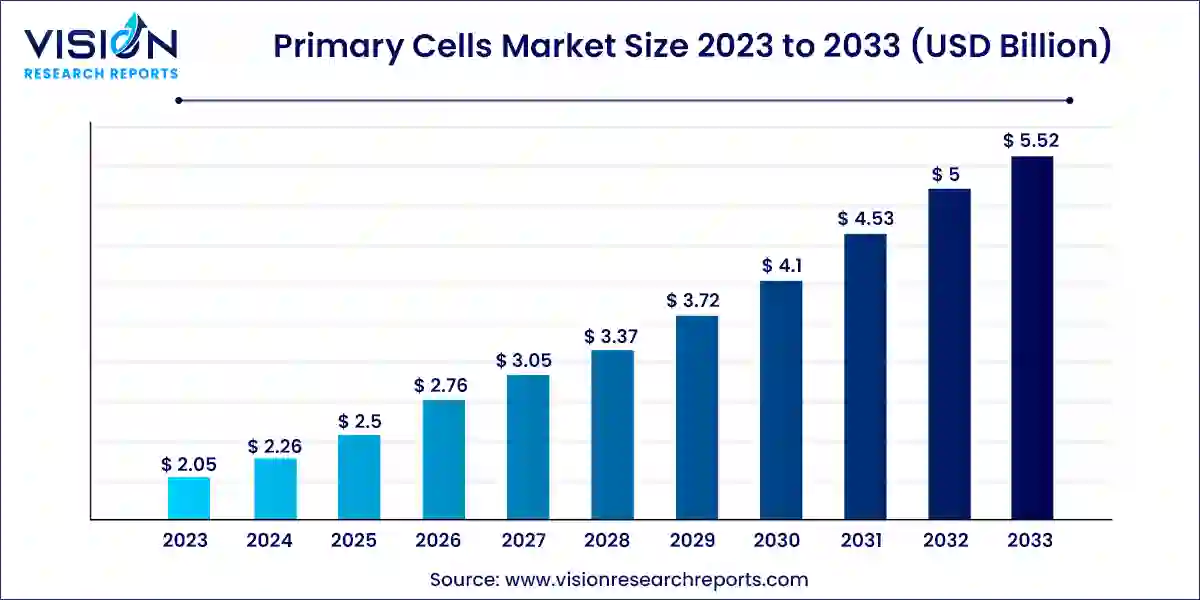

The global primary cells market size was estimated at around USD 2.05 billion in 2023 and it is projected to hit around USD 5.52 billion by 2033, growing at a CAGR of 10.42% from 2024 to 2033.

The primary cells market is experiencing significant growth driven by an increasing demand for personalized medicine and advanced research in cell biology and regenerative medicine. Primary cells, which are directly isolated from human or animal tissues, offer more accurate biological responses compared to immortalized cell lines, making them invaluable for drug discovery, toxicity testing, and cancer research. The market is bolstered by advancements in cell isolation and culture technologies, rising investments in biopharmaceutical research, and the expanding focus on developing novel therapies.

