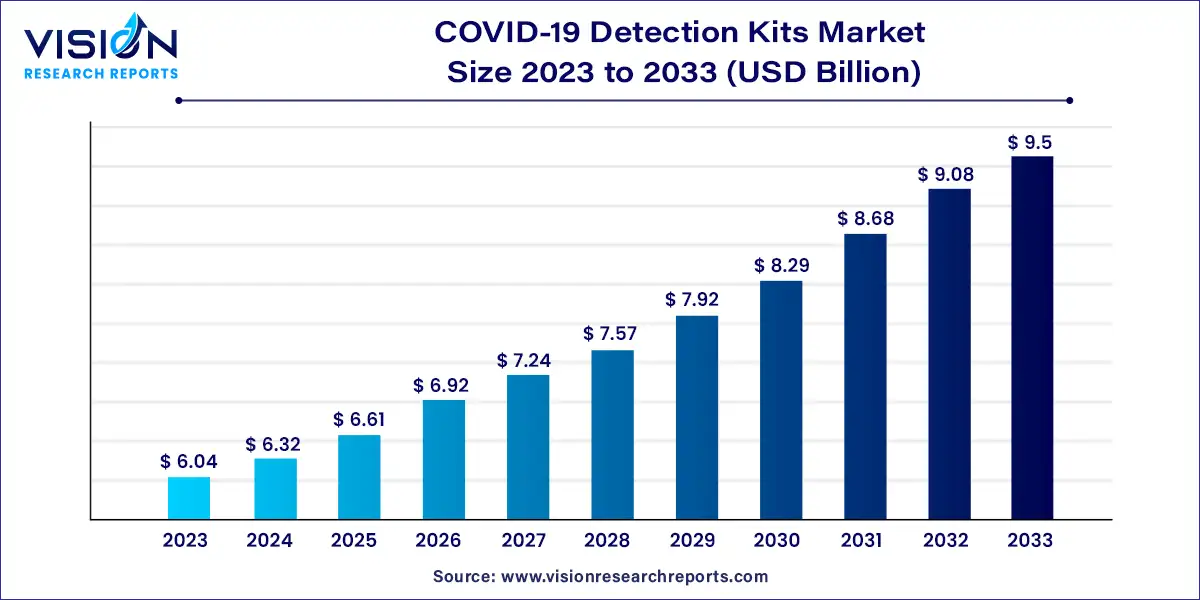

The global COVID-19 detection kits market size was estimated at USD 6.04 billion in 2023 and it is expected to surpass around USD 9.5 billion by 2033, poised to grow at a CAGR of 4.63% from 2024 to 2033.

The COVID-19 pandemic has drastically altered the landscape of global healthcare, propelling the demand for reliable and efficient detection methods. As the world grapples with waves of infection, the market for COVID-19 detection kits has seen unprecedented growth.

The growth of the COVID-19 detection kits market is driven by the persistent and evolving nature of the COVID-19 virus, including the emergence of new variants, has necessitated continuous and widespread testing. Secondly, government initiatives and funding aimed at increasing testing capabilities have significantly boosted market demand. Additionally, technological advancements have improved the accuracy, speed, and ease of use of testing kits, making them more accessible to a broader population. Increased public awareness about the importance of regular testing, coupled with the convenience of at-home testing kits, has also contributed to market expansion. Lastly, the integration of digital health platforms with testing solutions has streamlined the testing process, further propelling market growth.

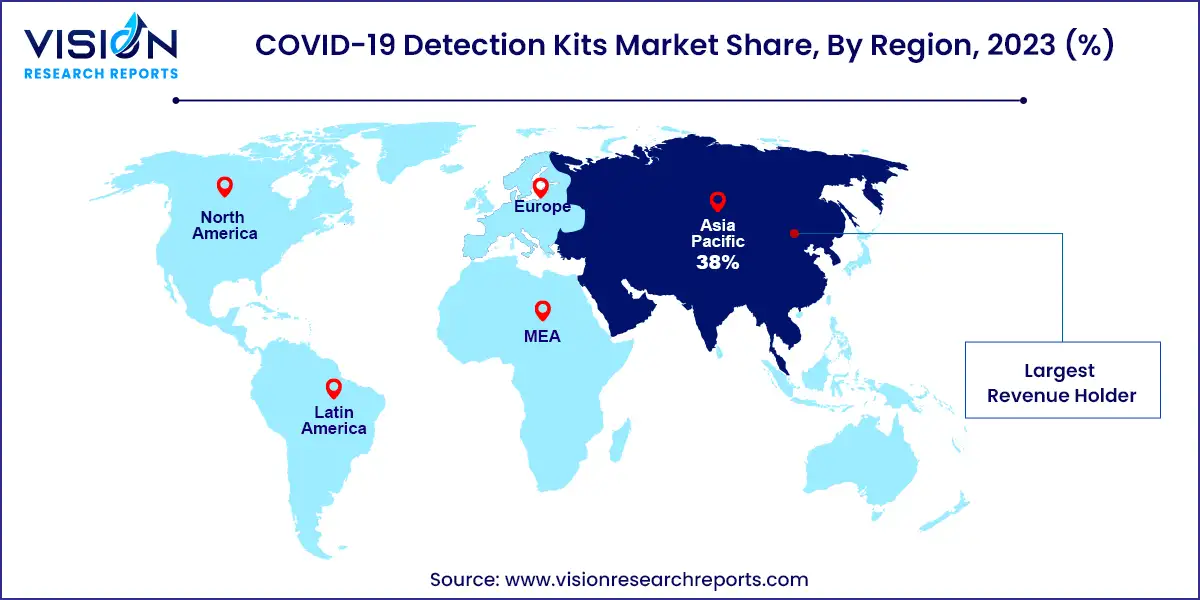

The Asia Pacific COVID-19 detection kits market size was estimated at around USD 2.29 billion in 2023 and it is projected to hit around USD 3.61 billion by 2033, growing at a CAGR of 4.65% from 2024 to 2033.

