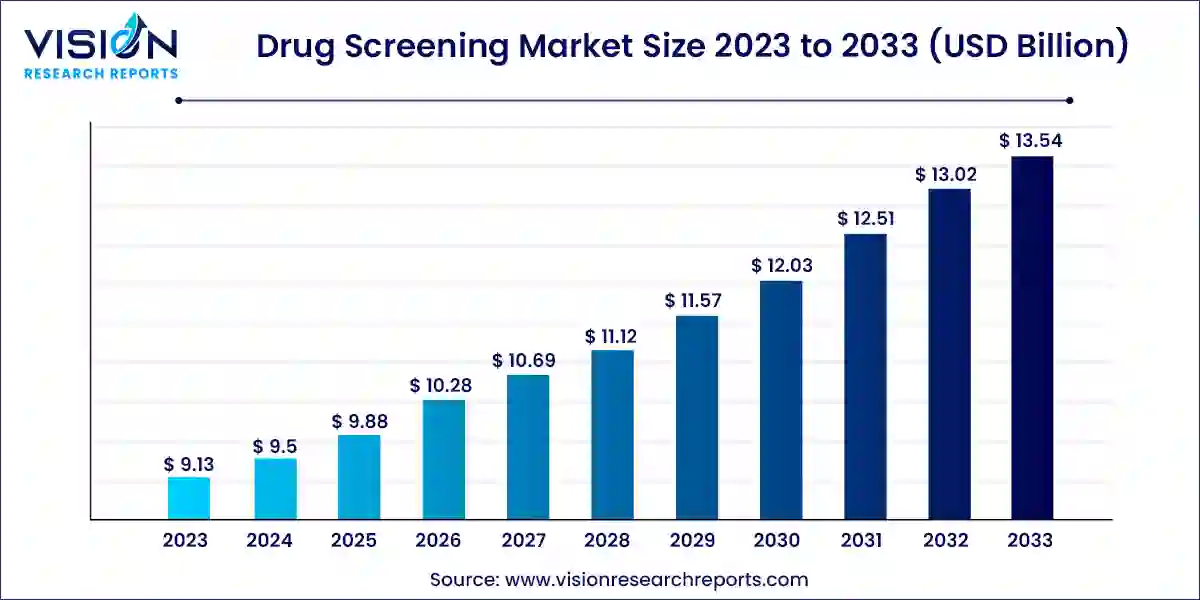

The global drug screening market size was valued at USD 9.13 billion in 2023 and it is predicted to surpass around USD 13.54 billion by 2033 with a CAGR of 4.02% from 2024 to 2033.

The drug screening market has been experiencing substantial growth due to the increasing need for drug testing across various sectors. This market encompasses a range of products and services designed to detect drug use, from laboratory-based testing to rapid on-site tests. The primary drivers include stringent government regulations, rising drug abuse, and the increasing adoption of drug screening in workplaces, educational institutions, and law enforcement agencies.

The growth of the drug screening market is driven by the stringent government regulations mandating drug testing in workplaces, educational institutions, and law enforcement agencies play a crucial role in expanding market demand. The rising prevalence of drug abuse globally necessitates frequent and comprehensive screening, further boosting market growth. Technological advancements in testing methodologies, such as rapid testing devices and advanced analytical instruments, enhance accuracy and efficiency, contributing to market expansion. Additionally, increasing awareness about the importance of maintaining drug-free environments drives the adoption of drug screening services across various sectors, underscoring the market's steady growth trajectory.