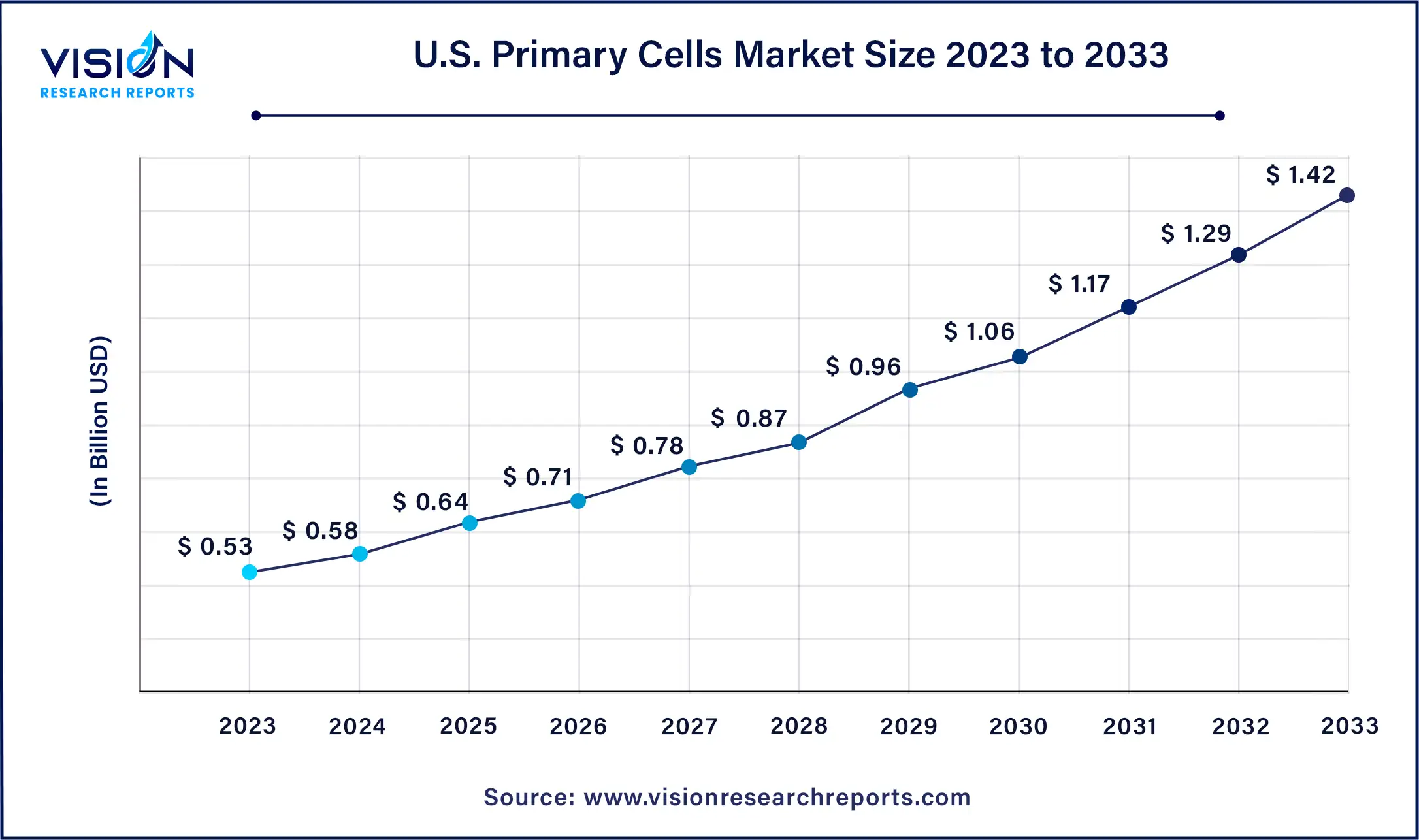

The U.S. primary cells market size was estimated at USD 0.53 billion in 2023 and is expected to surpass around USD 1.42 billion by 2033, poised to grow at a CAGR of 10.42% from 2024 to 2033.