In 2023, North America accounted for a significant 21% share of the global COVID-19 detection kits market. The region's high number of COVID-19 cases drove demand for accurate diagnostic tools. Government initiatives supported the development and distribution of COVID-19 detection kits, contributing to market growth.

The Asia Pacific region is expected to witness the fastest growth in the COVID-19 detection kits market. This growth is fueled by increasing coronavirus cases, expanding diagnostic facilities, and the implementation of mass testing programs across countries like India and China.

In 2023, the immunoassay test strips/cassettes segment dominated the market with an 89% revenue share. This is primarily due to their user-friendly nature, requiring minimal training and equipment. These qualities make them accessible to both healthcare professionals and non-specialized personnel. Additionally, their affordability compared to PCR-based tests makes them a practical choice for healthcare settings and regions with limited resources. Immunoassay tests provide rapid results within minutes, crucial for timely COVID-19 diagnosis and treatment.

The decline in the RT-PCR assay kits segment is attributed to technological advancements. Emerging technologies like rapid antigen tests and next-generation sequencing offer faster results and improved sensitivity over traditional RT-PCR assays. This shift in demand towards newer technologies is influenced by cost considerations as well. While RT-PCR assays are highly accurate, they are relatively expensive. This prompts healthcare providers and governments to seek cost-effective alternatives for mass testing and surveillance programs.

In 2023, the Nasopharyngeal (NP) swab segment held the largest market share at 49%. NP swabs are preferred for molecular testing due to their high sensitivity and accuracy in detecting the SARS-CoV-2 virus. Most COVID-19 diagnostic tests authorized by regulatory agencies like the FDA are based on NP swab samples. The acceptance and validation of NP swab-based tests have solidified their market position. The introduction of 3D-printed NP swabs has further enhanced their accessibility and efficiency in COVID-19 testing.

The nasal swabs segment is expected to decline due to the rising popularity of saliva-based tests. Saliva tests are convenient and easy to use, contributing to their increasing adoption, especially in self-testing and at-home testing scenarios. This shift reflects the demand for simpler and more accessible testing methods in the market.

The Centralized Testing (Non-PoC) segment held a dominant share of 77% in 2023 but is projected to decline. These laboratory-based tests are known for their accuracy in detecting COVID-19 infections, making them crucial during high-demand periods. However, their longer processing times pose challenges in situations requiring rapid diagnosis. The shift towards point-of-care (POC) testing, offering faster results directly at the testing site, is expected to drive the decline of centralized testing methods.

The Laboratories segment held the largest share of 40% in 2023 but is anticipated to decrease. Initially pivotal for centralized testing, laboratories saw reduced reliance as the pandemic progressed. The demand shifted towards decentralized testing solutions like rapid antigen tests and molecular POC devices, which offer quicker results and expanded testing capabilities outside traditional laboratory settings.

The development of innovative technologies, such as rapid antigen tests and molecular point-of-care devices, further facilitated the decentralization of testing. These advancements allowed for faster and more convenient testing options outside traditional laboratory settings. The emergence of numerous manufacturers offering point-of-care COVID-19 detection kits intensified competition in the market. This competitive landscape favored companies specializing in rapid testing solutions, leading to a decline in market share for traditional laboratory-focused players.

By Product

By Sample Type

By Mode

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on COVID-19 Detection Kits Market

5.1. COVID-19 Landscape: COVID-19 Detection Kits Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global COVID-19 Detection Kits Market, By Product

8.1. COVID-19 Detection Kits Market, by Product, 2024-2033

8.1.1. RT-PCR Assay Kits

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Immunoassay Test Strips/Cassettes

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global COVID-19 Detection Kits Market, By Sample Type

9.1. COVID-19 Detection Kits Market, by Sample Type, 2024-2033

9.1.1. Nasopharyngeal (NP) Swab

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Oropharyngeal (OP) Swab

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Nasal Swabs

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global COVID-19 Detection Kits Market, By Mode

10.1. COVID-19 Detection Kits Market, by Mode, 2024-2033

10.1.1. Decentralized or Point-of-Care (PoC) Testing

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Centralized Testing (Non-PoC)

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global COVID-19 Detection Kits Market, By End-use

11.1. COVID-19 Detection Kits Market, by End-use, 2024-2033

11.1.1. Laboratories

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Hospitals

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Diagnostic Centers and Clinics

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global COVID-19 Detection Kits Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Mode (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Mode (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Mode (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Mode (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Mode (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Mode (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Mode (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Mode (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Mode (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Mode (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Mode (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Mode (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Mode (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Mode (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Mode (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Mode (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Mode (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Mode (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Mode (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Mode (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Mode (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. F. Hoffmann-La Roche AG

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Perkin Elmer, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Thermo Fisher Scientific, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Veredus Laboratories

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. DiaSorin

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. altona Diagnostics GmbH

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Mylab Discovery Solutions Pvt Ltd.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Abbott

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Luminex Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Quidel Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others