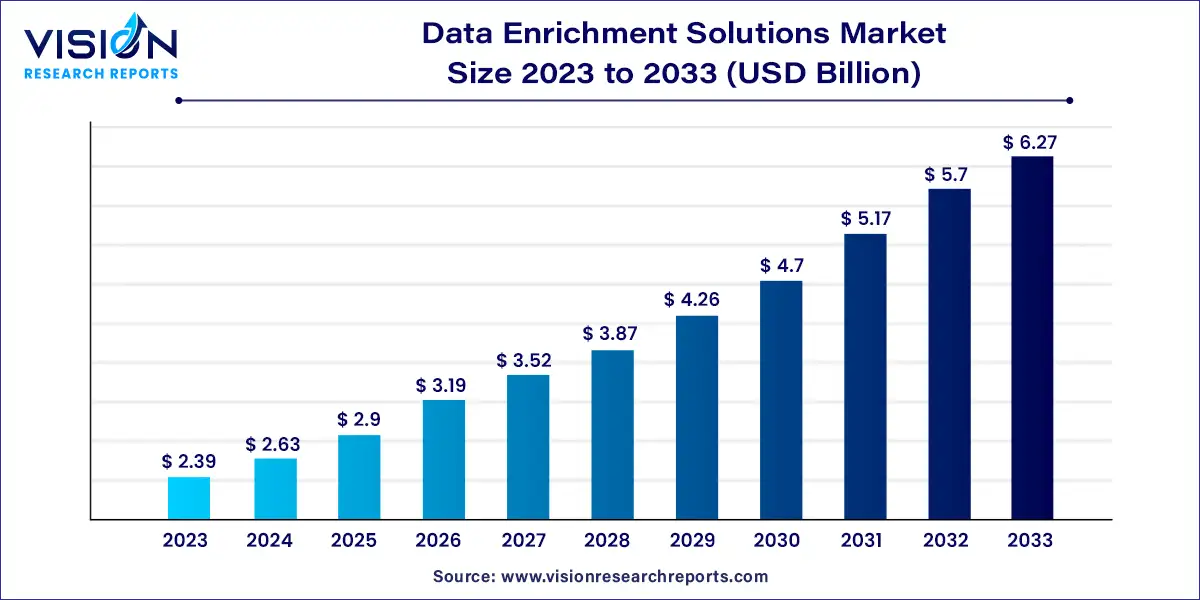

The global data enrichment solutions market size was estimated at around USD 2.39 billion in 2023 and it is projected to hit around USD 6.27 billion by 2033, growing at a CAGR of 10.13% from 2024 to 2033.

The data enrichment solutions market is rapidly expanding, driven by the increasing need for businesses to enhance their raw data with contextual information to gain valuable insights. These solutions integrate additional data sources, such as social media, geolocation, and behavioral data, to provide a more comprehensive view of customer profiles, market trends, and operational efficiencies. The market is characterized by advancements in AI and machine learning, enabling more sophisticated data analysis and real-time enrichment

The growth of the data enrichment solutions market is driven by the exponential growth in data volume generated across industries necessitates robust solutions to enhance data quality and relevance. Businesses are increasingly recognizing the importance of enriched data for gaining deeper insights and making informed decisions. Moreover, advancements in technologies such as artificial intelligence and machine learning play a pivotal role in automating and optimizing the data enrichment process, thereby reducing manual efforts and improving efficiency. Additionally, the rising adoption of data-driven strategies across sectors like retail, healthcare, and finance further fuels the demand for these solutions. As organizations strive to personalize customer experiences and streamline operations, the need for accurate and enriched data becomes indispensable.

