The U.S. small molecule innovator API CDMO (Contract Development and Manufacturing Organization) market stands as a critical sector within the pharmaceutical industry. As a hub of innovation and technology, the United States plays a pivotal role in the development and manufacturing of active pharmaceutical ingredients (APIs) for small molecule drugs

The growth of the U.S. small molecule innovator API CDMO market is fueled by an increasing demand for personalized medicine and the prevalence of chronic diseases drive the need for efficient API manufacturing solutions. Secondly, advancements in synthetic chemistry and process optimization contribute to enhanced efficiency and innovation within the industry. Additionally, stringent regulatory standards, including cGMP requirements, emphasize the importance of quality, safety, and compliance, further driving market expansion. Moreover, the adoption of cutting-edge technologies such as continuous flow synthesis and computational modeling accelerates API development and manufacturing processes.

Categorized by stage, the market is divided into preclinical, clinical, and commercial phases. The clinical segment emerged as the market leader in 2023, capturing the largest revenue share of 55%. Within the clinical phase, further sub-segmentation includes Phase I, Phase II, and Phase III trials. This segment's growth is primarily attributed to the expanding pipeline of small molecule products and the introduction of novel drugs. Notably, Lonza reported that small molecules constitute the largest single drug class during the clinical phase, representing over half of clinical pipelines and contributing more than 40% of the global biopharmaceutical market revenue. Consequently, there is a heightened demand for clinical services from pharmaceutical and biopharmaceutical companies, as clinical research facilitates investigations from the research stage to advancements through clinical trials.

Meanwhile, the preclinical segment is projected to witness a lucrative CAGR over the forecast period. Screening of small molecule drug candidates is pivotal in the drug discovery process, leading to an increase in the number of preclinical candidates and bolstering the drug development pipeline with a greater number of preclinical trials. For example, in August 2023, Astex announced a research collaboration and license agreement with MSD to categorize small molecule candidates targeting tumor suppressor proteins for cancer treatment. Such initiatives are expected to propel market growth.

The market's therapeutic area segment encompasses cardiovascular diseases, oncology, respiratory disorders, neurology, metabolic disorders, infectious diseases, and others. Oncology emerged as the dominant segment in 2023, commanding the largest revenue share of 43% and is projected to exhibit the fastest CAGR of 6.62% during the forecast period. The segment's growth is driven by the increasing incidence of cancer cases, escalating investments in pharmaceutical Research and Development (R&D), and the rising demand for oncology drugs and biologic innovations. For instance, the Cancer Atlas predicts a global tally of 29 million cancer cases by 2040. Moreover, government reimbursement policies and financing opportunities are further propelling the market, particularly in the development of small-molecule oncology therapies.

The neurology diseases market has recently seen significant advancements in treatment methods, research, and drug development, particularly in the realm of central nervous system APIs. These small molecules play a vital role in addressing neurological conditions, driving pharmaceutical companies to innovate in this field. For example, Societal CDMO, Inc. secured contracts from three new customers in August 2022, covering various services such as analytical method development and clinical trial services.

Segmented by customer type, the market comprises pharmaceutical and biotechnology sectors. Pharmaceutical companies dominated the market in 2023, holding a substantial revenue share of 92%. This dominance is attributed to the increasing demand for standard drugs and the emergence of small molecule APIs in the pipeline. Moreover, pharmaceutical firms are increasingly relying on CDMOs for the development of novel small molecule innovator APIs, driven by advancements in technologies such as AI and machine learning.

Conversely, the biotechnology segment is experiencing growth due to the surge in innovative products, including genomic medicines and immunotherapies. This innovation has spurred demand for various small molecule API products. Additionally, biotech firms, with their portfolios of compounds, are seeking small molecule innovator API CDMO services to bring novel therapies to market, further fueling growth in this segment.

By Stage Type

By Customer Type

By Therapeutic Area

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Stage Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Small Molecule Innovator API CDMO Market

5.1. COVID-19 Landscape: U.S. Small Molecule Innovator API CDMO Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Small Molecule Innovator API CDMO Market, By Stage Type

8.1. U.S. Small Molecule Innovator API CDMO Market, by Stage Type, 2024-2033

8.1.1 Preclinical

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Clinical

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Commercial

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Small Molecule Innovator API CDMO Market, By Customer Type

9.1. U.S. Small Molecule Innovator API CDMO Market, by Customer Type, 2024-2033

9.1.1. Pharmaceutical

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Biotechnology

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Small Molecule Innovator API CDMO Market, By Therapeutic Area

10.1. U.S. Small Molecule Innovator API CDMO Market, by Therapeutic Area, 2024-2033

10.1.1. Cardiovascular Diseases

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Oncology

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Respiratory Disorders

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Neurology

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Metabolic Disorders

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Infectious Diseases

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Small Molecule Innovator API CDMO Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Stage Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Customer Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

Chapter 12. Company Profiles

12.1. Lonza Group Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Novo Holdings (Catalent, Inc.).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Thermo Fisher Scientific, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Siegfried Holding AG.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Recipharm AB.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. CordenPharma International

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Samsung Biologics.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Labcorp

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Ajinomoto Bio-Pharma Services.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Piramal Pharma Solutions

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others