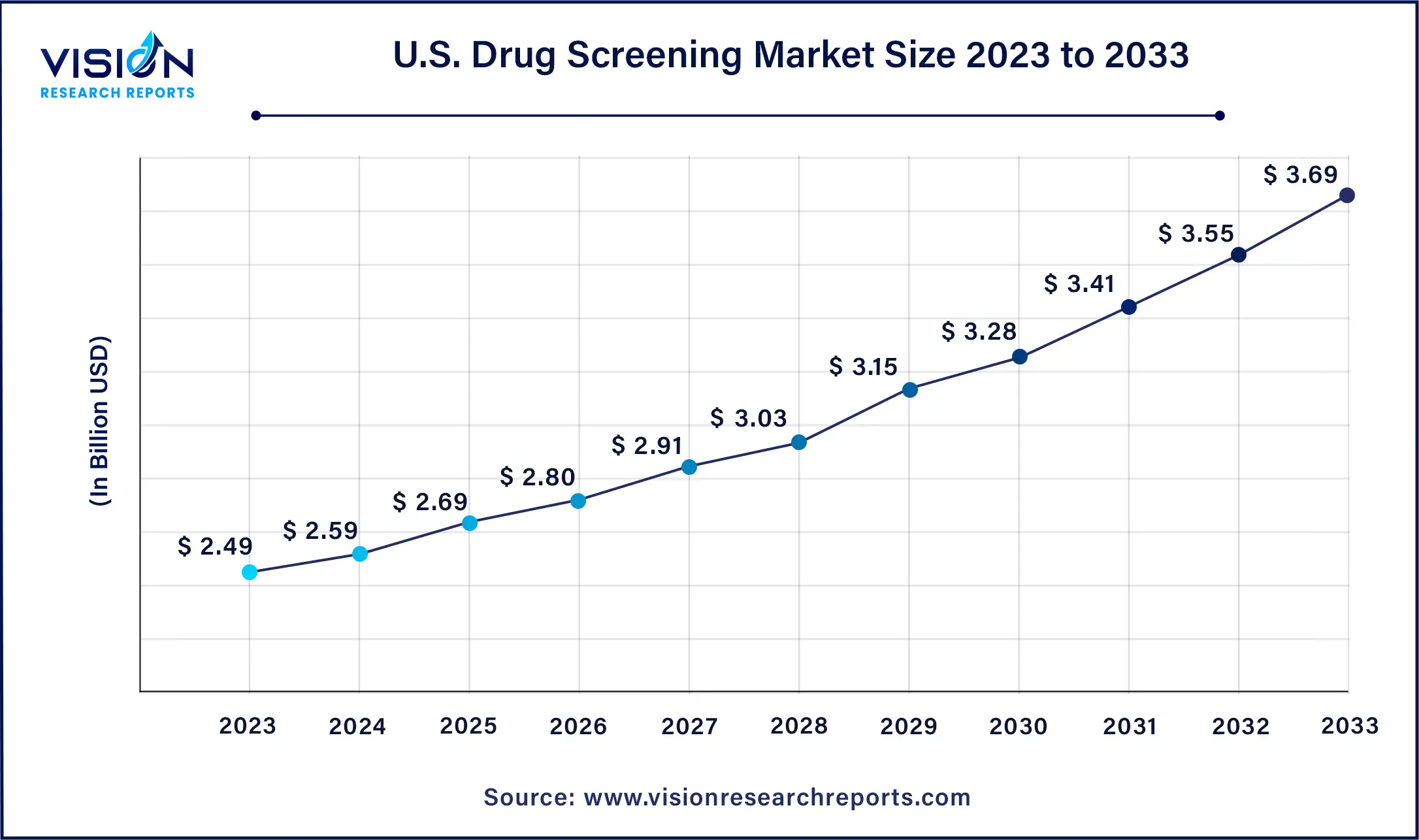

The U.S. drug screening market size was estimated at around USD 2.49 billion in 2023 and it is projected to hit around USD 3.69 billion by 2033, growing at a CAGR of 4.02% from 2024 to 2033.

