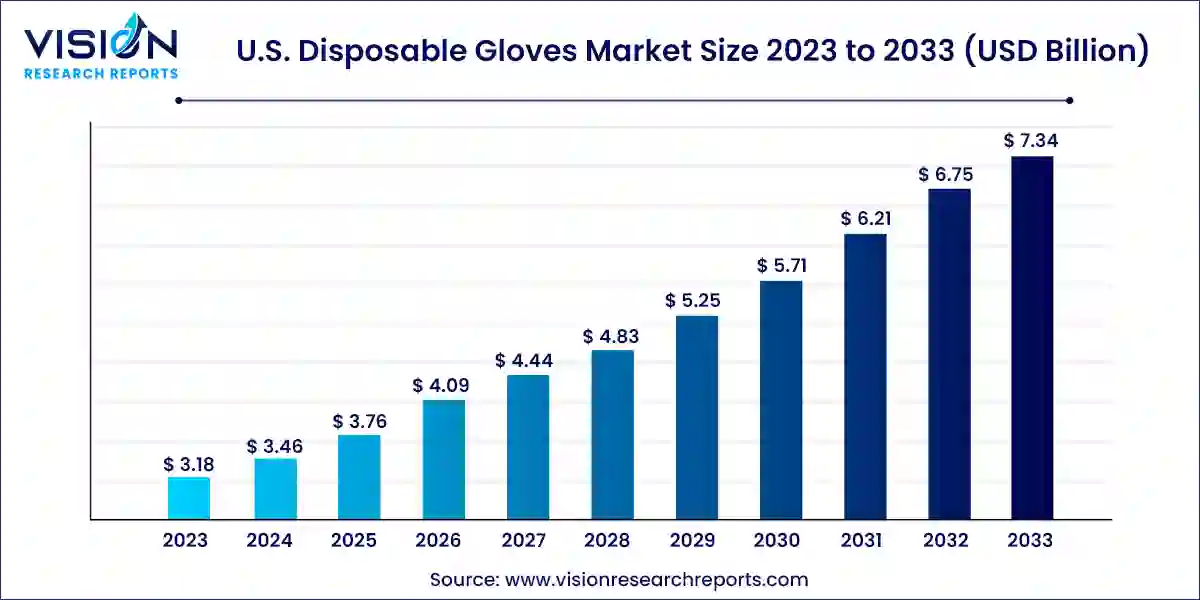

The U.S. disposable gloves market was estimated at USD 3.18 billion in 2023 and it is expected to surpass around USD 7.34 billion by 2033, poised to grow at a CAGR of 8.72% from 2024 to 2033.

The U.S. disposable gloves market is experiencing significant growth driven by increasing concerns regarding hygiene and safety across various industries such as healthcare, food service, and manufacturing. The demand surge is particularly pronounced in the healthcare sector due to the ongoing COVID-19 pandemic, where the emphasis on infection prevention measures has propelled the adoption of disposable gloves. Additionally, stringent regulations regarding workplace safety and hygiene standards further contribute to market expansion. As a result, manufacturers are innovating to meet evolving consumer needs, thereby fostering a competitive landscape within the U.S. disposable gloves market.

The growth of the U.S. disposable gloves market is influenced by the heightened awareness of hygiene and safety standards across various sectors such as healthcare, food service, and manufacturing drives the demand for disposable gloves. Secondly, the COVID-19 pandemic has significantly accelerated this demand, particularly in the healthcare sector, where stringent infection prevention measures have become paramount. Additionally, government regulations mandating workplace safety and hygiene standards further fuel market growth. Moreover, continuous innovations by manufacturers to enhance product quality and meet evolving consumer needs contribute to the expansion of the U.S. disposable gloves market.

