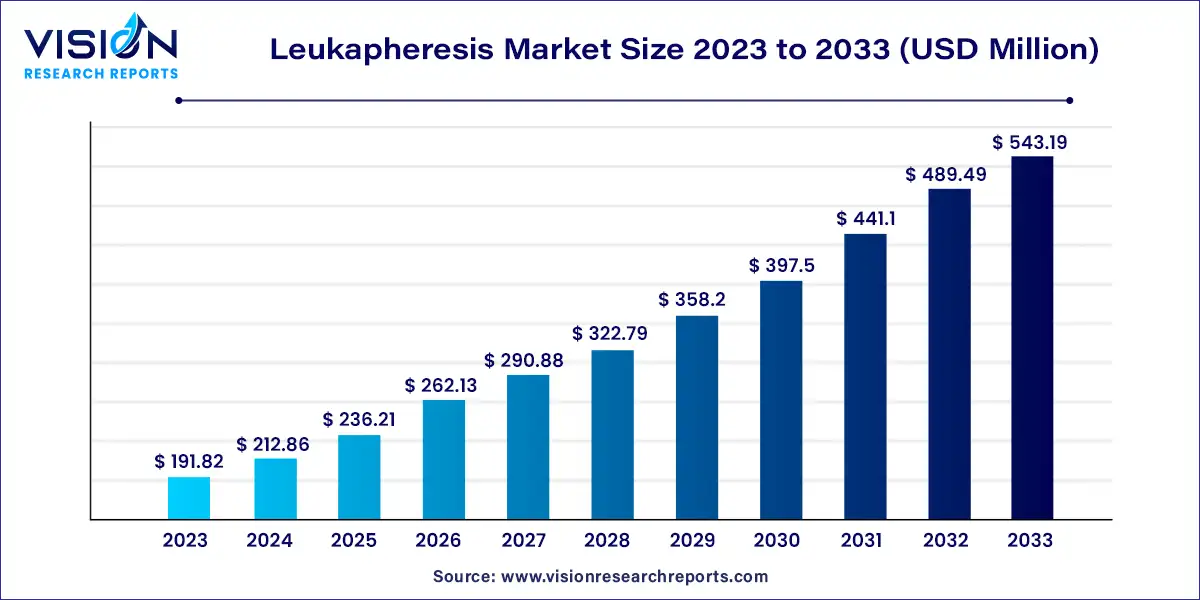

The global leukapheresis market size was valued at USD 191.82 million in 2023 and it is predicted to surpass around USD 543.19 million by 2033 with a CAGR of 10.97% from 2024 to 2033.

Leukapheresis is a specialized medical procedure used to separate and collect white blood cells (leukocytes) from the blood of a donor or patient. This process is crucial for various medical applications, including treatment for leukemia, lymphomas, and other conditions requiring high levels of leukocytes. The leukapheresis market has seen significant growth due to advancements in technology and increasing applications in medical research and treatment.

The leukapheresis market is experiencing robust growth due to several pivotal factors. One of the primary drivers is the escalating incidence of hematological disorders such as leukemia and lymphoma, which necessitates effective leukocyte separation and collection for treatment. This increasing prevalence is propelling demand for leukapheresis procedures. Furthermore, advancements in technology have significantly enhanced the efficiency and safety of leukapheresis. Modern automated devices offer improved precision and streamlined processes, making the procedure more accessible and effective. The expansion of research and development in medical treatments and diagnostics also fuels market growth by introducing innovative applications and enhancing existing technologies.