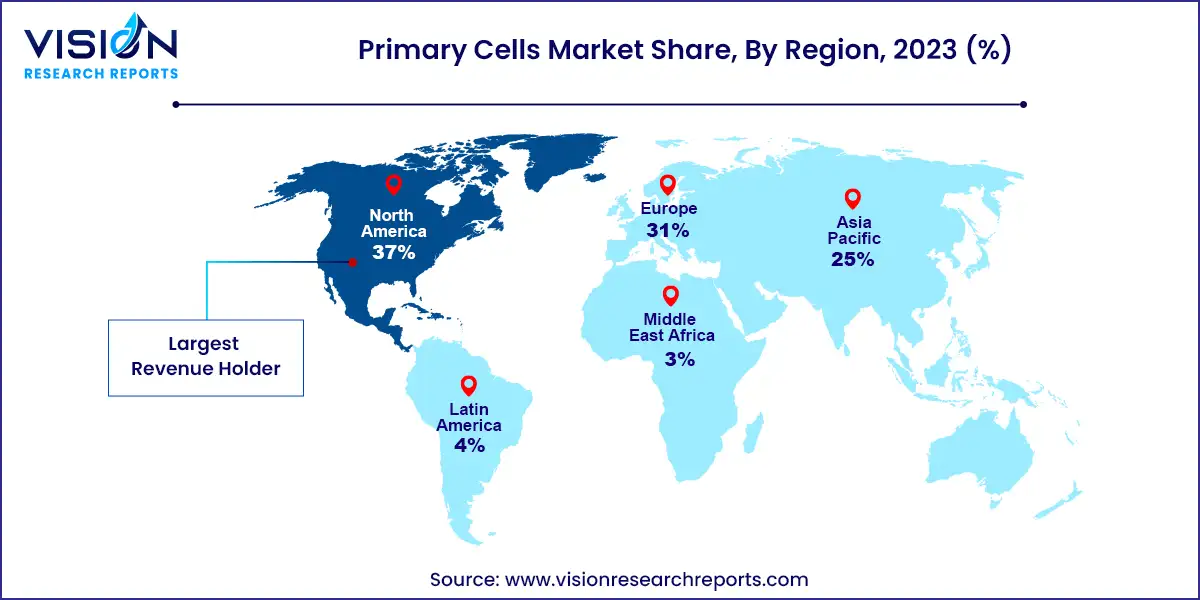

North America dominated the market with a 37% share in 2023 due to growing investments in cancer research and development. With numerous biotechnology and pharmaceutical companies in the region working on developing new therapies for cancer and chronic diseases, North America is expected to maintain its dominance over the forecast period.

The Asia Pacific region is anticipated to witness the fastest growth at a CAGR of 12.53% from 2024 to 2033. This growth is driven by increasing investments in healthcare infrastructure, rising cancer cases, and a growing focus on R&D activities related to cancer treatments and therapies.

The growth of the primary cells market is driven by several key factors, including the rising prevalence of chronic diseases, which necessitates advanced research for effective treatments. Additionally, the surge in personalized medicine emphasizes the need for biologically relevant cell models. Technological advancements in cell isolation and culture techniques have also made primary cells more accessible and viable for research purposes. Increased funding and investments in biopharmaceutical research further support market expansion. Moreover, the growing focus on regenerative medicine and the development of novel therapies are propelling the demand for primary cells, underscoring their critical role in modern medical research and development.

The human primary cells segment led the market with a 64% share in 2023. These cells are crucial for research and development (R&D) because they closely mimic the physiological state of cells in vivo, providing more biologically relevant data than immortalized cell lines. Their use in cell culture systems significantly enhances the physiological relevance of the generated data, enabling researchers to obtain insights that align more closely with in vivo outcomes. This segment is expected to grow at the fastest compound annual growth rate (CAGR) over the forecast period. Compared to immortalized cell lines, primary cells offer several advantages, such as maintaining key aspects of their tissue origin, representing donor variability, and generating predictive data.

Additionally, animal cells are essential for studying various biological processes and diseases in vitro. Primary cultures derived from animal tissues closely replicate the physiological state of cells in vivo, providing valuable insights into cellular functions. Animal primary cells are beneficial for physiological relevance, disease modeling, and research applications, and are widely used in fields such as cancer biology, drug development, toxicology studies, and regenerative medicine.

The pharmaceuticals and biotechnology companies segment experienced significant revenue growth in 2023. Primary cells are vital tools for these companies in drug discovery, disease modeling, toxicology studies, high-throughput screening projects, and personalized medicine initiatives. For example, in April 2023, AnaBios Corporation acquired Cell Systems, a leading U.S.-based human primary cell and cell culture media company. This acquisition is expected to significantly enhance AnaBios' portfolio of human tissues and cells, providing scientists with a broad array of biologically relevant tools to expedite drug discovery and deepen their understanding of cell biology.

Primary cells are also used to screen compounds for efficacy and safety profiles before clinical trials, and to assess new drugs' safety profiles by studying their effects on human tissues without solely relying on animal models. Their physiological relevance helps identify potential drug candidates with higher success rates.

