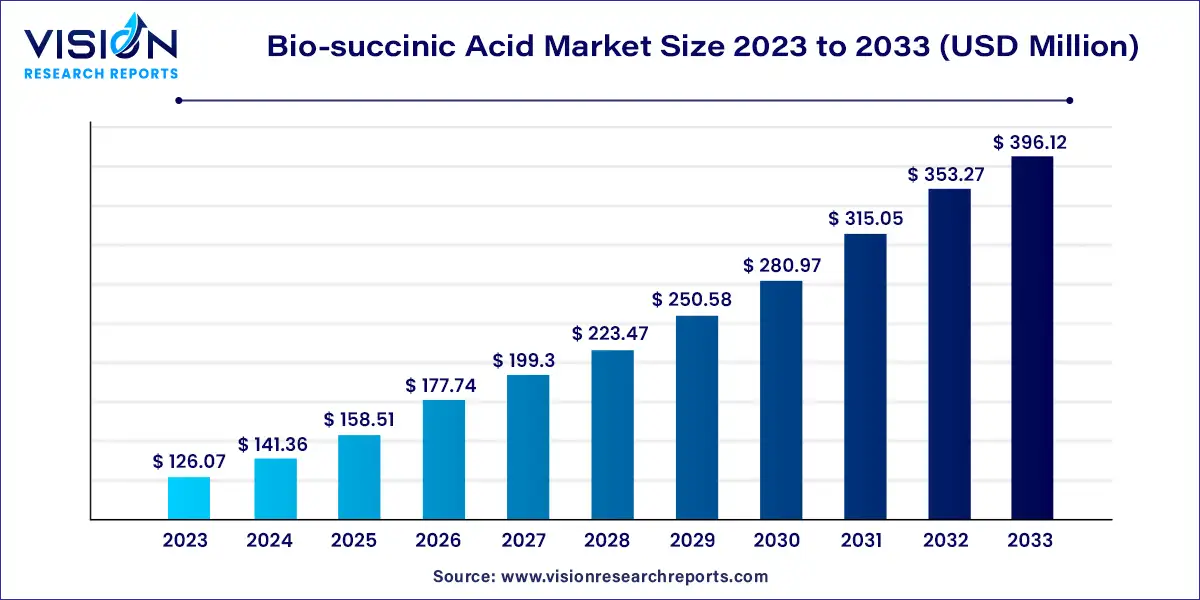

The global bio-succinic acid market size was estimated at around USD 126.07 million in 2023 and it is projected to hit around USD 396.12 million by 2033, growing at a CAGR of 12.13% from 2024 to 2033.

The bio-succinic acid market is gaining traction in the chemical industry due to increasing demand for sustainable alternatives. Derived from renewable sources like biomass, it serves diverse sectors including pharmaceuticals, food additives, and biodegradable plastics. Technological advancements are improving production efficiency and reducing costs, while stringent environmental regulations and consumer preference for eco-friendly products are driving market growth.

Bio-succinic acid market growth is driven by an increasing demand for sustainable chemicals and materials across various industries. Its eco-friendly properties, derived from renewable feedstocks like biomass and agricultural residues, appeal to manufacturers aiming to reduce their carbon footprint. The chemical's versatility in applications such as pharmaceuticals, food additives, and biodegradable plastics further amplifies its market appeal. Technological advancements in production processes, enhancing efficiency and lowering costs, also bolster market expansion. Moreover, stringent environmental regulations encouraging the adoption of bio-based products contribute significantly to the growth trajectory of the bio-succinic acid market.