In 2023, the powdered free lubricant segment emerged as the dominant force in the market, capturing an impressive 81% of the market share. This growth is primarily fueled by the escalating demand for powder-free gloves across diverse industries such as food processing, chemicals, and healthcare. Additionally, stringent regulations imposed on powdered gloves by numerous countries globally during the forecast period are expected to further bolster the market for powder-free gloves. Chlorination treatment of gloves, eliminating the need for powder, results in a less snug fit, facilitating easy donning and doffing. The projected surge in demand for powder-free gloves across sectors like food processing, medical, and chemicals is poised to drive market growth.

The Powdered segment maintained a substantial market share in 2023, owing to its ability to conform closely and provide protection against hazardous chemicals or physical contaminants. However, the use of cornstarch powder in latex gloves may exacerbate allergies or sensitivities, which is not a concern with vinyl or nitrile gloves.

In 2023, the healthcare segment emerged as the market leader in terms of revenue share. This growth is attributed to heightened awareness regarding cleanliness and infection prevention, especially during global health crises like the COVID-19 pandemic. Stringent regulations and standards for hygiene and safety in healthcare facilities further bolster market expansion. Moreover, the aging population and increasing prevalence of chronic diseases necessitate more frequent use of disposable gloves in medical procedures, driving market growth.

The food segment also commanded a significant revenue share in 2023, fueled by the nation's growing reliance on convenience and ready-to-eat foods. Additionally, the segment is witnessing accelerated growth due to the rise of takeout and delivery services, further expanding its reach.

The manufacturing segment experienced notable growth in 2023, attributed to increased adoption of automation and technological advancements, necessitating glove usage when handling delicate components and equipment. Furthermore, the disposable gloves market is driven by heightened focus on hygienic practices and cleanliness in production facilities.

In 2023, the natural rubber segment held the largest market share. This growth is driven by the escalating demand for disposable natural rubber gloves across various settings, including medical, surgical, and laboratory applications. Latex rubber gloves, renowned for their elasticity and chemical resistance, are increasingly favored in the disposable gloves market, particularly in industries dealing with chemicals, oil and gas, food processing, medical, and healthcare.

The nitrile gloves segment also captured a significant market share in 2023, primarily due to increased usage across chemical, painting, dental, laboratory, and oil industries. Offering advantages such as longer shelf life, reduced friction, and puncture resistance compared to latex gloves, nitrile gloves are projected to witness sustained demand throughout the forecast period, driven by the increasing emphasis on infection control and the prevalence of pandemic diseases like COVID-19 and swine flu (H1N1).

The Vinyl segment experienced substantial growth in 2023, driven by rising demand for FDA-certified and antimicrobial gloves. Composed of plasticizers and polyvinyl chloride, vinyl disposable gloves offer a latex-free alternative at a more affordable price point. Particularly prominent in food processing, medical, and healthcare industries due to their low cost and chemical resistance, vinyl gloves are favored for their comfort and touch sensitivity compared to neoprene gloves.

By Material

By Lubricant

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Material Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Disposable Gloves Market

5.1. COVID-19 Landscape: U.S. Disposable Gloves Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Disposable Gloves Market, By Material

8.1. U.S. Disposable Gloves Market, by Material, 2024-2033

8.1.1 Natural

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Nitrile

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Vinyl

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Neoprene

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Polyethylene

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Disposable Gloves Market, By Lubricant

9.1. U.S. Disposable Gloves Market, by Lubricant, 2024-2033

9.1.1. Powdered

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Powder Free

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Disposable Gloves Market, By End-use

10.1. U.S. Disposable Gloves Market, by End-use, 2024-2033

10.1.1. Construction

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Manufacturing

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Oil & Gas

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Chemicals

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Food

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Pharmaceuticals

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Healthcare

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Transportation

10.1.8.1. Market Revenue and Forecast (2021-2033)

10.1.9. Mining

10.1.9.1. Market Revenue and Forecast (2021-2033)

10.1.10. Others

10.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Disposable Gloves Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Material (2021-2033)

11.1.2. Market Revenue and Forecast, by Lubricant (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Adenna LLC.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. MCR Safety.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Atlantic Safety Products, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Ammex Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Kimberly-Clark Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sempermed USA, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Halyard Health, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Medline Industries

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Renco Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. 3M

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others