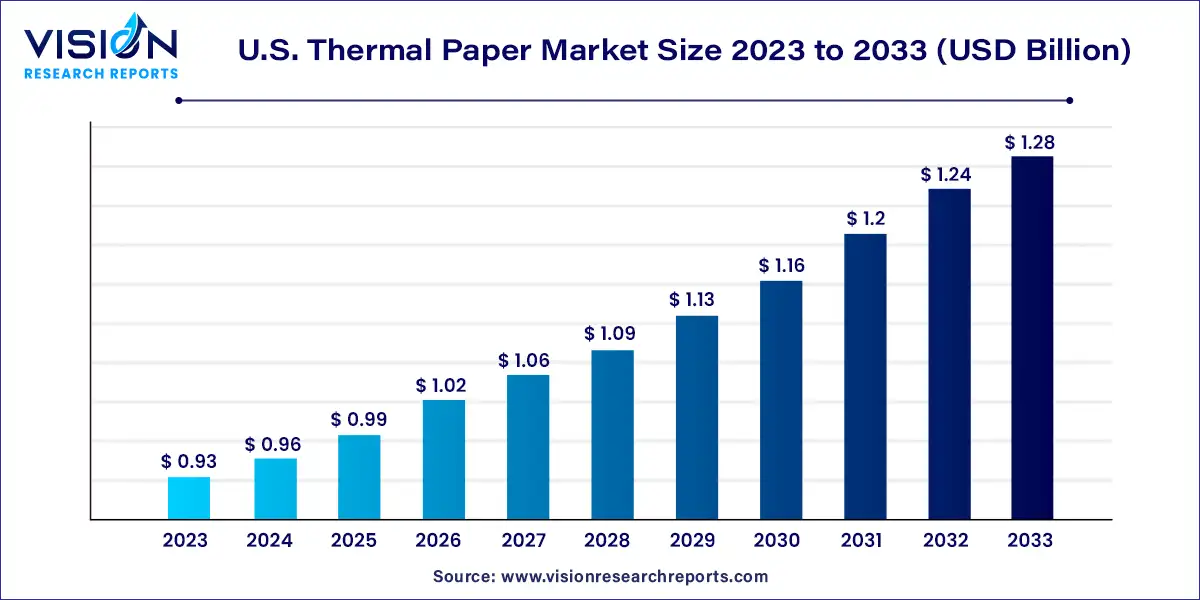

The U.S. thermal paper market size was valued at USD 0.93 billion in 2023 and is anticipated to reach around USD 1.28 billion by 2033, growing at a CAGR of 3.25% from 2024 to 2033.

The U.S. thermal paper market is a pivotal segment within the broader paper industry, characterized by its unique thermal coating that reacts to heat, enabling printing without the need for ink or ribbons. This technology finds extensive application across diverse sectors such as retail, healthcare, transportation, and hospitality due to its efficiency and convenience.

The growth of the U.S. thermal paper market is fueled by the expanding retail sector drives demand as businesses increasingly rely on thermal printers for efficient transaction processing and customer service. Secondly, ongoing advancements in thermal printing technology enhance print quality and durability, appealing to a broader range of industries including healthcare, transportation, and hospitality. Thirdly, the surge in e-commerce activities necessitates reliable printing solutions for shipping labels and order processing, further boosting market growth. These factors collectively contribute to a positive outlook for the U.S. thermal paper market, with continued innovation and expanding application areas driving its upward trajectory.

In 2023, the 80mm thermal paper segment emerged as the market leader, driven by its versatility across various sectors. This width is particularly suited for cash register receipts, parking tickets, ATM receipts, and lottery tickets due to its ability to accommodate detailed information. Its larger format allows for comprehensive itemized lists, logos, and promotional messages on receipts, catering to diverse business needs.

The 57mm thermal paper segment is poised for rapid growth in the coming years. Its compact size makes it ideal for applications where space efficiency is crucial, such as credit card terminals and mobile point-of-sale (POS) devices. Despite its narrower format, it ensures efficient receipt generation without compromising on portability.

In 2023, direct thermal technology dominated the market due to its simplicity and cost-effectiveness. Utilizing heat-sensitive paper that reacts directly with the thermal printhead, this method offers a quick and economical solution for printing receipts, parking tickets, and short-lived documents. However, direct thermal prints may fade over time, particularly when exposed to light and heat.

Conversely, thermal transfer technology addresses durability requirements for applications like shipping labels, product tags, and medical records. While providing long-lasting, high-quality prints, thermal transfer involves additional complexity and cost due to the use of ribbons. The growing demand for resilient labels and tags is expected to drive the expansion of the thermal transfer segment.

In 2023, the Point of Sale (PoS) application segment accounted for a significant share of 65%. Thermal paper is extensively used in PoS terminals across industries such as retail, healthcare, entertainment, and warehousing. It is valued for its barcode scanning capabilities, moisture resistance, and stability under high temperatures, making it indispensable for transactional purposes. Despite the rise of digital receipts, thermal paper continues to dominate in PoS applications.

The tags & labels application segment is projected to grow at a CAGR of 4.33% from 2024 to 2033, driven by increased adoption in e-commerce, logistics, and labeling. Thermal transfer labels are crucial in retail for product labeling and barcoding, manufacturing for asset tracking and compliance labeling, and healthcare for patient identification and medical records. The expanding e-commerce sector is anticipated to further boost demand for thermal paper applications in labeling and tagging.

By Width

By Technology

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Width Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Thermal Paper Market

5.1. COVID-19 Landscape: U.S. Thermal Paper Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Thermal Paper Market, By Width

8.1. U.S. Thermal Paper Market, by Width, 2024-2033

8.1.1 57mm

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. 80mm

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Thermal Paper Market, By Technology

9.1. U.S. Thermal Paper Market, by Technology, 2024-2033

9.1.1. Direct Transfer

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Thermal Transfer

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Thermal Paper Market, By Application

10.1. U.S. Thermal Paper Market, by Application, 2024-2033

10.1.1. POS

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Tags & Label

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Lottery & Gaming

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Thermal Paper Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Width (2021-2033)

11.1.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Koehler Group.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Appvion Operations, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Ricoh Company, Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Mitsubishi Paper Mills (MPM) Limited.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Oji Holdings Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Thermal Solutions International Inc

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Hansol Paper Co. Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Henan Province JiangHe Paper Co., Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Gold Huasheng Paper Co., Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Kanzaki Specialty Papers Inc. (KSP)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others