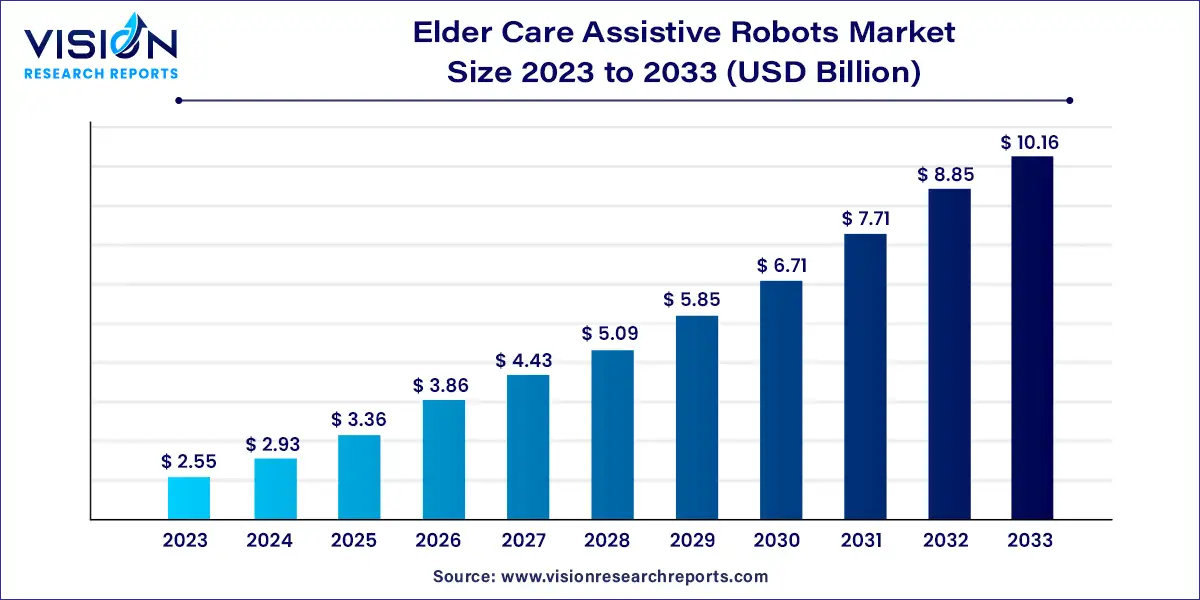

The global elder care assistive market size was valued at USD 2.55 billion in 2023 and is anticipated to reach around USD 10.16 billion by 2033, growing at a CAGR of 14.83% from 2024 to 2033. The adult stem cells market is witnessing significant growth driven by advancements in regenerative medicine and therapeutic research. Adult stem cells, also known as somatic stem cells, are undifferentiated cells found throughout the body that can divide and renew themselves to regenerate damaged tissues.

The growth of the adult stem cells market is driven by an advancements in regenerative medicine have expanded the therapeutic applications of adult stem cells, particularly in treating chronic diseases and injuries such as cardiovascular disorders, neurological conditions, and orthopedic injuries. Technological innovations in cell isolation, cultivation techniques, and genetic engineering have enhanced the efficiency and effectiveness of adult stem cell therapies. Additionally, increasing investments in research and development by governments, private organizations, and pharmaceutical companies are accelerating scientific discoveries and commercialization efforts in the field.

Rise of Physically Assistive Robots: Physically assistive robots are experiencing significant growth in the elder care market. These robots are designed to assist with activities such as mobility, bathing, and feeding, catering to the needs of an increasingly elderly population worldwide. The rise in age-related disabilities and the global increase in life expectancy are major factors driving this trend. As seniors seek more independence and caregivers face increasing demands, physically assistive robots play a crucial role in improving quality of life and reducing caregiver strain.

Advancements in Monitoring and Surveillance: The adoption of monitoring and surveillance robots is on the rise in elder care settings. These robots offer continuous observation and real-time alerts for falls, medical emergencies, and unusual activities. Advances in sensor technology, cameras, and artificial intelligence have improved the accuracy and reliability of these systems. This trend addresses safety concerns and provides peace of mind to caregivers and family members, ensuring timely intervention and support for elderly individuals living independently or in care facilities.

Integration of AI and Robotics: Integration of artificial intelligence (AI) with robotics is transforming elder care assistive robots. AI-powered features such as natural language processing, facial recognition, and predictive analytics enhance robot capabilities. These advancements enable robots to provide personalized care, adapt to user preferences, and anticipate healthcare needs. The synergy between AI and robotics is driving innovation in elder care, promising more efficient, responsive, and user-centric solutions for seniors and caregivers alike.

