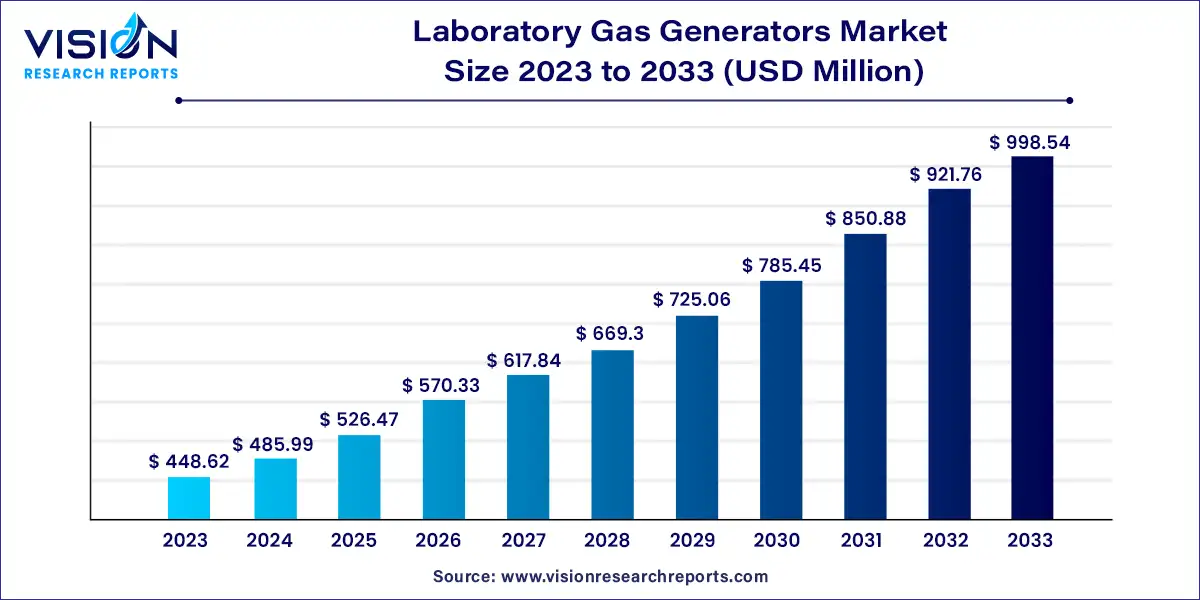

The global laboratory gas generators market size was estimated at USD 448.62 million in 2023 and it is expected to surpass around USD 998.54 million by 2033, poised to grow at a CAGR of 8.33% from 2024 to 2033. The laboratory gas generators market has witnessed substantial growth driven by increasing demand for reliable and cost-effective gas supply solutions in various laboratory settings. These generators are designed to produce pure gases such as nitrogen, hydrogen, oxygen, and zero air on-site, eliminating the need for traditional gas cylinders and enhancing operational efficiency.

The laboratory gas generators market is experiencing robust growth driven by an increasing demand for cost-effective and reliable gas supply solutions in laboratory settings. Laboratory gas generators offer significant cost savings compared to traditional gas cylinders, reducing logistical complexities and operational costs. Technological advancements have also played a crucial role, leading to the development of more efficient and compact gas generator systems. Additionally, the growing emphasis on environmental sustainability is accelerating market growth, as these generators help minimize carbon footprint and waste generation. Moreover, the expanding applications of gas generators in chromatography, mass spectrometry, and other laboratory processes further fuel market expansion.

