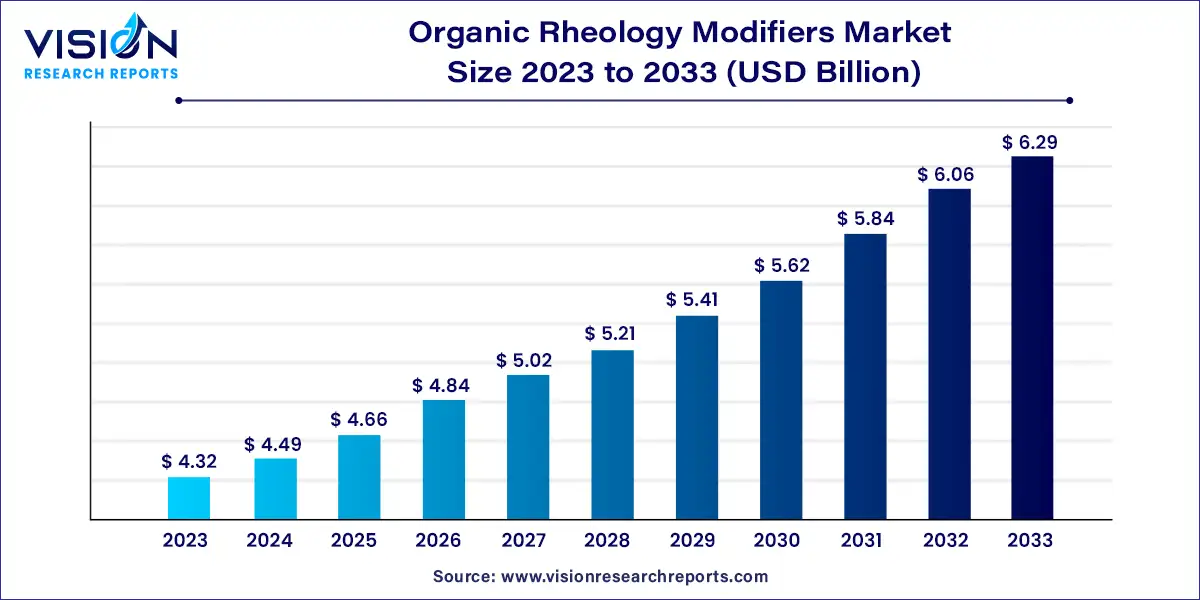

The global organic rheology modifiers market size was surpassed at USD 4.32 billion in 2023 and is expected to hit around USD 6.29 billion by 2033, growing at a CAGR of 3.83% from 2024 to 2033.

Organic rheology modifiers are essential additives used to control the flow and deformation properties of various materials. These modifiers play a crucial role in numerous industries, including paints and coatings, cosmetics, adhesives, and pharmaceuticals, by enhancing the performance and stability of the products. The growing demand for high-performance materials with specific rheological properties is driving the growth of the organic rheology modifiers market.

The organic rheology modifiers market is experiencing substantial growth driven by the burgeoning demand for high-performance paints and coatings in the construction and automotive industries is significantly boosting the market. These modifiers are essential for enhancing the application properties, stability, and finish of paints, making them indispensable in these sectors. Additionally, the rising consumer preference for natural and organic ingredients in cosmetics and personal care products is propelling the market forward. Organic rheology modifiers improve the texture, consistency, and stability of various formulations, catering to the growing trend towards eco-friendly and sustainable products. Furthermore, advancements in pharmaceutical formulations, particularly in drug delivery systems, are creating new opportunities for these modifiers.

