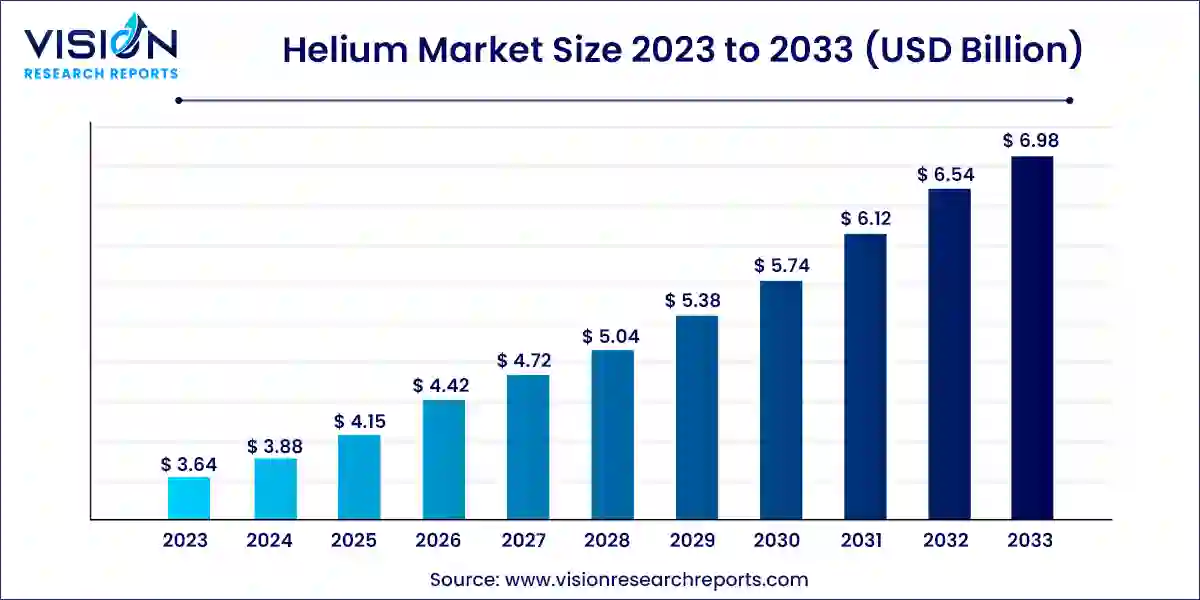

The global helium market size was estimated at around USD 3.64 billion in 2023 and it is projected to hit around USD 6.98 billion by 2033, growing at a CAGR of 6.72% from 2024 to 2033.

The helium market is characterized by its crucial role in various industries such as healthcare, electronics, and aerospace due to its unique properties, including its low boiling point and inertness. With increasing applications in MRI scanners, semiconductor manufacturing, and scientific research, the demand for helium continues to grow globally. However, its limited natural reserves and challenges in extraction and storage pose significant supply chain concerns, influencing market dynamics and pricing trends. As industries innovate and adapt to helium scarcity, strategic planning and technological advancements will be key in ensuring sustainable supply and meeting diverse market demands.

The helium market is experiencing growth driven by the significant factor is the increasing demand from the healthcare sector, particularly for MRI scanners where helium is essential for cooling superconducting magnets. The semiconductor industry also contributes to the market growth due to helium's role in the manufacturing process of semiconductors, which are crucial components in electronics. Additionally, helium is used in aerospace applications, such as rocket propulsion and pressurizing systems, further boosting demand. As industries continue to innovate and expand, particularly in emerging economies, the demand for helium is expected to rise steadily, driving market growth in the coming years.