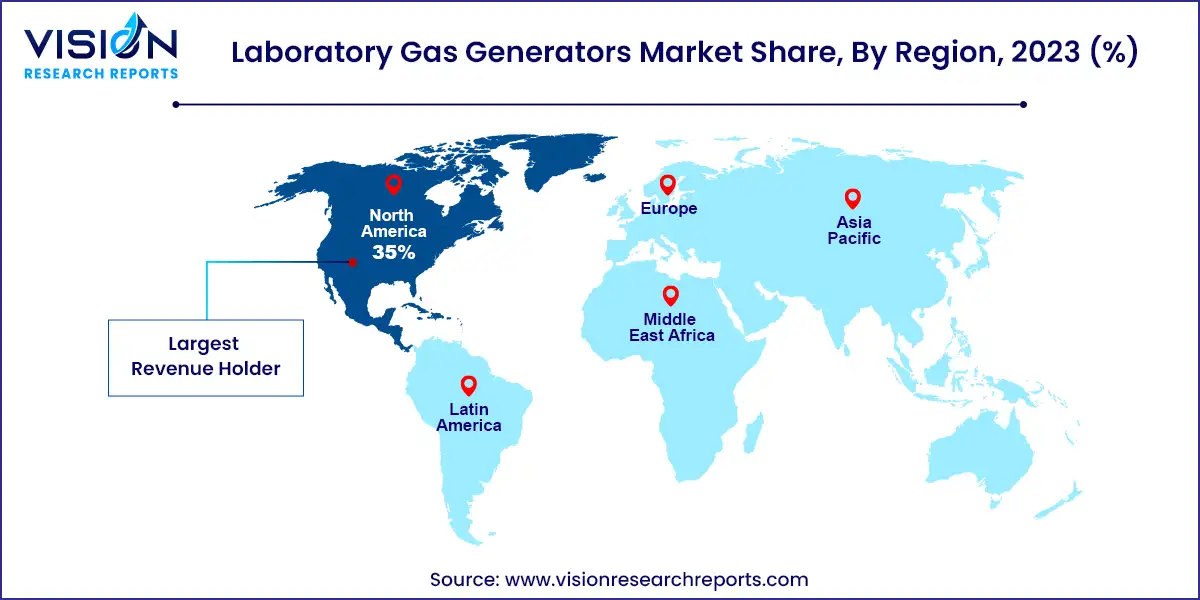

North America led the global laboratory gas generators market in 2023, accounting for 35% of the total revenue. This dominance is fueled by substantial investments in pharmaceuticals, biotechnology, and food & beverage industries across the U.S., Canada, and Mexico. The region's demand for reliable gas supply solutions continues to drive market expansion.