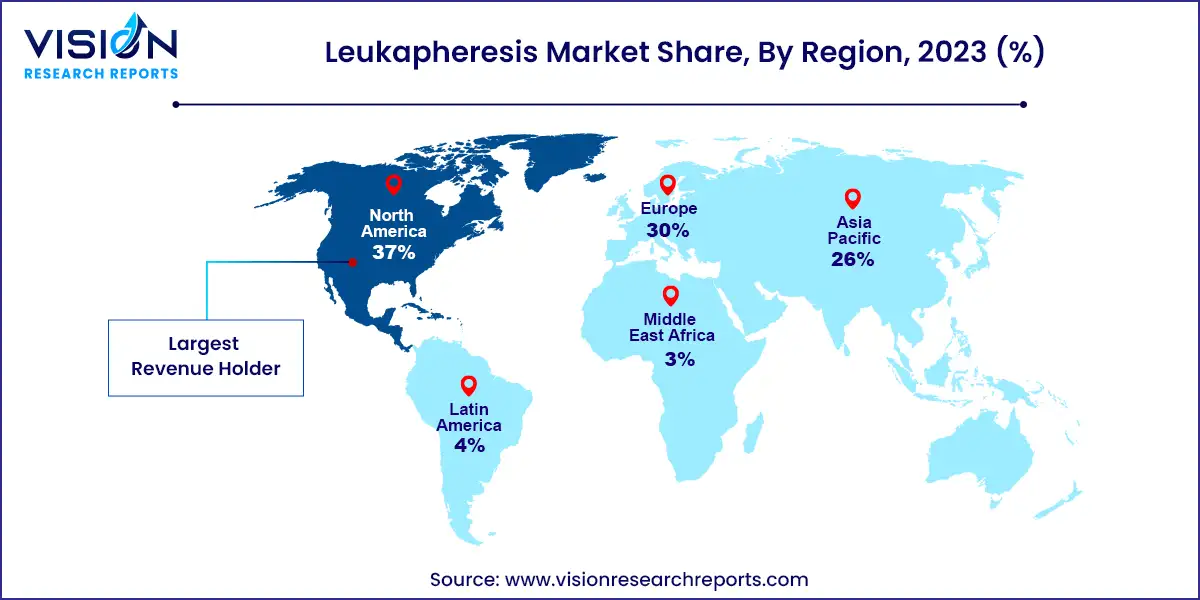

North America held the largest market share of 37% in 2023. This dominance is attributed to the region's well-established healthcare infrastructure, high healthcare expenditures, and extensive research and development activities. The presence of leading pharmaceutical and biotechnology companies further supports market growth.

| Attribute | North America |

| Market Value | USD 70.97 Million |

| Growth Rate | 10.97% CAGR |

| Projected Value | USD 200.98 Million |

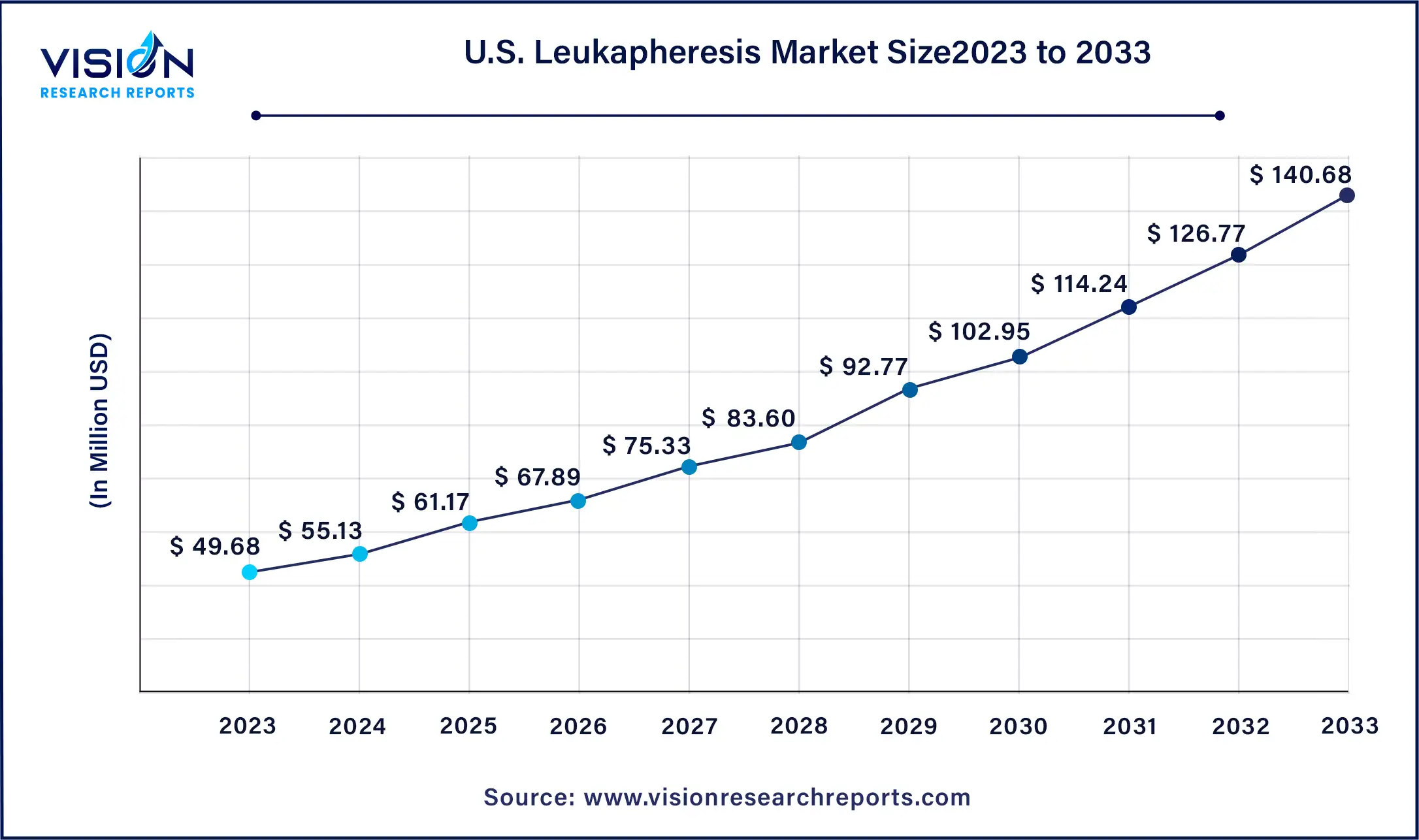

The U.S. leukapheresis market size was estimated at USD 49.68 million in 2023 and it is expected to surpass around USD 140.68 million by 2033, poised to grow at a CAGR of 10.97% from 2024 to 2033.