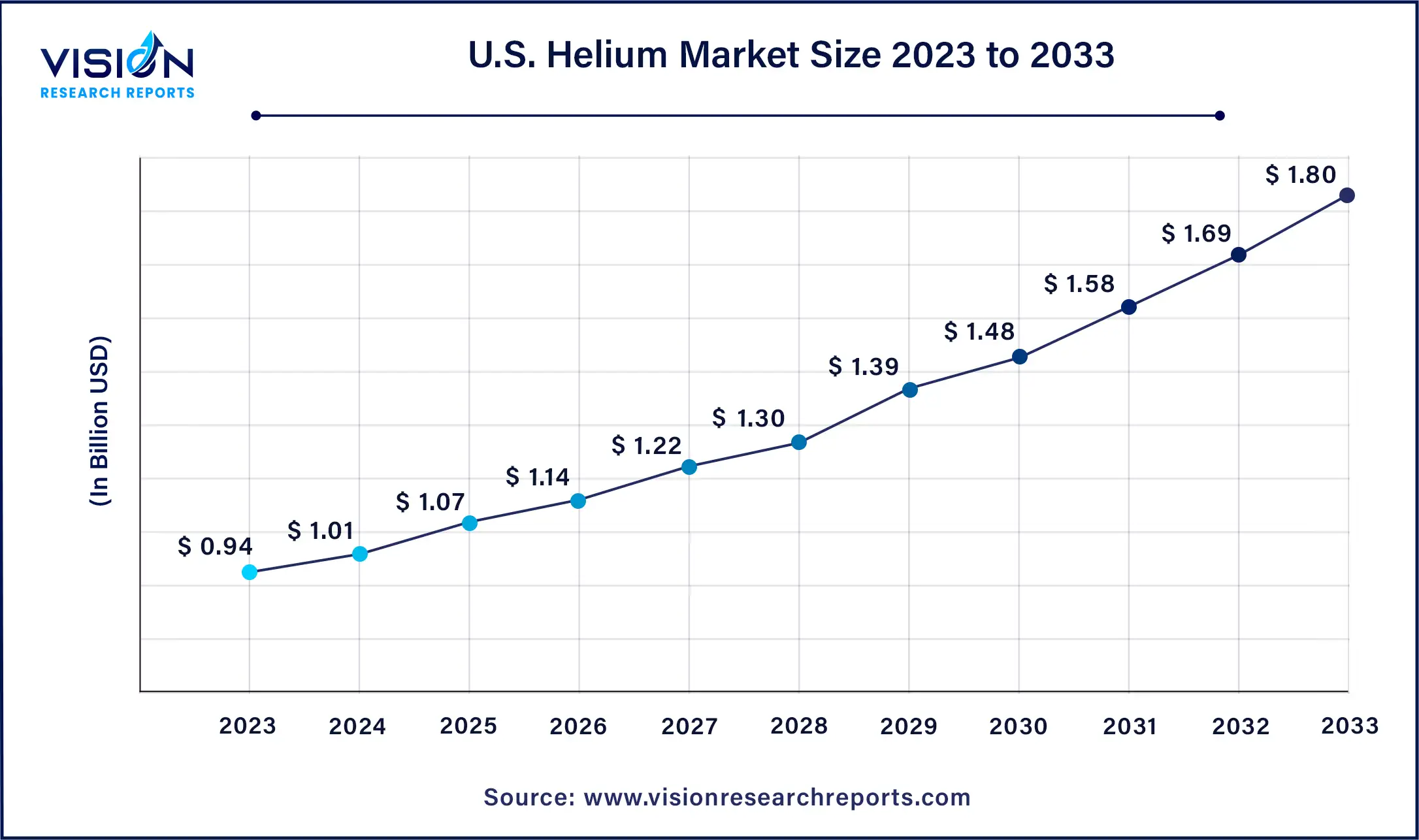

The U.S. Helium market size was estimated at around USD 0.94 billion in 2023 and it is projected to hit around USD 1.80 billion by 2033, growing at a CAGR of 6.72% from 2024 to 2033.