| Attribute | North America |

| Market Value | USD 157.01 Million |

| Growth Rate | 8.33% CAGR |

| Projected Value | USD 349.48 Million |

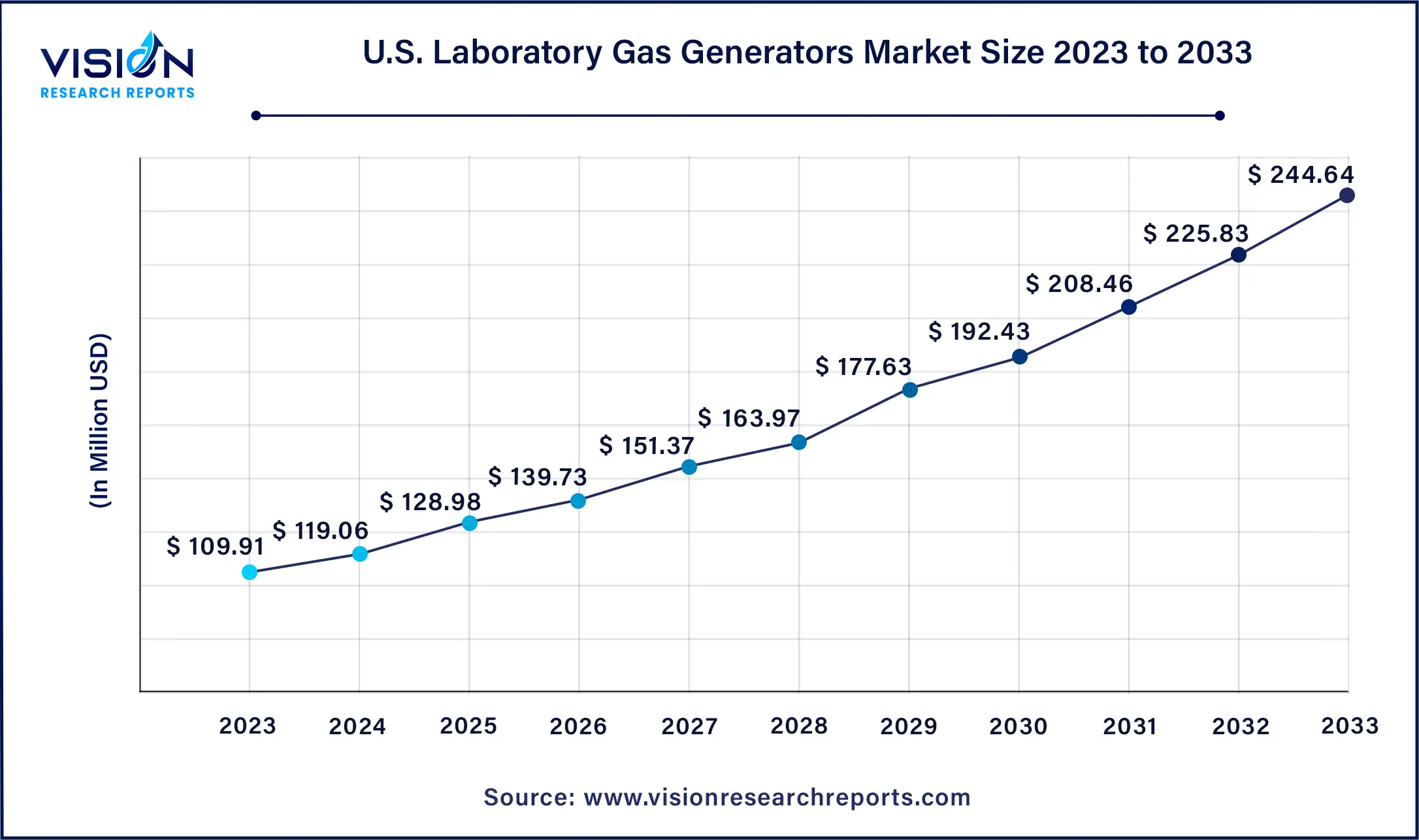

The U.S. laboratory gas generators market size was estimated at around USD 109.91 million in 2023 and it is projected to hit around USD 244.64 million by 2033, growing at a CAGR of 8.33% from 2024 to 2033.

Germany's laboratory gas generators market is poised for significant growth, supported by robust life sciences industries, stringent regulatory standards, and a strong focus on R&D. The country's extensive biotech sector, with over 4,019 companies, of which 66% are dedicated to R&D services, drives demand for advanced gas solutions in analytical testing applications.

China's laboratory gas generators market is also on an upward trajectory, buoyed by rapid growth in the life sciences sector. The country's aging population and increasing healthcare investments are attracting substantial investments in laboratory and pharmaceutical manufacturing infrastructure. This trend underscores rising demand for high-specification equipment, including gas generators, in one of the world's largest pharmaceutical markets.

The nitrogen gas generator segment dominated the market in 2023, capturing the largest revenue share. Nitrogen generators are integral to various applications such as gas chromatography, sample preparation, liquid chromatography-mass spectrometry, and as purge gas for analytical instruments. Their appeal lies in delivering high-purity nitrogen on-demand, thereby eliminating the complexities of handling and storing gas cylinders.

Hydrogen gas generators are also gaining traction, particularly in laboratories for flame ionization detection in gas chromatography and as fuel gas for hydrogen fuel cell applications. These generators provide a safer alternative to compressed hydrogen cylinders, reducing accident risks while ensuring a continuous supply of hydrogen gas for analytical instruments. Additionally, generators for helium, argon, and zero air serve niche applications in gas chromatography-mass spectrometry, gas analysis, leak detection, and semiconductor manufacturing.

Gas chromatography emerged as the leading application segment in 2023, driven by the significant use of nitrogen and hydrogen gas generators for carrier and fuel gases in analytical processes. Advances in techniques like GC-MS and hyphenated methodologies necessitate precise gas purity and flows, bolstering the demand for specialty gas generators. Portable gas chromatography units coupled with compact generators are expected to see increased deployment in field analysis and environmental monitoring.

The expanding field of Liquid Chromatography-Mass Spectrometry (LC-MS), crucial for drug discovery and metabolomics, underscores the need for high-purity nitrogen and helium gas generators for nebulization and collision gases. Moreover, integrated gas generators that optimize performance and user-friendliness with LC-MS systems are anticipated to gain traction. Real-time gas analysis across various industries relies on generators for continuous, specific gas supplies crucial for precise measurements and detecting low-level contaminants.

The life sciences sector remains a key end-user segment for laboratory gas generators, driven by the demand for analytical instruments in drug discovery, development, and quality control processes. Gas chromatography, mass spectrometry, cell culture, fermentation, and drug discovery heavily rely on these generators. Increasing R&D investments, advancements in personalized medicine, and stringent drug regulations further propel market growth.

Additionally, the food and beverage, environmental, and academic research sectors are adopting gas generators for diverse applications including mass spectrometry, gas chromatography, sample preparation, and environmental analysis. In the chemical industry, nitrogen generators play a crucial role in neutralizing or removing oxygen during various chemical manufacturing processes.

By Product

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Laboratory Gas Generators Market

5.1. COVID-19 Landscape: Laboratory Gas Generators Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Laboratory Gas Generators Market, By Product

8.1. Laboratory Gas Generators Market, by Product, 2024-2033

8.1.1 Nitrogen Gas Generator

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hydrogen Gas Generator

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Zero Air Gas Generator

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Purge Gas Generator

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. TOC Gas Generators

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Laboratory Gas Generators Market, By Application

9.1. Laboratory Gas Generators Market, by Application, 2024-2033

9.1.1. Gas Chromatography

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Liquid Chromatography-mass Spectrometry (LC-MS)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Gas Analyzers

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Laboratory Gas Generators Market, By End-use

10.1. Laboratory Gas Generators Market, by End-use, 2024-2033

10.1.1. Life Science

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Chemical & Petrochemical

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Food & Beverage

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Laboratory Gas Generators Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Peak Scientific Instruments.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. PerkinElmer Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Linde plc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. VICI DBS.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Dürr Technik GmbH & Co. KG.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Erre Due S.p.a.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Tisch Environmental, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. CLAIND srl

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Isolcell.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. OXYMAT

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others