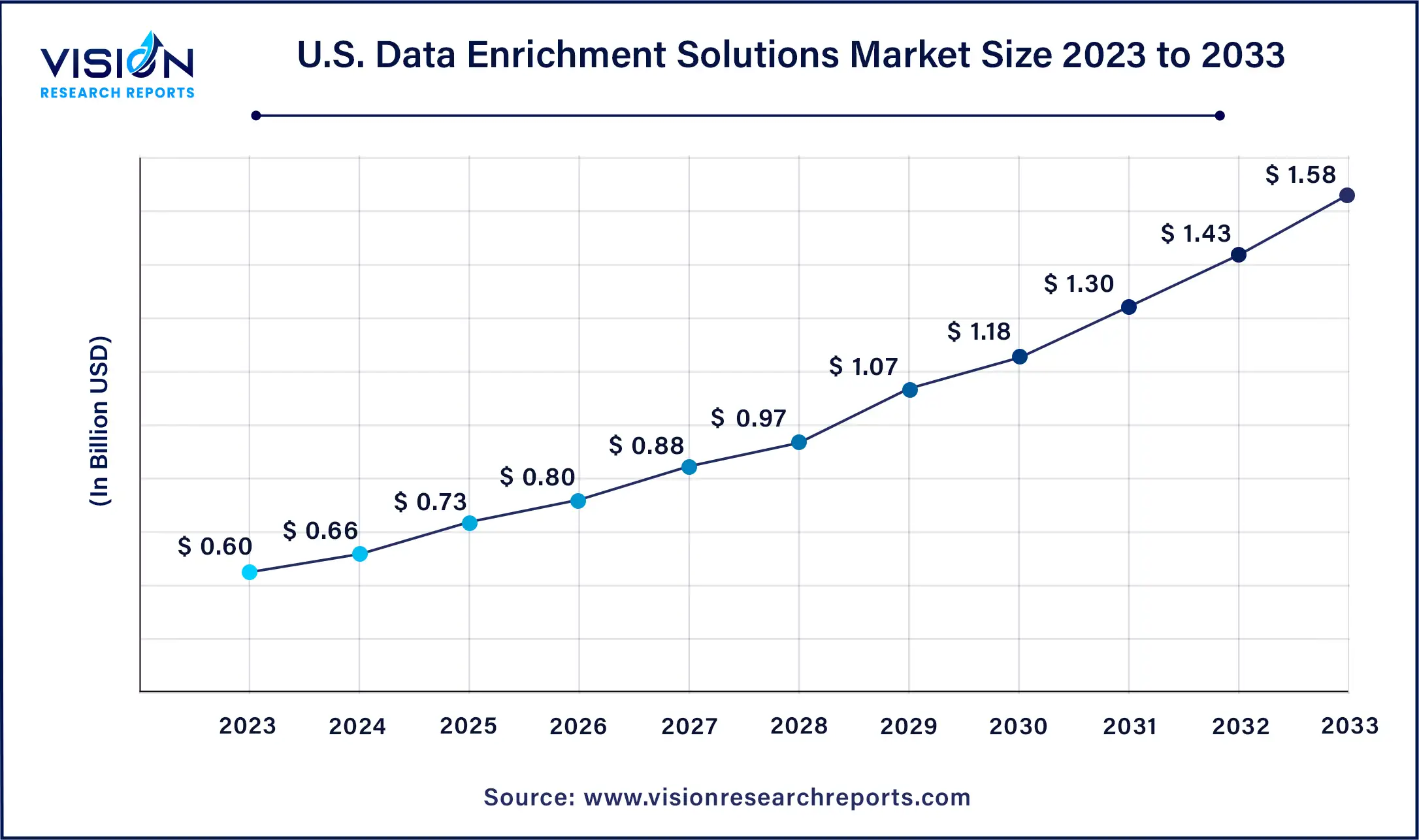

The U.S. data enrichment solutions market size was estimated at USD 0.60 billion in 2023 and it is expected to surpass around USD 1.58 billion by 2033, poised to grow at a CAGR of 10.16% from 2024 to 2033.

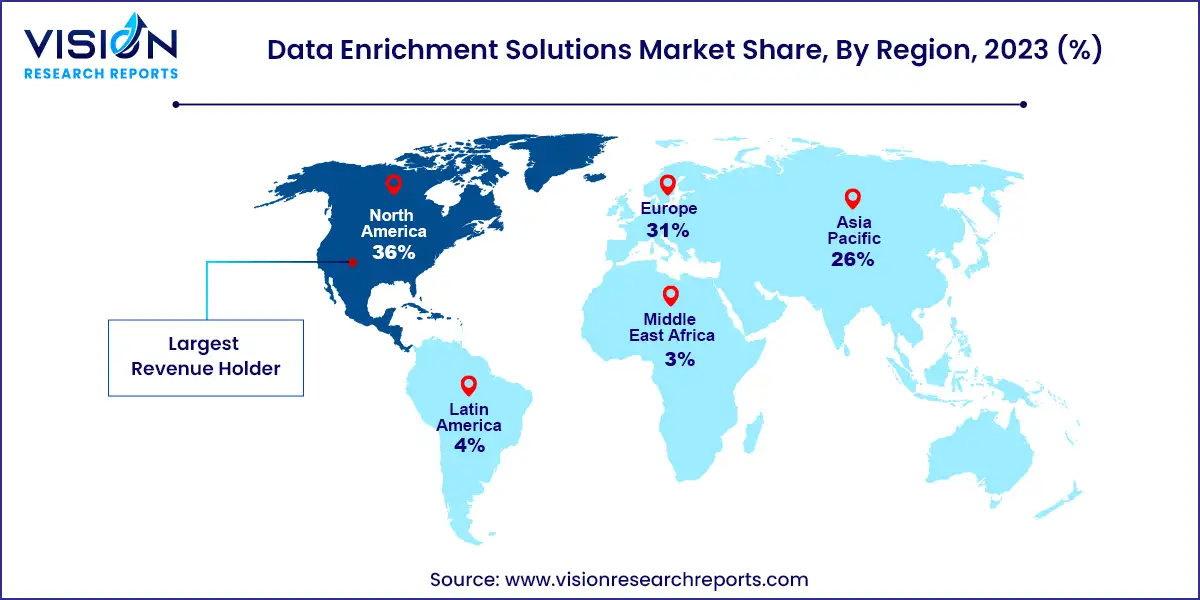

North America held the largest market share for data enrichment solutions in 2023, accounting for 36% of revenue. The region's leadership is driven by factors such as cloud adoption, a strong tech presence, data-driven decision-making, and a supportive regulatory landscape. This dominance is expected to continue, fueled by the increasing volume of data and the critical need to extract valuable insights. However, a growing emphasis on privacy compliance, driven by regulations like CCPA, is shaping the market. Data enrichment solutions are adapting by prioritizing features like data anonymization, user consent management, and data deletion capabilities.