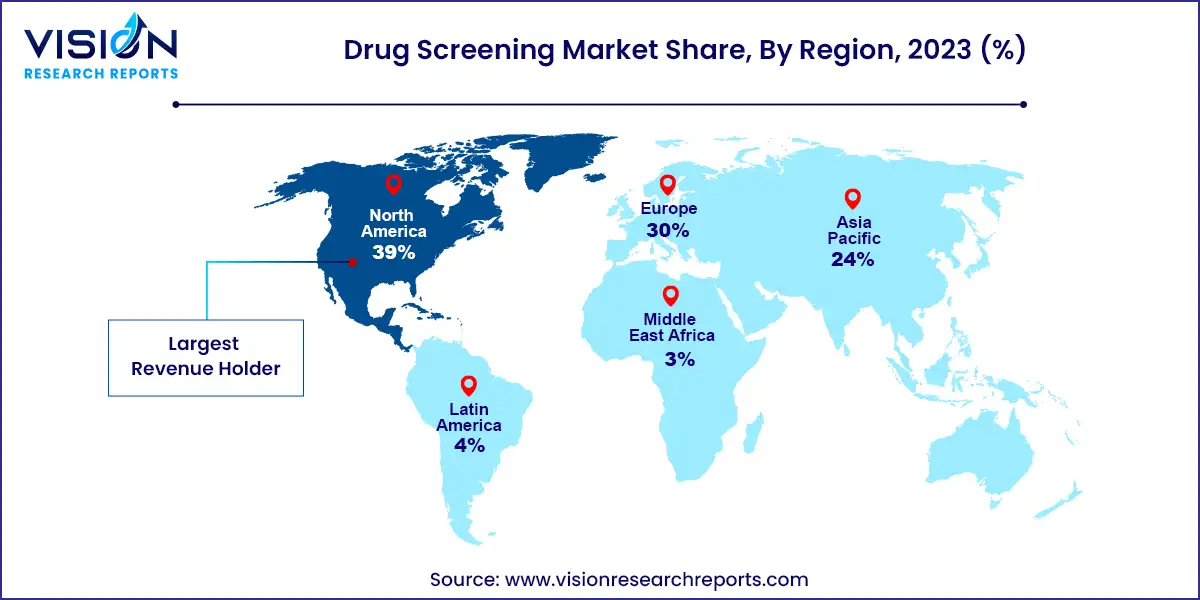

North America drug screening market accounted for a 39% share in 2023. The region's proactive measures against opioid overdose deaths underscore the critical need for robust screening measures, supporting North America's dominant position in the market.

Anticipated to witness the fastest growth, Asia Pacific benefits from a large target population, expanding healthcare infrastructure, and increasing investment in research and development. Rising chronic disease prevalence and outsourcing trends in drug discovery services further boost demand, positioning the region as a key growth frontier in the global drug screening market.

Consumables led the market in 2023, accounting for 35% of global revenue and projected to grow at the fastest CAGR over the forecast period. This dominance is attributed to the critical role consumables play in on-site illicit substance testing. Items like assay kits, sample collection devices, and calibrators & controls are essential due to their one-time use nature, ensuring reliable testing practices. Additionally, immunoassay analyzers, often used alongside consumables, offer quick and cost-effective sample screening across various matrices, further bolstering this segment's significance in the market. The continual introduction of new products, such as Sysmex's assay kits for measuring amyloid beta (Aβ) levels, reflects ongoing innovation driving growth in this segment.

Holding the second-largest market share in 2023, services and others encompass vital roles in substance screening processes. This segment includes drug testing laboratories, screening services, and analytical instruments essential for accurate and efficient testing. The growth is fueled by increasing demand for reliable screening measures amidst rising substance abuse issues. The emphasis on comprehensive services and innovative technologies underscores its pivotal role in addressing evolving challenges in drug testing across diverse industries and end-users.

Drug treatment centers led the market with a market share of 27% in 2023. These centers play a crucial role in comprehensive patient care, emphasizing the importance of monitoring and managing substance use disorders effectively. The segment's growth is propelled by the rising prevalence of drug addiction and the imperative for stringent monitoring protocols within treatment facilities.

Projected to witness the fastest growth rate, pain management centers cater to the increasing demand for specialized pain relief services globally. These centers require efficient drug screening protocols to ensure safe and effective treatment strategies for chronic pain conditions. Supported by key players and technological advancements, this segment is poised for substantial growth through strategic initiatives and innovative solutions.

Urine Samples led the market with a market share of 42% in 2023. The longer detection window further enhances their utility in monitoring patients undergoing long-term opioid therapy, driving segment growth. Cost-effectiveness compared to alternative methods like hair testing reinforces urine samples as a preferred choice in comprehensive drug screening programs.

Holding the second-largest market share, oral fluid samples offer convenience and rapid detection capabilities, making them increasingly preferred in drug testing. Their ease of collection and less invasive nature align with stringent regulatory requirements for substance testing, contributing to sustained market dominance amidst growing demand for efficient testing methods.

By Product Type

By Technology

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Drug Screening Market

5.1. COVID-19 Landscape: Drug Screening Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Drug Screening Market, By Product Type

8.1. Drug Screening Market, by Product Type, 2024-2033

8.1.1 Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Rapid Testing Devices

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Consumables

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Services and Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Drug Screening Market, By Technology

9.1. Drug Screening Market, by Technology, 2024-2033

9.1.1. Urine Samples

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Breath Samples

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Oral Fluid Samples

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Hair Samples

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Other Samples

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Drug Screening Market, By End-use

10.1. Drug Screening Market, by End-use, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Criminal Justice & Law Enforcement Agencies

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Workplaces

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Drug Treatment Centers

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Individual Users

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Pain Management Centers

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Schools & Colleges

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Drug Screening Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Abbott.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Quest Diagnostics Incorporated.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. F. Hoffmann-La Roche Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Thermo Fisher Scientific Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Siemens Healthcare AG.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Laboratory Corporation of America Holdings

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Alfa Scientific Designs, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. OraSure Technologies, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Omega Laboratories, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Drägerwerk AG & Co. KGaA

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others