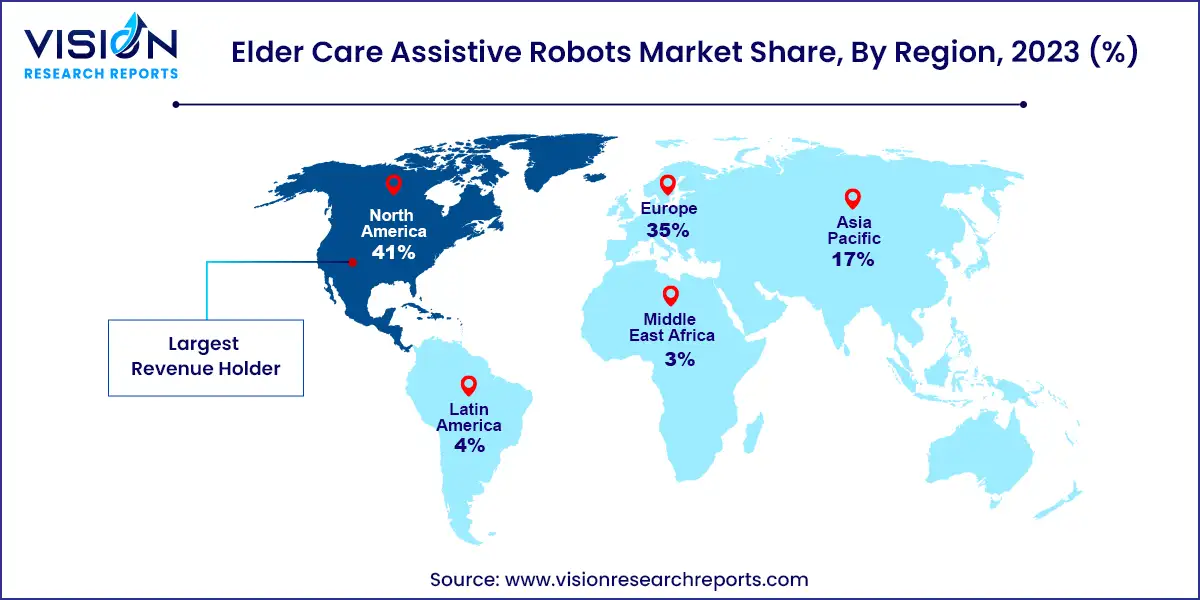

North America led the global elder care assistive robots market in 2023, capturing 41% of the revenue share. This dominance is attributed to advanced healthcare infrastructure, substantial investments in healthcare technology, and a strong focus on enhancing elderly quality of life. The region's vibrant tech ecosystem, including leading robotics and AI companies, supports the development and deployment of advanced elder care solutions.