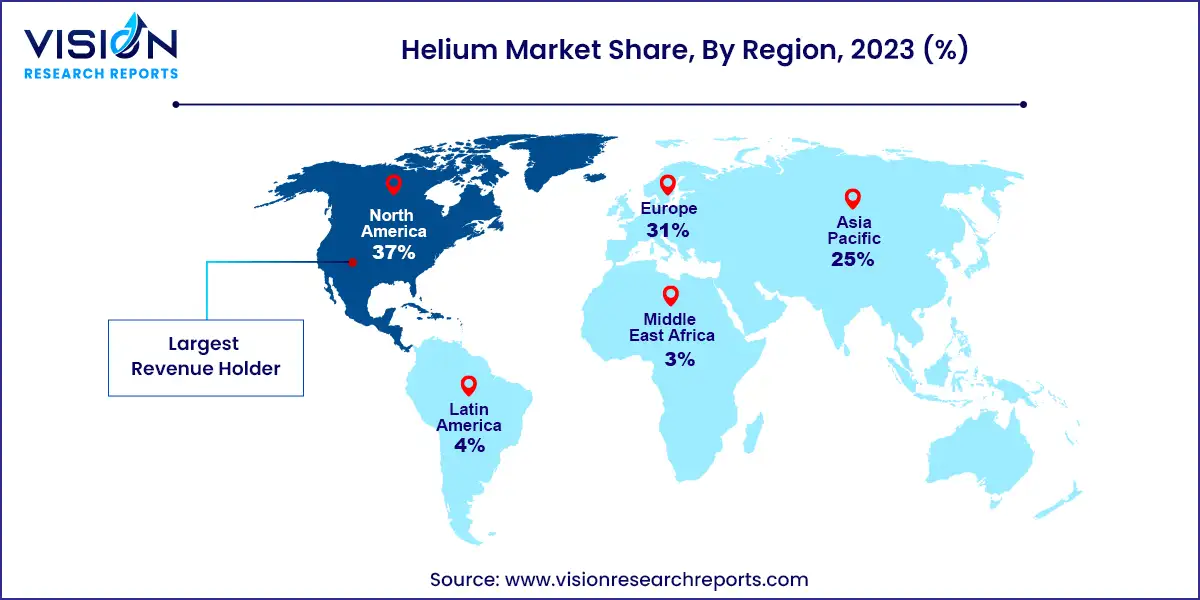

North America led the global market in 2023 with a dominant revenue share of 37%, owing to abundant reserves of helium-rich natural gas. The United States hosts the Federal Helium Reserve, established in 1925, which is one of the world's largest helium storage facilities and significantly contributes to global helium supply across various industries. Europe also commands a substantial share in both production and consumption, particularly in healthcare where helium is critical for MRI scanners in medical imaging.

Asia Pacific, driven by leading nations like China, Japan, South Korea, and Taiwan, serves as a major hub for electronics production. Helium plays a pivotal role in semiconductor manufacturing, electronics R&D, and production, bolstered by rising demand for consumer electronics and technological advancements in the region

The medical and healthcare sector held a significant revenue share of 41% in 2023, driven by its extensive application in various medical technologies. Helium is essential in MRI machines, endoscopy, laser technology, breathing mixtures, spectroscopy, and positron emission tomography (PET). Additionally, helium-filled aerostats, tethered balloons, and blimps are employed for surveillance and monitoring purposes, providing stable platforms for payloads like radar and cameras used in border security, military surveillance, and disaster management.

Moreover, helium finds crucial utility in spacecraft as a pressurant gas for propulsion systems and in cooling sensitive equipment in the extreme conditions of space. Its low boiling point and inert properties make it particularly advantageous in space applications. The nuclear power sector also shows increasing demand, especially in the development of next-generation nuclear reactors and advanced gas-cooled reactors, where its effectiveness as a coolant and compatibility with nuclear processes are pivotal. However, careful management of helium demand is essential even within this sector due to its limited supply. Efforts to secure helium resources and enhance its use in nuclear power remain high priorities.

In 2023, the gas phase dominated the global helium market with a substantial revenue share of approximately 73%. This dominance is attributed to helium's widespread adoption across various applications, including leak detection, gas chromatography, welding and cutting, cooling and refrigeration, and nuclear power. Helium gas is indispensable in scientific research across physics, chemistry, and materials science, facilitating cryogenic studies, low-temperature investigations, and serving as a carrier gas in numerous analytical instruments.

Cutting-edge technologies such as quantum computing and quantum communication heavily rely on superconducting components cooled by liquid helium, driving further demand growth. Despite its critical role and increasing demand, helium remains a finite resource with limited availability. Most global production stems from natural gas extraction, where helium is often a byproduct, and not all natural gas reservoirs contain helium. As existing helium reserves deplete and new sources remain challenging to discover, scarcity continues to fuel demand.

Cryogenics emerged as the largest application segment in 2023, holding a substantial revenue share of 24%. Helium's unique ability to achieve and maintain extremely low temperatures is indispensable for scientific experiments, space exploration, and various industrial applications. It is crucial in cooling infrared detectors, scientific instruments on spacecraft, and maintaining temperatures necessary for semiconductor manufacturing processes like ion implantation and chemical vapor deposition.

Helium's inert and buoyant properties make it ideal for lifting applications in balloons and airships where safety is paramount, as it does not support combustion. Its role in semiconductor manufacturing ensures stable temperatures essential for precision and quality in semiconductor device production.

By Phase

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Phase Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Helium Market

5.1. COVID-19 Landscape: Helium Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Helium Market, By Phase

8.1. Helium Market, by Phase, 2024-2033

8.1.1 Gas

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Liquid

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Helium Market, By Application

9.1. Helium Market, by Application, 2024-2033

9.1.1. Breathing Mixes

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cryogenics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Leak Detection

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Pressurizing & Puring

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Welding

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Controlled Atmosphere

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Other Applications

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Helium Market, By End-use

10.1. Helium Market, by End-use, 2024-2033

10.1.1. Aerospace & Defense

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Medical & Healthcare

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Electronics & Electrical

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Nuclear Power

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Metal Fabrication

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Other End-uses

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Helium Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Phase (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Phase (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Phase (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Phase (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Phase (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Phase (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Phase (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Phase (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Phase (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Phase (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Phase (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Phase (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Phase (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Phase (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Phase (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Phase (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Phase (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Phase (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Phase (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Phase (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Phase (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Air Products and Chemicals, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Linde Plc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Air Liquide.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Messer Group.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Taiyo Nippon Sanso India.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. MESA Specialty Gases & Equipment

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Matheson Tri-Gas Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Iwatani Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Gazprom PJSC.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Gulf Cryo S.A.L.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others