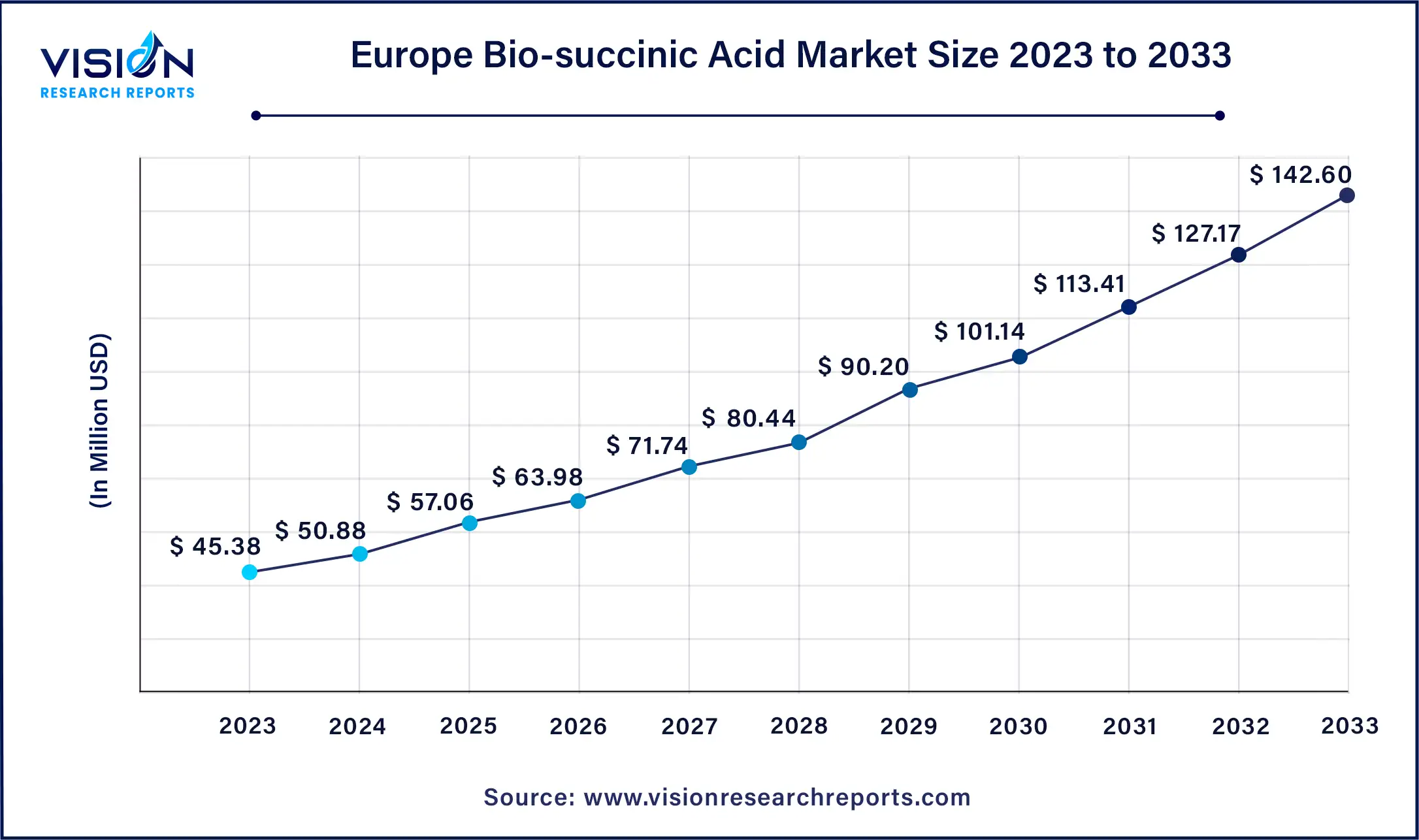

The Europe bio-succinic acid market size was estimated at USD 45.38 billion in 2023 and it is expected to surpass around USD 142.60 billion by 2033, poised to grow at a CAGR of 12.13% from 2024 to 2033.