| Attribute | North America |

| Market Value | USD 1.04 Billion |

| Growth Rate | 14.83% CAGR |

| Projected Value | USD 4.16 Billion |

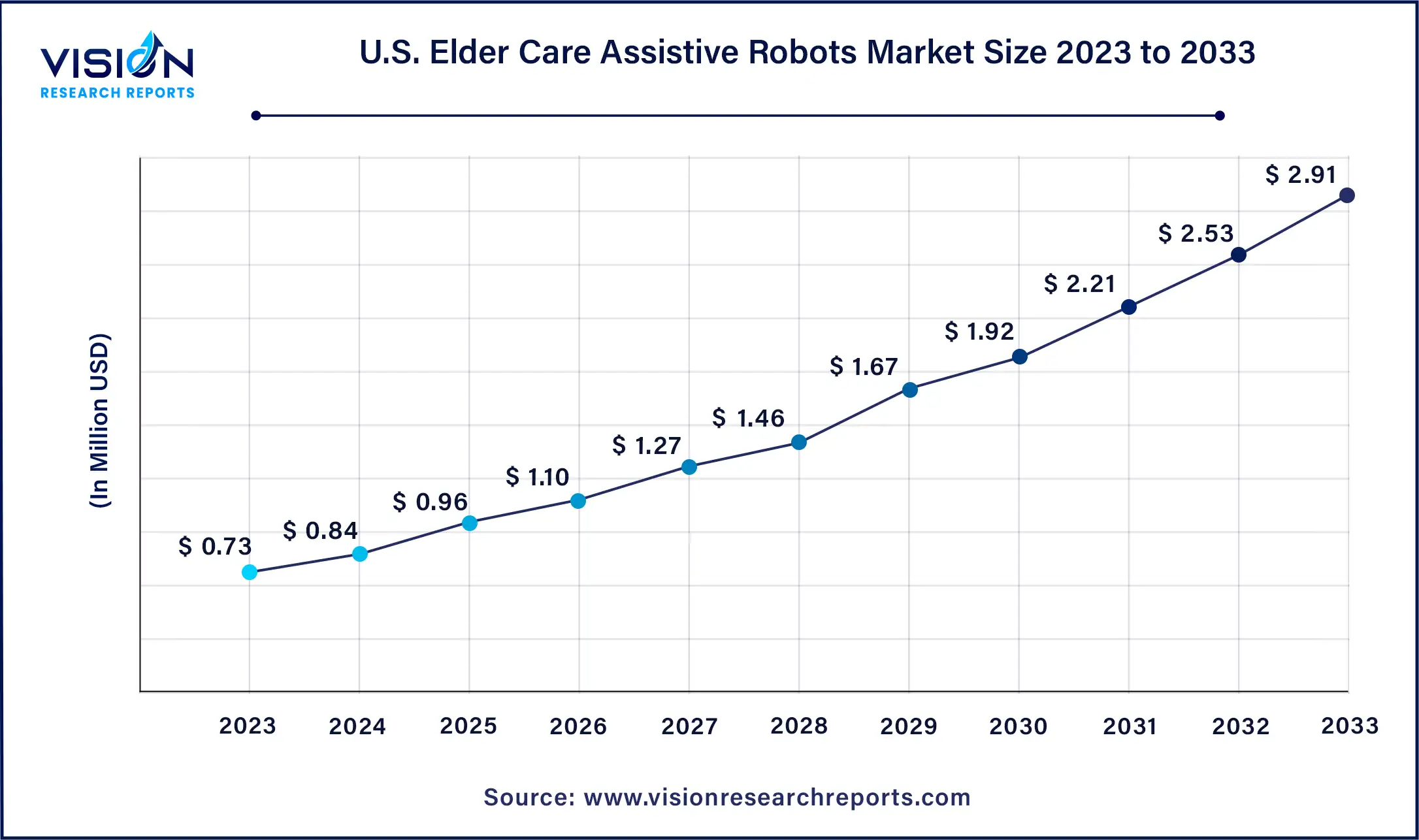

The U.S. elder care assistive market size was estimated at around USD 0.73 billion in 2023 and it is projected to hit around USD 2.91 billion by 2033, growing at a CAGR of 14.83% from 2024 to 2033.

The U.S. accounted for 83.7% of the North American elder care assistive robots market in 2023. Adoption of robots is accelerating, exemplified by New York State's initiative to introduce companion robots, in partnership with Intuition Robotics, to around 800 seniors, as reported by Forbes in 2022.

The elder care assistive robots market in Asia Pacific is poised for the fastest growth during the forecast period. Economic growth in countries like China and India, coupled with rising disposable incomes, is driving increased investment in assistive technologies. The region's aging population and challenges in caregiving workforce availability further propel demand for automated solutions.

In 2023, the elder care assistive robots market was led by physically assistive robots, contributing the largest share of revenue and expected to grow at a rapid rate of 15.13% throughout the forecast period. The global rise in the elderly population and prevalence of age-related disabilities are key drivers of this expansion. As life expectancy increases, so does the demand for assistance with daily activities like mobility, bathing, and feeding. For example, mobility issues affect approximately 35% of those aged 70 and a majority of those over 85, as highlighted in a 2020 NIH report. Physically assistive robots are designed to aid in these activities, improving seniors' lives and easing the physical burden on caregivers.

Socially assistive robots are poised for significant growth, driven by increasing awareness of social isolation and loneliness among the elderly. The University of Michigan's National Poll on Healthy Aging reported that 34% of adults aged 50-80 experienced isolation in 2023, with 29% feeling isolated at times and 5% frequently. These robots provide companionship, cognitive stimulation, and emotional support, addressing critical issues and enhancing market growth.

In 2023, social interaction robots held the largest revenue share of 37%. These robots engage seniors in conversations, games, and activities to mitigate loneliness and isolation, while also assisting with medication adherence—a significant issue affecting older adults. Non-adherence contributes to hospital admissions for around 200,000 seniors annually, as reported by the Department of Health and Human Services. Social interaction robots provide cognitive stimulation, medication reminders, and facilitate communication with family and friends, driving market expansion.

The monitoring and surveillance segment is expected to grow rapidly, spurred by increasing falls among the elderly. The CDC's 2020 report noted over 14 million falls annually among older adults in the U.S. Monitoring robots offer continuous observation, detecting falls, emergencies, and unusual activities, thereby alerting caregivers or medical professionals promptly. Advances in sensors, cameras, and AI technology enhance their accuracy and reliability, further fueling market growth.

By Type

By Functionality

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Elder Care Assistive Robots Market

5.1. COVID-19 Landscape: Elder Care Assistive Robots Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Elder Care Assistive Robots Market, By Type

8.1. Elder Care Assistive Robots Market, by Type, 2024-2033

8.1.1. Physically Assistive Robots

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Socially Assistive Robots

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Elder Care Assistive Robots Market, By Functionality

9.1. Elder Care Assistive Robots Market, by Functionality, 2024-2033

9.1.1. Monitoring and Surveillance

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Mobility Assistance

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Social Interaction

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Household Tasks

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Elder Care Assistive Robots Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Functionality (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Functionality (2021-2033)

Chapter 11. Company Profiles

11.1. Intuition Robotics Inc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Toyota (GB) PLC.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. SoftBank Robotics UK Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Blue Frog Robotics

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. KOMPAÏ robotics

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Zorarobotics NV

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. YUJIN ROBOT Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Panasonic Holdings Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. PARO Robots U.S., Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others