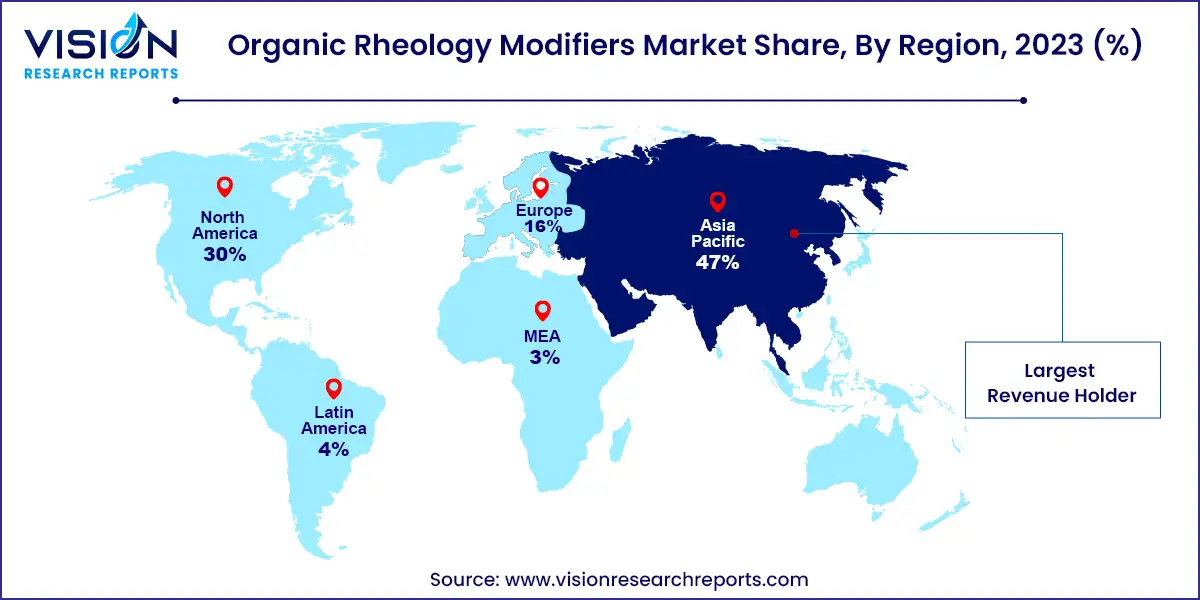

The Asia Pacific organic rheology modifiers market dominated with a revenue share of 47% in 2023. This dominance is due to high demand across various industries in the region, driven by increased expenditure on construction activities and the automotive industry's expansion. The region is positioned as a key market driver, with rapid growth projected from 2024 to 2033.

| Attribute | Asia Pacific |

| Market Value | USD 2.03 Billion |

| Growth Rate | 3.83% CAGR |

| Projected Value | USD 2.95 Billion |

China, in particular, held the largest share in the Asia Pacific organic rheology modifiers market in 2023. The country's expanding construction industry and rising demand for paints and coatings significantly contribute to market growth.

The North American organic rheology modifiers market held the second-largest revenue share in 2023 due to the rising demand for cosmetic and personal care products driven by growing consumer awareness. The substantial market share of North America is also attributed to its large geographical markets in various industries, including paints and coatings, personal care, pharmaceuticals, and oil and gas.

The U.S. organic rheology modifiers market is projected to grow at a significant CAGR from 2024 to 2033. In the paints and coatings sector, this growth is fueled by the increasing demand for high-performance coatings with enhanced flow and leveling properties. Additionally, in the cosmetics and personal care sector, there is strong demand for rheology modifiers to improve the texture and stability of skincare and hair care products.

The European organic rheology modifiers market is expected to grow at a significant rate from 2024 to 2033. This growth is driven by increasing demand from the paints and coatings, adhesives and sealants, and personal care and cosmetics industries, especially in Western European countries. The demand highlights the crucial role of rheology modifiers in enhancing product performance and quality in these industries.

The cosmetics and personal care segment dominated the organic rheology modifiers market with a revenue share of 36% in 2023. These modifiers are widely utilized in this industry to improve the texture, stability, and performance of various products. In hair care items, they enhance viscosity and suspension properties, ensuring uniform distribution of active ingredients and preventing particle settling. Similarly, in sunscreens, organic rheology modifiers provide the right consistency and spreadability, enabling effective adherence to the skin while maintaining protective properties.

In the paints and coatings industry, organic rheology modifiers are vital for controlling formulations' rheological properties, such as viscosity, sag resistance, and leveling. Hydrophobically modified ethoxylated urethanes (HEURs) are used in water-based paints to provide excellent flow and leveling, ensuring smooth and uniform film formation. In industrial coatings, like automotive coatings, these modifiers optimize rheological behavior, enhancing application properties such as sprayability, brushability, and film build.

The oil and gas industry uses organic rheology modifiers in various applications, including drilling fluids, cementing, and well stimulation. In drilling fluids, these modifiers help maintain desired viscosity and suspension properties, preventing solids from sagging and settling while providing lubrication and cooling at high temperatures and pressures. In cementing operations, they adjust the rheological properties of cement slurries, improving pumpability, displacement efficiency, and zonal isolation.

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Organic Rheology Modifiers Market

5.1. COVID-19 Landscape: Organic Rheology Modifiers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Organic Rheology Modifiers Market, By Application

8.1. Organic Rheology Modifiers Market, by Application Type, 2024-2033

8.1.1. Paints & Coatings

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cosmetics & Personal Care

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Pharmaceuticals

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Oil & Gas

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Construction

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Other Applications

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Organic Rheology Modifiers Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. BASF SE

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Dow

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Ashland Inc.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Croda International

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Clariant AG

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Lubrizol Corporation

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Arkema

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Evonik Industries

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Eastman Chemical Company

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. AkzoNobel N.V.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others