The Asia Pacific market is expected to grow significantly, with a CAGR of 12.53% from 2024 to 2033. High mobile penetration and growing numbers of mobile internet users drive the demand for enriched data to personalize mobile marketing campaigns, leading to better customer engagement and conversions. According to the GSM Association, mobile connectivity is the predominant form of internet access in the Asia Pacific region, with over 1.2 billion mobile internet users by the end of 2021, representing approximately 45% of the population. Real-time insights are crucial for businesses to make agile decisions, and cloud-based solutions enable real-time data processing and enrichment, impacting fraud detection and dynamic e-commerce pricing.

In 2023, cloud data enrichment solutions dominated the market, holding a 57% share. The growth of these solutions is driven by their scalability and efficiency in managing large data volumes. Additionally, stricter data privacy regulations require compliant enrichment methods, which cloud solutions address through data anonymization, user consent management, and data deletion capabilities. The demand for real-time insights also fuels the adoption of cloud-based enrichment, enabling immediate data processing for fraud detection and personalized marketing applications.

The on-premises segment is projected to grow at a CAGR of 8.73% from 2024 to 2033. Organizations in security-sensitive sectors like finance or healthcare often prefer on-premise storage due to the greater control it offers over data privacy. Companies with substantial investments in existing IT infrastructure may be reluctant to migrate to the cloud due to cost concerns or potential disruptions, finding on-premise solutions to integrate seamlessly with their established environments.

In 2023, large enterprises held the largest market share. These organizations generate vast amounts of data, necessitating sophisticated enrichment solutions for actionable insights and strategic decision-making across various departments. Large enterprises also emphasize customer experience, driving the adoption of enrichment solutions for personalized marketing and enhanced customer service, which in turn boosts customer loyalty. Compliance with stringent data privacy regulations further increases the demand for solutions with robust data anonymization and user consent management.

SMEs are expected to grow significantly from 2024 to 2033. These enterprises invest in data enrichment tools to gain actionable insights, optimize marketing strategies, and improve customer engagement. Their agile nature allows for rapid adoption of innovative solutions, often leveraging cloud-based platforms for cost-effectiveness and scalability. Additionally, growing awareness of data privacy regulations prompts SMEs to seek compliant data enrichment services to ensure legal adherence.

In 2023, the IT & telecom segment held the largest market share. This industry leverages data enrichment solutions to enhance operations and customer experience. By enriching customer data with location and usage patterns, network optimization enables targeted upgrades and personalized service packages. Enriched data with financial details and device information supports robust fraud detection and risk management, protecting both the company and its customers. Additionally, data enrichment facilitates targeted marketing campaigns and upselling opportunities based on individual customer profiles, leading to increased customer satisfaction and revenue growth. Enriched customer data also empowers service representatives to resolve issues more efficiently, elevating customer service in the IT & telecom sector.

The healthcare segment is expected to grow significantly over the forecast period. Data enrichment solutions provide comprehensive insights for more accurate diagnoses and personalized treatment plans by integrating patient records with external data from clinical trials, medical journals, and genetic information. Beyond individual care, these solutions enable healthcare providers to identify at-risk populations by combining patient data with demographics, social determinants of health, and medical history. This facilitates targeted preventative measures and patient education to promote overall well-being.

By Deployment

By Enterprise Size

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Deployment Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Enrichment Solutions Market

5.1. COVID-19 Landscape: Data Enrichment Solutions Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Enrichment Solutions Market, By Deployment

8.1. Data Enrichment Solutions Market, by Deployment, 2024-2033

8.1.1 Cloud

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. On-premise

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Data Enrichment Solutions Market, By Enterprise Size

9.1. Data Enrichment Solutions Market, by Enterprise Size, 2024-2033

9.1.1. Large Enterprises

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. SMEs

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Data Enrichment Solutions Market, By End-use

10.1. Data Enrichment Solutions Market, by End-use, 2024-2033

10.1.1. BFSI

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Government

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Healthcare

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. IT & Telecom

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Manufacturing

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Retail

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Data Enrichment Solutions Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Enterprise Size (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. 6Sense.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Adapt (SLI Technologies Inc.).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Apollo.io.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Clearbit.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. COGNISM LIMITED.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Crunchbase Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Datamatics Business Solutions Limited.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Demandbase, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Enricher.io.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Experian Information Solutions, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others