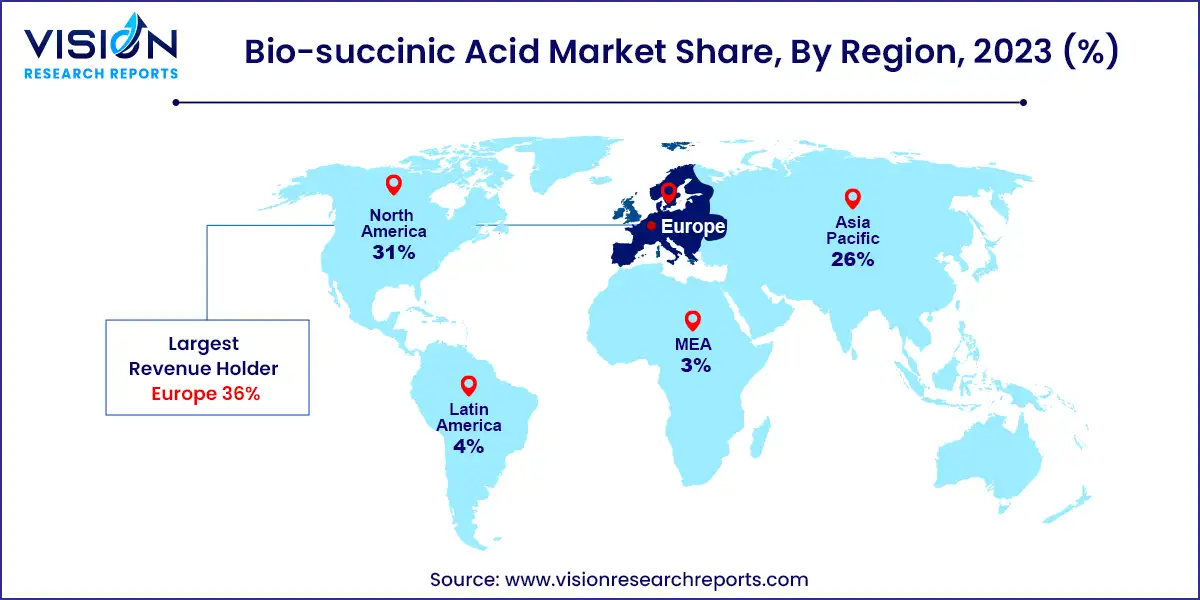

Bio-succinic acid finds diverse applications in bioplastics, pharmaceuticals, food additives, and coatings, driven by demand for biodegradable and sustainable materials, particularly in North America.

Europe led the market with a 36% revenue share in 2023, fueled by increasing demand for environmentally friendly construction practices. Factors such as rising carbon footprints, preference for locally sourced raw materials, and fluctuations in fossil fuel prices are driving market growth in the region.

In Germany, the bio-succinic acid market emphasizes sustainability and carbon emission reduction, utilizing renewable biomass resources for production, thereby enhancing its environmental profile compared to traditional petrochemical-derived succinic acid.

The UK market implements stringent regulations related to environmental impact and chemical usage, promoting bio-succinic acid as a sustainable alternative to petroleum-based succinic acid, aligning with efforts to reduce fossil fuel dependency and promote sustainability.

The 1,4-butanediol (BDO) segment led the market with a 35% revenue share in 2023 and is projected to grow at a CAGR of 12.03% during the forecast period. This dominance is driven by robust demand for producing polyurethane, tetrahydrofuran, and polybutylene, among other key products.

1,4-butanediol (BDO) finds extensive application across various industries, particularly in the production of major polymers like polyurethanes, polyethers, and polyesters. Its crucial role extends to the manufacturing of polybutylene terephthalate (PBT) and tetrahydrofuran (THF) resins for engineering plastics. The increasing demand for BDO and its derivatives, including THF, is expected to bolster market growth significantly.

In 2023, the PBS/PBST application segment held the second-largest revenue share of 19%, with a projected CAGR of 12.53% over the forecast period. This growth is fueled by rising demand for Phosphate Balanced Saline Solution (PBS) and PBST across diverse end-use industries.

The industrial segment dominated the market with over 42% revenue share in 2023, driven by increasing demand for products used in the production of polyurethane, tetrahydrofuran, and polybutylene terephthalate, among others. Bio-succinic acid serves as a versatile raw material in a wide range of industrial applications, facilitating the production of adhesives, solvents, sealants, resins, elastomers, coatings, plastics, and lubricants. Its versatility enables widespread utilization across various industrial sectors. The anticipated growth in industrial applications is expected to propel market expansion in the coming years.

During the COVID-19 pandemic, the pharmaceutical sector gained prominence, resulting in heightened demand. The pharmaceutical application segment held the second-largest revenue share globally, accounting for nearly 18% in 2023 and anticipated to grow at a CAGR of 11.73% during the forecast period. This growth is driven by increasing use of bio-succinic acid in drug formulations aimed at enhancing cardiovascular health.

By Application

By End-Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bio-succinic Acid Market

5.1. COVID-19 Landscape: Bio-succinic Acid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bio-succinic Acid Market, By Application

8.1. Bio-succinic Acid Market, by Application, 2024-2033

8.1.1. BDO

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Polyester Polyols

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Plasticizers

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. PBS/PBST

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Alkyd Resins

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Bio-succinic Acid Market, By End-Use

9.1. Bio-succinic Acid Market, by End-Use, 2024-2033

9.1.1. Industrial

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Food and Beverages

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Pharmaceuticals

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Personal Care and Cosmetics

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Bio-succinic Acid Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. DSM

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Roquette Freres

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. BioAmber

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Myriant Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Kawasaki Kasei Chemicals

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Mitsui & Co., Ltd

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Mitsubishi Chemical Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others