The academic and research institutes segment is anticipated to grow at the fastest CAGR over the forecast period. In these settings, primary cells are essential for advancing scientific knowledge and understanding various biological processes. They offer a more accurate representation of in vivo cellular behavior than immortalized cell lines. These freshly isolated cells maintain their physiological properties and closely mimic the tissue microenvironment, providing valuable insights into cell function, disease mechanisms, drug responses, and therapeutic development.

The hematopoietic cells segment held the largest market share of 26% in 2023, due to their importance in regenerative medicine research and development. These multipotent primitive cells can develop into all types of blood cells, including myeloid and lymphoid lineage cells. Researchers are actively exploring the use of adult-derived hematopoietic stem cells (HSCs) in clinical and basic science applications due to their diverse feasibility and significance in stem cell biology. HSCs and their derived progenitors are crucial in regenerative medicine, offering potential treatments for various conditions, including non-hematopoietic tissue regeneration and blood disorders. Their ability to differentiate into diverse progenitors makes them valuable for developing effective therapeutic strategies.

The skeletal and muscle cells segment is expected to grow at the fastest CAGR over the forecast period due to their use in studying satellite cell function and regeneration mechanisms as potential therapeutic targets for muscular dystrophies. Researchers from King's College London and University College London recently published findings on a novel tool that uses images to identify optimal cells for implantation, potentially aiding in repairing damaged and diseased muscles.

The cancer research segment led the market with a 38% share in 2023. Primary cells are significant in oncology R&D due to their physiological relevance, genetic diversity, and representation of the tumor microenvironment, offering more accurate and reliable results than cell lines. This allows researchers to study disease mechanisms and drug responses and develop targeted therapies for various cancers. The advantages of primary human cells, such as their ability to closely represent signaling in vivo, make them essential in oncology research.

The regenerative medicine segment is expected to grow at the fastest CAGR over the forecast period. Human primary cells play a substantial role in regenerative medicine due to their ability to closely mimic the in vivo biology of cells. Isolated directly from human tissues, these cells provide a more reliable and relevant representation of human biology compared to immortalized cell lines. In October 2020, Astellas Pharma, a Japanese pharmaceutical company, opened its $120 million expanded Astellas Institute for Regenerative Medicine (AIRM) facility in Westborough, Massachusetts.

By Origin

By Type

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Primary Cells Market

5.1. COVID-19 Landscape: Primary Cells Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Primary Cells Market, By Origin

8.1. Primary Cells Market, by Origin, 2024-2033

8.1.1. Human Primary Cells

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Animal Primary Cells

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Primary Cells Market, By Type

9.1. Primary Cells Market, by Type, 2024-2033

9.1.1. Hematopoietic Cells

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Skin Cells

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Hepatocytes

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Gastrointestinal Cells

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Lung Cells

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Renal Cells

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Heart Cells

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Skeletal and Muscle Cells

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Other Primary Cells

9.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Primary Cells Market, By Application

10.1. Primary Cells Market, by Application, 2024-2033

10.1.1. Drug Discovery and Development

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Regenerative Medicine

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cancer Research

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Primary Cells Market, By End-use

11.1. Primary Cells Market, by End-use, 2024-2033

11.1.1. Pharmaceuticals & Biotechnology Companies

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Academic & Research Institutes

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. CROs

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Primary Cells Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Origin (2021-2033)

12.1.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Origin (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Origin (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Origin (2021-2033)

12.2.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Origin (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Origin (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Origin (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Origin (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Origin (2021-2033)

12.3.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Origin (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Origin (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Origin (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Origin (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Origin (2021-2033)

12.4.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Origin (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Origin (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Origin (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Origin (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Origin (2021-2033)

12.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Origin (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Origin (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Merck KGaA

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Lonza

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Cell Biologics, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. PromoCell

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. ZenBio

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. STEMCELL Technologies

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. AllCells

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. American Type Culture Collection

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Axol Biosciences Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others