The U.S. leukapheresis market is expected to grow at the fastest CAGR due to advancements in healthcare infrastructure and technology, combined with rising healthcare expenditures that facilitate broader adoption of leukapheresis procedures.

Europe Leukapheresis Market Trends

Europe is identified as a promising region for leukapheresis, driven by increasing healthcare expenditure and growing awareness of therapeutic advancements. Collaborations between research institutions, pharmaceutical companies, and healthcare providers are enhancing the development and adoption of new leukapheresis technologies.

Asia Pacific Leukapheresis Market Trends

The Asia Pacific region is anticipated to experience the highest CAGR of 12.23% from 2024 to 2033. Factors contributing to this growth include rising healthcare expenditures, improving healthcare infrastructure, and growing awareness of advanced treatment options. The large and aging population, along with a higher prevalence of chronic diseases, is expected to drive demand for leukapheresis.

In 2023, the leukapheresis devices segment commanded the market with a substantial revenue share of 77%. This segment is divided into centrifugation-based devices and membrane filtration-based devices. The rise in blood disorders such as leukemia and lymphoma, coupled with increased demand for stem cell transplantation, is driving the growth of centrifugation-based devices. Technological advancements have led to the development of more efficient and automated systems. Meanwhile, the increasing incidence of autoimmune diseases and chronic conditions requiring therapeutic apheresis is boosting the demand for membrane filtration-based devices.

The leukapheresis disposables segment is projected to experience the fastest growth rate. This surge is driven by the increasing volume of procedures, heightened awareness of blood component separation techniques, and stringent regulatory standards ensuring patient safety. As the patient population with hematologic disorders and solid tumors expands, the demand for disposables used in these procedures is also increasing. For example, Haemonetics Corporation provides comprehensive disposable kits compatible with its MCS+ system to facilitate efficient cell collection and processing. This trend is anticipated to continue driving segmental growth.

In 2023, the research application segment led the market with a revenue share of 68%. This dominance is driven by the rising focus on developing novel therapies for diseases such as cancer and autoimmune disorders. The need to isolate specific cell populations, like T cells or stem cells, for research and therapeutic development is expected to increase the demand for leukapheresis procedures. A December 2023 study reported in the journal Cancers highlighted that patients with acute myeloid leukemia (AML) and FLT3-ITD mutations had better outcomes and lower early mortality rates following emergency leukapheresis compared to those with leukocytosis.

The therapeutic application segment is anticipated to grow at the fastest CAGR of 11.53% during the forecast period. This growth is driven by the rising adoption of cell-based therapies and personalized medicine. An article in the August 2022 issue of Transfusion Medicine and Hemotherapy noted that therapeutic leukapheresis remains a viable, safe, and effective treatment option, even with a reduced patient population.

The hospitals & clinics segment led the market in 2023 with a revenue share of 42%. This segment's prominence is due to its integral role in direct patient care, therapeutic procedures, and diagnostic services. For instance, in July 2022, the Hoxworth Blood Center at the University of Cincinnati unveiled its newly renovated Apheresis Center, collaborating with UCH, The Christ Hospital, and Cincinnati Children's Hospital Medical Center. These partnerships are expected to drive growth in the segment.

The pharmaceutical & biotechnology companies segment is expected to grow at the fastest CAGR over the forecast period. These companies use leukapheresis products for research, drug development, and manufacturing processes. The increasing focus on personalized medicine and cell-based therapies is fueling this demand. For example, in November 2023, Charles River Laboratories International, Inc. announced the addition of CliniPrime Cryopreserved Leukopaks to its GMP-compliant offerings. These cryopreserved leukopaks serve as essential starting material for gene-modified cell therapy research and development, boosting demand for leukapheresis.

By Product

By Application

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Leukapheresis Market

5.1. COVID-19 Landscape: Leukapheresis Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Leukapheresis Market, By Product

8.1. Leukapheresis Market, by Product, 2024-2033

8.1.1 Leukapheresis Devices

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Leukapheresis Disposables

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Leukapheresis Market, By Application

9.1. Leukapheresis Market, by Application, 2024-2033

9.1.1. Research Application

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Therapeutics Application

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Leukapheresis Market, By End Use

10.1. Leukapheresis Market, by End Use, 2024-2033

10.1.1. Blood Centers

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Academic & Research Institutes

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Pharmaceutical & Biotechnology Companies

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Hospitals & Clinics

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Leukapheresis Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End Use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 12. Company Profiles

12.1. Charles River Laboratories International, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Adacyte Therapeutics.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. AllCells, LLC.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Asahi Kasei Medical.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Haemonetics Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Macopharma

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Cerus Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. SB-Kawasumi Laboratories, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. StemExpress, LLC..

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Haemonetics Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others